We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

How to split a will

Comments

-

With respect to the IHT allowance available to you in the future - the £325k is the basic but if your daughter inherits from you then you can add on residential allowance of up to £175k (dependent on value of property). Also if you are married and your spouse predeceases you then there may be transferable allowances which can also be added on. Don’t worry about this too much now as you get your head around the question you asked, just to say you may not need to worry about that particular issue.1

-

I'll try and add to a couple of points.

Did your father's will leave his portion of the house to you, and leave a life interest (right to reside) to mum? Hopefully?

Don’t know, sorry, will have to take a look. I thought half the house was already hers, and he left his half to me…?

If you are single or divorced your potential IHT exemption is £325k + £175 residential allowance, because you own a house, so £500k.

If you are married or widowed, it could be double that, up to £1m.

I'm not suggesting dad didn't leave half the house to you.

What matters is if he left you that half "absolutely," in which case you may have to pay CGT within 6 weeks of the house being sold. Or whether he left mum a life interest, enabling her to live in the house for the rest of her life rent free, in which case you may be a trustee and CGT doesn't apply. The life interest trust needs to be registered with HMRC.

If you've have not made a mistake, you've made nothing1 -

RAS said:

I'll try and add to a couple of points.

Did your father's will leave his portion of the house to you, and leave a life interest (right to reside) to mum? Hopefully?

Don’t know, sorry, will have to take a look. I thought half the house was already hers, and he left his half to me…?

If you are single or divorced your potential IHT exemption is £325k + £175 residential allowance, because you own a house, so £500k.

If you are married or widowed, it could be double that, up to £1m.

I'm not suggesting dad didn't leave half the house to you.

What matters is if he left you that half "absolutely," in which case you may have to pay CGT within 6 weeks of the house being sold. Or whether he left mum a life interest, enabling her to live in the house for the rest of her life rent free, in which case you may be a trustee and CGT doesn't apply. The life interest trust needs to be registered with HMRC.Sorry, being thick here - for some reason, as a reasonably intelligent chap, my brain is unable to comprehend anything mathematical, financial, or legal, it seems... what I meant was, I thought the tenants in common thingy meant they each owned half the house, separately?So when Dad died, I came to own his half of the house, and Mum retained ownership of her half... is that wrong?Thanks again0 -

It’s not the best way of doing things as this leaves you with a potential capital gains tax liability on your share when the house is eventually sold. Best practice is to give your spouse a life interest which means that the surviving spouse is the beneficial owner of the entire property with legal ownership slit between then and the life interest trust.hogweed said:RAS said:

I'll try and add to a couple of points.RAS said:

Did your father's will leave his portion of the house to you, and leave a life interest (right to reside) to mum? Hopefully?

Don’t know, sorry, will have to take a look. I thought half the house was already hers, and he left his half to me…?

If you are single or divorced your potential IHT exemption is £325k + £175 residential allowance, because you own a house, so £500k.

If you are married or widowed, it could be double that, up to £1m.

I'm not suggesting dad didn't leave half the house to you.

What matters is if he left you that half "absolutely," in which case you may have to pay CGT within 6 weeks of the house being sold. Or whether he left mum a life interest, enabling her to live in the house for the rest of her life rent free, in which case you may be a trustee and CGT doesn't apply. The life interest trust needs to be registered with HMRC.Sorry, being thick here - for some reason, as a reasonably intelligent chap, my brain is unable to comprehend anything mathematical, financial, or legal, it seems... what I meant was, I thought the tenants in common thingy meant they each owned half the house, separately?So when Dad died, I came to own his half of the house, and Mum retained ownership of her half... is that wrong?Thanks againWhat is the exact wording (redact real names) in your fathers will with regard to his share of the house?3 -

Your parents each owned half the house.

We have no idea whether you now own dad's half, or whether it is in a life interest trust, until you read his will and type out exactly what it says but redact the names. If you can't find it, pay £1.50 to the Probate Registry to get a copy.

A life interest trust would end when mum dies, at which point you gain absolute ownership of his half and inherit mum's half, or whatever is left after any debts are paid.

It's very common in mirror wills as it ensures half the value for the beneficiaries if the second spouse goes into care or remarries, and secures a roof over the head of the surviving spouse.

I hope that is what you find, as selling half a house in which you don't live leaves you liable for 18-28% Capital Gains Tax on any increase in value.If you've have not made a mistake, you've made nothing1 -

What is the exact wording (redact real names) in your fathers will with regard to his share of the house?Haven't got a copy, as far as I know... I think it's with their solicitor. As a beneficiary, can I just request a copy?Thanks0

-

Right, will get hold of a copy of the will and report back

0

0 -

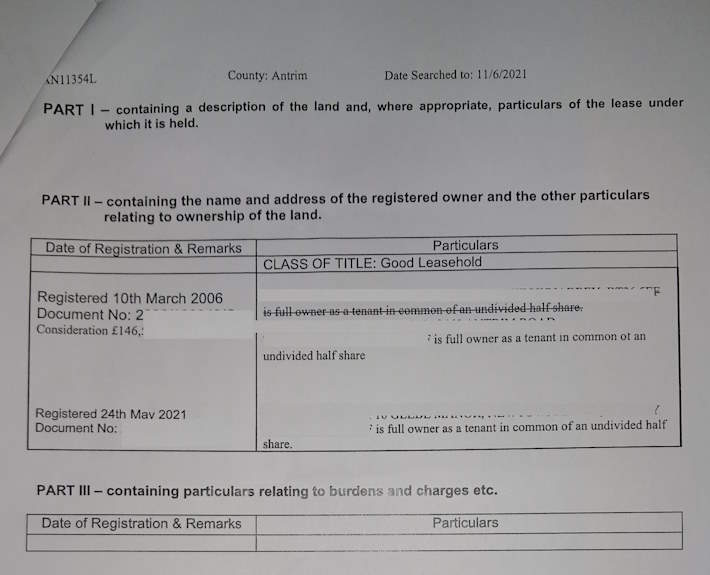

Right - in the event anybody's still getting notifications for this, sorry about the long delay in posting, but various health and other crises intervened. I've had a look through the documents we have, and this one appears to be the search from the Land Registry.Things are of course done differently here in NI... as usual... so the document (and law) may not be what you're used to.When we had the initial transfer done, we (perhaps naively) understood that the house was now simply divided into two halves, with my mother and father owning half each, with each half left to me in their wills. Dad died three years ago, so we assumed that Mum and I now separately own half each - and this document SEEMS to say the same?As things stand, when Mum dies, I will inherit her half. I would then sell the house, and give at least half to my daughter. But it seems to me that a simpler arrangement might be for Mum to change her will to leave her half to my daughter, and leave me out of that part of the equation.That's what I'm asking, really.. does that make sense?Thanks

0

0 -

I would avoid doing that, as your mother may no longer own the property by the time she dies, she may decide that assisted living or sheltered housing might be more suitable accommodation, or she may need residential care.

There is nothing stopping you gifting your daughter a share of your inheritance and if you do it via a deed of variation it won’t ever be seen as part of your estate so the 7 year rule won’t apply.

Does your father’s will give your mother a life interest in his share of the home? If not that could give you a capital gains tax liability on the sale of the property.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards