We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Paralysis - tracker and gilts v one fund or do I need an IFA?

Comments

-

Thank you

When you say a time weighted portfolio do you mean something where the asset allocation changes over time similar to the default pension funds or TargetStrategy type funds?

On the wider dilemma I can't find a single planning/forecasting tool that shows me in a bad place almost regardless of what I do.

Anyone have anything they'd recommend as Guiide and Timeline and anything like that show no issue.0 -

I think you are in a good place. You will be able to make almost any personal finance situation and portfolio fail if you put in zero growth and high inflation along with reckless spending into a retirement planner, but such scenarios are very improbable. I would do some thinking about your spending habits and budgeting to see how they mesh with your investments and income sources and let that inform your asset allocation. With a DB plan, no debt and a comfortable amount of savings and investments you can take a bit more risk than many people and also realize that your investing horizon isn’t the 20 years until retirement it’s the 50 years until the retirement we all cannot avoid.Aminatidi said:Thank you

When you say a time weighted portfolio do you mean something where the asset allocation changes over time similar to the default pension funds or TargetStrategy type funds?

On the wider dilemma I can't find a single planning/forecasting tool that shows me in a bad place almost regardless of what I do.

Anyone have anything they'd recommend as Guiide and Timeline and anything like that show no issue.

My situation was similar to yours 20 years ago; I’m now retired and drawing my DB plan. I have arranged things so that my income needs are covered by the DB pension and some rental income and I have SP still to come. My pension and GIA accounts are almost all simple equity tracker funds. My finances are now self sustaining. My portfolio is simple and inexpensive and I just let it keep growing through reinvesting of dividends and capital growth. I think you could also get to a similar place by using DB pension, SP and maybe an annuity or a dividend portfolio. Of course spending is the important other side of the equation.And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

So the more I consider this the more I don't think individual gilts are quite "me".

I find myself thinking either HSBC Global Strategy Balanced or LS60 in the unwrapped account and don't let the tax tail wag the dog.

Part of me is also considering whether I might change the ISA to the same thing so I'm running one asset allocation regardless of whether it's in the ISA or unwrapped as I'm conscious it's easy to bite off more than you can chew in terms of appetite for risk.

I like Vanguard for simplicity but Global Strategy are cheaper and don't appear to have the UK bias that I (perhaps irrationally) dislike about LifeStrategy.0 -

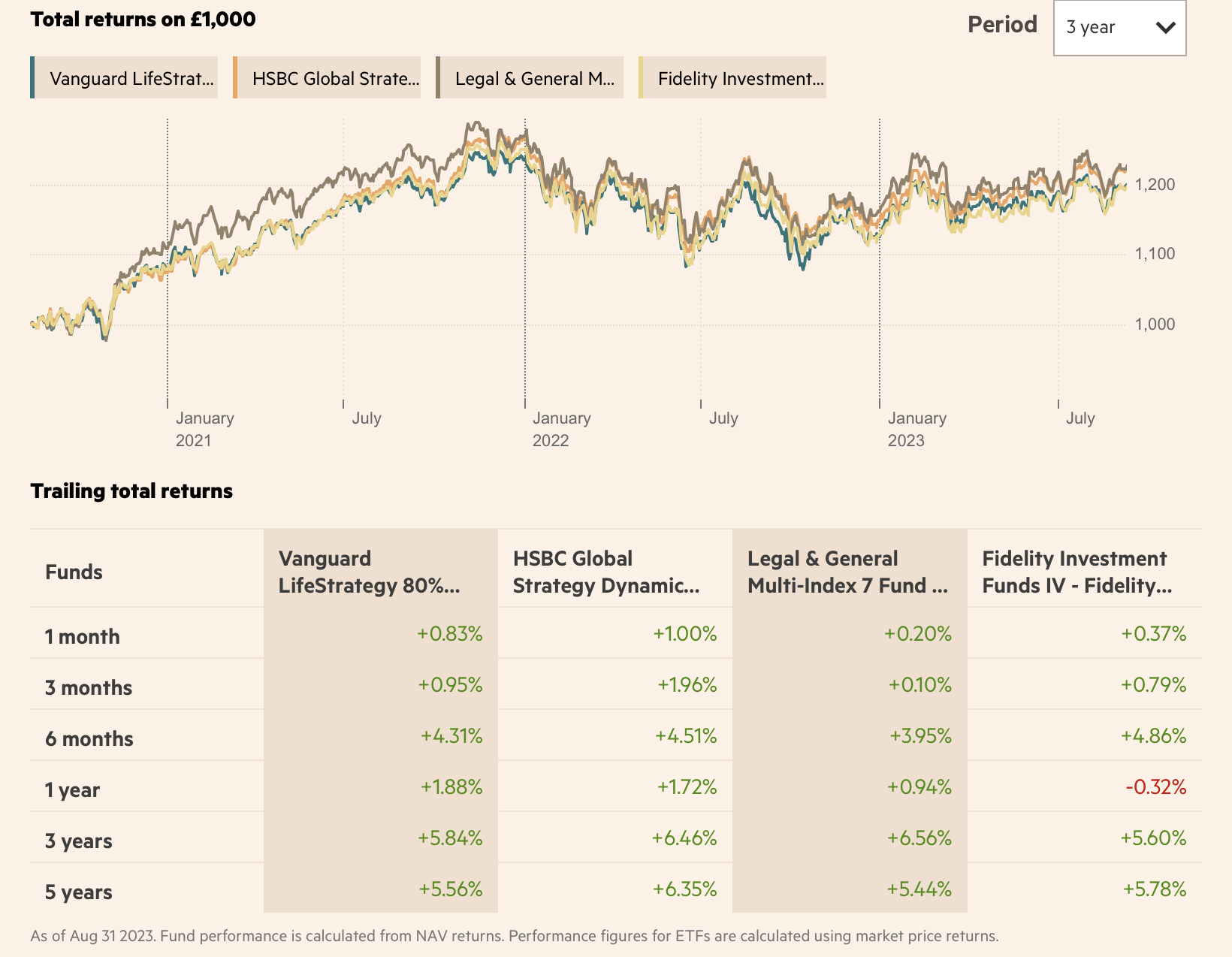

Nothing wrong with any of this. That said, you are still relatively young. You could consider LS80 or GS Dynamic. Or even a mix of the two which would dilute the home weighting if that’s of concern. A decent alternative to LS (as it keeps a set equity/bond mix) with no home weighting could be Fidelity Multi Asset Allocator. The Adventurous fund is the equivalent to LS80. I also like the Legal & General Index range such as the no. 7 fund.Aminatidi said:So the more I consider this the more I don't think individual gilts are quite "me".

I find myself thinking either HSBC Global Strategy Balanced or LS60 in the unwrapped account and don't let the tax tail wag the dog.

Part of me is also considering whether I might change the ISA to the same thing so I'm running one asset allocation regardless of whether it's in the ISA or unwrapped as I'm conscious it's easy to bite off more than you can chew in terms of appetite for risk.

I like Vanguard for simplicity but Global Strategy are cheaper and don't appear to have the UK bias that I (perhaps irrationally) dislike about LifeStrategy.

While one multi asset fund is OK, I’m of the view that having a couple can help mitigate a bit of risk.

I also might try to shift everything to a fixed cost platform. 0

0 -

Because past performance is so badly related to future performance for most market based investments, and because there are rather easy other methods to evaluate an investment, you ought to reflect on whether ‘so far has performed well’ is a sound basis for making a choice. If it’s not, try to get it out of your thinking.so it's cheap enough and so far Royal London seem to have performed well on the default Governed Portfolio 4 plan. ‘

I don’t have enough information about your RL pension to do it justice, or skin in the game like you, so here are some quick and dirty observations…

Royal London Governed Portfolio 4 is multi-asset comprising several RL funds, mostly their RL Global Managed (TER 1%). RL GM is an equity fund with 25% UK, 40% USA etc. It has a reasonable index benchmark which it tracks well. RL GM is made up of several other RL funds, the main one RL American Tilt.

RM AT (TER 1%) holds individual shares, mostly USA. It tracks a good benchmark, but not nearly as closely as Vanguard track their USA index (0.3-.4%/yr difference).

So, multi-asset funds hold several funds, with Vanguard the step in is individual securities; with RL the next step in is another layer of funds. I don’t know what the consequences of that are, but who is bearing the extra layer of management fees?

My sense of it is there’s not much to choose between the VLS series and your RL GP4: one costs 0.22%/yr, yours 0.35%; one is an index tracker, the other seems like a closet tracker. I’ve ignored mutual bonuses and time weighted portfolios through ignorance. But what’s in them and how well that asset mix suits you is crucial; try to get beyond performance.

0 -

A little bit of progress.

Transferred £20K out of the cash sat in HL earlier today and when that hits the bank it'll go over to Vanguard to open a SIPP.

The plan is to put that into LS60.

I've opened an IWeb general account and put in £4K of new money and kicked off a transfer from HL so the £100K that will be left in HL will go across to IWeb.

Once it's in IWeb the plan is to put it into HSBC Global Strategy Balanced.

At that point I should be left with around £185K in the ISA in FTSE Global All Cap and the rest split across the new Vanguard SIPP and IWeb general account in approx 60/40.

For now I'll leave the FTSE Global All Cap whilst I give some thought to whether I want the whole lot at approx 60/40.

All low cost passive and what I consider sensible fees for that amount of AUM.

Between monthly income and the general account I can hopefully feed the ISA and SIPP and try and keep things simple around tax and capital gains etc.

I still need to look for a decent instant access home for the £20K in emergency fund savings that's sat in the bank.

0 -

Royal London Governed Portfolio 4 is multi-asset comprising several RL funds, mostly their RL Global Managed (TER 1%). RL GM is an equity fund with 25% UK, 40% USA etc. It has a reasonable index benchmark which it tracks well. RL GM is made up of several other RL funds, the main one RL American Tilt.1% is the default charge before fund based discounts. i.e. the maximum. Most will be on 0.45% or 0.40%. Higher values down to 0.35%

RM AT (TER 1%) holds individual shares, mostly USA. It tracks a good benchmark, but not nearly as closely as Vanguard track their USA index (0.3-.4%/yr difference).

RL also allow the switch out of the managed global equity fund into a global equity tracker.So, multi-asset funds hold several funds, with Vanguard the step in is individual securities; with RL the next step in is another layer of funds. I don’t know what the consequences of that are, but who is bearing the extra layer of management fees?VLS holds 17 funds. The RLGP range typically holds a few less than that but. There is no extra layer of management fees with RL as the RL GP range is not a multi-asset fund of funds but a software controlled collection of single sector funds.

RLGP4 holds 11 funds at the moment.My sense of it is there’s not much to choose between the VLS series and your RL GP4: one costs 0.22%/yr, yours 0.35%; one is an index tracker, the other seems like a closet tracker. IVLS is not a tracker. It is a fund of funds. The underlying funds are trackers. Plus, you need to add the platform charge on top. RL doesn't have a platform charge, and you hold the funds directly.I’ve ignored mutual bonuses and time weighted portfolios through ignorance. But what’s in them and how well that asset mix suits you is crucial; try to get beyond performance.RL is not a PLC but a mutual. It returns a share of its profits to policyholders as there are no shareholders. It has floated between 0.15% and 0.18% p.a. over the years.

The time weighting allows the asset mix and the underlying assets to match timescales. e.g. those drawing £xxxx over the next 5 years compared to £yyyyy that may not be drawn for 20 years. So, you can bucket your portfolio if you wish (no cost for doing so and you don't have to).

RL also gets 100% FSCS protection with no upper limit.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

Right so a week later the £100K in the General Account has transferred across to IWeb as cash which is stunningly quick but no complaints.

I am re-thinking the Vanguard SIPP on a couple of fronts.

One of them is whether it would be simpler just dropping that £20K into my Aviva workplace pension.

It's in the default Aviva My Future Focus Growth S6.

I have a copy of Tim Hales Smarter Investing that I'm slowly working my way through.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards