We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

Council tax, probate and duty to retain

We are dealing with an empty probate property which I thought had an exemption lasting for 6 months after probate had been granted, but I've just read something on the council website that says;

"If there is an exemption on the property this will remain in place until probate has been granted however -

If there is no duty to retain the property the beneficiaries will become liable and charges will apply – if the property remains empty for over 2 years, Empty premiums will start.

If there is a duty to retain, the exemption can be extended for 6months from the date of probate before charges apply.

If your property has the exemption applied, no charges are due until either one of the above comes into place.

For example, if a property has an exemption from

01.12.2022 and the furniture was removed on the 01.01.2023, the

beneficiaries became liable from the date of probate because there was

no duty to retain and the beneficiaries left the property

empty, then on the 01.01.2025, empty premiums will start because the

property had been left empty from 01.01.2023.

Regardless of the date liability changes, if the

property has been left empty the premiums will start from the date the

property became empty.."

I called the council a number of time but just got an answerphone saying call back later.

Comments

-

We've moved this to a more appropriate boardOfficial MSE Forum Team member. Please use the 'report' button to alert us to problem posts, or email forumteam@moneysavingexpert.com0

-

Which council is it? I didn't get any relevant results from searching for "duty to retain council tax" so it's hard to work out what your council means without seeing more of the context in which they say it.

0 -

It's Cornwall, and I didn't get any Google hits on it either. My thinking is that it is saying, if you have no reason not to sell, then the additional clock starts.SiliconChip said:Which council is it? I didn't get any relevant results from searching for "duty to retain council tax" so it's hard to work out what your council means without seeing more of the context in which they say it.

Looks like I'll have to try calling them again.0 -

I'm not sure probate thread is better as it's asking about vacant property additional premiums which I'm guessing is a pretty specialised council tax question. But, let's see what happens.MSE_ForumTeam5 said:We've moved this to a more appropriate board0 -

I have had exactly the same! And with Cornwall council. I rang Gloucestershire Council and Bath, and they would have allowed the 6 months free after probate on code F2. Why is Cornwall different? Did you manage to sort it out?uknick said:What is a "duty to retain" on an empty property? It's in reference to when additional council tax premiums are due on empty properties.

We are dealing with an empty probate property which I thought had an exemption lasting for 6 months after probate had been granted, but I've just read something on the council website that says;

"If there is an exemption on the property this will remain in place until probate has been granted however -If there is no duty to retain the property the beneficiaries will become liable and charges will apply – if the property remains empty for over 2 years, Empty premiums will start.

If there is a duty to retain, the exemption can be extended for 6months from the date of probate before charges apply.

If your property has the exemption applied, no charges are due until either one of the above comes into place.

For example, if a property has an exemption from 01.12.2022 and the furniture was removed on the 01.01.2023, the beneficiaries became liable from the date of probate because there was no duty to retain and the beneficiaries left the property empty, then on the 01.01.2025, empty premiums will start because the property had been left empty from 01.01.2023.

Regardless of the date liability changes, if the property has been left empty the premiums will start from the date the property became empty.."

I called the council a number of time but just got an answerphone saying call back later.

0 -

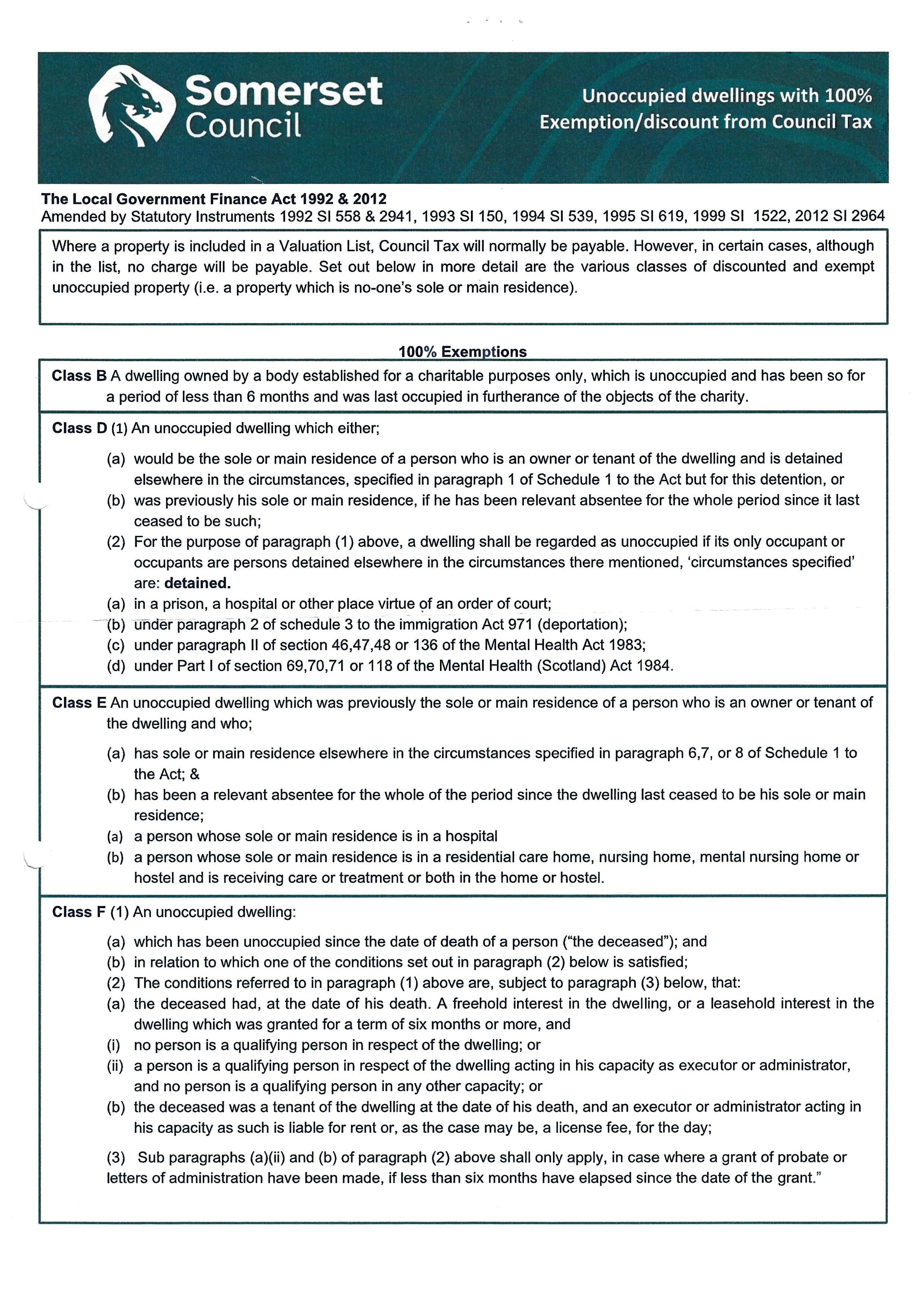

Somerset Council have given me 6 months on a Class F exemption. Either then or when probate is granted it’s the full amount due.

i seem to have a bit of a passive aggressive case officer - my Mums estate is apparently due a refund from CT. I asked in my capacity as Executor for it to be paid back but I was told it could only be released if I provide a document signed by all beneficiaries agreeing to this. So that's me, and a small amount to a cousin and a charity donation. She also said she couldn’t read the will I emailed at her request as it was upside down, so she won’t accept it. As far as I am aware it’s none of the councils business how I administer the estate.1 -

curious_i_am said:Somerset Council have given me 6 months on a Class F exemption. Either then or when probate is granted it’s the full amount due.

i seem to have a bit of a passive aggressive case officer - my Mums estate is apparently due a refund from CT. I asked in my capacity as Executor for it to be paid back but I was told it could only be released if I provide a document signed by all beneficiaries agreeing to this. So that's me, and a small amount to a cousin and a charity donation. She also said she couldn’t read the will I emailed at her request as it was upside down, so she won’t accept it. As far as I am aware it’s none of the councils business how I administer the estate.Your post reads as saying the exemption applies for 6 months after death or until probate is granted. I don't know if that was what you meant to say. But my understanding is that the class F exemption applies until probate is granted and then for a further 6 months (provided there is no liable person living in the house now etc). This is what Somerset Council sent me re the class F exemption. This isn't something available on their website hence why I'm attaching it.In the estate I'm dealing with a refund had already been granted in relation to an earlier class E exemption (long term care) so the refund issue doesn't exist.Good luck sorting this out. I came, I saw, I melted1

I came, I saw, I melted1 -

That’s really helpful SnowMan, thank you. I’ll go back through the paperwork to check.SnowMan saidYour post reads as saying the exemption applies for 6 months after death or until probate is granted. I don't know if that was what you meant to say. But my understanding is that the class F exemption applies until probate is granted and then for a further 6 months (provided there is no liable person living in the house now etc). This is what Somerset Council sent me re the class F exemption. This isn't something available on their website hence why I'm attaching it.

i was sent 3 different bills dated the same day, each for different amounts. One for single occupancy, one for nursing home and one for unoccupied since date of death. They really don’t like making it straightforward for you, do they!

1 -

I didn't pursue it. It turns out the executor had, unbeknown to me, let the property to tenants as soon as probate was granted.sallyd136 said:

I have had exactly the same! And with Cornwall council. I rang Gloucestershire Council and Bath, and they would have allowed the 6 months free after probate on code F2. Why is Cornwall different? Did you manage to sort it out?uknick said:What is a "duty to retain" on an empty property? It's in reference to when additional council tax premiums are due on empty properties.

We are dealing with an empty probate property which I thought had an exemption lasting for 6 months after probate had been granted, but I've just read something on the council website that says;

"If there is an exemption on the property this will remain in place until probate has been granted however -If there is no duty to retain the property the beneficiaries will become liable and charges will apply – if the property remains empty for over 2 years, Empty premiums will start.

If there is a duty to retain, the exemption can be extended for 6months from the date of probate before charges apply.

If your property has the exemption applied, no charges are due until either one of the above comes into place.

For example, if a property has an exemption from 01.12.2022 and the furniture was removed on the 01.01.2023, the beneficiaries became liable from the date of probate because there was no duty to retain and the beneficiaries left the property empty, then on the 01.01.2025, empty premiums will start because the property had been left empty from 01.01.2023.

Regardless of the date liability changes, if the property has been left empty the premiums will start from the date the property became empty.."

I called the council a number of time but just got an answerphone saying call back later.0 -

Sorry to hear you had issues with your executor. I have phoned another council now and they have looked into all the official government rules of the extension of 6 months council tax free after probate and say I am entitled to it but Cornwall council are saying they make up their own rules!!! Unbelievable. Cornwall Council said the government issues guidelines and they can interpret them in their own way. So every other Council follows the guidelines to the letter. I'm furious.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.3K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.2K Work, Benefits & Business

- 599.4K Mortgages, Homes & Bills

- 177.1K Life & Family

- 257.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards