We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Short Term Gilts

Comments

-

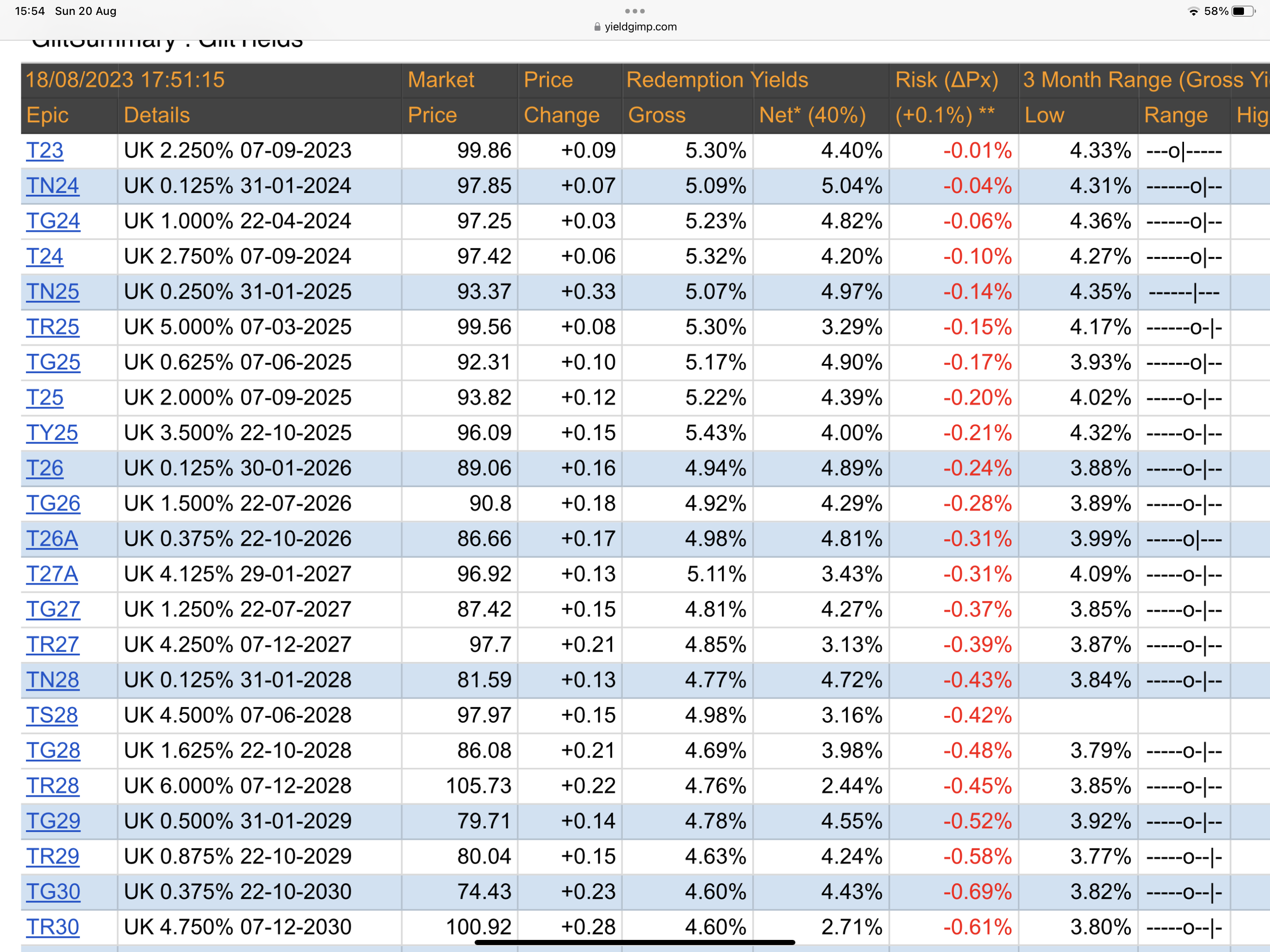

The yieldgimp website attempts to give an indication of how volatile different issues are - see the Risk column. As you'd expect, the further into the future you go the more you'll expect them to be affected by changes in rates expectations.Aminatidi said:I think my problem (there are lots ) is that I don't know how long I'm prepared to "fix" for so I'm trying to have my cake and eat it.

) is that I don't know how long I'm prepared to "fix" for so I'm trying to have my cake and eat it.

As I said I'm not sure there is a right answer but my gut reaction is I'm not sure I would want to venture much beyond TN25 right now.

But I also don't know if my thinking is flawed using a fixed term savings account as a frame of reference.

It's quite funny in a way because roll back a year or two and I'd have said people are killing for a guaranteed 4% return that's 100% government backed and now it's easy enough to get and I'm not sure how long I want to lock the money in for.

** Risk - %age change in price for a +0.10% increase in Gross Redemption Yield

https://www.yieldgimp.com/

2 -

Aminatidi said:It's quite funny in a way because roll back a year or two and I'd have said people are killing for a guaranteed 4% return that's 100% government backed and now it's easy enough to get and I'm not sure how long I want to lock the money in for.The issue with that is that in the past a guaranteed 4% return would have preserved the purchasing power of your capital, whereas over the past couple of years...Index linked gilts are worth considering for longer term low risk investing, and today you can get that protection without a capital loss reducing the real yield into negative territory.0

-

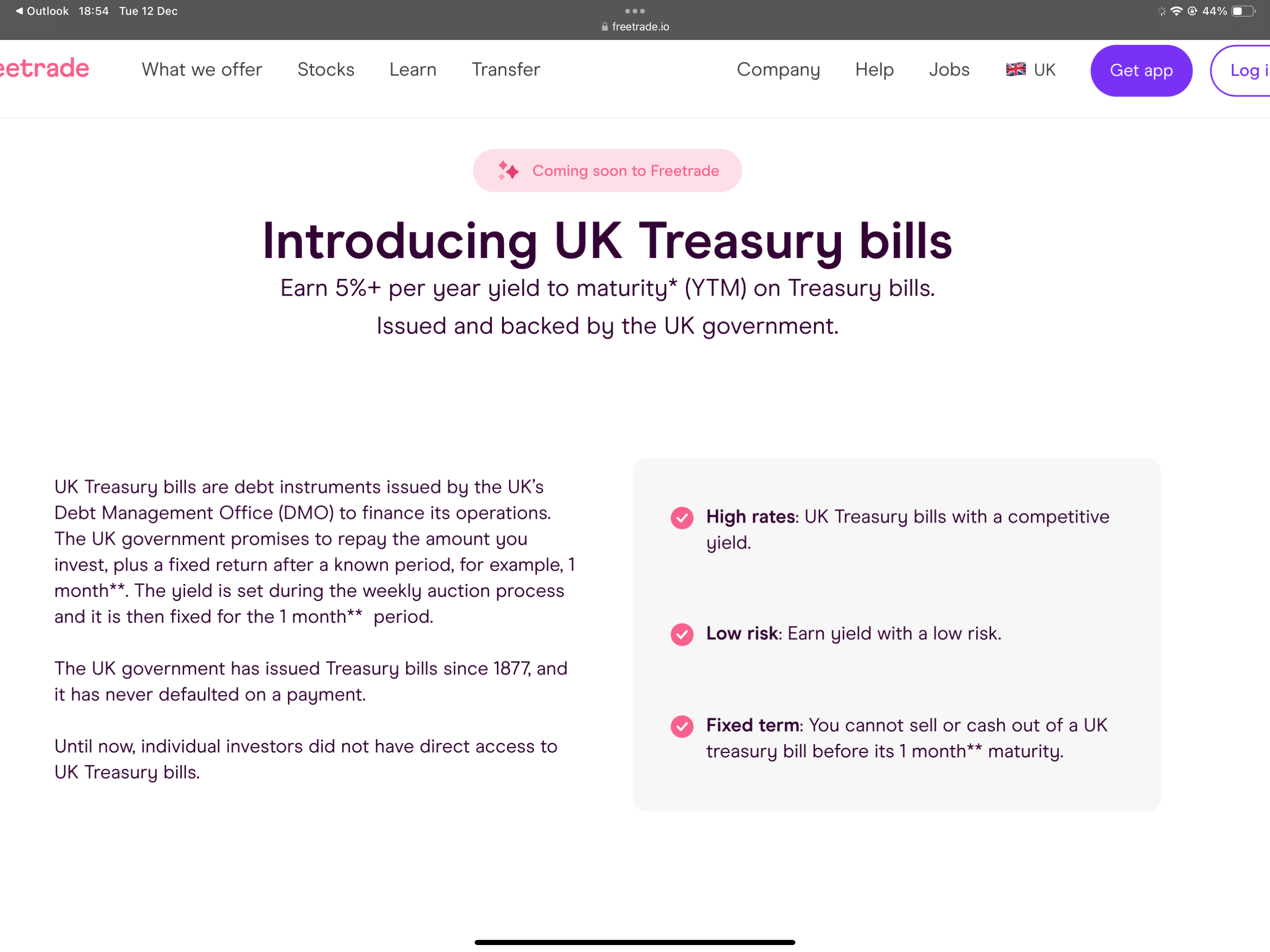

Interesting news: Freetrade will "soon" introduce the ability to buy Treasury bills.

https://freetrade.io/treasury

3 -

wmb194 said:Interesting news: Freetrade will "soon" introduce the ability to buy Treasury bills.

https://freetrade.io/treasury Thanks for that. More details here:

Thanks for that. More details here:

0 -

You can now trade UK Gilts through AJ Bell

https://www.ajbell.co.uk/our-services/investment-options/bonds/gilts

1 -

Please excuse me if I'm missing something very obvious.

I'm struggling to see any advantage in the Freetrade UK Treasury Bills offering, given that I can (still just about) get 5.2% in an Easy Access Account.

I'm happy to say I don't know what I don't know but I can't figure out what job these would do in a portfolio.

I'd really appreciate it if someone who uses them could clarify for me what role they serve or maybe point me towards something I could read, which explains.

TIA£6000 in 20230 -

brucefan_2 said:Please excuse me if I'm missing something very obvious.

I'm struggling to see any advantage in the Freetrade UK Treasury Bills offering, given that I can (still just about) get 5.2% in an Easy Access Account.

I'm happy to say I don't know what I don't know but I can't figure out what job these would do in a portfolio.

I'd really appreciate it if someone who uses them could clarify for me what role they serve or maybe point me towards something I could read, which explains.

TIA

They're not easy access cash, so if you need that then of course you wouldn't consider these. However gilts are fixed coupon so you're guaranteed the return, while easy access cash is usually variable. Any capital gain on gilts is also free of tax, while there is no capital gain on cash and interest is taxed up to 45%.

1 -

Thanks for the reply.InvesterJones said:brucefan_2 said:Please excuse me if I'm missing something very obvious.

I'm struggling to see any advantage in the Freetrade UK Treasury Bills offering, given that I can (still just about) get 5.2% in an Easy Access Account.

I'm happy to say I don't know what I don't know but I can't figure out what job these would do in a portfolio.

I'd really appreciate it if someone who uses them could clarify for me what role they serve or maybe point me towards something I could read, which explains.

TIA

They're not easy access cash, so if you need that then of course you wouldn't consider these. However gilts are fixed coupon so you're guaranteed the return, while easy access cash is usually variable. Any capital gain on gilts is also free of tax, while there is no capital gain on cash and interest is taxed up to 45%.

I get that EA cash accounts are liable to rate changes but most providers currently give good notice of these coming into effect. The PSA also influences the tax levels on interest.

I'm having difficulty articulating the question but I guess I don't understand potential scenarios where these Treasury Bills might fit into an investment/savings strategy.

Thanks again.

£6000 in 20230 -

brucefan_2 said:

Thanks for the reply.InvesterJones said:brucefan_2 said:Please excuse me if I'm missing something very obvious.

I'm struggling to see any advantage in the Freetrade UK Treasury Bills offering, given that I can (still just about) get 5.2% in an Easy Access Account.

I'm happy to say I don't know what I don't know but I can't figure out what job these would do in a portfolio.

I'd really appreciate it if someone who uses them could clarify for me what role they serve or maybe point me towards something I could read, which explains.

TIA

They're not easy access cash, so if you need that then of course you wouldn't consider these. However gilts are fixed coupon so you're guaranteed the return, while easy access cash is usually variable. Any capital gain on gilts is also free of tax, while there is no capital gain on cash and interest is taxed up to 45%.

I get that EA cash accounts are liable to rate changes but most providers currently give good notice of these coming into effect. The PSA also influences the tax levels on interest.

I'm having difficulty articulating the question but I guess I don't understand potential scenarios where these Treasury Bills might fit into an investment/savings strategy.

Thanks again.I think your question is why would someone not instead opt for the best easy access or notice account available at the time. There are several reasons someone might prefer something like this. For example, convenience. It means not having to chase the best rate and move money around. Though a money market fund would make things even more convenient, those carry slightly different risks. These Bills might also be somewhere to temporarily park cash held within a S&S ISA or SIPP with Freetrade. Also, if someone is not resident in the UK, they may be unable to open new savings accounts, but often can manage existing investment accounts.I don't think it is advisable for the typical forumite to use these, but for someone who doesn't like opening new accounts, but wants to get a fair market rate on their capital, something like this could fit the bill. Of course a lot depends on the so far undisclosed charges that will be deducted after April.1 -

@masonic.masonic said:brucefan_2 said:

Thanks for the reply.InvesterJones said:brucefan_2 said:Please excuse me if I'm missing something very obvious.

I'm struggling to see any advantage in the Freetrade UK Treasury Bills offering, given that I can (still just about) get 5.2% in an Easy Access Account.

I'm happy to say I don't know what I don't know but I can't figure out what job these would do in a portfolio.

I'd really appreciate it if someone who uses them could clarify for me what role they serve or maybe point me towards something I could read, which explains.

TIA

They're not easy access cash, so if you need that then of course you wouldn't consider these. However gilts are fixed coupon so you're guaranteed the return, while easy access cash is usually variable. Any capital gain on gilts is also free of tax, while there is no capital gain on cash and interest is taxed up to 45%.

I get that EA cash accounts are liable to rate changes but most providers currently give good notice of these coming into effect. The PSA also influences the tax levels on interest.

I'm having difficulty articulating the question but I guess I don't understand potential scenarios where these Treasury Bills might fit into an investment/savings strategy.

Thanks again.I think your question is why would someone not instead opt for the best easy access or notice account available at the time. There are several reasons someone might prefer something like this. For example, convenience. It means not having to chase the best rate and move money around. Though a money market fund would make things even more convenient, those carry slightly different risks. These Bills might also be somewhere to temporarily park cash held within a S&S ISA or SIPP with Freetrade. Also, if someone is not resident in the UK, they may be unable to open new savings accounts, but often can manage existing investment accounts.I don't think it is advisable for the typical forumite to use these, but for someone who doesn't like opening new accounts, but wants to get a fair market rate on their capital, something like this could fit the bill. Of course a lot depends on the so far undisclosed charges that will be deducted after April.

Thank you. That has helped clarify several things for me.

If I've understood correctly, these cannot yet be held within an ISA or SIPP wrapper.

Your point that these are probably not for the typical forumite makes a lot of sense but the low entry threshold of £50 to participate is probably designed to attract a wider range of clients.

I've just done a quick check - not the most competitive but a Zopa 31 day notice account currently offers 4.65% AER with no platform charge.

I've been using Freetrade pretty much from the outset and invested in them also. This is an interesting development but I'm left wondering whether this is intended to be more of use to the client or to Freetrade itself, via its charges.

Thanks for taking the time to reply.£6000 in 20230

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards