We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

EON wrongly marked credit file and declined for mortgage - how much compensation is fair?

Comments

-

Felt a bit guilty re not reading OP's other post - so scanned it and some others.

The fact a bank has reduced a loan offer from 90 to 85 % seems a perfectly normal event from original application to final offer - after detailed review of ongoing market conditions and individual finances.

1000s of deals are pulled and reviewed upwarss mostly these days - as per market conditions which have been changing regularly with every inflation forecast and 6 weekly BofE rate rise.

And not to wish to sound too judgemental, The OP for instance was posting in Dec talking about wanting not 1 but potentially 2 new credit cards by Mar this year - one to fund potential lasik - upto £1000s in new debt per eye.

Equifax for instance recommend no new credit applications in the 6m before mortgage applications due to negative potential impact.

And earlier threads by OP hint at earlier problems and historical debt.

And depending on if progressed or how obvious / clear that was to lender at time of initial 90% offer definitely another potential reason to drop mortgage offer.

And the OP says in that other mortgage thread had an alternative offer from her broker to cover the purchase at 90%.

So arguably hasn't really lost the house.

At a higher cost and rate - but that is how the market works.

Higher ltv = higher risk = higher rate - even in stable market.

We are not in a stable or rising market in the eyes of OP's original chosen lender.

What is clear is that only the OP and or the bank know the full details, the timings of any recent credit and debt transactions and disclosures thereof, credit searches etc and reasoning for the banks 85% decision.

So anything other than generic guidance is impossible.

Edit

And possibly the best advice - rather than continuing to fight one lenders decision, take other offer if can really afford to and have more faith in market than many, or find a cheaper house, or given time constraints, try to renegotiate with vendor on the basis that a major UK lender (biggest?) now only willing to lend the over £10k less against it.

3 -

So, in summary, the answer is £0, unless the OP wants to take EON to court and prove a loss.2

-

They have just emailed me offering me £400 but thanks for your really useless comment.MeteredOut said:So, in summary, the answer is £0, unless the OP wants to take EON to court and prove a loss.

And thanks for all the other comments too, glad I haven’t taken any advice from here!0 -

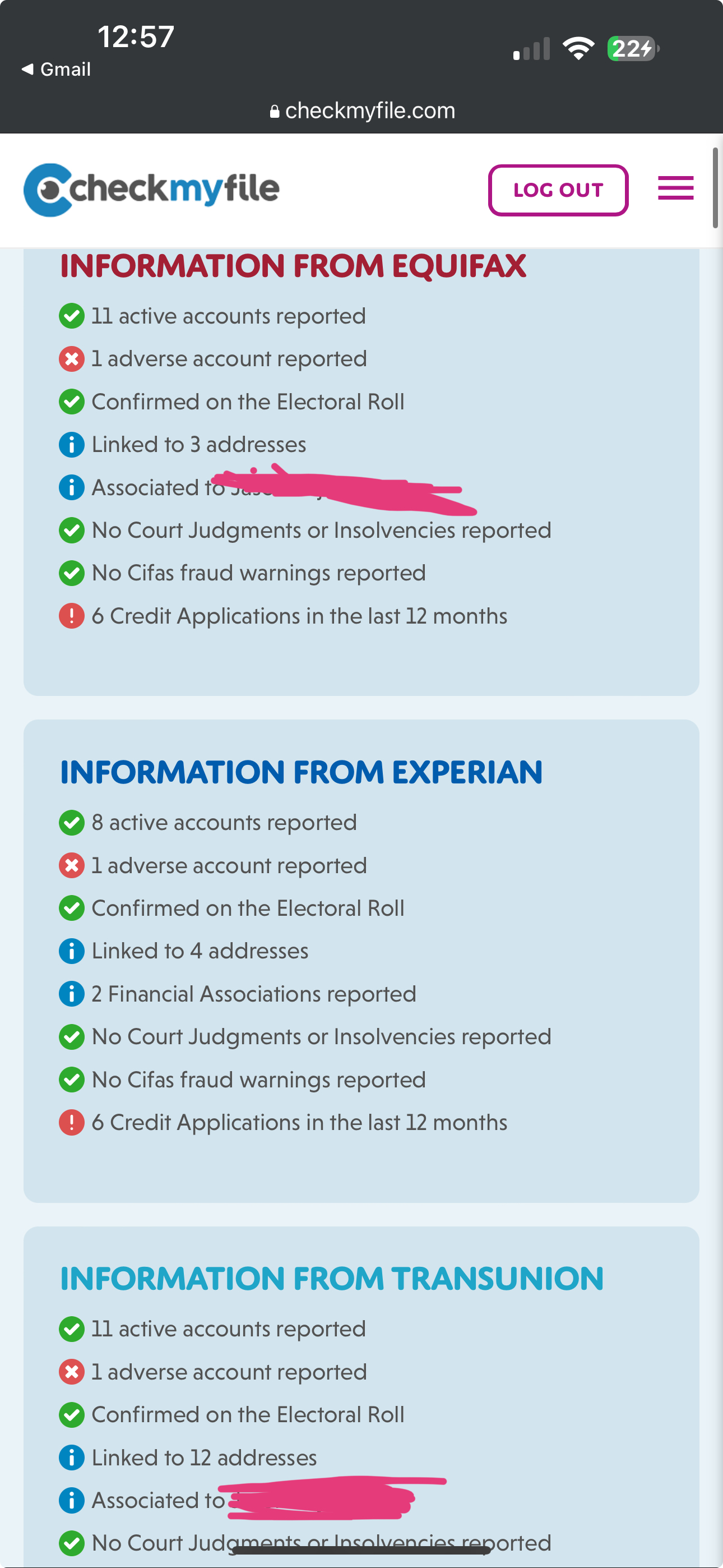

I’d say you were very judgmental, basing this issue off my previous posts on here. This is my credit report, the one adverse account being the EON one and the credit checks being hard mortgage checks. Halifax have made loads for some reason.Scot_39 said:Felt a bit guilty re not reading OP's other post - so scanned it and some others.

The fact a bank has reduced a loan offer from 90 to 85 % seems a perfectly normal event from original application to final offer - after detailed review of ongoing market conditions and individual finances.

1000s of deals are pulled and reviewed upwarss mostly these days - as per market conditions which have been changing regularly with every inflation forecast and 6 weekly BofE rate rise.

And not to wish to sound too judgemental, The OP for instance was posting in Dec talking about wanting not 1 but potentially 2 new credit cards by Mar this year - one to fund potential lasik - upto £1000s in new debt per eye.

Equifax for instance recommend no new credit applications in the 6m before mortgage applications due to negative potential impact.

And earlier threads by OP hint at earlier problems and historical debt.

And depending on if progressed or how obvious / clear that was to lender at time of initial 90% offer definitely another potential reason to drop mortgage offer.

And the OP says in that other mortgage thread had an alternative offer from her broker to cover the purchase at 90%.

So arguably hasn't really lost the house.

At a higher cost and rate - but that is how the market works.

Higher ltv = higher risk = higher rate - even in stable market.

We are not in a stable or rising market in the eyes of OP's original chosen lender.

What is clear is that only the OP and or the bank know the full details, the timings of any recent credit and debt transactions and disclosures thereof, credit searches etc and reasoning for the banks 85% decision.

So anything other than generic guidance is impossible.

Edit

And possibly the best advice - rather than continuing to fight one lenders decision, take other offer if can really afford to and have more faith in market than many, or find a cheaper house, or given time constraints, try to renegotiate with vendor on the basis that a major UK lender (biggest?) now only willing to lend the over £10k less against it.

I do appreciate your advice though, we are now forced to try with a sub prime lender and hoping for the best. Eon have agreed to remove their bad debt markers but by the time it shows on my report, I will be homeless. 0

0 -

we are now forced to try with a sub prime lender and hoping for the best. Eon have agreed to remove their bad debt markers but by the time it shows on my report, I will be homeless.There is no way that this mistake with Eon would lead you to need to use a sub-prime lender unless there are other issues. it is too insignificant and has sufficient detail from eon to allow the lender to ignore it. So, there must be something else if you are being directed to sub prime instead of prime or near prime.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Do the six credit applications in the previous twelve months have any bearing?dunstonh said:we are now forced to try with a sub prime lender and hoping for the best. Eon have agreed to remove their bad debt markers but by the time it shows on my report, I will be homeless.There is no way that this mistake with Eon would lead you to need to use a sub-prime lender unless there are other issues. it is too insignificant and has sufficient detail from eon to allow the lender to ignore it. So, there must be something else if you are being directed to sub prime instead of prime or near prime.0 -

I have worked so hard to keep my credit file squeaky clean for house buying time and this EON issue is causing no end of stress. Halifax have said they won’t see past it other than give a 85% mortgage and we don’t have £13k spare cash.dunstonh said:we are now forced to try with a sub prime lender and hoping for the best. Eon have agreed to remove their bad debt markers but by the time it shows on my report, I will be homeless.There is no way that this mistake with Eon would lead you to need to use a sub-prime lender unless there are other issues. it is too insignificant and has sufficient detail from eon to allow the lender to ignore it. So, there must be something else if you are being directed to sub prime instead of prime or near prime.Maybe I just have a bad broker? EON have sent me a letter admitting fault and advising they are taking it off the file, this was provided to Halifax.0 -

Can EON not provide a letter to Halifax stating they will be updating your credit file? Surely that will resolve the issue with Halifax?0

-

4 of them are Halifax mortgages and the other 2 are from a new bank account. Would the bank account have a big impact? There’s no overdraft facility.GingerTim said:

Do the six credit applications in the previous twelve months have any bearing?dunstonh said:we are now forced to try with a sub prime lender and hoping for the best. Eon have agreed to remove their bad debt markers but by the time it shows on my report, I will be homeless.There is no way that this mistake with Eon would lead you to need to use a sub-prime lender unless there are other issues. it is too insignificant and has sufficient detail from eon to allow the lender to ignore it. So, there must be something else if you are being directed to sub prime instead of prime or near prime.0 -

They have sent one to me that was sent to Halifax but they’ve still said no/only 85% LTVBeerSavesMoney said:Can EON not provide a letter to Halifax stating they will be updating your credit file? Surely that will resolve the issue with Halifax?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards