We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

If I don't buy annuity, give me the name of 3 funds to do the same in a SIPP drawdown scenario

Comments

-

There are no funds that can do the same job as an annuity. Anyone who tells you there is doesn't know what they're talking about and should be ignored.

0 -

(No replies with 60% stock, 30% bond, 10 gilts and cash etc. etc. - just 3 exact fund names sold in UK, let's see if we can do it... !)no such option exists that matches your objective. it would be daft to even try. Drawdown requires a bit more work and flexibility and isn't really a hit, hope and leave alone option.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

If you pick it's worst point which was the 1999 dotcom boom and totally overvalued you'd have 6900 index and 2.1% yield or £145. Today we are at 7250 and £281. Inflation from that point would give £264. All ballpark stuff but still a return on capital and dividend. The OP is asking for a fund so why not the FTSE play a part. I'm also guessing with the annuity all you can do is withdraw the income over time . So we are playing todays natural yield of 3.88% on the FTSE as the alternative. Which annuities return more than the original capital as I'm not that clued up ? I know the OP is 57 yo so plenty time and a 20 yr window as suggested.OldScientist said:

I'd agree with some of what you have said here (although the database at macrohistory.net has a yield of 4.3% in 1985 - but that doesn't change the narrative). However, the performance of the FTSE100 has been rather good since 1985 (e.g., a retirement starting in 1985 with 100% allocation to stocks would have had a 30 year SWR of about 9%), so that period may not be a good indicator of future performance (although, of course, it may)...coastline said:Here's a basic list of annuities although an IFA could probably get a bit more ? The level annuity is over 6% . RPI and escalating annuities are around the 4% mark at 60 yo.

Annuity Rates: View Best Annuity Rates from the UK Market (hl.co.uk)

Well you've ask for a fund and it ain't going to go down well on here but I'd rather buy a FTSE tracker than an annuity with a 10- 20 year window.

Current yield is 3.88% so within the escalating range of the annuity.

Dividend Yields - FTSE 100 (dividenddata.co.uk)

In comparison to other countries the FTSE is cheaper regarding valuation but that doesn't mean it will catch up. It's something in its favour.

Six charts that show how cheap UK equities are (schroders.com)

The dividends are forecast higher 2023-24. You will get blips along the way eg GFC 2008 and 2020 pandemic but the general trend is up.

FTSE 100 dividend forecasts slide amid uncertain climate | AJ Bell

In 1985 the FTSE yield was 3.2% on an index reading of 1000. So £32 pay out a year. Today we have 3.88% on an index of 7250 or £281 pay out.

saupload_FTSE-100-Dividend-yield-over-30-years-2015-05.png (605×341) (seekingalpha.com)

From the inflation calculator £32 in 1985 is £94 today and todays pay out is £281.

Inflation calculator | Bank of England

Given the FTSE is 10% off its all time high and throw in another 10% uplift we're no asking for much even in 10 years. 20% capital gain and a rising dividend set against an annuity of your choice. So there's on simple selection.

FTSE 100 Index, UK:UKX Advanced Chart - (FTSE UK) UK:UKX, FTSE 100 Index Stock Price - BigCharts.com (marketwatch.com)

saupload_FTSE-100-Dividend-yield-over-30-years-2015-05.png (605×341) (seekingalpha.com)

Inflation calculator | Bank of England

3 -

A 20 year time frame for sonmeone aged 57 does not seem prudent if you are in average health since life expectancy is expected to be about 9 years longer than that.coastline said:

If you pick it's worst point which was the 1999 dotcom boom and totally overvalued you'd have 6900 index and 2.1% yield or £145. Today we are at 7250 and £281. Inflation from that point would give £264. All ballpark stuff but still a return on capital and dividend. The OP is asking for a fund so why not the FTSE play a part. I'm also guessing with the annuity all you can do is withdraw the income over time . So we are playing todays natural yield of 3.88% on the FTSE as the alternative. Which annuities return more than the original capital as I'm not that clued up ? I know the OP is 57 yo so plenty time and a 20 yr window as suggested.OldScientist said:

I'd agree with some of what you have said here (although the database at macrohistory.net has a yield of 4.3% in 1985 - but that doesn't change the narrative). However, the performance of the FTSE100 has been rather good since 1985 (e.g., a retirement starting in 1985 with 100% allocation to stocks would have had a 30 year SWR of about 9%), so that period may not be a good indicator of future performance (although, of course, it may)...coastline said:Here's a basic list of annuities although an IFA could probably get a bit more ? The level annuity is over 6% . RPI and escalating annuities are around the 4% mark at 60 yo.

Annuity Rates: View Best Annuity Rates from the UK Market (hl.co.uk)

Well you've ask for a fund and it ain't going to go down well on here but I'd rather buy a FTSE tracker than an annuity with a 10- 20 year window.

Current yield is 3.88% so within the escalating range of the annuity.

Dividend Yields - FTSE 100 (dividenddata.co.uk)

In comparison to other countries the FTSE is cheaper regarding valuation but that doesn't mean it will catch up. It's something in its favour.

Six charts that show how cheap UK equities are (schroders.com)

The dividends are forecast higher 2023-24. You will get blips along the way eg GFC 2008 and 2020 pandemic but the general trend is up.

FTSE 100 dividend forecasts slide amid uncertain climate | AJ Bell

In 1985 the FTSE yield was 3.2% on an index reading of 1000. So £32 pay out a year. Today we have 3.88% on an index of 7250 or £281 pay out.

saupload_FTSE-100-Dividend-yield-over-30-years-2015-05.png (605×341) (seekingalpha.com)

From the inflation calculator £32 in 1985 is £94 today and todays pay out is £281.

Inflation calculator | Bank of England

Given the FTSE is 10% off its all time high and throw in another 10% uplift we're no asking for much even in 10 years. 20% capital gain and a rising dividend set against an annuity of your choice. So there's on simple selection.

FTSE 100 Index, UK:UKX Advanced Chart - (FTSE UK) UK:UKX, FTSE 100 Index Stock Price - BigCharts.com (marketwatch.com)

saupload_FTSE-100-Dividend-yield-over-30-years-2015-05.png (605×341) (seekingalpha.com)

Inflation calculator | Bank of England

The key feature of an annuity is that it is guaranteed for however long you live. So if you die early the return could well be poor, but you will be dead and so wont care. If you die late an annuity could prove to be very good value.

Current fixed annuity rates for someone aged 55 are currently about 6% of purchase cost and index linked rates 3.4% but unlike an investment of course you or rather your estate dont retain the capital.

As well as currently providing a lower return than an annuity, natural income from a FTSE 100 investment would not be in any sense guaranteed and could be quite variable. Inflation would present a significant risk. So all in all not a real alternative.

0 -

In the two cases I've provided the dividend has outpaced inflation . From launch 1984/85 and from 1999 to present day. From launch its over double the rate. The track record is there although not guaranteed I know that. I can see the benefits as you get older but not 57 yo. 100k at 3.4% is only pocket money subject to tax at the end of the day. Every little helps I suppose . State pension plus £70 a week ain't much . Todays pension savers are going to need some effort to make things worthwhile. 40% of homes are rented at the moment and those in that unfortunate trap will need huge pots. I honestly can't see that happening. The income from a DC pot will end up paying the rent. I think myself lucky I own my home.Linton said:

A 20 year time frame for sonmeone aged 57 does not seem prudent if you are in average health since life expectancy is expected to be about 9 years longer than that.coastline said:

If you pick it's worst point which was the 1999 dotcom boom and totally overvalued you'd have 6900 index and 2.1% yield or £145. Today we are at 7250 and £281. Inflation from that point would give £264. All ballpark stuff but still a return on capital and dividend. The OP is asking for a fund so why not the FTSE play a part. I'm also guessing with the annuity all you can do is withdraw the income over time . So we are playing todays natural yield of 3.88% on the FTSE as the alternative. Which annuities return more than the original capital as I'm not that clued up ? I know the OP is 57 yo so plenty time and a 20 yr window as suggested.OldScientist said:

I'd agree with some of what you have said here (although the database at macrohistory.net has a yield of 4.3% in 1985 - but that doesn't change the narrative). However, the performance of the FTSE100 has been rather good since 1985 (e.g., a retirement starting in 1985 with 100% allocation to stocks would have had a 30 year SWR of about 9%), so that period may not be a good indicator of future performance (although, of course, it may)...coastline said:Here's a basic list of annuities although an IFA could probably get a bit more ? The level annuity is over 6% . RPI and escalating annuities are around the 4% mark at 60 yo.

Annuity Rates: View Best Annuity Rates from the UK Market (hl.co.uk)

Well you've ask for a fund and it ain't going to go down well on here but I'd rather buy a FTSE tracker than an annuity with a 10- 20 year window.

Current yield is 3.88% so within the escalating range of the annuity.

Dividend Yields - FTSE 100 (dividenddata.co.uk)

In comparison to other countries the FTSE is cheaper regarding valuation but that doesn't mean it will catch up. It's something in its favour.

Six charts that show how cheap UK equities are (schroders.com)

The dividends are forecast higher 2023-24. You will get blips along the way eg GFC 2008 and 2020 pandemic but the general trend is up.

FTSE 100 dividend forecasts slide amid uncertain climate | AJ Bell

In 1985 the FTSE yield was 3.2% on an index reading of 1000. So £32 pay out a year. Today we have 3.88% on an index of 7250 or £281 pay out.

saupload_FTSE-100-Dividend-yield-over-30-years-2015-05.png (605×341) (seekingalpha.com)

From the inflation calculator £32 in 1985 is £94 today and todays pay out is £281.

Inflation calculator | Bank of England

Given the FTSE is 10% off its all time high and throw in another 10% uplift we're no asking for much even in 10 years. 20% capital gain and a rising dividend set against an annuity of your choice. So there's on simple selection.

FTSE 100 Index, UK:UKX Advanced Chart - (FTSE UK) UK:UKX, FTSE 100 Index Stock Price - BigCharts.com (marketwatch.com)

saupload_FTSE-100-Dividend-yield-over-30-years-2015-05.png (605×341) (seekingalpha.com)

Inflation calculator | Bank of England

The key feature of an annuity is that it is guaranteed for however long you live. So if you die early the return could well be poor, but you will be dead and so wont care. If you die late an annuity could prove to be very good value.

Current fixed annuity rates for someone aged 55 are currently about 6% of purchase cost and index linked rates 3.4% but unlike an investment of course you or rather your estate dont retain the capital.

As well as currently providing a lower return than an annuity, natural income from a FTSE 100 investment would not be in any sense guaranteed and could be quite variable. Inflation would present a significant risk. So all in all not a real alternative.0 -

Edit: sorry, meant as a response to @coastline

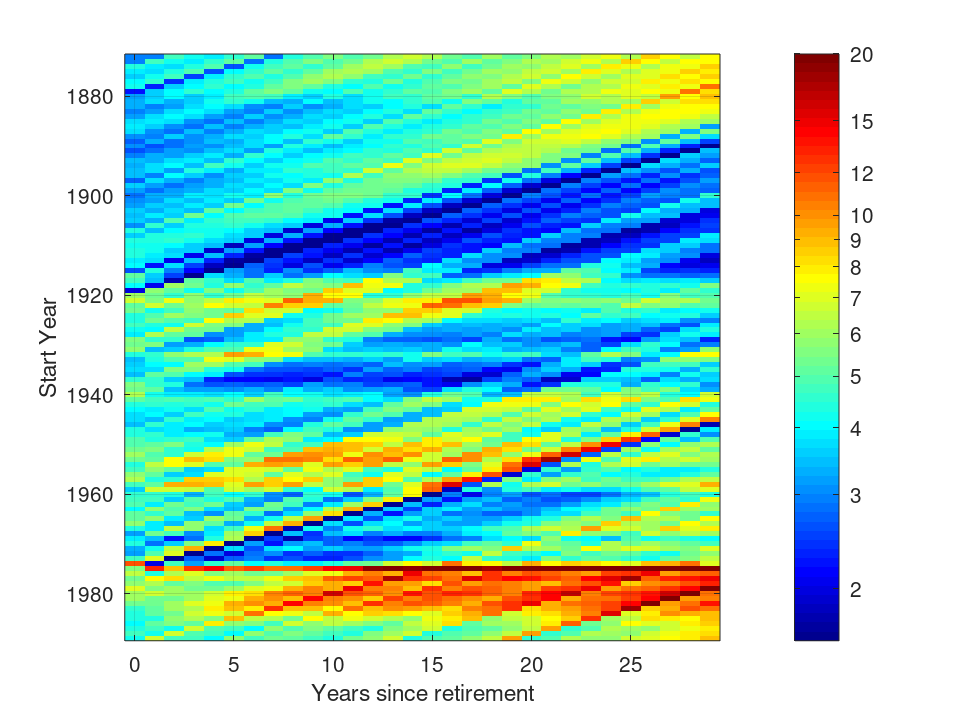

Just to illustrate what I meant about limited history, the following graph shows the real withdrawal rate (expressed as a percentage of the initial portfolio value, in colour - see scale for values) as a function of retirement start year (y-axis) and time since retirement (x-axis) taking natural yield from the UK stock market assuming a 30 year retirement and no fees (yields, returns and cpi from macrohistory.net, my own calculations).

A few things to note:

1) There was a lot of variation between retirement start dates (in other words there were some retirees who were 'lucky' and some who were 'unlucky').

For example, there was generally relatively low real withdrawals for retirements starting in mid-1880s through to the late 1910s and (to a lesser extent) for those starting in the 1960s to the mid-1970s.

On the other hand, retirements starting in the mid-1970s to mid-1980s had periods of very good performance.

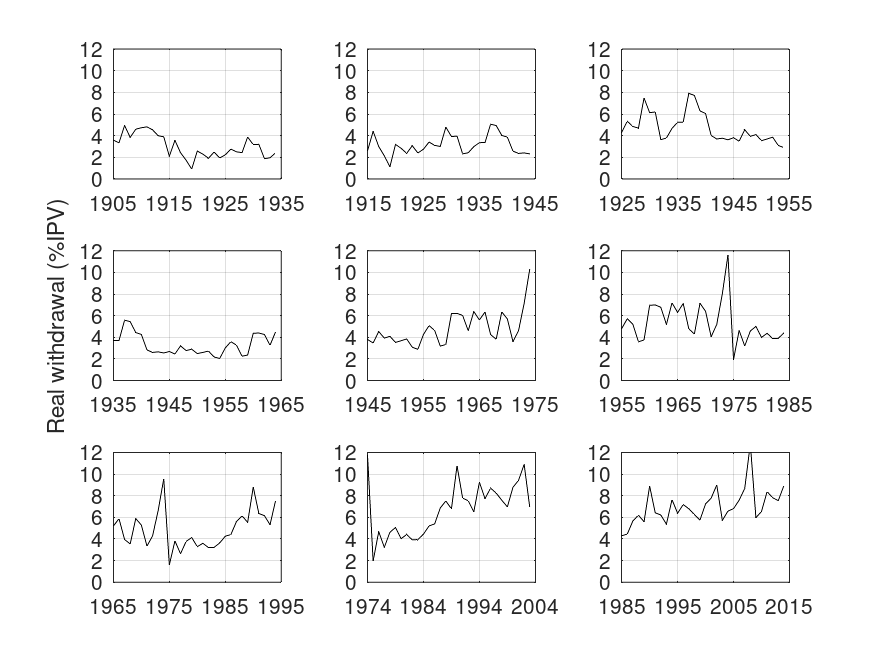

2) There was a lot of variation in income with each retirement. This is probably easier to see in the next graph where some selected examples are plotted.

For example, the retirement starting in 1935, started quite well going from about 4% up to nearly 6% over the first few years, before dropping to under 3% where it remained until the mid-1950s.

The astute of you will have noticed that I used 1974 instead of 1975 - starting a retirement in the middle of a huge bear market means that subsequent withdrawals expressed as a percentage of the initial portfolio are very high, but (of course), the initial portfolio value was very low.

While the natural yield approach is a sound enough approach (and was commonly used when transaction fees were very high), it doesn't provide constant income in real terms and, like all portfolio based approaches, is highly dependent on 'history'. For another view (and I don't agree with his use of the term 'bonkers') see https://finalytiq.co.uk/natural-yield-totally-bonkers-retirement-income-strategy/

Coupling an annuity with the state pension to provide a floor of guaranteed income and using natural yield from the portfolio to provide a variable income on top is one way to go.

Anyway, as other have said, the conclusion is that using the natural yield from a FTSE100 tracker is not a replacement for an annuity.

4 -

Like everyone said, there aren't any. Annuities (with FSCS guarantee) are risk free, any investments have risk - look at what has happened to "safe" funds with a heavy bond weighting in recent years.AustinZ said:Annuities are attractive now, because of interest rates going up, but some people totally dismiss them as wasting your pension and giving it all in admin fees to providers and no control over them.

So give me 3 funds that can buy in my SIPP to do the same job for then next 10 or 20 years, and I could just do drawdown and avoid buying annuity...

(No replies with 60% stock, 30% bond, 10 gilts and cash etc. etc. - just 3 exact fund names sold in UK, let's see if we can do it... !)

You also seem to misunderstand annuities. You aren't wasting your money in admin fees, you pay a one-off fee to the intermediary when you arrange the annuity, after that you pay nothing in fees. You have a guaranteed income stream. IMO you are wasting your money if you keep paying annual admin fees to advisors.

Buying an annuity is a choice between a guaranteed income and a possibly higher, but maybe lower, income from investments. It's purely a risk decision, no money is being "wasted". I am risk averse and recently purchased an annuity with part of my SIPP pot because rates were very good. I am really glad I did this. But a less risk averse person may well make a different decision.2 -

With the exception of duration matching with bond funds - e.g. see https://occaminvesting.co.uk/duration-matching-in-practice for some details (from a UK perspective too!) or https://www.bogleheads.org/forum/viewtopic.php?t=240325 for a US perspective (where an absence of inflation linked annuities means they have to use a DIY approach). AFAIK, there are no short duration inflation linked bond funds currently available in the UK, so an inflation linked ladder cannot be built with funds here.zagfles said:There are no funds that can do the same job as an annuity. Anyone who tells you there is doesn't know what they're talking about and should be ignored.

However, because, unlike an annuity, a bond ladder (or two fund equivalent) does not include mortality credits, the payout rate will virtually always be below that of a single life annuity, but will be closer to that for joint life with 100% survivor benefits. The relatively low payout rate is also not helped by the requirement to build the ladder to the extreme end of longevity (e.g., to age 100). On the other hand, the capital (until spent) is available for legacy in the event of early death.

0 -

From that link there's comments below . I've read it several times in the past but thanks anyway. Hobie explains what I've tried to use with the FTSE tracker and the BOE calculator . Today the FTSE yield is 3.88% slightly higher than the index linked of 3.4% . If it was 2% I wouldn't be posting all of this. We are entering at attractive levels which might get even better if the market goes lower. Who knows ? Now we concentrate on the income produced and history suggests , yes I know not guaranteed , that it will match or outpace inflation. 40 years of data with all the pitfalls in that time is a pretty good guide. Yes we're going around in circles I understand that but the OP is 57 yo and a 20 yr window. There's a good opportunity when markets go lower to pick up income producing funds etc.OldScientist said:

While the natural yield approach is a sound enough approach (and was commonly used when transaction fees were very high), it doesn't provide constant income in real terms and, like all portfolio based approaches, is highly dependent on 'history'. For another view (and I don't agree with his use of the term 'bonkers') see https://finalytiq.co.uk/natural-yield-totally-bonkers-retirement-income-strategy/

Coupling an annuity with the state pension to provide a floor of guaranteed income and using natural yield from the portfolio to provide a variable income on top is one way to go.

Anyway, as other have said, the conclusion is that using the natural yield from a FTSE100 tracker is not a replacement for an annuity.

https://finalytiq.co.uk/natural-yield-totally-bonkers-retirement-income-strategy/

CTY is yielding 5.2%.

City of London Investment Trust PLC, UK:CTY Advanced Chart - (LON) UK:CTY, City of London Investment Trust PLC Stock Price - BigCharts.com (marketwatch.com)

Fundswire article | Trustnet

Another for my list ..Yield 3.69%

JPMorgan Global Growth & Income plc Ord Fund factsheet | Trustnet

3 -

OldScientist said:

With the exception of duration matching with bond funds - e.g. see https://occaminvesting.co.uk/duration-matching-in-practice for some details (from a UK perspective too!) or https://www.bogleheads.org/forum/viewtopic.php?t=240325 for a US perspective (where an absence of inflation linked annuities means they have to use a DIY approach).zagfles said:There are no funds that can do the same job as an annuity. Anyone who tells you there is doesn't know what they're talking about and should be ignored.There is no exception. You can't use "duration matching" or a gilts ladder etc if you don't know the duration required. So unless you know when you die, then it's not doing the same "job" as an annuity.You can make reasonable assumptions about your lifespan, you can make reasonable assumptions about investment returns, interest rates etc, and other investments obviously have potential advantages over an annuity eg likelyhood of better returns, leaving an inheritance etc. But none will do the same job, ie a guaranteed income for the rest of your life.AFAIK, there are no short duration inflation linked bond funds currently available in the UK, so an inflation linked ladder cannot be built with funds here.

Why use funds, you can just use a ladder of index linked gilts. That's easy enough to do if the duration is known, for instance if someone retires early and wants to cover the income gap between retirement and when the state pension/DB pensions kick in.

Well exactly. When you start comparing other investments with annuities you'll start looking at "worst case scenarios", what if you live a really long time, what if investments don't do well etc, then when you look at what the "safe" withdrawal rate is, you might find it's a lot less than an annuity would pay. These days you can get 3.8% index linked annuity at 60 or 4.6% at 65, how does that compare with "safe withdrawal rates"?However, because, unlike an annuity, a bond ladder (or two fund equivalent) does not include mortality credits, the payout rate will virtually always be below that of a single life annuity, but will be closer to that for joint life with 100% survivor benefits. The relatively low payout rate is also not helped by the requirement to build the ladder to the extreme end of longevity (e.g., to age 100). On the other hand, the capital (until spent) is available for legacy in the event of early death.And even so called "safe withdrawal rates" seem to be based on the premise that the past will repeat itself, which period of the past is unknown but the future must be a repeat of some period in the past, therefore if we use the worst period in the past then we'll be "safe"! Who says the future will be anything like the past? Or that in 100 years time, when they look back, the "worst" period won't be eg 2023-2053. (Not that I believe this will happen, I have equity/bond investments, just that it's possible)2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards