We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How are we supposed to afford an 40% increase in mortgage payments...this can't go on!

Options

Comments

-

Actually I think using monetary policy to reign in demand which means that a small proportion of the population takes the majority of the pain is far from the best of fairest way to deal with the situation.Ryan_Holden said:

Brilliant. And if they don't earn that? What if one of them earns £18k in an average clerical role.michaels said:

Two earners, £30k and £25k, after tax per month is £3780pmRyan_Holden said:

Ahhh man this really, really grinds my gears and only reinforces the disconnect some people have.michaels said:You can save £500 per month by giving up the lease on a BMW and buying a 2k runabout.

Getting rid of sky tv and sports package £90pm

Sim only no iphone deal is £5 pm not £70

Shop at aldi with cheaper meat, no alcohol can cut a family food bill to £400pm from £800

Meals out and takeaways are not essential, nor are purchased coffees and packed lunches are less than one quarter the cost of buying lunch.

Holidays are not essential, nor are gigs, theatre trips or festivals

These are all things older generations did without when incomes were lower. We will afford our mortgage increase going up by 130%/£635pm as we value having a home. If you are not willing to give up some of the things mentioned above to own a home it is a choice not a punishment.

I would hedge my bets confidentially that the majority of people struggling with a mortgage are not paying out £1055+ on discretionary spending.

To just broadly suggest they need to cut back on things they probably don't have is insulting and just shows the disconnect.

Older generations didn't cut back on £500 pcm car payments or Sky TV or Sim only phone deals.

Be honest or be quiet.

5 x joint salary mortgage £275k at 6% repayment over 25 years costs £1842pm leaves £1940 per month for other bills.

That is more than just essentials IMHO.

And if they have 2 children which need childcare so they can go to those jobs?

And the consequent bills of food, clothing, academic stuff.

It's a good job you've put IMHO because it's very much just your opinion.

Tbh I know nothing about you or your age but you sound like the almost typical boomer vox-pops that appear on the internet regularly. I'm surprised you haven't mentioned Netflix or Avacado on toast.

We need to be more compassionate to people who are bearing the brunt of this.

The best policy would be to increase income tax and reduce the government deficit, fair, fast acting, reversible and with long term benefits on the debt burden.

However that does not change my opinion that given the mortgage multiples that lenders allow, most borrowers should be able to keep their homes at the current interest rate levels or be it with a sharp and unpleasant adjustment to their lifestyles.I think....3 -

I agree, it needs a cohesive fiscal policy. The country's finances are being run in a ludicrous way at present. The govt has given the BoE sole responsibility for controlling inflation at 2%. And the only tool they have for doing so is the base rate of interest. Meanwhile the govt has been printing money like it was going out of fashion, introduced the stamp duty holiday, and increased the minimum wage (by 10% just this year). All things that are massively inflationary. Then the govt blames inflation on the poor old BoE, who's hands are tied anyway - the UK base rate is more or less pegged to international rates these days.michaels said:

Actually I think using monetary policy to reign in demand which means that a small proportion of the population takes the majority of the pain is far from the best of fairest way to deal with the situation.Ryan_Holden said:

Brilliant. And if they don't earn that? What if one of them earns £18k in an average clerical role.michaels said:

Two earners, £30k and £25k, after tax per month is £3780pmRyan_Holden said:

Ahhh man this really, really grinds my gears and only reinforces the disconnect some people have.michaels said:You can save £500 per month by giving up the lease on a BMW and buying a 2k runabout.

Getting rid of sky tv and sports package £90pm

Sim only no iphone deal is £5 pm not £70

Shop at aldi with cheaper meat, no alcohol can cut a family food bill to £400pm from £800

Meals out and takeaways are not essential, nor are purchased coffees and packed lunches are less than one quarter the cost of buying lunch.

Holidays are not essential, nor are gigs, theatre trips or festivals

These are all things older generations did without when incomes were lower. We will afford our mortgage increase going up by 130%/£635pm as we value having a home. If you are not willing to give up some of the things mentioned above to own a home it is a choice not a punishment.

I would hedge my bets confidentially that the majority of people struggling with a mortgage are not paying out £1055+ on discretionary spending.

To just broadly suggest they need to cut back on things they probably don't have is insulting and just shows the disconnect.

Older generations didn't cut back on £500 pcm car payments or Sky TV or Sim only phone deals.

Be honest or be quiet.

5 x joint salary mortgage £275k at 6% repayment over 25 years costs £1842pm leaves £1940 per month for other bills.

That is more than just essentials IMHO.

And if they have 2 children which need childcare so they can go to those jobs?

And the consequent bills of food, clothing, academic stuff.

It's a good job you've put IMHO because it's very much just your opinion.

Tbh I know nothing about you or your age but you sound like the almost typical boomer vox-pops that appear on the internet regularly. I'm surprised you haven't mentioned Netflix or Avacado on toast.

We need to be more compassionate to people who are bearing the brunt of this.

The best policy would be to increase income tax and reduce the government deficit, fair, fast acting, reversible and with long term benefits on the debt burden.

However that does not change my opinion that given the mortgage multiples that lenders allow, most borrowers should be able to keep their homes at the current interest rate levels or be it with a sharp and unpleasant adjustment to their lifestyles.

4 -

MattMattMattUK said:Edited - I have mismatched my replies here so my original reply is contextually wrong and thus I have removed it.

Their figures appear to be accurate, an opinion based on fact, rather than an opinion based upon emotion

Let's be clear, I'm not emotional here. I am being objective. Yes the OP hasn't been specific in their needs and has posted something that seems more like a vent than a request for information, but the majority of the replies they have received boil down to "well you should have seen it coming" and " well you must be over spending on your social life and driving fancy cars so you better cancel all of that".

And that isn't helpful. People need to stop speculating about the potential that the OP is living some lavish Instagram lifestyle until there's been some clarity.

3 -

As ever its the grafters in the middle hit with trying to own their own house or rent privately. And then they see Government money thrown around like confetti on bungs, grants, benefits increased by inflation 10% + (that includes triple lock and pension credit) all of which is inflationary. As one of the previous posters said fiscal and monetary policy needs to work in harmony. We ALL need to feel a notch or two of tightening on the belt and all accept lower living standards till inflation is slayed. Not just young families with mortgages.4

-

You clearly haven't been on Mumsnet - they are perfectly capable of handing posters their !!!!!! on a plate, in far more robust terms than I have ever seen on here!MeteredOut said:

Compassion won't pay the increase. This board is about providing help; if the OP wants support rather than practical advice, I suspect Mumsnet might be a better place.Ryan_Holden said:The lack of compassion and comprehension by some people here is astonishing.

Telling the OP to 'batten down the hatches' and 'cut back' on a 40% increase on mortgage costs is absurdly disconnected with the reality of what some mortgage holders are facing.

If you take the national average, you'd have to earn 10K more p/a before tax to accommodate for it and maintain your standard of living. That's just not a possibility for a lot of people.

I do think that many people will have to actively manage their finances in a way they haven't had to before. It was relatively easy just to bumble along in an average job when the cost of living was reasonable (viz. the number of people who just spend what they fancy, and still manage to pay the bills), but in the face of larger mortgages and bills people will have to be far more proactive - push for a pay rise or move jobs, think about using the car and make a habit of bringing a packed lunch.5 -

Who predicted the energy costs leaping massively last year? Pretty much no one, right until the moment Russia invaded Ukraine. Anyone who was on a long fixed rate deal before then has benefitted massively, but many people who's fixed rate terms had expired in the preceding 6 months or so, went onto on the variable rate/price cap (as advised by Martin Lewis, so clearly the most sensible option at the time). I guess lots of people were caught out by this, not necessarily the same people who are now getting caught out by the rapidly rising interest rates. Whilst it was clear to most that the super low interest rates couldn't continue forever, I think it's very harsh to say 'you should have seen it coming' with interest rates, certainly not as quickly as it has done.

And yes, everyone had their affordability checked when they took out their mortgage. But when those affordability checks were carried out, they didn't factor in energy prices tripling and the cost of living crisis. For many people the spare disposable income that the banks budgeted for in their affordability calcs has been swallowed up by the rise in energy and food costs.

The problem that we have is that the most significant elements of inflation have been on non discretionary purchases. It's difficult to cut back much on essentials like food and fuel.

My prediction is that the main place a lot of people can reduce their spending is on car leases/PCP. Something I think we're already starting to see, just anecdotally by the number of newly registered cars I've seen on the roads over the last 18 months. We've been conditioned into a credit society over the last 30 years - buy now pay later.

5 -

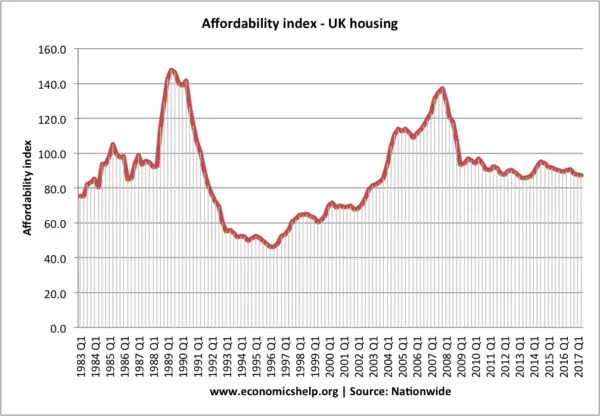

The comparisons suggested in this graph are not really meaningful. 100 years ago houses were generally only bought by th erichest people, the majority of people rented or simply continued to live in the family home. In 1914 only 15% of people owned their own home ref. So people on the average wage would not have bought a house anyway.Newbie_John said:To everyone bringing data back from 70s.. worth also comparing average house price with average salaries - in 70s/80s it was 4x, now it's nearly 10x - so referring to data back in time it's not really relevant:

Also first time buyers with no equity who would be most concerned about price/income ratios cant expect to be able to buy "average" priced houses.1 -

I only wanted to refer to 70s/80s as this was brought back here couple of time when people said that mortgages are finally at normal rate as they always used to be around 8%.Linton said:

The comparisons suggested in this graph are not really meaningful. 100 years ago houses were generally only bought by th erichest people, the majority of people rented or simply continued to live in the family home. In 1914 only 15% of people owned their own home ref. So people on the average wage would not have bought a house anyway.Newbie_John said:To everyone bringing data back from 70s.. worth also comparing average house price with average salaries - in 70s/80s it was 4x, now it's nearly 10x - so referring to data back in time it's not really relevant:

Also first time buyers with no equity who would be most concerned about price/income ratios cant expect to be able to buy "average" priced houses.

They may have been like that back then, but also an average house would cost 4x the average salary - so if I could buy an average house now for the price of £140k instead of £300k then I wouldn't mind paying 8% interest rate.

1 -

If mortgage rates go to 9 or 10% and stay there that is what you will get.Newbie_John said:

I only wanted to refer to 70s/80s as this was brought back here couple of time when people said that mortgages are finally at normal rate as they always used to be around 8%.Linton said:

The comparisons suggested in this graph are not really meaningful. 100 years ago houses were generally only bought by th erichest people, the majority of people rented or simply continued to live in the family home. In 1914 only 15% of people owned their own home ref. So people on the average wage would not have bought a house anyway.Newbie_John said:To everyone bringing data back from 70s.. worth also comparing average house price with average salaries - in 70s/80s it was 4x, now it's nearly 10x - so referring to data back in time it's not really relevant:

Also first time buyers with no equity who would be most concerned about price/income ratios cant expect to be able to buy "average" priced houses.

They may have been like that back then, but also an average house would cost 4x the average salary - so if I could buy an average house now for the price of £140k instead of £300k then I wouldn't mind paying 8% interest rate.1 -

Here's the graphs i linked to earlier in this thread. Quite interesting IMO (though, as always stats can be used to show almost anything). But, on the face of it, until these recent rises, people have not been hit quite as hard as many say, and have arguable had it easier than, or at least comparable to, buyers in the period 2004-2008.

From https://www.economicshelp.org/blog/5568/housing/uk-house-price-affordability/0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599.1K Mortgages, Homes & Bills

- 177K Life & Family

- 257.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards