We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How are we supposed to afford an 40% increase in mortgage payments...this can't go on!

Options

Comments

-

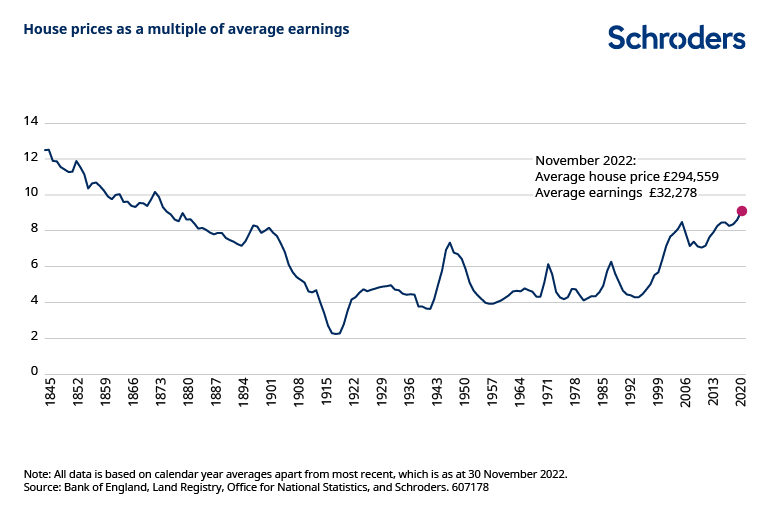

Don't agree.Newbie_John said:To everyone bringing data back from 70s.. worth also comparing average house price with average salaries - in 70s/80s it was 4x, now it's nearly 10x - so referring to data back in time it's not really relevant:

We're talking about where rates could reasonably be expected to go. Rates are not set by house prices but most broadly by macroeconomic forces.

But noting higher house prices now than in previous decades is even more reason to consider affordability.

To those who think those struggling are not getting enough empathy from some....we are talking about a legal agreement for a considerable amount of money. I'm inferring from those defensive comments that some don't recognise the issue of being able to enter such agreements without a lack of comprehension of the potential outcomes.

We either have a lack of regulatory standards, lack of compliance or applicants lying about their circumstances. I think the former is most likely at fault but still I cannot believe the FCA will be saying banks should not have considered rates returning to historic levels when running their mortgage book.

Let me be clear, I am not referring to borrowers whose circumstances have changed for the worse. I hope we can all have empathy there. I am talking about those who borrowed and lent incredible amounts of money which the borrower could not reasonably afford.

Why do people enter such incredibly onerous obligations with such little comprehension of the potential outcomes. Perhaps there needs to be a more stringent application process.

To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.3 -

When did we become a binary board where we can do one but not the other?MeteredOut said:

Compassion won't pay the increase. This board is about providing help; if the OP wants support rather than practical advice, I suspect Mumsnet might be a better place.Ryan_Holden said:The lack of compassion and comprehension by some people here is astonishing.

Telling the OP to 'batten down the hatches' and 'cut back' on a 40% increase on mortgage costs is absurdly disconnected with the reality of what some mortgage holders are facing.

If you take the national average, you'd have to earn 10K more p/a before tax to accommodate for it and maintain your standard of living. That's just not a possibility for a lot of people.

My issue is the sheer condescension that is being shown to the OP by some users.

It's obviously quite a desperate post, so just saying buckle up won't do anything to help.

Nor will those users preaching to cut down on £1000 of completely discretionary spending without any understanding of the OP's current situation.2 -

If the OP really wants help, they could post their mortgage/house details, monthly income and outgoings and I'm sure they'll get some compassionate advice on where they could make savings.Ryan_Holden said:

When did we become a binary board where we can do one but not the other?MeteredOut said:

Compassion won't pay the increase. This board is about providing help; if the OP wants support rather than practical advice, I suspect Mumsnet might be a better place.Ryan_Holden said:The lack of compassion and comprehension by some people here is astonishing.

Telling the OP to 'batten down the hatches' and 'cut back' on a 40% increase on mortgage costs is absurdly disconnected with the reality of what some mortgage holders are facing.

If you take the national average, you'd have to earn 10K more p/a before tax to accommodate for it and maintain your standard of living. That's just not a possibility for a lot of people.

My issue is the sheer condescension that is being shown to the OP by some users.

It's obviously quite a desperate post, so just saying buckle up won't do anything to help.

Nor will those users preaching to cut down on £1000 of completely discretionary spending without any understanding of the OP's current situation.

I doubt many people would want to do that, however, to effectively have your lifestyle picked apart (and what might look like it being judged). I know I wouldn't.

As it is, the post is just a rant with no substance to really allow people to help.8 -

With an 18k income (32 hours at nmw) then the mortgage 5x joint income would be lower too.Ryan_Holden said:

Brilliant. And if they don't earn that? What if one of them earns £18k in an average clerical role.michaels said:

Two earners, £30k and £25k, after tax per month is £3780pmRyan_Holden said:

Ahhh man this really, really grinds my gears and only reinforces the disconnect some people have.michaels said:You can save £500 per month by giving up the lease on a BMW and buying a 2k runabout.

Getting rid of sky tv and sports package £90pm

Sim only no iphone deal is £5 pm not £70

Shop at aldi with cheaper meat, no alcohol can cut a family food bill to £400pm from £800

Meals out and takeaways are not essential, nor are purchased coffees and packed lunches are less than one quarter the cost of buying lunch.

Holidays are not essential, nor are gigs, theatre trips or festivals

These are all things older generations did without when incomes were lower. We will afford our mortgage increase going up by 130%/£635pm as we value having a home. If you are not willing to give up some of the things mentioned above to own a home it is a choice not a punishment.

I would hedge my bets confidentially that the majority of people struggling with a mortgage are not paying out £1055+ on discretionary spending.

To just broadly suggest they need to cut back on things they probably don't have is insulting and just shows the disconnect.

Older generations didn't cut back on £500 pcm car payments or Sky TV or Sim only phone deals.

Be honest or be quiet.

5 x joint salary mortgage £275k at 6% repayment over 25 years costs £1842pm leaves £1940 per month for other bills.

That is more than just essentials IMHO.

And if they have 2 children which need childcare so they can go to those jobs?

And the consequent bills of food, clothing, academic stuff.

It's a good job you've put IMHO because it's very much just your opinion.

Tbh I know nothing about you or your age but you sound like the almost typical boomer vox-pops that appear on the internet regularly. I'm surprised you haven't mentioned Netflix or Avacado on toast.

We need to be more compassionate to people who are bearing the brunt of this.

I have 3 teenage kids and our monthly spend less mortgage is 2400 but we could cut from that such as health insurance, holidays etc if needed.

I suspect at this sort of income you would get universal credit to help with childcare costs and of course child benefit.I think....4 -

MeteredOut said:If the OP really wants help, they could post their mortgage/house details, monthly income and outgoings and I'm sure they'll get some compassionate advice on where they could make savings.

I doubt many people would want to do that, however, to effectively have your lifestyle picked apart (and what might look like it being judged). I know I wouldn't.

As it is, the post is just a rant with no substance to really allow people to help.There is a judgement-free forum here exactly for that, and it is probably a better place to go to get real help than this group.

4 -

Ryan_Holden said:

Older generations didn't cut back on £500 pcm car payments or Sky TV or Sim only phone deals. because we bought cheap cars outright and there were no mobile phones or anything other than terrestial TV - it is all the fancy extras that are costing so much.

because we bought cheap cars outright and there were no mobile phones or anything other than terrestial TV - it is all the fancy extras that are costing so much.

5 -

Yes the banks will want their money back one way or another. If taking possession of a home where someone can't afford the mortgage is the only way that's possible then they will certainly do it. But no they don't want to. Repossession is costly and time consuming for a bank and is unlikely to actually be profitable. And the bad publicity could be really expensive for them in the long run. (think of all those sad face family photos in the papers along side "bank made family with baby homeless" type headlines)Rjhsteel said:When we bought our new home in May 2022, the mortgage rate was 1.44%. With the mortgage rate atm we will be paying close to 40% more a month!

How the hell is that affordable? It may not be, at least not with major changes in the family finances.

Do they want people to hand back their homes? Well, yes and no.

So it's back to making it affordable. This isn't as others suggest a simply case of selling the beemer and getting a bike instead. It's taking a good hard look at everything one has for incomes and expenditures, maximising the first and minimising the second. The debt free board is definitely the place to look.

I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇4 -

An "average clerical role" is going to be £25-30k these days, minimum wage full time is £20,319 pa. Mortgages are proportional to income, a couple only earning £40k between them will at most have managed to get a £180k mortgage and even that would have been unlikely, probably no more than £150k. That £150k mortgage at 6.5% interest over 25 years would cost them £1,013 pcm, or £906 over 35 years. They would take home £2,937 pcm between them, leaving them with around two thousand pounds a month for everything else. If they had children they would also almost certainly be entitled to Universal Credit, as well as Child Benefit.Ryan_Holden said:

Brilliant. And if they don't earn that? What if one of them earns £18k in an average clerical role.michaels said:

Two earners, £30k and £25k, after tax per month is £3780pmRyan_Holden said:

Ahhh man this really, really grinds my gears and only reinforces the disconnect some people have.michaels said:You can save £500 per month by giving up the lease on a BMW and buying a 2k runabout.

Getting rid of sky tv and sports package £90pm

Sim only no iphone deal is £5 pm not £70

Shop at aldi with cheaper meat, no alcohol can cut a family food bill to £400pm from £800

Meals out and takeaways are not essential, nor are purchased coffees and packed lunches are less than one quarter the cost of buying lunch.

Holidays are not essential, nor are gigs, theatre trips or festivals

These are all things older generations did without when incomes were lower. We will afford our mortgage increase going up by 130%/£635pm as we value having a home. If you are not willing to give up some of the things mentioned above to own a home it is a choice not a punishment.

I would hedge my bets confidentially that the majority of people struggling with a mortgage are not paying out £1055+ on discretionary spending.

To just broadly suggest they need to cut back on things they probably don't have is insulting and just shows the disconnect.

Older generations didn't cut back on £500 pcm car payments or Sky TV or Sim only phone deals.

Be honest or be quiet.

5 x joint salary mortgage £275k at 6% repayment over 25 years costs £1842pm leaves £1940 per month for other bills.

That is more than just essentials IMHO.

They they either need to work around their childcare requirements, or pay for it. They will however get tax free childcare.Ryan_Holden said:And if they have 2 children which need childcare so they can go to those jobs?

Everyone has bills, food, clothing, some people have "academic stuff", but that all has to be planned for.Ryan_Holden said:And the consequent bills of food, clothing, academic stuff.

Their figures appear to be accurate, an opinion based on fact, rather than an opinion based upon emotion.Ryan_Holden said:It's a good job you've put IMHO because it's very much just your opinion.

I am not sure what benefit you feel that comment adds.Ryan_Holden said:Tbh I know nothing about you or your age but you sound like the almost typical boomer vox-pops that appear on the internet regularly. I'm surprised you haven't mentioned Netflix or Avacado on toast.

To a point, but practical solutions are far more important than wishy washy answers that do not help anyone.Ryan_Holden said:We need to be more compassionate to people who are bearing the brunt of this.5 -

I guess we won't know this particular poster's actual position unless they choose to come back and clarify it.

But I agree in that if they really do feel that they have no "fat" to trim from their budget, then they could probably get help in trimming it even further, by posting an SOA on the debt boards. They may not like the suggestions mind.

Maybe they haven't picked off the 'low hanging fruit' yet. Who knows.

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)2 -

It isn't a desperate post - the OP purchased their home in May 2022 so they still have 1 or 4 years of their fixed term, but it's also lacking details - we don't know how much they earn nor how much is their mortgage, it can be that they earn 100k as couple, and their mortgage is £100 a month but now will be £140. Yes their situation could be totally different - 5 kids, no employment, £500k mortgage..Ryan_Holden said:

When did we become a binary board where we can do one but not the other?MeteredOut said:

Compassion won't pay the increase. This board is about providing help; if the OP wants support rather than practical advice, I suspect Mumsnet might be a better place.Ryan_Holden said:The lack of compassion and comprehension by some people here is astonishing.

Telling the OP to 'batten down the hatches' and 'cut back' on a 40% increase on mortgage costs is absurdly disconnected with the reality of what some mortgage holders are facing.

If you take the national average, you'd have to earn 10K more p/a before tax to accommodate for it and maintain your standard of living. That's just not a possibility for a lot of people.

My issue is the sheer condescension that is being shown to the OP by some users.

It's obviously quite a desperate post, so just saying buckle up won't do anything to help.

Nor will those users preaching to cut down on £1000 of completely discretionary spending without any understanding of the OP's current situation.

Everyone here is playing ping pong based on different assumptions.

So there is question, there are answers - many of us are or soon will be in similar situation so great place to collect ideas.4

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599.1K Mortgages, Homes & Bills

- 177K Life & Family

- 257.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards