We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Sanity check - Buying a 1 bed new build with estate charges

Comments

-

silvercar said:I’d rather be an owner and risk any paper losses, given that losses only materialise when you sell, than not buy and risk never being able to afford to do so.

I’ve sold at a loss in the past, but the next purchase was cheaper as a result, so I didn’t mind and certainly would have preferred it that way round than renting while waiting to buy.

I could never afford my current home that I bought 16 years ago. It’s gone up and down in value over the years, but this doesn’t matter if your not selling

Thank you both. Main issue I have is figuring out if I should or can afford my own place. On paper I would only have £400 a month left after all costs.Mr.Generous said:silvercar said:I’d rather be an owner and risk any paper losses, given that losses only materialise when you sell, than not buy and risk never being able to afford to do so.

I’ve sold at a loss in the past, but the next purchase was cheaper as a result, so I didn’t mind and certainly would have preferred it that way round than renting while waiting to buy.

I could never afford my current home that I bought 16 years ago. It’s gone up and down in value over the years, but this doesn’t matter if your not sellingAgree with every word.I have financial security because of property. I rode out the storms because the good years add so much more than the bad years take away. I see people on here post things about debts or money with earning much, much higher than my best years in employment, but my net worth is more than I ever thought I'd get close to. The best financial decisions I ever made were buying properties.Sometimes you have to just go for it. I'd rather take a slight risk by being in the game than watch house prices get further out of reach from the sidelines.

I have a second job that bring in an additional £500 but I don't want to work this forever so haven't factored that in.2 -

We have to look at actual sales as well, there are plenty of places to live it is just that people desire the best places to live, but when affordability is constrained it seems that a lot of people just stay where they are already living?snowqueen555 said:

No I don't, and I don't see it as optimistic. I just don't see them dipping that much, outside of interest rates and house prices there will always be a lack of housing supply in this country.Sarah1Mitty2 said:

You don`t see prices falling 10%? That is an extremely optimistic position IMO. Why not post up examples of the sort of property you are looking at so we can follow the price movements with PropertyLog?snowqueen555 said:

Will prices really reduce enough to counteract the 1-2% rates rises? I'm not so sure, there also seems to be a really big lag.Sarah1Mitty2 said:

Interest rates are back to where they were in 2008, that is before you even started saving? This alone should help you to pause and think about how prices are created by borrowing costs.snowqueen555 said:

I've been waiting a loooong time and invested so much energy. But I am slowly leaning towards waiting. Thanks for your feedback.Sarah1Mitty2 said:

I`ll stick my neck out and say they will, The Bristol bubble (like the London, Edinburgh, Manchester etc. etc. bubbles) is built on cheap credit, why not just enjoy some higher savings rates for a while?snowqueen555 said:

If only I had a crystal ball. I've been saving up close to a decade so this has been pretty long experience. I'm not sure prices will fall where I am (Bristol).Sarah1Mitty2 said:

Pass this time, they will be cheaper in future, and so will 2 beds.snowqueen555 said:Hello,

I'm a FTB in my late 30's considering buying a 1 bed newbuild out in the suburbs. I think they are struggling to sell it. It was on for £210k but I've negotiated it down to £195k which is good considering a lot of older run down apartments are going for £180k-ish that requires refurbishment or replacing things.

My main worries are trying to sell it on in the future. A lot of these new estates have estate charges on top of the service charge, this covers maintenance of the greenspaces. This is currently £140pa and the standard service charges are £1040pa. I am also paying the same fees as 2 bed flats so feel like it it expensive, unfortunately I have no control over that.

Should I give this a hard pass, I've been looking for a year and it has been pretty tough. I think I'd be happy there but worried about the saleability in the future, because it is only a 1 bed and also the possible off putting nature of the estate and service charges. I'd like a 2 bed but can't quite seem to be able to get one.

£100k borrow @ 5% = £585pm

£90k borrow @ 6% = £580pm

From 4% to 5% the price of the house would need to reduce almost 10% to be the same, I really can't see that happening. So you're right, interest rates have a huge impact on price, but I don't see prices falling that much.

Rather than focus on specific properties it would be fairer to track the average sold price with a city or region. By all means prove me wrong, it is just my opinion.

https://www.plumplot.co.uk/Bristol-property-transactions.html

0 -

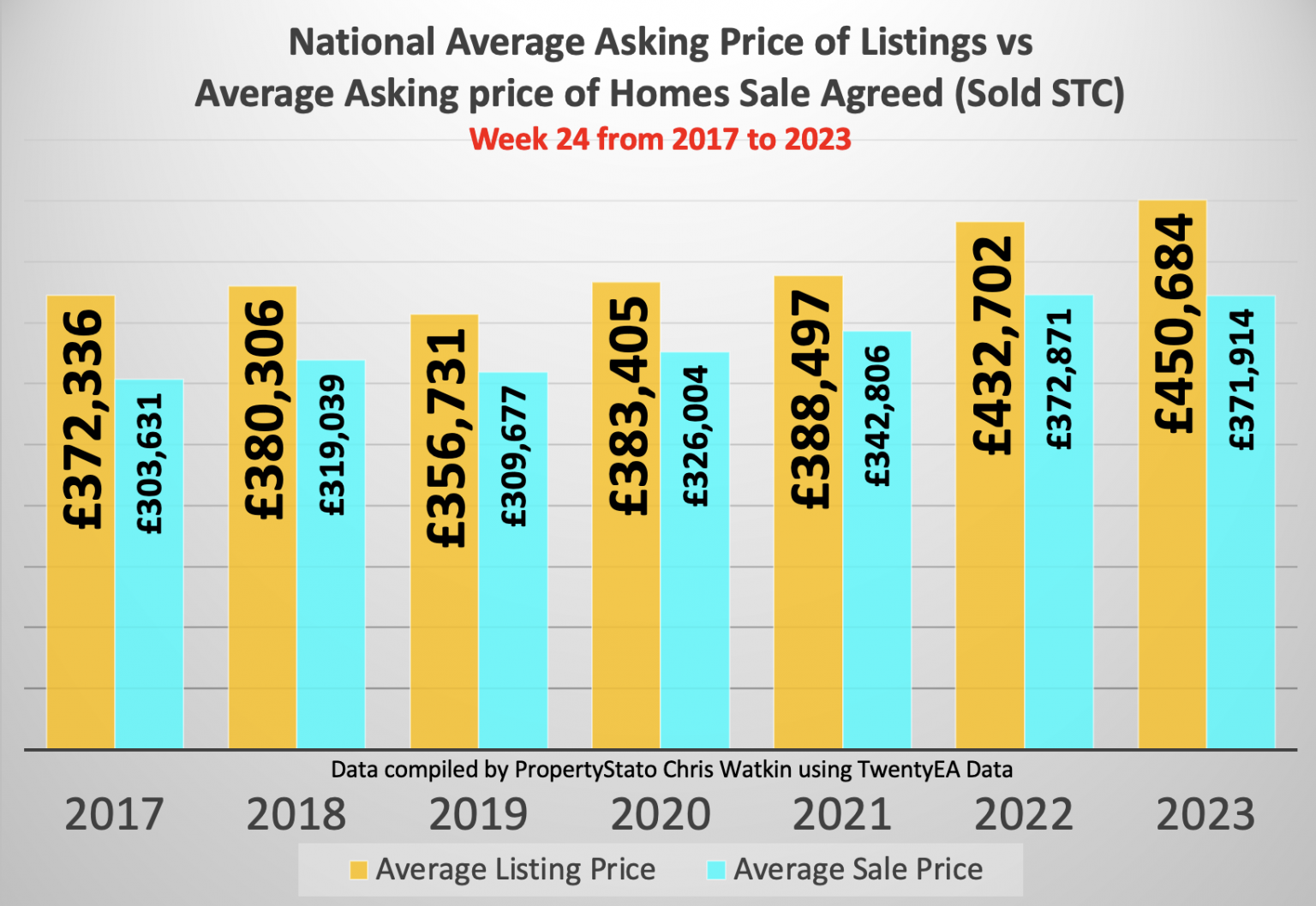

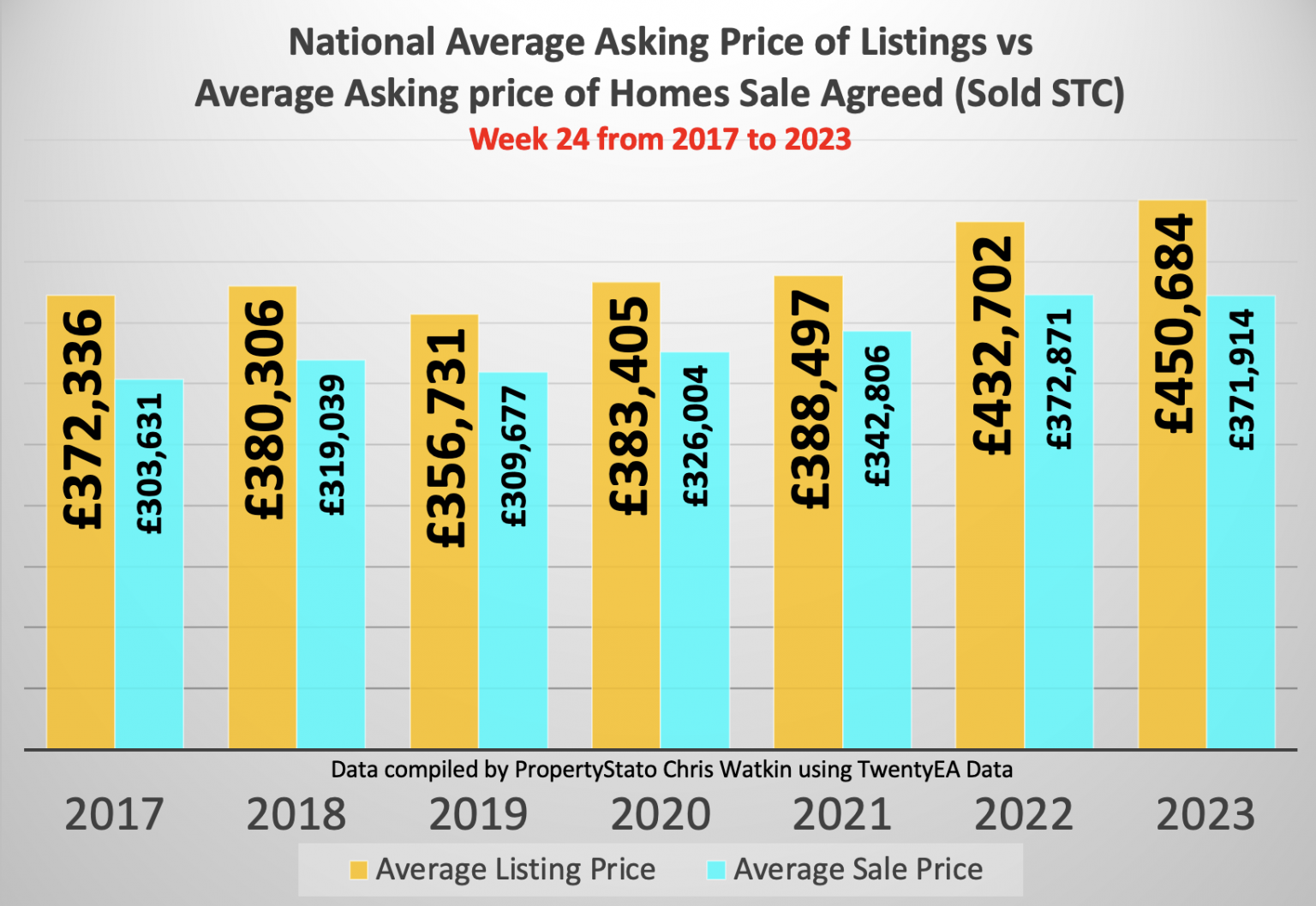

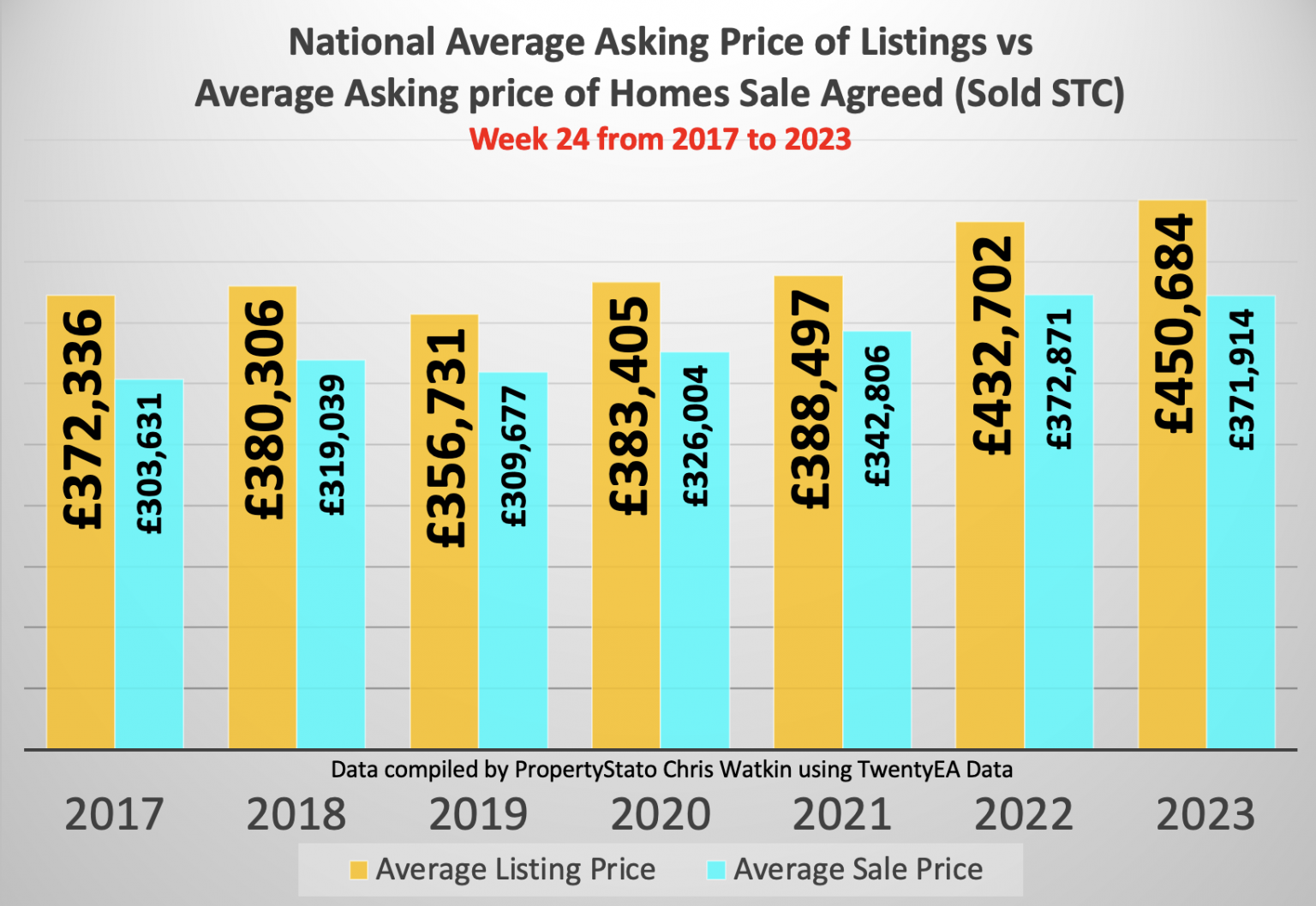

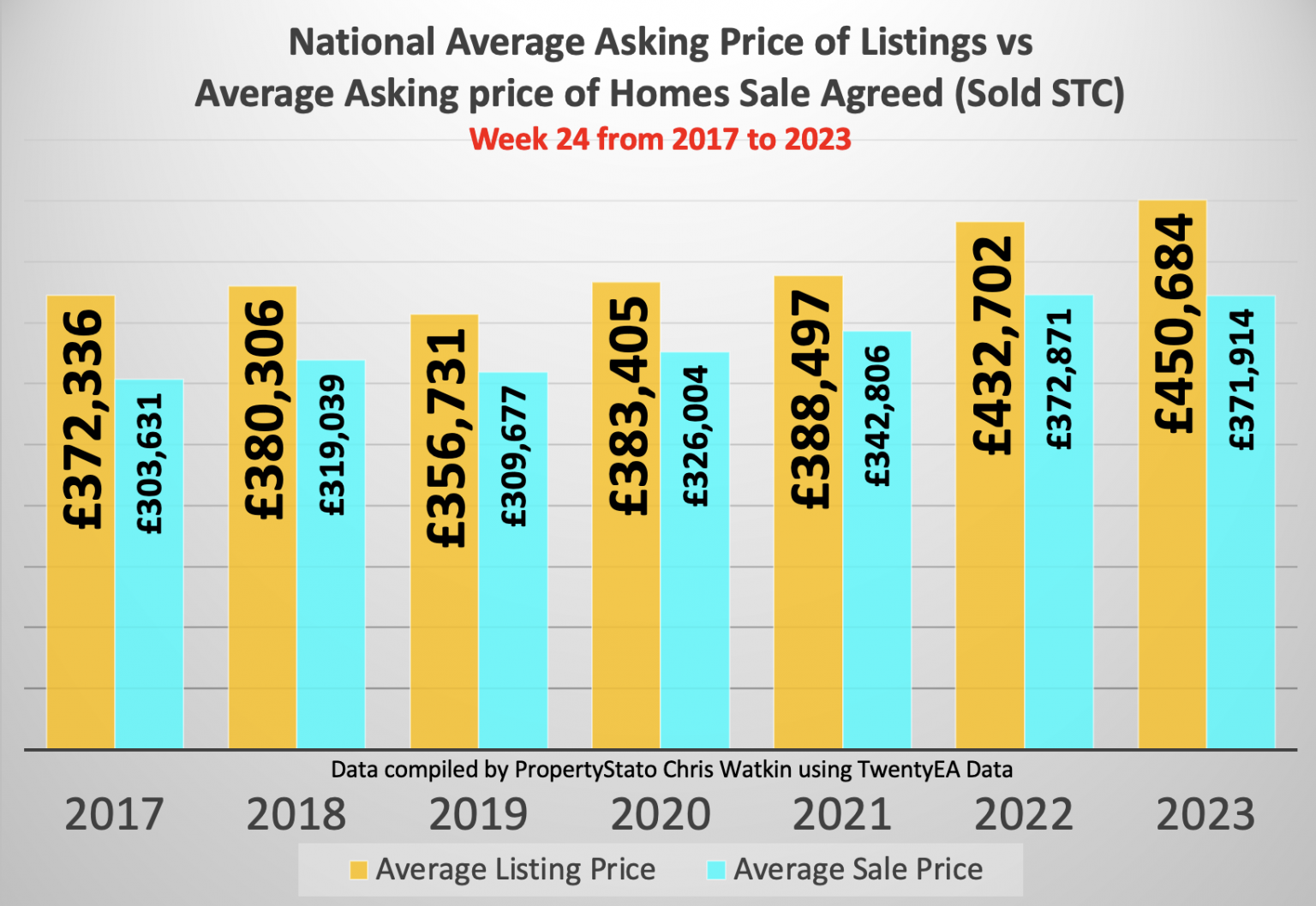

So as we can see you may well see 10% reductions on properties or even more, but the sale prices move upwards over time. If you saved 10k a year towards a house but didn't buy between 2020 and 2023 you'd have £32k after enjoying the interest.The house would be on ave £46k more.

So as we can see you may well see 10% reductions on properties or even more, but the sale prices move upwards over time. If you saved 10k a year towards a house but didn't buy between 2020 and 2023 you'd have £32k after enjoying the interest.The house would be on ave £46k more.

Mr Generous - Landlord for more than 10 years. Generous? - Possibly but sarcastic more likely.1 -

So unless you downsized you would be better off with the money in the bank? Assuming of course that interest rates do their job of bringing prices down.Mr.Generous said: So as we can see you may well see 10% reductions on properties or even more, but the sale prices move upwards over time. If you saved 10k a year towards a house but didn't buy between 2020 and 2023 you'd have £32k after enjoying the interest.The house would be on ave £46k more.0

So as we can see you may well see 10% reductions on properties or even more, but the sale prices move upwards over time. If you saved 10k a year towards a house but didn't buy between 2020 and 2023 you'd have £32k after enjoying the interest.The house would be on ave £46k more.0 -

That's roughly the opposite.Sarah1Mitty2 said:

So unless you downsized you would be better off with the money in the bank? Assuming of course that interest rates do their job of bringing prices down.Mr.Generous said: So as we can see you may well see 10% reductions on properties or even more, but the sale prices move upwards over time. If you saved 10k a year towards a house but didn't buy between 2020 and 2023 you'd have £32k after enjoying the interest.The house would be on ave £46k more.0

So as we can see you may well see 10% reductions on properties or even more, but the sale prices move upwards over time. If you saved 10k a year towards a house but didn't buy between 2020 and 2023 you'd have £32k after enjoying the interest.The house would be on ave £46k more.0 -

What are estate charges?Op, if you do buy, I think an older flat might be better, because if prices go down, new ones on estates seem to go down first.Personally I do think house prices will come down, but I don't have a crystal ball either.0

-

What part of bristol

if it’s a new build and the lease starts after July last year at least you won’t get stuck with the ground rent issue as new builds only have a peppercorn GR

my son is buying in Bristol and knocked 15k off the price off a gorgeous 3 bed house in Whitchurch only last week and the sellers accepted it that day would

He’s in a good position as chain free and he has a huge deposithe doesn’t have to do anything to it either it’s in show house condition so he can just move his stuff in

There seems to be a lot of ex rentals on the market in Bristol at the moment and what I’ve noticed is hat a house either sells straight away ie within a week or it’s stays there for weeks and weeks before they reduce the price and it still doesn’t seem to sellThe ones that sell seem to be in excellent condition and don’t need any work doing to it0 -

A house isn`t a savings account, that is the lesson that people are unfortunately learning now in real time with real financial consequences for them and their family.CSI_Yorkshire said:

That's roughly the opposite.Sarah1Mitty2 said:

So unless you downsized you would be better off with the money in the bank? Assuming of course that interest rates do their job of bringing prices down.Mr.Generous said: So as we can see you may well see 10% reductions on properties or even more, but the sale prices move upwards over time. If you saved 10k a year towards a house but didn't buy between 2020 and 2023 you'd have £32k after enjoying the interest.The house would be on ave £46k more.0

So as we can see you may well see 10% reductions on properties or even more, but the sale prices move upwards over time. If you saved 10k a year towards a house but didn't buy between 2020 and 2023 you'd have £32k after enjoying the interest.The house would be on ave £46k more.0 -

Do you love the flat/new development? Who are your neighbours likely to be? Predominantly Homeowners or rental?snowqueen555 said:

If only I had a crystal ball. I've been saving up close to a decade so this has been pretty long experience. I'm not sure prices will fall where I am (Bristol).Sarah1Mitty2 said:

Pass this time, they will be cheaper in future, and so will 2 beds.snowqueen555 said:Hello,

I'm a FTB in my late 30's considering buying a 1 bed newbuild out in the suburbs. I think they are struggling to sell it. It was on for £210k but I've negotiated it down to £195k which is good considering a lot of older run down apartments are going for £180k-ish that requires refurbishment or replacing things.

My main worries are trying to sell it on in the future. A lot of these new estates have estate charges on top of the service charge, this covers maintenance of the greenspaces. This is currently £140pa and the standard service charges are £1040pa. I am also paying the same fees as 2 bed flats so feel like it it expensive, unfortunately I have no control over that.

Should I give this a hard pass, I've been looking for a year and it has been pretty tough. I think I'd be happy there but worried about the saleability in the future, because it is only a 1 bed and also the possible off putting nature of the estate and service charges. I'd like a 2 bed but can't quite seem to be able to get one.

With the properties that require work, are they liveable now (do they need a new kitchen bathroom at some point in the next 5-10 years or do they need it now)?

I would normally go for older buildings but others here prefer new. If you can get that off the new, what can you get off the older ones? Would it then stretch to a 2 bed?2006 LBM £28,000+ in debt.

2021 mortgage and debt free, working part time and living the dream0 -

I think your son has done well then. If I could get a house I would, no matter the condition. I would be in the BS16 area. I'd say the cheapest houses are probably £250k right now?[Deleted User] said:What part of bristol

if it’s a new build and the lease starts after July last year at least you won’t get stuck with the ground rent issue as new builds only have a peppercorn GR

my son is buying in Bristol and knocked 15k off the price off a gorgeous 3 bed house in Whitchurch only last week and the sellers accepted it that day would

He’s in a good position as chain free and he has a huge deposithe doesn’t have to do anything to it either it’s in show house condition so he can just move his stuff in

There seems to be a lot of ex rentals on the market in Bristol at the moment and what I’ve noticed is hat a house either sells straight away ie within a week or it’s stays there for weeks and weeks before they reduce the price and it still doesn’t seem to sellThe ones that sell seem to be in excellent condition and don’t need any work doing to it

Yeah no ground rent but that bloody estate charge has replaced it.jonnydeppiwish! said:

The location is in a new suburb so mainly families, quiet but good connections to work.

Do you love the flat/new development? Who are your neighbours likely to be? Predominantly Homeowners or rental?snowqueen555 said:

If only I had a crystal ball. I've been saving up close to a decade so this has been pretty long experience. I'm not sure prices will fall where I am (Bristol).Sarah1Mitty2 said:

Pass this time, they will be cheaper in future, and so will 2 beds.snowqueen555 said:Hello,

I'm a FTB in my late 30's considering buying a 1 bed newbuild out in the suburbs. I think they are struggling to sell it. It was on for £210k but I've negotiated it down to £195k which is good considering a lot of older run down apartments are going for £180k-ish that requires refurbishment or replacing things.

My main worries are trying to sell it on in the future. A lot of these new estates have estate charges on top of the service charge, this covers maintenance of the greenspaces. This is currently £140pa and the standard service charges are £1040pa. I am also paying the same fees as 2 bed flats so feel like it it expensive, unfortunately I have no control over that.

Should I give this a hard pass, I've been looking for a year and it has been pretty tough. I think I'd be happy there but worried about the saleability in the future, because it is only a 1 bed and also the possible off putting nature of the estate and service charges. I'd like a 2 bed but can't quite seem to be able to get one.

With the properties that require work, are they liveable now (do they need a new kitchen bathroom at some point in the next 5-10 years or do they need it now)?

I would normally go for older buildings but others here prefer new. If you can get that off the new, what can you get off the older ones? Would it then stretch to a 2 bed?

Most properties available need work, liveable but lets say changing carpets, repainting and bathrooms and kitchens need work. It does surprise me how people don't look after their homes. But if they are 20k less than a newbuild it will surely cost £10k or more to do them up.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards