We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Couples threshold with 1 looking after an under 3

soundlab_2

Posts: 27 Forumite

Married and with have 3 kids, 7, 10 and 2.

Wife has started work, 18.5 hours a week, earning £1022 a month, and iam staying at home looking after our 2 year old.

We've informed universal credit and everything. she had a message saying to attend job centre for job search review, she asked about this as she is now working, she was told our combined earnings are under £1083 so she still needs to attend.

But seeing as iam main carer for our 2 year and was told I don't have to look for work (just prepare) we thought we would fall into the single person threshold rate but seems that's not the case.

So just abit confused weather we do actually fall into the single person threshold rate.https://www.turn2us.org.uk/Benefit-guides/Universal-Credit/Claimant-Commitment-Conditionality

If you are working but are earning less than £677 per month (if you are single) or £1083 per month joint income (if you are a member of a couple), you will be expected to look for more work and be available for work.

There are some exceptions if your partner is not expected to work. If your partner is not expected to work (for example, because they're a carer or have Limited Capability for Work), the single person threshold will be used instead of the couple threshold.

0

Comments

-

By carer in that quote above I'm fairly sure it means claiming the carer element as a carer for a severely disabled person. They are in a different work group (no work-related requirements) whereas someone looking after a child of 2 is in the work preparation group and the earnings threshold applies. When your youngest child turns 3 you'd then be in the all work-related requirements group.

See this page, including the sections relating to 'responsible for a child' and 'working/self-employed'

https://www.citizensadvice.org.uk/benefits/universal-credit/what-youll-need-to-do-on-universal-credit/claimant-commitment-what-group/

My apologies, I seem to have misread that page.0 -

Spoonie_Turtle said:By carer in that quote above I'm fairly sure it means claiming the carer element as a carer for a severely disabled person. They are in a different work group (no work-related requirements) whereas someone looking after a child of 2 is in the work preparation group and the earnings threshold applies. When your youngest child turns 3 you'd then be in the all work-related requirements group.Someone in the work preparation group is not expected to work so it would not be logical to assume they are getting earnings. This looks more logical for the individual threshold to apply.

EDIT - incorrect, please see later comment by tomtom.Information I post is for England unless otherwise stated. Some rules may be different in other parts of UK.0 -

I agree with the logic but the CAB page specifically says the work prep andcalcotti said:Spoonie_Turtle said:By carer in that quote above I'm fairly sure it means claiming the carer element as a carer for a severely disabled person. They are in a different work group (no work-related requirements) whereas someone looking after a child of 2 is in the work preparation group and the earnings threshold applies. When your youngest child turns 3 you'd then be in the all work-related requirements group.Someone in the work preparation group is not expected to work so it would not be logical to assume they are getting earnings. This looks more logical for the individual threshold to apply.

Nope, I misread the page, my apologies. Will amend my previous post.

0 -

You are a couple so need to meet the couple rate. You will both have expected hours, but as you are the primary carer, yours is 0, but your partner would be expected to be working 35 hours per week.

As you are not single, the single rate will not apply to you.

4 -

Be prepared for them being difficult with your wife (or anyone) working part time as they may well insist that she attend meetings during hours when she is scheduled to work. They did that to me and insisted that I should attend exactly when I was supposed to start work for a 2 hour shift (not something I could change). They agreed eventually that because I was working that phone interviews were possible but didn't ring at the times arranged. And then wouldn't advise when revised times would be. And then would ring at random times and days but because I couldn't answer the phone when they rang that was me not attending interviews. No matter how many times I rang their central number (because they w/couldn't give me a direct number) I could never get this sorted. I tried emailing my "coach" who never responded except to eventually shut down my claim as I wasn't co-operating. I complained and that went absolutely no where. Fortunately in the end I didn't need the money they should have paid me enough for me to take this any further.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅0 -

Thanks, tomtom.tomtom256 said:You are a couple so need to meet the couple rate. You will both have expected hours, but as you are the primary carer, yours is 0, but your partner would be expected to be working 35 hours per week.

As you are not single, the single rate will not apply to you.Information I post is for England unless otherwise stated. Some rules may be different in other parts of UK.1 -

they are bloody difficult. I'm self employed and earn around £2000 a month. My wife is stay at home mum, and she has to attend some BS "preparation for work" jobs. She had to leave and go to a job centre on commuter path at 9:15 in the morning.Her task is to research childcare places in the area to show that she's looking at her options.When she's required to work. I hope to have profits of £3000 or more each month and I'll just give her a job in my business - but they don't know that.I heard stats on UC. They welfare state bill is quite substantial for the treasury. One could be forgiven for thinking all that money goes to claimants. But what was shocking is that around half of the welfare budget was for the running of jobcentre and administration of UC.I ge tthe feeling a lot of the jobcentre staff are just sitting around twiddling their thumbs. Just doing random BS work just to look busy.Pointless interviews, calling into jobcentre for a box ticking excercise. I make a query about savings via work coach.. Big mistake. They called me in for a face 2 face to bring all my statements to see for themselves. My word wasn't enough. In the end the work coach got overwhelmed with 5 sets of bank statements going back 3 months with lots of intra-bank transfers between them to work out how much capital I really had - in the end they just asked me to explain it and put it on the computer.What a waste of time.0

-

Remember too that about a third of the welfare cost is State Pensions.seatbeltnoob said:They welfare state bill is quite substantial for the treasury.Information I post is for England unless otherwise stated. Some rules may be different in other parts of UK.3 -

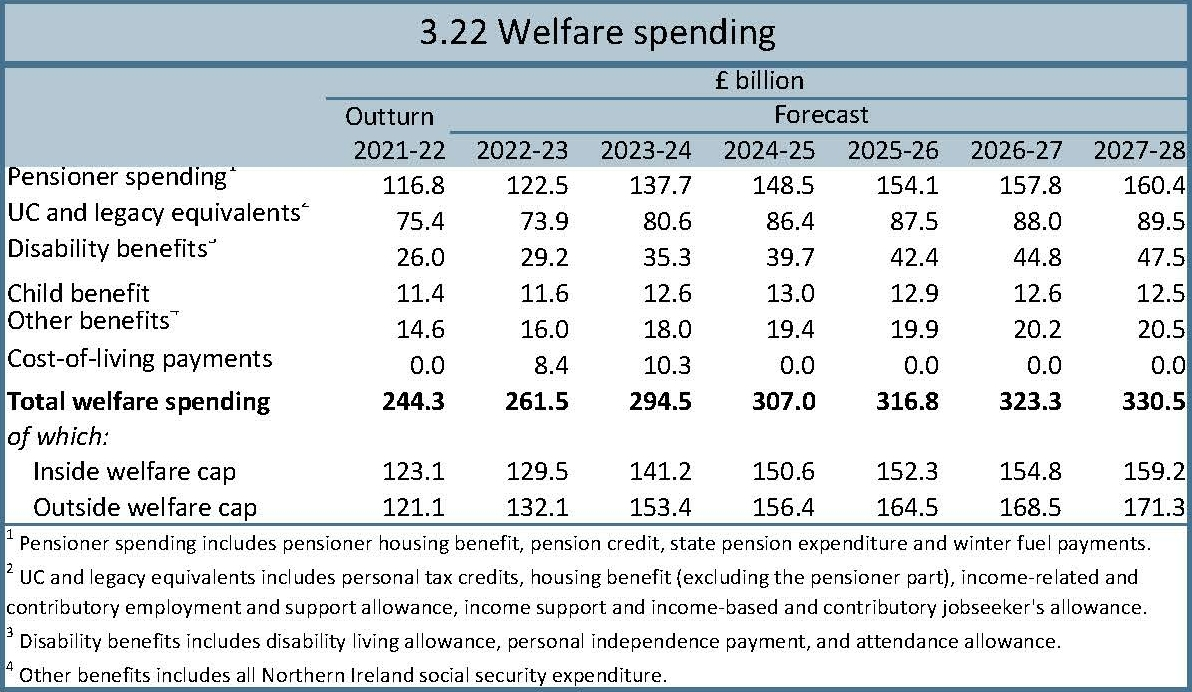

Which statistics are you referring to, please share. It is certainly expensive, spending on welfare will be £294billion in 2023/24, that's an increase in welfare spending of £50 billion in the last two years. I'm happy to be corrected but I simply don't believe administration costs are £150 billion, not least because pensioner benefits at £137 billion, account for 47.6% of the entire welfare budget.seatbeltnoob said:I heard stats on UC. They welfare state bill is quite substantial for the treasury. One could be forgiven for thinking all that money goes to claimants. But what was shocking is that around half of the welfare budget was for the running of jobcentre and administration of UC.

https://obr.uk/forecasts-in-depth/tax-by-tax-spend-by-spend/welfare-spending-pensioner-benefits/

ETA,

Doing some digging and actually the entire welfare budget is spent on claimants, administration costs come from the relevant departmental budgets. Total DWP departmental budget in 2021/22 was £9.33 Billion

https://www.gov.uk/government/statistics/public-spending-statistics-release-may-2023/public-spending-statistics-may-2023#total-departmental-expenditure-limits-2021-22-millions

I'm sure the staff are thrilled about meeting you too.seatbeltnoob said:Pointless interviews, calling into jobcentre for a box ticking excercise. I make a query about savings via work coach.. Big mistake. They called me in for a face 2 face to bring all my statements to see for themselves. My word wasn't enough. In the end the work coach got overwhelmed with 5 sets of bank statements going back 3 months with lots of intra-bank transfers between them to work out how much capital I really had - in the end they just asked me to explain it and put it on the computer.What a waste of time.7 -

Interesting that State Pension alone is now 42% of the welfare budget.kaMelo said:...because pensioner benefits at £137 billion, account for 47.6% of the entire welfare budget.Information I post is for England unless otherwise stated. Some rules may be different in other parts of UK.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards