We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

7.0% actually 3.69%?

Comments

-

I don’t get what confuses people. The money you put in is either new, say £300 from your monthly pay, which means you get the highest level of interest for that money, or it came from a lower paying easy access account, in which case you are earning not just the 7% on that money, but also what that £300 was earning previously. Either way you make way more interest for your money than if you just left it in/let it go to another easy access account. Only locking away for a year might get you a better deal, but only if it’s existing money, not new income.

2 -

I think you have to remember that we on the Savings board are the exception, having the resources to fund multiple regular savers each month, and being able to drip feed from our instant access accounts etc. About a quarter of adults in the UK have no savings at all, and another quarter have less than £1,000. In that context, opening a Regular Saver and putting aside even £20 a month is a good thing.cricidmuslibale said:

I agree with this very much!RG2015 said:

You could actually say that the banks should be praised for offering loss leading accounts to entice people into saving when they otherwise may not have done.TheBanker said:I think there is a psychological effect to the high rates. I think they're designed to attract attention - they are obviously loss-leaders for the banks otherwise they wouldn't limit the amount you can deposit.

But they also encourage customers to get into the savings habit. Many years ago I used to help school leavers open their first bank account (when having a bank account as a teenager was less common than now). If they were starting work I'd encourage them to set up a regular saver. I know this helped some of them to build up savings to pay for holidays, studies, or to avoid debt when something went wrong. I also opened bank accounts for healthcare professionals who'd come to the UK from abroad to work for the NHS. Again, a regular saver was a good addition to the current account to help meet unexpected bills.

I was always much happier selling savings accounts than credit cards (which, at the time came with PPI )

)

It's a win-win situation - the customer gets a good rate, the bank gets a good customer. Nothing wrong with that.

Far more of a win-win than a deceptive policy.

I think many people who have a significant amount of savings but are not necessarily savvy savers all that often will probably be aware of 1 or 2 Regular Savings accounts, such as those offered by a big well-established bank or building society that they already have their money with. What they may not be aware of though is how many other good Regular Savers are also available for them to potentially utilise at the same time as the familiar 1 or 2 that they do know about and may well be already saving into.

If these sometimes non-savvy savers were to realise that that in total they could currently easily save £1000 and potentially a lot more each month into several Regular Savers paying at least 4% and up to 7% annual interest, then they would soon see how very beneficial indeed multiple Regular Savings accounts can be!

3 -

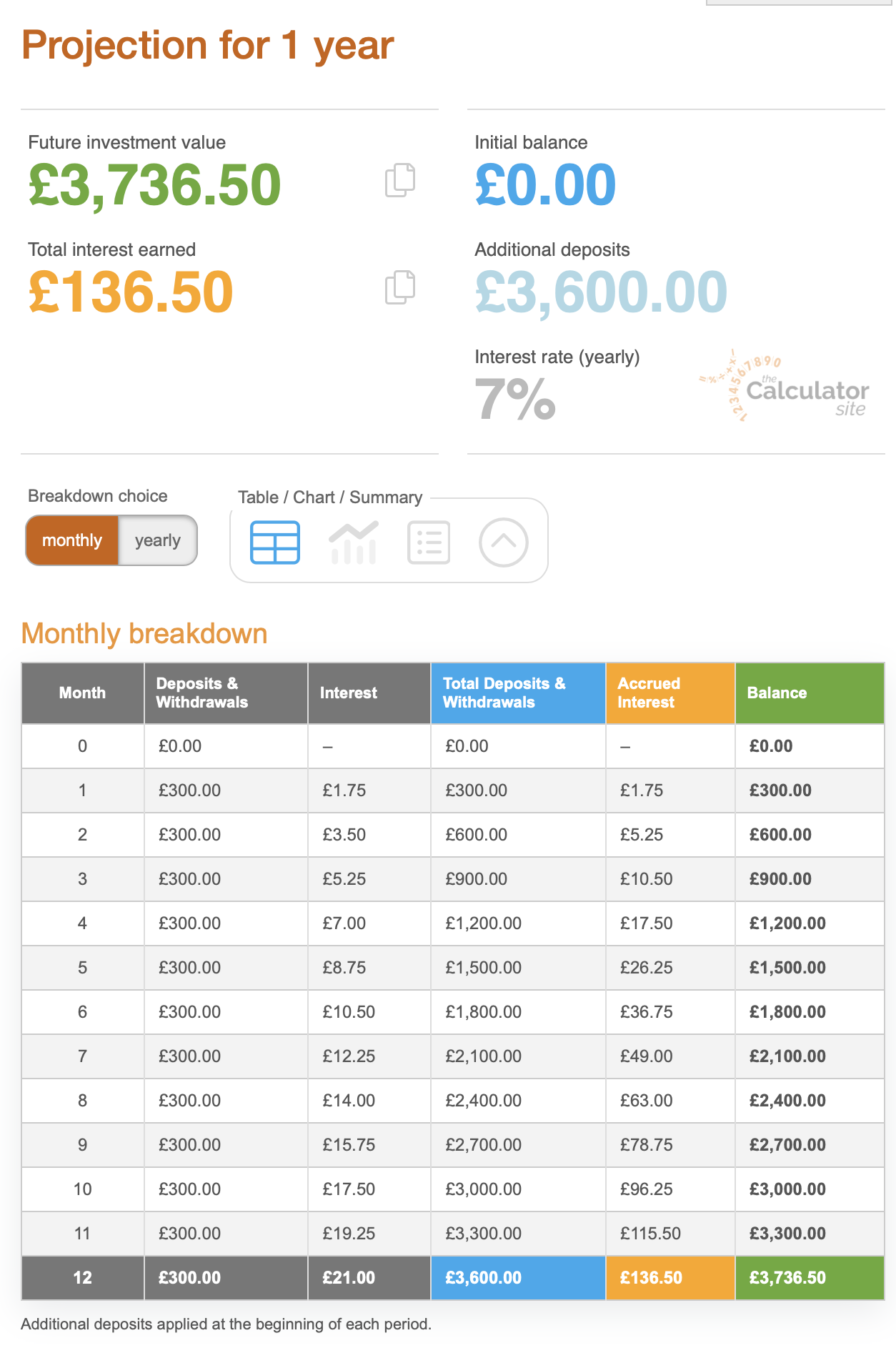

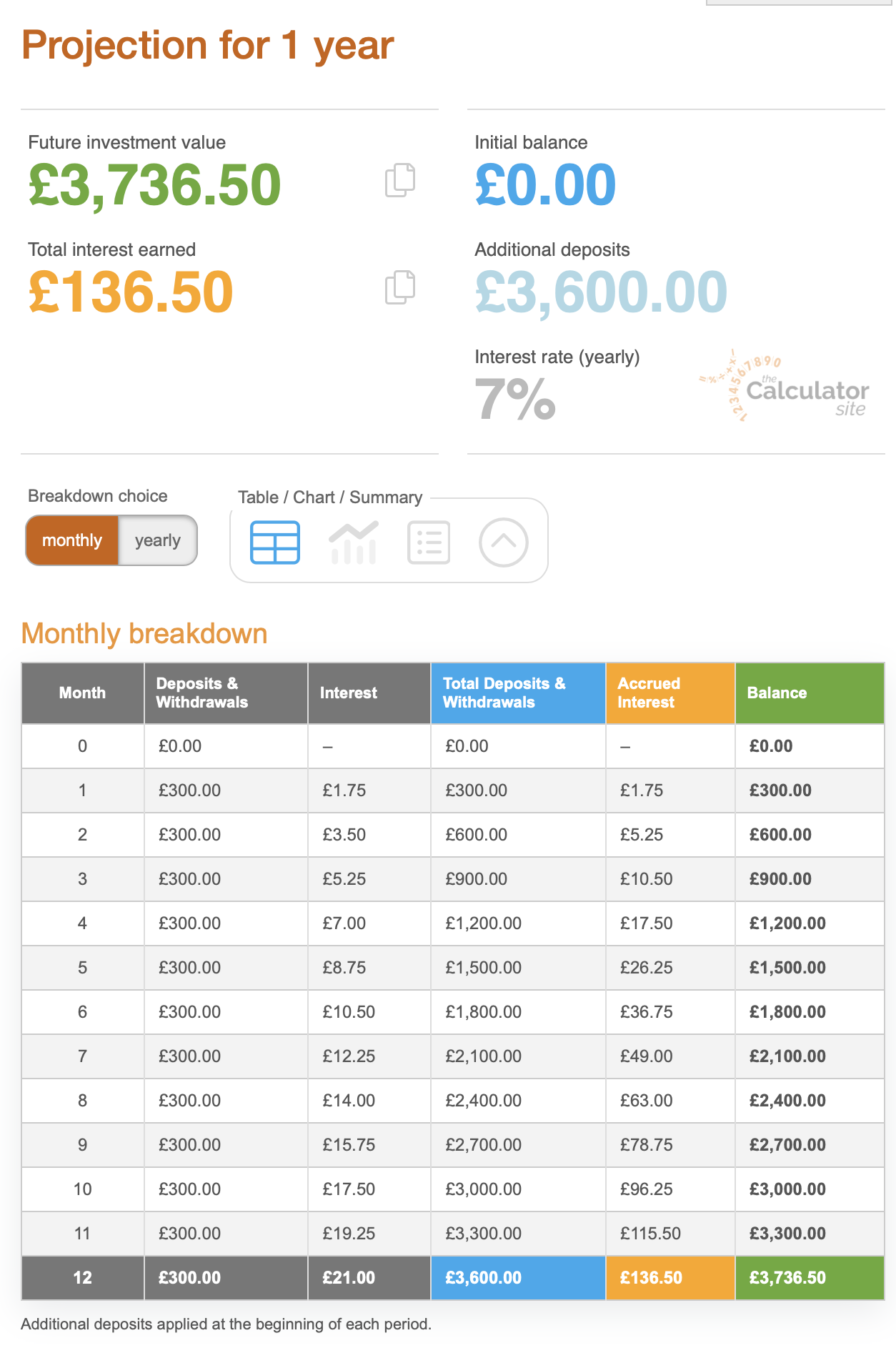

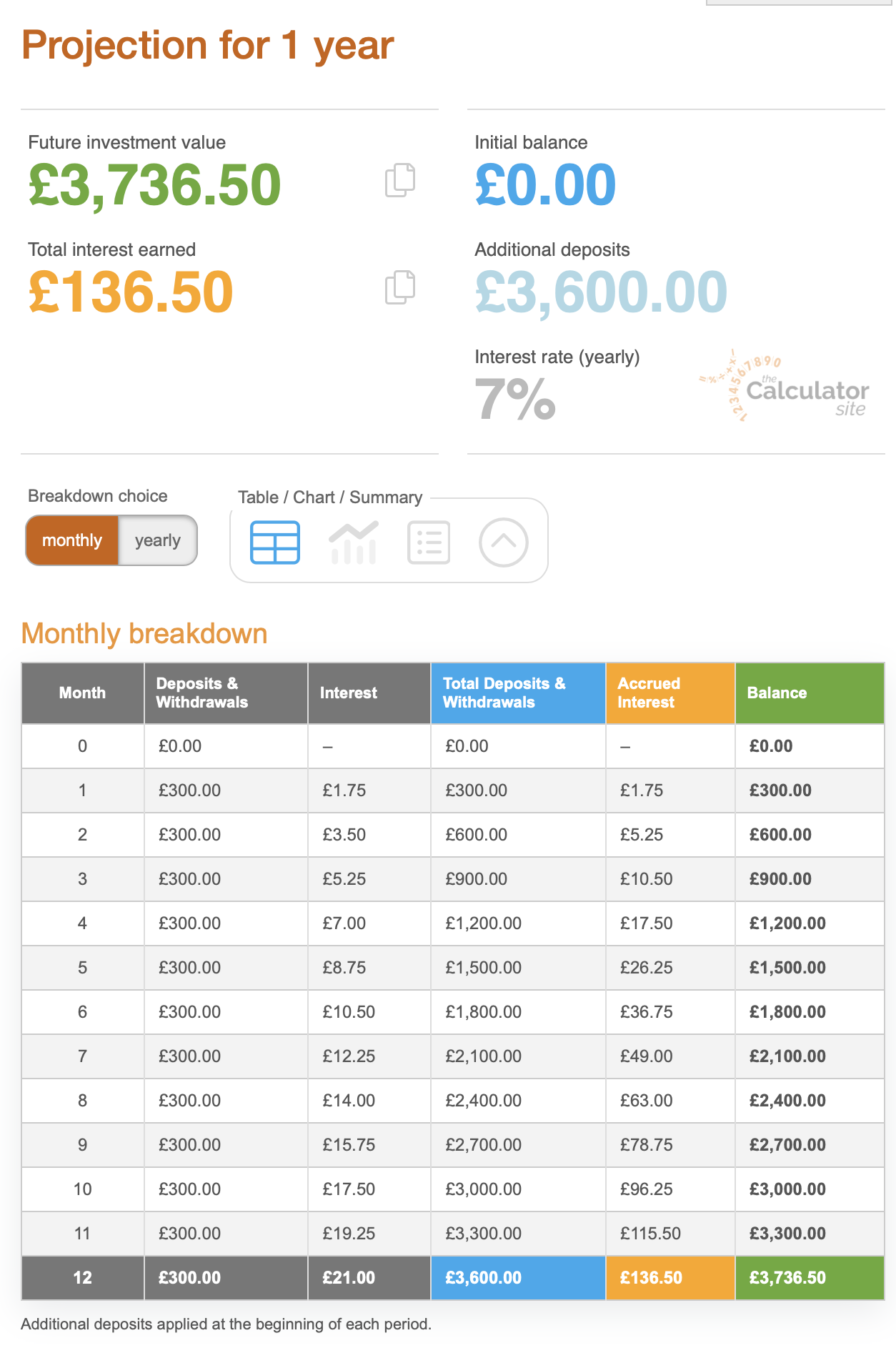

What site did you get the calculator from? This would be useful for other things.ForumUser7 said:Your calculation appears to be (300x12) x 0.07. That would give you the interest for if you deposited £3,600 in the 7% account straight away at the start of the 12 months in one go - which is not permitted.

Rather you can deposit £300 each month for 12 months.

You will not get interest for the days funds are not in your account, hopefully that makes sense.

This calculator may help you to visualise it - https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php 0

0 -

Not sure I understand. The link to the site is on the post.housebuyer143 said:

What site did you get the calculator from? This would be useful for other things.ForumUser7 said:Your calculation appears to be (300x12) x 0.07. That would give you the interest for if you deposited £3,600 in the 7% account straight away at the start of the 12 months in one go - which is not permitted.

Rather you can deposit £300 each month for 12 months.

You will not get interest for the days funds are not in your account, hopefully that makes sense.

This calculator may help you to visualise it - https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

You need to click through to get here.

https://www.thecalculatorsite.com/finance/calculators/savings-calculators.php

2 -

I found it on Google, the link to the calculator is in my post in this thread (the one you replied to). It sometimes returns marginally different results, but as you say, it is very useful!housebuyer143 said:

What site did you get the calculator from? This would be useful for other things.ForumUser7 said:Your calculation appears to be (300x12) x 0.07. That would give you the interest for if you deposited £3,600 in the 7% account straight away at the start of the 12 months in one go - which is not permitted.

Rather you can deposit £300 each month for 12 months.

You will not get interest for the days funds are not in your account, hopefully that makes sense.

This calculator may help you to visualise it - https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

I don't understand how it can be designed to deceive. I think anyone would understand that they don't get charged interest on the money they've paid off their mortgage balance. It's just the opposite of that.Beddie said:To those who say it is not designed to deceive - it really is. If you asked 100 people in the street, half would think the same as this poster. Just because we on here are good with finances and maths does not mean everyone is.

There is a psychological draw to these high rates on regular savings, even though the actual gains are small.Remember the saying: if it looks too good to be true it almost certainly is.9 -

If there were enough of these regular savings accounts at the same rate that someone could have 12 of them, started at monthly intervals, and renew each on maturity, with the interest paid out to another account, the aggregate principal would be constant, and the interest paid would be the headline rate on the constant balance

But apart from that set of circumstances, the balance isn't constant, and you won't be paid interest on money that hasn't yet arrived. The last month's deposit gets about half a per cent, as it's been there only a month. The rest, regular intervals in between

What if the interest was £1 in the first month, £2 in the second, and so on, to £12 in the last. The sum of all the numbers from 1 to 12 is 78, not 144

n(n+1)/21 -

If the terms allowed you to deposit £300 when you first opened the account and make no further payments. At the end of term you would receive your £21anakeimai said:Thanks all, but I'm still baffled. In one month I'll have paid in £300.00 so why at 7% doesn't that give me £21?

The 7% is for a year not per month2 -

The illustration literally tells you how much you will earn if you pay in £300 a month for a year. I don't think they are trying to deceive anyone.3

-

Haha this was exactly my first thought when I read Beddie's comment.Band7 said:Surely people would not expect to pay interest for money they have not borrowed (e.g. on a credit card or with a loan) - so why would anyone expect get interest for money they have not deposited?

We may see a thread pop up now and then of 'why did I not earn the AER on savings I've just deposited' - but I have yet to ever see a thread of "I have a credit card with a £5,000 balance on it at 20% APR. Over the year I gradually cleared the credit card. By my Maths, £5,000 borrowed at 20% APR would give me an annual interest payment of £1,000, yet I only ended up paying about half of this."

I think is similar to the phenomenon where consumers are very quick to report when they've been overcharged for something, but less quick when they've been undercharged.

Know what you don't3

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards