We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Vangaurd life strategy 40

Comments

-

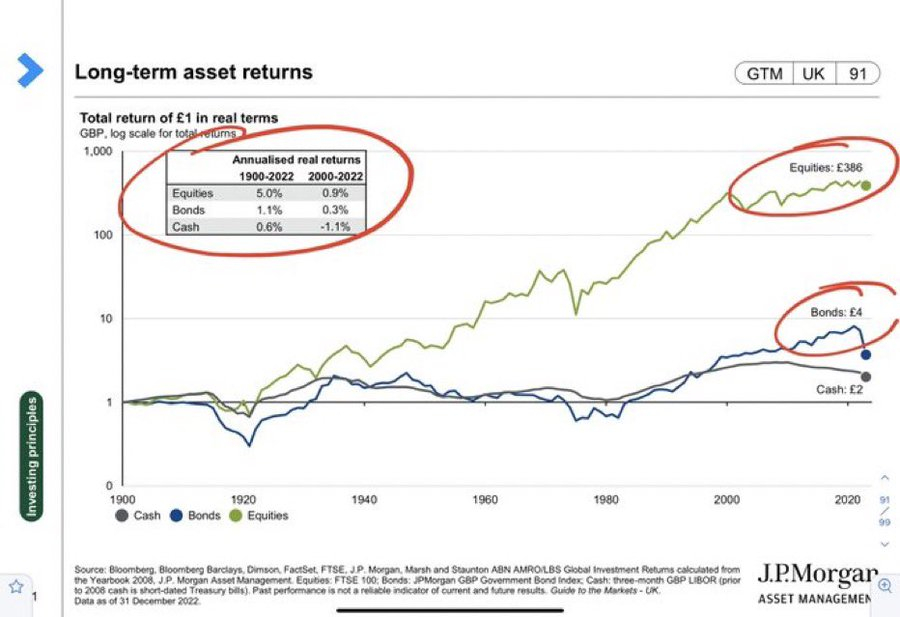

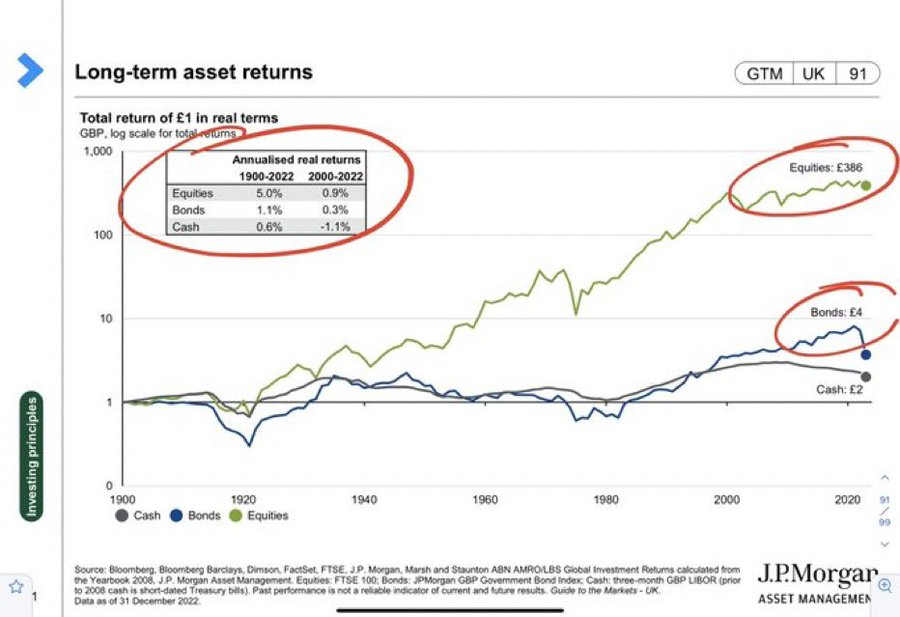

Another good example what people are saying about investing in a large percentage in bond. If you search there are a lot of similar complain since about two years ago in this forum.There are the same group of people in this forum do not like it and they will be cheering up each other again watching people keep moaning losing their money.For those who want to invest in bond especially for the long run do your research what investing too much in bond is doing for your return and do not just following the crowd.In 10+ years time (say) looking back again and compare your return and compared with those without bond. We could keep this thread alive to be visited agan in 10+ time.0

-

Judging from the posts here, if you do not want to follow the crowd right now fill your boots with bonds.adindas said:Another good example what people are saying about investing in a large percentage in bond. If you search there are a lot of similar complain since about two years ago in this forum.There are the same group of people in this forum do not like it and they will be cheering up each other again watching people keep moaning losing their money.For those who want to invest in bond especially for the long run do your research what investing too much in bond is doing for your return and do not just following the crowd.0 -

GeoffTF said:

Judging from the posts here, if you do not want to follow the crowd right now fill your boots with bonds.adindas said:Another good example what people are saying about investing in a large percentage in bond. If you search there are a lot of similar complain since about two years ago in this forum.There are the same group of people in this forum do not like it and they will be cheering up each other again watching people keep moaning losing their money.For those who want to invest in bond especially for the long run do your research what investing too much in bond is doing for your return and do not just following the crowd.Yes, "the crowd" of this forum have had a very negative outlook on bonds for some time now. Just do a forum search on "return-free risk" and you'll see posts from the same group of people on this forum who did not like bonds, going back at least to 2019. That same group of people have had to come in and explain what is going on to people who have been losing their money while heavily invested in bonds. I hope our posts helped some folk avoid investing at the worst possible time.Meanwhile, with prices having fallen significantly, bonds have been priced increasingly attractively. You can buy index linked gilts that are guaranteed to deliver a positive real return, and nominal gilts that have at times been more attractive than cash savings with a largely tax-exempt return. Bond funds are still at risk of further declines, but the risk/reward landscape has completely changed over the past couple of years.4 -

To me it is a simple decision. If you could currently get a Regular saving account paying 7%, 6.25%, reasonable number of RSA paying 5.5%+, one year fix rate around 5% risk free, why take unnecessary risk for a lower return ?? But if my portfolio was currently containing a large percentage of bonds currently making a significant loss, still have very good potential to recover in the future, I would be thinking twice to sell it for a loss. I would wait until at least they break-even and make an escape, use it as a lesson learnt.The saving rate will go down once inflation is under control. For that reason thinking into the long run, it is also good to be combined with DCA it into equity while the equity price is still low.People put some percentage of bond to sooth volatility, but in reality they sometimes do not do the job.Also 60% percentage of portfolio in bond ?? There is no investment literature will ever suggest that. You will never see any proven billionaire investor put such bond percentage into their portfolios. Even Ray Dalio one of the devoted proponent of multi assets portfolios, do not do that.But this is just personal opinion. People might have a different opinion. So do your own research and make up your own decision.0

-

Also 60% percentage of portfolio in bond ?? There is no investment literature will ever suggest thatBenjamin Graham, Buffett’s guru, is quoted as commending 60% bonds:

‘We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds. There is an implication here that the standard division should be an equal one, or 50–50, between the two major investment mediums.’ https://www.bogleheads.org/wiki/Graham_75-25_rule

You will never see any proven billionaire investor put such bond percentage into their portfolios.The ordinary woman, even quite extra-ordinary women, as your dear readers mostly are will never become billionaires through investing in a diversified stock-only fund (and having no bonds) during the period of a normal lifetime. 10%/year average returns on an ordinary or even somewhat extra-ordinary income will not make one a billionaire.

2 -

And what is the bond percentage of VLS40 ? is it 50%, 25%% or 60%.JohnWinder said:Also 60% percentage of portfolio in bond ?? There is no investment literature will ever suggest thatBenjamin Graham, Buffett’s guru, is quoted as commending 60% bonds:‘We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds. There is an implication here that the standard division should be an equal one, or 50–50, between the two major investment mediums.’ https://www.bogleheads.org/wiki/Graham_75-25_rule

You will never see any proven billionaire investor put such bond percentage into their portfolios.The ordinary woman, even quite extra-ordinary women, as your dear readers mostly are will never become billionaires through investing in a diversified stock-only fund (and having no bonds) during the period of a normal lifetime. 10%/year average returns on an ordinary or even somewhat extra-ordinary income will not make one a billionaire.

What is his general suggestion ? 75-25% (25% in Bond, certainly not 60% in bond)"Graham recommended distributing one's portfolio evenly between stocks and bonds as a way to preserve capital in market downturns while still achieving growth of capital through bond income. Remember, Graham's philosophy was first and foremost to preserve capital, and then to try to make it grow. He suggested having 25% to 75% of your investments in bonds and varying this based on market conditions. This strategy had the added advantage of keeping investors from boredom, which leads to the temptation to participate in unprofitable trading (i.e., speculating). "Generally his Formula, recommends that an investor should have a bond allocation equal to their age subtracted from 100.

For example, a 30-year-old investor would have a suggested bond allocation of 70% (100 - 30 = 70). A 60-year-old investor would have a suggested bond allocation of 40% (100 - 60 = 40). NOT 60%What other people need to notice is that bogleheads.org leaning toward Jack Boogle investment vehicles, e.g Vanguard, for whatever reason. They might even provoke VLS20 (80% in Bond), while no investing strategists, let alone proven billionaires investors will ever suggest that.Above all especially for the UK investors do not forget the risk free alternative which might not be applicable to investors from other countries. Certainly not when Benjamin Graham wrote his book "The Intelligent Investor" in 1949. Also, when Benjamin Graham wrote his book certainly this statistics was not available for him to refer. If you could currently get a Regular saving account paying 7%, 6.25%, a reasonable number of RSA paying 5.5%+, a reasonable number of one year fix rate around 5% risk free, why on earth take unnecessary risk for a lower return in Bond ??0

If you could currently get a Regular saving account paying 7%, 6.25%, a reasonable number of RSA paying 5.5%+, a reasonable number of one year fix rate around 5% risk free, why on earth take unnecessary risk for a lower return in Bond ??0 -

The point has been made several times before in vain, so I don't hold much hope of it being acknowledged this time, but one can only put a limited amount of money into each regular saver that is available, so an investor with significant assets will quickly run out of places to earn >5% in risk free deposit accounts. I'd wager not many proven billionaires are making use of regular saver accounts, but they are great for consumers to use as a proxy emergency fund. If someone doesn't have enough capital to fill as many of these as they care to open, then they are probably better off waiting until they have a surplus to start investing.Fixed rate savers and nominal gilts have alternated as to which has delivered the best returns in recent months, currently fixed rate savers may have some edge depending on your tax situation. If your capital is locked up in a S&S ISA or pension, then you may be limited to cash ISA rates or have no access to deposit accounts at all.Had someone bought a nominal gilt or index linked gilt at the right time and hold it to maturity, they will achieve a risk free return which may be the most attractive option available if they have already exhausted some of those mentioned above. If they were very lucky and bought an index linked gilt back around the time of the infamous KamiKwasi budget, they may well have locked in an annualised risk free double digit return, based on the current RPI and even the optimistic case of inflation falling later this year.Money market funds, which hold ultra-short dated bonds and related assets, have been generating returns north of 4% in an easy access fashion while the best easy access rate has been well below 4%, and interest paid on uninvested cash in a SIPP or S&S ISA is a lot lower again.Maybe that goes some way to answering the "why on earth" question.0

-

masonic said:The point has been made several times before in vain, so I don't hold much hope of it being acknowledged this time, but one can only put a limited amount of money into each regular saver that is available, so an investor with significant assets will quickly run out of places to earn >5% in risk free deposit accounts. I'd wager not many proven billionaires are making use of regular saver accounts, but they are great for consumers to use as a proxy emergency fund. If someone doesn't have enough capital to fill as many of these as they care to open, then they are probably better off waiting until they have a surplus to start investing.Fixed rate savers and nominal gilts have alternated as to which has delivered the best returns in recent months, currently fixed rate savers may have some edge depending on your tax situation. If your capital is locked up in a S&S ISA or pension, then you may be limited to cash ISA rates or have no access to deposit accounts at all.Had someone bought a nominal gilt or index linked gilt at the right time and hold it to maturity, they will achieve a risk free return which may be the most attractive option available if they have already exhausted some of those mentioned above. If they were very lucky and bought an index linked gilt back around the time of the infamous KamiKwasi budget, they may well have locked in an annualised risk free double digit return, based on the current RPI and even the optimistic case of inflation falling later this year.Money market funds, which hold ultra-short dated bonds and related assets, have been generating returns north of 4% in an easy access fashion while the best easy access rate has been well below 4%, and interest paid on uninvested cash in a SIPP or S&S ISA is a lot lower again.Maybe that goes some way to answering the "why on earth" question.

Yes, the graphics above is fact, not talk, argument or hypothesis. There are numerous examples of similar cases for people who want to search for it.Also remember that you have the option to DCA (drip fed drain it) from saving to equity rather than blindly throwing lumpsum in this current climate.0

Yes, the graphics above is fact, not talk, argument or hypothesis. There are numerous examples of similar cases for people who want to search for it.Also remember that you have the option to DCA (drip fed drain it) from saving to equity rather than blindly throwing lumpsum in this current climate.0 -

You seem unaware that 60 is a number between 25 and 75. You wrote "What is his general suggestion ? 75-25% (25% in Bond, certainly not 60% in bond)", but that's wrong. His suggestion was, in your own quote, "25% to 75% of your investments in bonds"; 60% is certainly in that range.adindas said:

And what is the bond percentage of VLS40 ? is it 50%, 25%% or 60%.JohnWinder said:Also 60% percentage of portfolio in bond ?? There is no investment literature will ever suggest thatBenjamin Graham, Buffett’s guru, is quoted as commending 60% bonds:‘We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds. There is an implication here that the standard division should be an equal one, or 50–50, between the two major investment mediums.’ https://www.bogleheads.org/wiki/Graham_75-25_rule

You will never see any proven billionaire investor put such bond percentage into their portfolios.The ordinary woman, even quite extra-ordinary women, as your dear readers mostly are will never become billionaires through investing in a diversified stock-only fund (and having no bonds) during the period of a normal lifetime. 10%/year average returns on an ordinary or even somewhat extra-ordinary income will not make one a billionaire.

What is his general suggestion ? 75-25% (25% in Bond, certainly not 60% in bond)"Graham recommended distributing one's portfolio evenly between stocks and bonds as a way to preserve capital in market downturns while still achieving growth of capital through bond income. Remember, Graham's philosophy was first and foremost to preserve capital, and then to try to make it grow. He suggested having 25% to 75% of your investments in bonds and varying this based on market conditions. This strategy had the added advantage of keeping investors from boredom, which leads to the temptation to participate in unprofitable trading (i.e., speculating). "Generally his Formula, recommends that an investor should have a bond allocation equal to their age subtracted from 100.

For example, a 30-year-old investor would have a suggested bond allocation of 70% (100 - 30 = 70). A 60-year-old investor would have a suggested bond allocation of 40% (100 - 60 = 40). NOT 60%

The "100 minus your age" suggestion does not appear to come explicitly from Graham, but it is used for the amount to hold in stocks (as you age, you have more in bonds, the value of which varies less). The 40% stock, 60% bond ratio would then fit a 60 year old. But even if you follow the rule you claim of "100 - age" for the amount in bonds, then it would fit a 40 year old.3 -

In the age of social media, never before have simple graphics and statistics been so frequently misinterpreted and misused. One can never hope to get a deep and nuanced understanding of a complex topic such as this from a graph. Images can be used to help explain concepts, but the heavy lifting needs to be done with spoken and/or written word. A discussion requires some willingness to engage with others points or arguments, rather than repeatedly posting the same things over and over. Doing this just creates unnecessary clutter for those genuinely interested in discussing a topic.

5

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards