We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Annuity without using financial adviser

Comments

-

You are correct. Its like the UK Government usually blamed the EU for over regulation when in reality it was mostly UK civil servants adding gold plating to the EU rules.incus432 said:From one of the IFAs"We would only provide annuity recommendations through a fully advised service, not execution only. This is because any formal advice to be given needs to be in accordance with FCA regulation that we know and understand our client's full circumstantial and financial position to ensure any advice is appropriate."I mean this justification is surely hogwash, no? The FCA don't outlaw execution only and If the firm does this they are not giving formal advice. In other words they can obviously run their business how they want but just be honest ('no we have decided not to offer this') and don't blame the FCA

Regulation over the last 15 years has seen a trend where the regulator wants all advisers in a firm to be working the same way. Same software, research tools etc. For small firms (around 1 to 5 advisers), that is not an issue but the larger a firm gets, the more systems and controls they have to put in place and they have to allow for the lowest common denominator. They start handicapping their advisers in what they can and cannot do. Especially those that historically were more salesforce style. Execution only can be abused and for firms with a sales focus, that can be quite dangerous. So, stopping their staff from doing it is a way to protect the firm.

In my firm, I won't let my guys do execution only but if they had someone approach them to do it, they would refer it to me and I would make the decision. And if its in low risk areas, I would do it but not if its in high risk area.

Any firm that attempts to blame the regulator for not doing execution only is wrong. It is the adviser firm's decision not to do it.A friend of mine who took out an annuity quite recently said there was a cap of £10000 on the commission. I think he was using LV= not Retirement Line. I did not ask so I do not know if that is the same across all these brokers. But it may be some comfort for those with pots over £500,000.Although £10,000 is obscene for a non-advised annuity that takes about 30 minutes work.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

To be fair my whole process took from the second May bank holiday until the August bank holiday and I think they spent more than 30 minutes on it during that time.dunstonh said:.A friend of mine who took out an annuity quite recently said there was a cap of £10000 on the commission. I think he was using LV= not Retirement Line. I did not ask so I do not know if that is the same across all these brokers. But it may be some comfort for those with pots over £500,000.Although £10,000 is obscene for a non-advised annuity that takes about 30 minutes work.

Anyway the reason I posted about Retirement Line was to give a possible route which does not involve an IFA who wanted to work on a full advice basis not to discover that I had paid too much for something I have already done. That is water under the bridge and congratulations to @FIREDreamer for getting a good deal. I think my rate worked out at 1.1%.0 -

To be fair my whole process took from the second May bank holiday until the August bank holiday and I think they spent more than 30 minutes on it during that time.

The "retailer" wouldn't be involved once the application is sent to the receiving scheme. After that, the work is done by the ceding and receiving schemes. Very rarely, a chaser call may done by the retailer.

A timescale of May to August is much longer than normal though.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

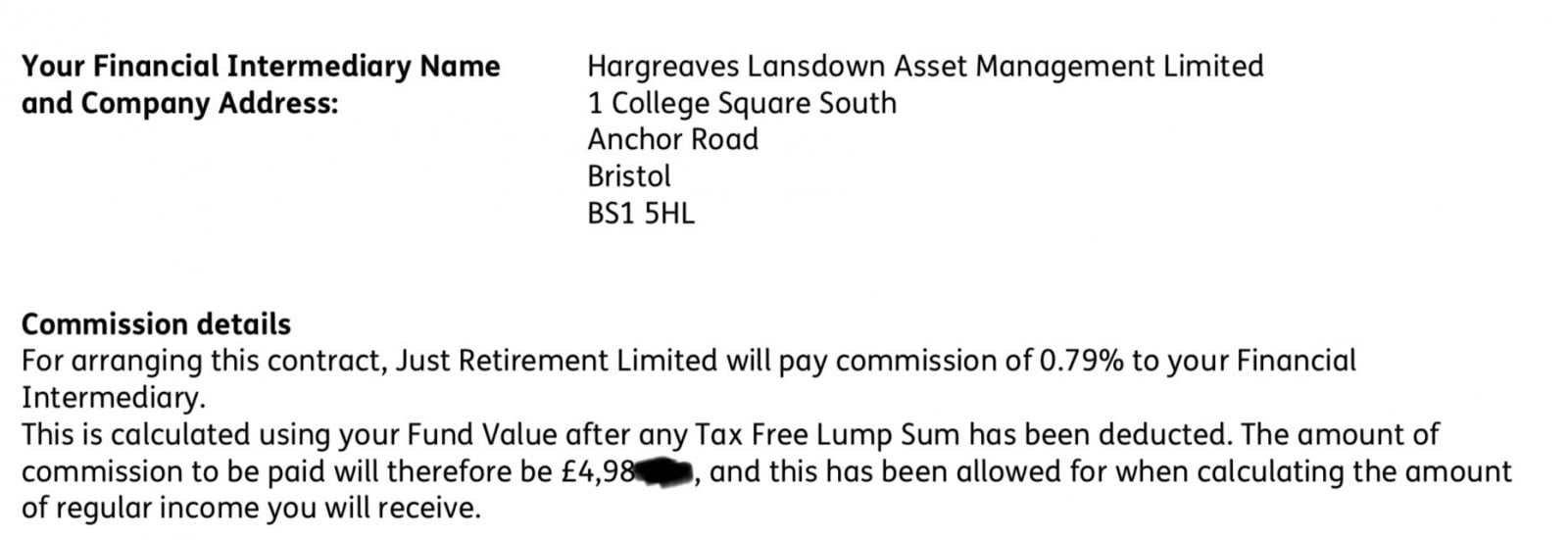

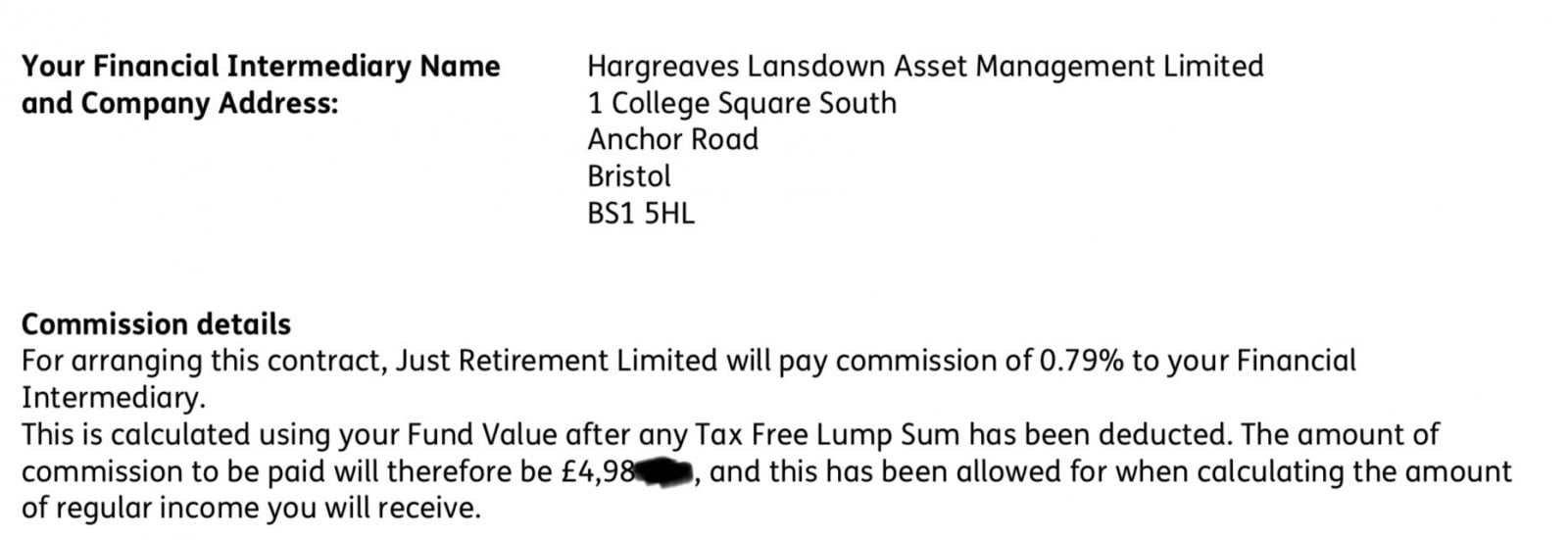

Hargreaves would have got 0.77% to 0.81% depending on provider, based on all the provider quotes I was given, so much of a much really. None were capped.DRS1 said:

To be fair my whole process took from the second May bank holiday until the August bank holiday and I think they spent more than 30 minutes on it during that time.dunstonh said:.A friend of mine who took out an annuity quite recently said there was a cap of £10000 on the commission. I think he was using LV= not Retirement Line. I did not ask so I do not know if that is the same across all these brokers. But it may be some comfort for those with pots over £500,000.Although £10,000 is obscene for a non-advised annuity that takes about 30 minutes work.

Anyway the reason I posted about Retirement Line was to give a possible route which does not involve an IFA who wanted to work on a full advice basis not to discover that I had paid too much for something I have already done. That is water under the bridge and congratulations to @FIREDreamer for getting a good deal. I think my rate worked out at 1.1%.0 -

HL got 0.5% of the annuity starting pot for mine.0

-

When was this? Mine was last year.arthur_fowler said:HL got 0.5% of the annuity starting pot for mine.

0 -

Yes there was a getting the quotes stage handled by one person (well two or three as it happens) and then the admin side handled by someone else (or two or three).dunstonh said:To be fair my whole process took from the second May bank holiday until the August bank holiday and I think they spent more than 30 minutes on it during that time.The "retailer" wouldn't be involved once the application is sent to the receiving scheme. After that, the work is done by the ceding and receiving schemes. Very rarely, a chaser call may done by the retailer.

A timescale of May to August is much longer than normal though.

I could expand on the timescale but that would be going off thread. All I will say is it felt like being back at work. Retirement Line did however get things moving when I couldn't so fair play to them.0 -

Well done. I ran my figures through the HL annuity quote and for some reason they came up with a different insurer as top of the tree compared to the other ones I used. So I did not pursue it.arthur_fowler said:HL got 0.5% of the annuity starting pot for mine.1 -

But how did the rates compare?DRS1 said:

Well done. I ran my figures through the HL annuity quote and for some reason they came up with a different insurer as top of the tree compared to the other ones I used. So I did not pursue it.arthur_fowler said:HL got 0.5% of the annuity starting pot for mine.0 -

Going through at the momentFIREDreamer said:

When was this? Mine was last year.arthur_fowler said:HL got 0.5% of the annuity starting pot for mine. 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards