We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Are we expecting BOE to remain at 4.75% on 8th February 2025?

Comments

-

Lots of people thought that a massive drop in house prices was "inevitable" (some might even say a 'crash'ReadySteadyPop said:

lots of people had no idea that rates rising was "inevitable", and many people are still waiting for them to go back down!RelievedSheff said:

Not really.ReadySteadyPop said:

So lots of people caught out by the rate hikes then?Hoenir said:

You are I out of how million mortgage holders though. Better to view the world through the macro rather than micro lens. As it's the macro that determines the future direction of travel.sevenhills said:Hoenir said:

Very few UK mortgages have ever been fixed "long term". That would be a period in excess of 15 years.sevenhills said:

All those people that didn't get long-term fixed mortgages?RelievedSheff said:Where is this evidence that people have been "caught out by the rate rises?"

It certainly doesn't seem to be indicated in any of the statistics publications.

I got a 10-year fix, so I have missed all these increases.

People having to remortgage onto a higher rate product isn't being "caught out by rate hikes" .

It was inevitable given how low mortgage rates were. There was only ever one way they were headed.

Current rates are not high. They are average at best. People really need to get their heads around that. If rates do start to drop, they will not be heading back to the ultra low rates we have had. ), and some of those are still waiting for it. 1

), and some of those are still waiting for it. 1 -

And have been for decades.BarelySentientAI said:

Lots of people thought that a massive drop in house prices was "inevitable" (some might even say a 'crash'ReadySteadyPop said:

lots of people had no idea that rates rising was "inevitable", and many people are still waiting for them to go back down!RelievedSheff said:

Not really.ReadySteadyPop said:

So lots of people caught out by the rate hikes then?Hoenir said:

You are I out of how million mortgage holders though. Better to view the world through the macro rather than micro lens. As it's the macro that determines the future direction of travel.sevenhills said:Hoenir said:

Very few UK mortgages have ever been fixed "long term". That would be a period in excess of 15 years.sevenhills said:

All those people that didn't get long-term fixed mortgages?RelievedSheff said:Where is this evidence that people have been "caught out by the rate rises?"

It certainly doesn't seem to be indicated in any of the statistics publications.

I got a 10-year fix, so I have missed all these increases.

People having to remortgage onto a higher rate product isn't being "caught out by rate hikes" .

It was inevitable given how low mortgage rates were. There was only ever one way they were headed.

Current rates are not high. They are average at best. People really need to get their heads around that. If rates do start to drop, they will not be heading back to the ultra low rates we have had. ), and some of those are still waiting for it.1

), and some of those are still waiting for it.1 -

RelievedSheff said:

It was inevitable given how low mortgage rates were. There was only ever one way they were headed."You are I out of a million mortgage holders though."Why was I one of a million, when Relieved has said they were only going one way? Maybe 10% got a 10-year fix?I recall that they had negative interest rates in China, so they could have gone lower?Did I gamble, or was it a dead cert?

0 -

Economy again showings (small) signs of growth. The only way BoE will now cut is if it's due to political pressure. Otherwise, another hold0

-

Opting for any product is a gamble. In July 2007 I opted for a base rate tracker of +0.35%. BOE base rate at the time was 5.50%. Little did I know that by March 2009 base rate would fall to 0.50%. Result was was we fully repaid our mortgage 9 years early.sevenhills said:RelievedSheff said:

It was inevitable given how low mortgage rates were. There was only ever one way they were headed."You are I out of a million mortgage holders though."Why was I one of a million, when Relieved has said they were only going one way? Maybe 10% got a 10-year fix?I recall that they had negative interest rates in China, so they could have gone lower?Did I gamble, or was it a dead cert?0 -

It is not the fact that the rates are high but that the expected lifestyle predicated on paying a small sum based on unrealistic and suppressed rates for an overly expensive property cannot now be sustained. Why else are so many mortgages now being sold that will require people to pay off in their "retirement"RelievedSheff said:

Not really.ReadySteadyPop said:

So lots of people caught out by the rate hikes then?Hoenir said:

You are I out of how million mortgage holders though. Better to view the world through the macro rather than micro lens. As it's the macro that determines the future direction of travel.sevenhills said:Hoenir said:

Very few UK mortgages have ever been fixed "long term". That would be a period in excess of 15 years.sevenhills said:

All those people that didn't get long-term fixed mortgages?RelievedSheff said:Where is this evidence that people have been "caught out by the rate rises?"

It certainly doesn't seem to be indicated in any of the statistics publications.

I got a 10-year fix, so I have missed all these increases.

People having to remortgage onto a higher rate product isn't being "caught out by rate hikes" .

It was inevitable given how low mortgage rates were. There was only ever one way they were headed.

Current rates are not high. They are average at best. People really need to get their heads around that. If rates do start to drop, they will not be heading back to the ultra low rates we have had.

For many something in the household budget will have to give but political expediency will no doubt apply, a solution will be found that keeps the boomers onside and the youth will continue to suffer for many years of supporting the generation that continues to proclaim my houses are my pension.

I'm only a simple man but what benefit did we, the big we society, actually get from low interest rates for all those years?Your life is too short to be unhappy 5 days a week in exchange for 2 days of freedom!0 -

We benefited at the expense of our collective children.BikingBud said:RelievedSheff said:

Not really.ReadySteadyPop said:

So lots of people caught out by the rate hikes then?Hoenir said:

You are I out of how million mortgage holders though. Better to view the world through the macro rather than micro lens. As it's the macro that determines the future direction of travel.sevenhills said:Hoenir said:

Very few UK mortgages have ever been fixed "long term". That would be a period in excess of 15 years.sevenhills said:

All those people that didn't get long-term fixed mortgages?RelievedSheff said:Where is this evidence that people have been "caught out by the rate rises?"

It certainly doesn't seem to be indicated in any of the statistics publications.

I got a 10-year fix, so I have missed all these increases.

People having to remortgage onto a higher rate product isn't being "caught out by rate hikes" .

It was inevitable given how low mortgage rates were. There was only ever one way they were headed.

Current rates are not high. They are average at best. People really need to get their heads around that. If rates do start to drop, they will not be heading back to the ultra low rates we have had.

I'm only a simple man but what benefit did we, the big we society, actually get from low interest rates for all those years?To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

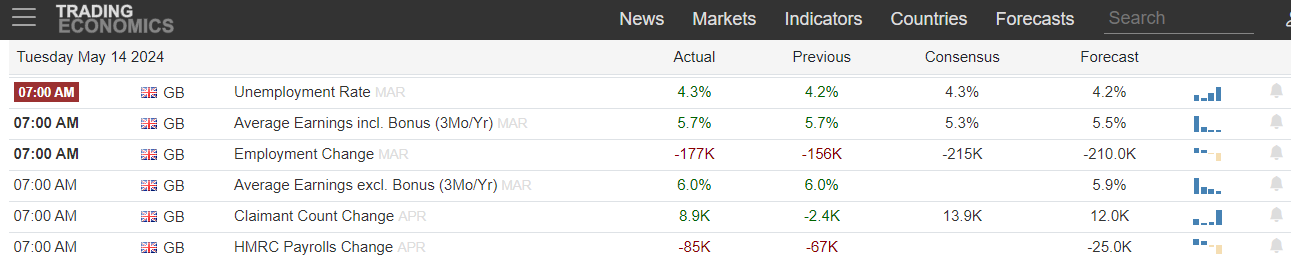

Today's UK employment data shows the employment market still strong but weakening but wages still well above CPI, not falling and above expectations.

There will be no rate cut for June. To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

The general consensus is that low interest rates benefit all of us because they encourage spending which grows the economy.BikingBud said:I'm only a simple man but what benefit did we, the big we society, actually get from low interest rates for all those years?lojo1000 said:We benefited at the expense of our collective children.Or if you are a glass half-full type of person, our children benefitted from more jobs because more people were spending more money which required more products and services.Every generation blames the one before...

Mike + The Mechanics - The Living Years0 -

Only way to know for sure is to go back in time and then see how the last 15 years play out with higher rates. Everything else is just theorising.BikingBud said:

I'm only a simple man but what benefit did we, the big we society, actually get from low interest rates for all those years?

The theorisers almost all agree that we would be worse off now if that had happened though.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards