We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

How to beat inflation?

Comments

-

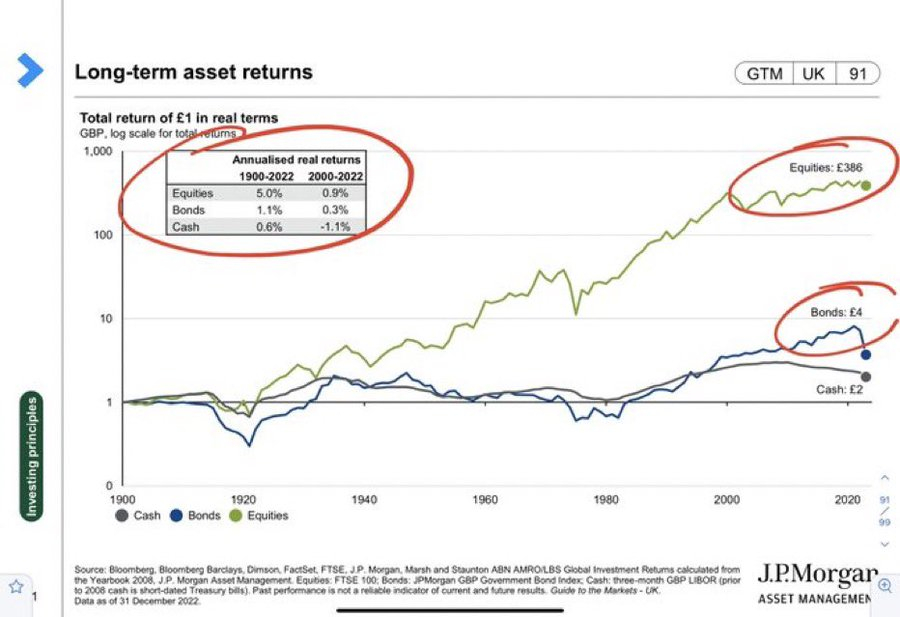

Back in the 80s and 90s the general truth was that you could beat inflation if you put your money in a savings account.adindas said:There is already general truth that investing in equity will beat inflation in the long run. Also equity outperform bond and saving in the long run and beats inflation.

Have we now entered another decade where if your money is in a savings account, it will lose value?

I recall one of my first attempts at saving was a special unit trust that invested in eco companies. I needed the money after twelve months, I was lucky and it was 10% higher value.0 -

sevenhills said:

Back in the 80s and 90s the general truth was that you could beat inflation if you put your money in a savings account.adindas said:There is already general truth that investing in equity will beat inflation in the long run. Also equity outperform bond and saving in the long run and beats inflation.

Have we now entered another decade where if your money is in a savings account, it will lose value?

I recall one of my first attempts at saving was a special unit trust that invested in eco companies. I needed the money after twelve months, I was lucky and it was 10% higher value.Because twelve months is not a long run. People should not expect that equity will always outperform bonds/savings all the time. It is a sensible decision not to invest most of your money in the stock market if you will need it after 12 months, especially during the period of the bear market. You might be forced to sell it even at a great loss when you need the money, where they might recover later when you give it more time.Coastline has presented the graphics over a long run equity vs bond vs cash. People keep losing money because they keep listening to random people on the internet just because they are very vocal and get cheering up by the same random people rather than doing their own research or listen to proven billionaires inventors. I know some people do not like it if you keep referring to using authoritative sources, proven billionaires inventors to prove against what they have been telling people. I wish you luck all you guys who invest in Bonds if your intention is to grow wealth rather than to preserve wealth.

0 -

No one ever beats inflation. The only mechanism to do so, is deflation.

Reduce the effect of inflation, sure.

0 -

Over the long term people who invest in stocks and shares do usually beat inflation. That includes anyone who puts money into a workplace or personal pension.Middle_of_the_Road said:No one ever beats inflation. The only mechanism to do so, is deflation.

Reduce the effect of inflation, sure.1 -

I don't consider it sensible to invest £1,000 for twelve months at 3.1% when RPI inflation is 13.4%Because twelve months is not a long run. People should not expect that equity will always outperform bonds/savings all the time. It is a sensible decision not to invest most of your money in the stock market if you will need it after 12 months, especially during the period of the bear market.

Back in the 90s when I invested £1,000 in a unit trust, it was unwise, because an above inflation return was available. But today's circumstances are different.1 -

Agreed, they will "out perform" inflation, and have a larger net worth.Prism said:

Over the long term people who invest in stocks and shares do usually beat inflation. That includes anyone who puts money into a workplace or personal pension.Middle_of_the_Road said:No one ever beats inflation. The only mechanism to do so, is deflation.

Reduce the effect of inflation, sure.

That net worth though ,will still be at the mercy of inflation.

Inflation hurts the winners, and the losers, not equally, but never the less, it is, a parasite.0 -

That is the title of the thread, but really all that we need to do, is beat the most common savings rate, so around 3%, that's easy.Middle_of_the_Road said:No one ever beats inflation. The only mechanism to do so, is deflation.

Reduce the effect of inflation, sure.0 -

Middle_of_the_Road said:No one ever beats inflation. The only mechanism to do so, is deflation.

Reduce the effect of inflation, sure.Middle_of_the_Road said:

Agreed, they will "out perform" inflation, and have a larger net worth.Prism said:

Over the long term people who invest in stocks and shares do usually beat inflation. That includes anyone who puts money into a workplace or personal pension.Middle_of_the_Road said:No one ever beats inflation. The only mechanism to do so, is deflation.

Reduce the effect of inflation, sure.

That net worth though ,will still be at the mercy of inflation.

Inflation hurts the winners, and the losers, not equally, but never the less, it is, a parasite.Moderate inflation is often associated with economic growth.Although high inflation, uncontrolled inflation hurts an economy, deflation, is not desirable either."When prices are falling, consumers delay making purchases if they can, anticipating lower prices in the future. For the economy this means less economic activity, less income generated by producers, and lower economic growth. Japan is one country with a long period of nearly no economic growth, largely because of deflation"10 Common Effects of InflationJust look at the US although one of the highest inflation rate in the history, but it is also one of the lowest unemployment rate in the history.

1 -

That's all very well and good. What I would like to know is-adindas said:Middle_of_the_Road said:No one ever beats inflation. The only mechanism to do so, is deflation.

Reduce the effect of inflation, sure.Middle_of_the_Road said:

Agreed, they will "out perform" inflation, and have a larger net worth.Prism said:

Over the long term people who invest in stocks and shares do usually beat inflation. That includes anyone who puts money into a workplace or personal pension.Middle_of_the_Road said:No one ever beats inflation. The only mechanism to do so, is deflation.

Reduce the effect of inflation, sure.

That net worth though ,will still be at the mercy of inflation.

Inflation hurts the winners, and the losers, not equally, but never the less, it is, a parasite.Moderate inflation is often associated with economic growth. Although high inflation, uncontrolled inflation hurts an economy, deflation, is not desirable either."When prices are falling, consumers delay making purchases if they can, anticipating lower prices in the future. For the economy this means less economic activity, less income generated by producers, and lower economic growth. Japan is one country with a long period of nearly no economic growth, largely because of deflation"10 Common Effects of Inflation

What have we got to show for all these years of economic growth....in this country?0 -

Depends who you mean by 'we'.Middle_of_the_Road said:

What have we got to show for all these years of economic growth....in this country?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards