We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

SWIFT payment gone missing

Comments

-

yes, in the form of bank A saying they have always been sending all their payment via SWIFT.1

-

Although you’re correct that there are a limited number of direct CHAPS members, smaller banks can get sponsored into CHAPS by a member. In practice the sponsored bank sends their MT103 message to the sponsoring bank and they make the CHAPS payment on their behalf.masonic said:Band7 said:Doesn't CHAPS use SWIFT?CHAPS does use the SWIFT messaging system, but it is a separate club of only a few dozen direct members as opposed to 11,000 SWIFT member institutions. As I understand it, CHAPS provides more certainty of payment settlement by placing additional requirements on member banks than a typical SWIFT transfer would, including the inability to recall a payment after it is sent.In an analogous manner, Direct Debits piggyback on the BACS transfer system.There are probably a couple of reasons why consumers don't tend to encounter standard domestic SWIFT transfers in retail banking: 1) CHAPS is de rigueur for high value or guaranteed money transfers; and 2) there is an expectation that other types of transfers should be made free of charge, so banks opt for something more cost-effective than SWIFT, even if that means using the services of another clearing bank.

2 -

OK, time to reveal the banks involved.

The money was sent from my Fineco UK multicurrency account to my Santander 123 Lite.

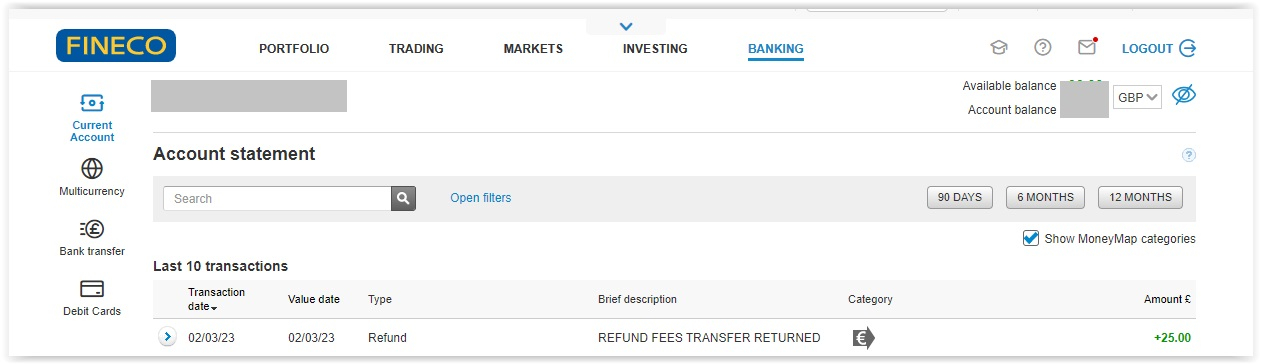

Since neither of them assumed responsibility for the missing money, I had raised complaints with both banks. They have both turned down the complaint, and I was about to escalate the matter to the FOS. Upon collecting all the relevant info, I stumbled across a refund of the missing £25 that has arrived yesterday in my Fineco account. No further explanation received, but after nearly a month of ping-pong between Fineco and Santander, I now have all my money back.

I won't now be escalating the matter to the FOS, so am unlikely to ever find out for certain who created the havoc in the first place. I still very strongly suspect Santander as they had texted me to say the money had arrived in my 123 account but then never credited it, so it was definitely them who sent the money back. Whether they withheld the £25, or whether Fineco charged £25 for receiving the money back is unclear.

I have now withdrawn my Fineco balance at an ATM and I won't be using Fineco in a rush again. Whilst their EUR - GBP exchange rate is consistently the best, the hassle that might ensue when sending money from Fineco to a proper UK bank is just not worth it. Going to use Wise in future, despite their lack of FSCS.

3 -

Thanks for the update, and good to get confirmation that it was indeed Fineco and therefore an international bank transfer was involved. Would have been sent via SEPA in the past, but I guess the landscape has changed in the last few years. I recall having to transfer in/out via Nationwide as some other banks charged for receiving these payments. You are probably right about Santander being at issue, as they are notoriously sensitive about unusual online transfers (and clearly did receive the funds).

0 -

Congratulations on the refund. I suspect the bank took the pragmatic view that giving you £25 was easier and cheaper than investigating your complaint.0

-

Glad you are sorted.

Part of the problem with these types of transfers are they often are not direct end to end transfers, unlike UK bank payments. They can have several intermediaries in the transfer.Life in the slow lane0 -

I have had no problems or charges with over a dozen previous payments from Fineco to Santander, totalling a 6 figure sum. The one that went bad was just a few hundred pounds. But it was so bad that I won't use Fineco again. It's not so much about the money but I can do without the dreadful CS in both, Fineco and Santander. To be fair, though, Fineco CS was marginally more helpful than Santander. What I really object to is that neither bank was willing to talk to the other but expected me to sort it out myself.masonic said:Thanks for the update, and good to get confirmation that it was indeed Fineco and therefore an international bank transfer was involved. Would have been sent via SEPA in the past, but I guess the landscape has changed in the last few years. I recall having to transfer in/out via Nationwide as some other banks charged for receiving these payments. You are probably right about Santander being at issue, as they are notoriously sensitive about unusual online transfers (and clearly did receive the funds).0 -

@Band7 I have just read this thread after your response in the other “currency discussion” thread.

I am sorry it took a while but the £25 fee issues was discussed early on in my 2016 (or thereabouts) Fineco Thread. Basically, some UK banks see Fineco payments as foreign and charges a fee, but they should not. In any case, there are some specific banks that do not do that (Nationwide being one of them). So it was Santander that withheld the £25 in the first place and also rejected the payment, so not sure why you concluded that using Fineco is not suitable any longer …0 -

Marchitiello said:@Band7 I have just read this thread after your response in the other “currency discussion” thread.

I am sorry it took a while but the £25 fee issues was discussed early on in my 2016 (or thereabouts) Fineco Thread. Basically, some UK banks see Fineco payments as foreign and charges a fee, but they should not. In any case, there are some specific banks that do not do that (Nationwide being one of them). So it was Santander that withheld the £25 in the first place and also rejected the payment, so not sure why you concluded that using Fineco is not suitable any longer …

Thought Santander was the second bank, alongside Nationwide, that was recommended to be used as a result of not charging for inward SEPA payments. Clearly Band7 was not charged for any of the other successful transactions made prior to this problematic one.

2 -

I'm not sure that Fineco is using Sepa to make transfers to British banks anymore: Nationwide describes them now as Chaps deposits.masonic said:Marchitiello said:@Band7 I have just read this thread after your response in the other “currency discussion” thread.

I am sorry it took a while but the £25 fee issues was discussed early on in my 2016 (or thereabouts) Fineco Thread. Basically, some UK banks see Fineco payments as foreign and charges a fee, but they should not. In any case, there are some specific banks that do not do that (Nationwide being one of them). So it was Santander that withheld the £25 in the first place and also rejected the payment, so not sure why you concluded that using Fineco is not suitable any longer …

Thought Santander was the second bank, alongside Nationwide, that was recommended to be used as a result of not charging for inward SEPA payments. Clearly Band7 was not charged for any of the other successful transactions made prior to this problematic one.For Chaps it's (always?) the sender that's charged: could it be that Santander returned it by Chaps - as this is how it was received - and charged its usual £25 fee?If it's a risk that this could be a 'thing' with Fineco it could be that Barclays is a better choice now as it doesn't charge* its customers for Chaps payments.

*Though if you cancel or amend a payment you'll be charged £20.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards