We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

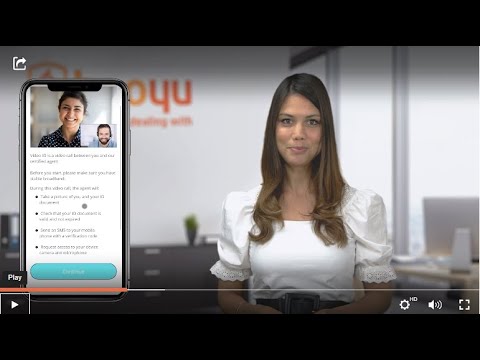

NatWest 0% Balance Transfer Incentive and HooYu Video Identification Process.

sterling30

Posts: 69 Forumite

Martin's recent headline is:

I imagine thouands of people will be applying, but no one realises what's in store for them.

I just applied, got accepted by NatWest and then was asked to follow a process of identification by a company called HooYu. They wanted to take a video of me. What? Curious, I looked into this further and watched a YouTube video about what I was about to do. As it happened the NatWest post-approval application page timed out, for which I count my blessings for. I then looked up HooYu on TrustPilot. I've easily decided to not go ahead with it and risk mental torture. Check this out...

and then this...

We are all doomed.

If Martin sees this (unlikely) I suggest he adds a note onto the NatWest details 'But beware of potentially mentally scarring indentification process with HooYu.'

0

Comments

-

Looks like NatWest are trying to move into the 21st Century and update their customer on boarding service.

What's the issue?0 -

Im sure I did this when I opened a new account with Natwest, took no time at all.1

-

I agree with Penguin_ - I hardly remember doing it, it was so straightforward.

1 -

I share your fear of appearing on film. But I think this is the way forward now. And I do really approve of strict security measures. It's like one of those bitter pills, one swallow and it's all over. Or one click of the webcam and hey bingo! You've got a new account.

I don't receive any commission for saying this - lol - but if you can, I'd urge you to have a glance at the programme 'Dirty Rotten Scammers' on BBC iPlayer.

It's a programme made in conjunction with the Open University and aims to help people to avoid being scammed. I think they make some really good points and they do give some great advice. Some info in the following link -

https://connect.open.ac.uk/science-technology-engineering-and-maths/dirty-rotten-scammers/

Michelle and Mavis do their best and I think they're very likeable. You could have a look for nothing. And no adverts, either because it's on the beeb.Please note - taken from the Forum Rules and amended for my own personal use (with thanks) : It is up to you to investigate, check, double-check and check yet again before you make any decisions or take any action based on any information you glean from any of my posts. Although I do carry out careful research before posting and never intend to mislead or supply out-of-date or incorrect information, please do not rely 100% on what you are reading. Verify everything in order to protect yourself as you are responsible for any action you consequently take.0 -

So you're warning people about something you haven't actually experienced yourself and have just based your opinion on TrustPilot reviews?sterling30 said:I then looked up HooYu on TrustPilot. I've easily decided to not go ahead with it and risk mental torture.0 -

Interesting bias of comments thus far. There are enough people on TrustPilot who have spent over 4 hours trying to get it to work and given up, including some who are clearly adept at that kind of thing. Have you read the reviews? I'm not taking that risk. It's not a fear of being on video, it's a fear of a simple process taking ages and causing stress, which a lot of modern tech and anti-fraid measures does.I've removed the 'Warning' in the title as it's obviously too dramatic.

0 -

Are you ignoring the inherent bias of those choosing to leave reviews on TrustPilot? How many financial institutions have you studied where the reviews are mainly from enthusiastic happy punters delighted to share good news about how easy it is to apply for accounts?2

-

I trust Trustpilot. I find it interesting that First Direct gets Excellent, whereas Barclays and NatWest get Bad. As for HooYu, which is what my original post was mostly about, it's clear something isn't working for a lot of people who experience their technology. Let's be honest, I don't think many people are exactly enthusiastic and happy when it comes to banks. but obviously many are prepared to leave good reviews.

0 -

Interesting on FD there.

As a couple of years ago they were hammered on TrustPilot with 1 star. Due to people moaning about long waits. Despite being top of customer service rankings. How things change.

Life in the slow lane1 -

I’ve had to use HooYu on applications before now and never had any issues. I’m all for extra security to keep my hard earned money safe.If you believe you can, you will. If you believe you can't, you won't.

Secured/Unsecured loans x 1

Credit Cards x 8 (total limit £55,050)

Creation FS Retail Account x 1

Creation Credit Sale 0% x 1 = £112.50pm x 20 mths

0% Overdraft x 1 (£0 / £250)

Mortgage Outstanding - £137,707.00 (Payment 13/360)

Total Debt = £7,400 (0%APR) @ £100pm - Stoozing0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=V5m9cYiy6nc

https://www.youtube.com/watch?v=V5m9cYiy6nc