We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

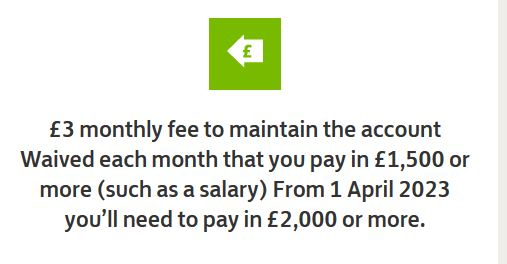

Club Lloyds Monthly Fee Waiver Minimum Deposit changing to £2,000

Comments

-

And they've stayed pretty quiet about it too. What do you think the odds are of them launching new Ts&Cs in the next month or so which states that the minimum monthly pay in will rise to £2k/mth, probably mentioned on page 20 or something, which most will not bother to read properly. Then when people complain, they will say "well, we did tell you in our new Ts&Cs which you accepted".UKSBD said:Looking at the figures it's a cynical move by Lloyds

Average pay of all workers in UK is approx £27,000 giving take home pay of £1,800

In just one move they are now charging these people £3.00 a month if they don't notice.1 -

If wasn’t too long ago that keeping £5,000 in a Club Lloyds account was consistently one of the best Easy Access options, until Chase came along and disrupted the status quo. I still make use of the Monthly Saver(s) and the lifestyle perks, and I took advantage of the switch offer that was available to existing customers.

I personally think the ‘crap’ current accounts are those that offer no benefits at all, and they’re only crap when considered relatively to those that do.

I believe I used to have a marker/flag on my file which meant I was constantly invited at every opportunity (including phone calls) for a meeting with a “wealth manager”. I even recall using the counter service for a banal branch-only task, and the clerk’s face palpably noticed something on his screen and he immediately used the opportunity to extend another invitation, which was downright annoyingly brash. Eventually I acquiesced, and the meeting was nothing more than a heavy sales pitch of investment options involving only LBG products. After that, I insisted they remove whatever marker/flag was on my file, and since then I haven’t been pestered by them at all.5 -

Bridlington1 said:

And they've stayed pretty quiet about it too. What do you think the odds are of them launching new Ts&Cs in the next month or so which states that the minimum monthly pay in will rise to £2k/mth, probably mentioned on page 20 or something, which most will not bother to read properly. Then when people complain, they will say "well, we did tell you in our new Ts&Cs which you accepted".UKSBD said:Looking at the figures it's a cynical move by Lloyds

Average pay of all workers in UK is approx £27,000 giving take home pay of £1,800

In just one move they are now charging these people £3.00 a month if they don't notice.They are not actually hiding it.

0 -

Bridlington1 said:

And they've stayed pretty quiet about it too. What do you think the odds are of them launching new Ts&Cs in the next month or so which states that the minimum monthly pay in will rise to £2k/mth, probably mentioned on page 20 or something, which most will not bother to read properly. Then when people complain, they will say "well, we did tell you in our new Ts&Cs which you accepted".UKSBD said:Looking at the figures it's a cynical move by Lloyds

Average pay of all workers in UK is approx £27,000 giving take home pay of £1,800

In just one move they are now charging these people £3.00 a month if they don't notice.The change doesn't happen until 1 April, so nobody will yet be paying the £3 due to not noticing. (per UKSBD's "now").As Sea_Shell pointed out on page 1, Lloyds have to give notice to customers and there is plenty of time for them to do that for existing customers.AFAIK there has been no confirmation this will apply to existing customers (but appears likely).If Lloyds buried the change in an update to their T&Cs it is likely customers hit by the change would have valid cause to complain (and ask for a refund). The potential cost of handling these complaints and refunding money could be vastly more than any gain Lloyds might hope to make through subterfuge (cf "PPI"). Packaged bank accounts have been through similar 'reclaim' processes in the past - it would be foolish of Lloyds to think they would get away with what is being suggested, so is a rather unlikely scenario.I don't think it is fair to accuse Lloyds of being "cynical" until we know more. I'm also unsure there is any basis for assuming any particular proportion of Club Lloyds customers earn around average pay, nor that they use their pay to fund their Club Lloyds account.5 -

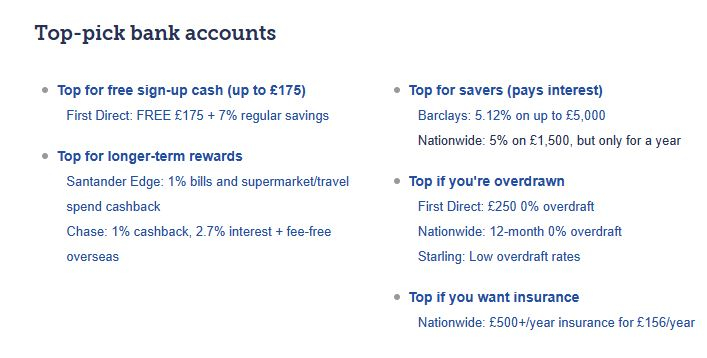

My opinion is based on the main site. I don't know what the ratio of visitors of the main site that also look at the forum but my guess would be it's quite low, I suspect a lot of people are not even aware of this forum. So your average visitor looking for a bank account would look at the main site and see this (I can't see Lloyds, can you?)Band7 said:

As has been pointed out, it might be so for your requirements but not for others, many of whom have given examples for how the account works in their favour. May be you don't want to be known for your objective views.Deleted_User said:

PS: I still think the Lloyds account is crap.

0 -

And when those notices DO go out, expect a deluge of "I don't earn £2000 a month" posts to wash over the forum like a tsunami.

Either that, or they'll just ignore and fall foul of the fee, which they may or may not notice, depending on how close an eye they keep on such things.How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)5 -

I had a similar in-branch experience being invited to apply for a credit card then and there. I pointed out I wouldn't meet their criteria, but the staff member insisted the system thought I would. I took them up on the offer, then made a complaint when the 'system' inevitably rejected my application. It was about 2 years after that before the invitations (by post) to apply for a credit card started again.AmityNeon said:

I believe I used to have a marker/flag on my file which meant I was constantly invited at every opportunity (including phone calls) for a meeting with a “wealth manager”. I even recall using the counter service for a banal branch-only task, and the clerk’s face palpably noticed something on his screen and he immediately used the opportunity to extend another invitation, which was downright annoyingly brash. Eventually I acquiesced, and the meeting was nothing more than a heavy sales pitch of investment options involving only LBG products. After that, I insisted they remove whatever marker/flag was on my file, and since then I haven’t been pestered by them at all.

0 -

Primarily because the main site doesn't have a category for "lifestyle rewards".Deleted_User said:

My opinion is based on the main site. I don't know what the ratio of visitors of the main site that also look at the forum but my guess would be it's quite low, I suspect a lot of people are not even aware of this forum. So your average visitor looking for a bank account would look at the main site and see this (I can't see Lloyds, can you?)Band7 said:

As has been pointed out, it might be so for your requirements but not for others, many of whom have given examples for how the account works in their favour. May be you don't want to be known for your objective views.Deleted_User said:

PS: I still think the Lloyds account is crap. I would argue the 5.25% RS account puts Club Lloyds in the "Top for Savers" category (Barclay's 5.12% isn't for balances in the current account either), but I accept the main site is journalism and reflects opinions rather than immutable facts that unfailingly apply in my personal circumstances. (The Club Lloyds magazine offer is worth more in cash terms to me than the Santander Edge 1% cashback, so IMV it should be included there too)2

I would argue the 5.25% RS account puts Club Lloyds in the "Top for Savers" category (Barclay's 5.12% isn't for balances in the current account either), but I accept the main site is journalism and reflects opinions rather than immutable facts that unfailingly apply in my personal circumstances. (The Club Lloyds magazine offer is worth more in cash terms to me than the Santander Edge 1% cashback, so IMV it should be included there too)2 -

I'd insist on a lunch time meeting with tea and sandwiches, I think it would be important to touch base at least once a week.AmityNeon said:I believe I used to have a marker/flag on my file which meant I was constantly invited at every opportunity (including phone calls) for a meeting with a “wealth manager”.

1 -

I had a similar invitation (different bank) from someone with a similar sounding job title. I thought they were calling me up to congratulate me on paying off my loan early and becoming debt free, I thought they might talk to me about a savings account and the importance of budgeting. No. They suggested I might want to do some home improvements or upgrade my car or something and tried to tempt me back into debt.Bridlington1 said:

I tend to regard it as a sign that they think I'm going up in the world or that I'm slightly posh. I regard both these things as compliments. It's certainly more complimentary than being pestered about loans at extortionate rates, or even worse life insurance.Debt Free: 01/01/2020

Mortgage: 11/09/20241

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

They are not actually hiding it.

They are not actually hiding it.