We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Barclays Fraud / GDPR breach

Comments

-

Presumably you've already told them that you had signed the forms, they only need them if you denied that you did.HiggiHiggins said:I don’t want to argue anything. They have said that the decision made on the two cases is unable to be changed so getting the £2000 back from them isn’t an option I believe.

Have you raised a simple complaint with them like I said before and gone through the ombudsman? That is your route, but you need to stop going off onto tangents.

0 -

I had sent back a copy of each cases transaction list ticked, an additional info sheet and a disclaimer form. When I’d looked at the additional info sheet and disclaimer for all 3 cases they appeared the same. Now each form has a “unique ref” (I was told recently) which relates to each case ref number. I’d noticed the three different case numbers C- 8 digits but this number was only on the front cover and transaction list of each pack and not on the additional info or signed disclaimer form. What I hadn’t seen was the slight difference in the 18 digit reference as the first 7 and last 7 digits were the same so and so my error but I only sent 1 form thinking it would cover all 3.

that form was then applied to the wrong case and for unknown reasons despite daily live chats, calls and or emails no one could tell me this and so it took to raising a complaint to initially confirm this. I suppose this accounts for my frustration with the whole situation, the way it’s been handled, and so to just reject the claims with no answers and not say why it’s the polar opposite to this first case leaves me trying to pick failings within the process. I’m mad frustrated and upset and as I say £2000 out of pocket plus £500 overdrawn for another error of theirs.

ombudsman wise then what’s the rough timescale and level of information needed initially please. I’m sorry if I come across objective, I really appreciate your time and take your advice. I suppose it’s 4 months after the initial event and dragged on at their cause where I’m now having to start the process of ombudsman0 -

HiggiHiggins said:It was in relation to a GDPR comment when someone said that as soon as you declare fraud you have no right under GDPR as they can investigate criminal activity.If that's a reference to what I said about the GDPR, you misunderstand. The bank doesn't need your permission to investigate anything that they suspect to be fraud, and they don't need proof of criminal activity before they can investigate fraud. If you think about it, it would make fraud almost impossible to deal with if they did.In your thread heading you refer to "GDPR breach" and in your first sentence you refer to a "GDPR issue". What I'm pointing out is that in this situation, there has been no GDPR breach and there is no GDPR issue.

3 -

The declaration is important as it is the only way the bank can go back to the retailer to claim the money back & for the retailer to provide details.HiggiHiggins said:If this form is so important that fraud cannot proceed without it and if it’s not received it’s automated to close the case. It must carry a significant level of legality otherwise surely it wouldn’t be required. If this is the case then a mistake causing a case to be processed without the form has to against process in some way. Also to then just proceed with another case without receiving a form is again against process?

This is part of the card regulations.

Not saying that is the case, but would explain why some were rejected straight away.

From a banks perspective & I have had customer claim transactions that were theirs as fraud in large cases. Easily done in the panic when seeing lots of your money gone.

From banks end they can see how the transactions are made so someone saying They have their card & no one knows the PIN, but are claiming that these are fraud. Clearly a Chip & Pin requires card & pin. Same with contactless transactions requiring card. So you can see the banks point of view.

If they are all online, then it's a different matter, but retailer can & will provide customer details if they feel it is not fraud.

Other option is a retailer that has been used before online, or a known retailer that takes recurring payments.

Life in the slow lane0 -

Thanks for the info.born_again said:

The declaration is important as it is the only way the bank can go back to the retailer to claim the money back & for the retailer to provide details.HiggiHiggins said:If this form is so important that fraud cannot proceed without it and if it’s not received it’s automated to close the case. It must carry a significant level of legality otherwise surely it wouldn’t be required. If this is the case then a mistake causing a case to be processed without the form has to against process in some way. Also to then just proceed with another case without receiving a form is again against process?

This is part of the card regulations.

From banks end they can see how the transactions are made so someone saying They have their card & no one knows the PIN, but are claiming that these are fraud. Clearly a Chip & Pin requires card & pin. Same with contactless transactions requiring card. So you can see the banks point of view.

If they are all online, then it's a different matter, but retailer can & will provide customer details if they feel it is not fraud.

Other option is a retailer that has been used before online, or a known retailer that takes recurring payments.

so if they have gone to the retailer without this as they have done, have they actually done anything wrong in that sense.

they are all online transactions but I’ve no idea what details these companies have provided if any when the bank have gone to them. None of the companies are British all taken in dollars and all based in Africa, South America and the Middle East. Some are closed, some return no results so I’d guess they didn’t even get in touch with some.

they’ve refunded all payments July and august and and rejected May June to same companies.0 -

It could be (do not know when you started this case) that the May payments were over 120 days when you notified them, to start the fraud process. So they will do the ones they can, once declaration is returned. If any details come back to prove they are not yours, then they should refund the previous ones.HiggiHiggins said:

Thanks for the info.born_again said:

The declaration is important as it is the only way the bank can go back to the retailer to claim the money back & for the retailer to provide details.HiggiHiggins said:If this form is so important that fraud cannot proceed without it and if it’s not received it’s automated to close the case. It must carry a significant level of legality otherwise surely it wouldn’t be required. If this is the case then a mistake causing a case to be processed without the form has to against process in some way. Also to then just proceed with another case without receiving a form is again against process?

This is part of the card regulations.

From banks end they can see how the transactions are made so someone saying They have their card & no one knows the PIN, but are claiming that these are fraud. Clearly a Chip & Pin requires card & pin. Same with contactless transactions requiring card. So you can see the banks point of view.

If they are all online, then it's a different matter, but retailer can & will provide customer details if they feel it is not fraud.

Other option is a retailer that has been used before online, or a known retailer that takes recurring payments.

so if they have gone to the retailer without this as they have done, have they actually done anything wrong in that sense.

they are all online transactions but I’ve no idea what details these companies have provided if any when the bank have gone to them. None of the companies are British all taken in dollars and all based in Africa, South America and the Middle East. Some are closed, some return no results so I’d guess they didn’t even get in touch with some.

they’ve refunded all payments July and august and and rejected May June to same companies.

If not you need to raise a complaint with them, as to why you have not been refunded for them, asking for proof that they are yours or not.

There is a FCA rule that anything under 13 months has to be refunded if fraud. Even though the bank can not claim it back. So if there are any out of time & some that are, they will wait before refunding in case retailer provides evidence either way.Life in the slow lane0 -

Started 9 Sept so should capture all but about 4 payments which happened after 12 May.So 12 May to 3 July have been rejected

3 July to end August refunded

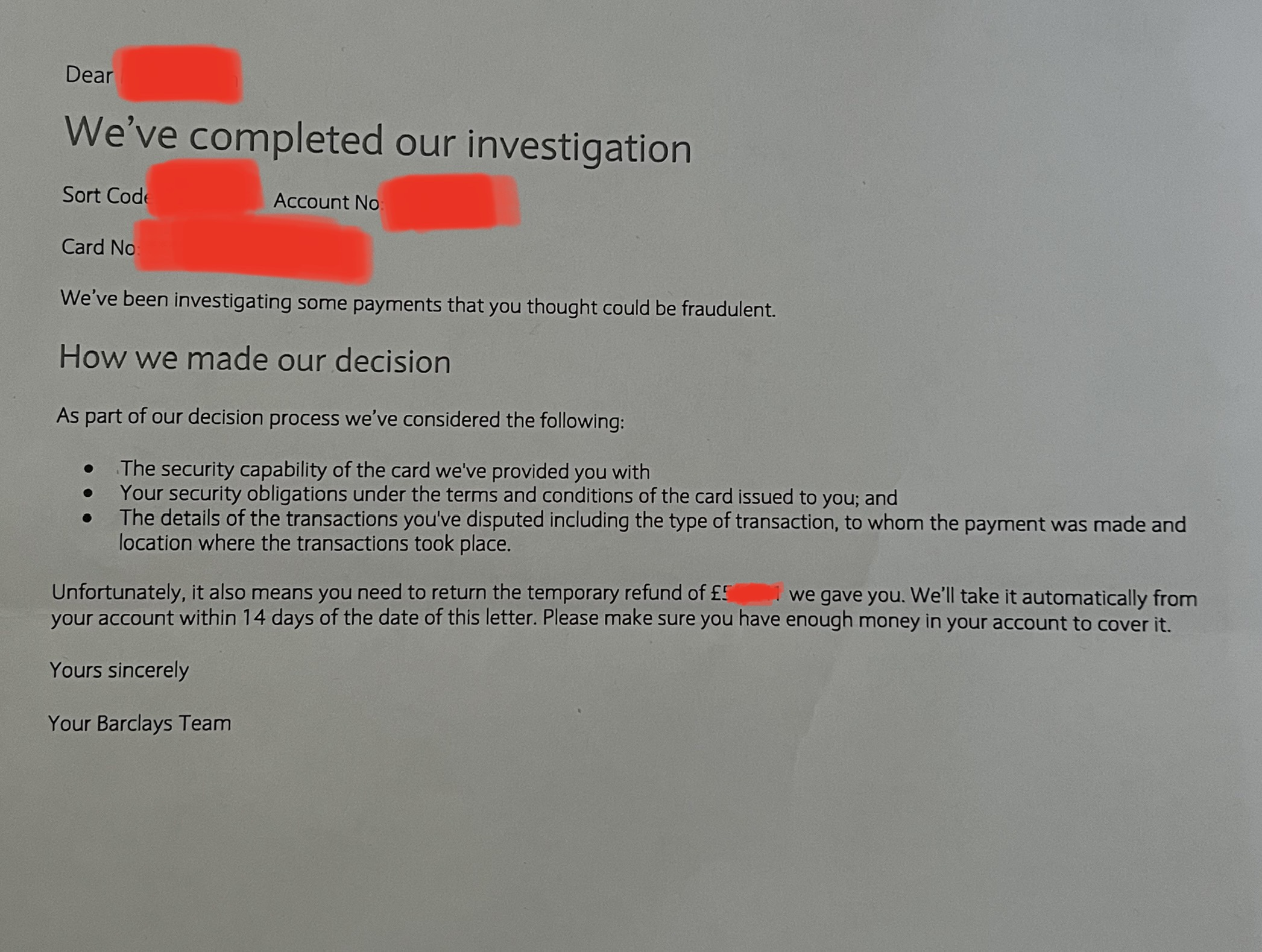

On 3 July they refunded 9 txn as fraudulent on the original case back in September. 4 being to Company A. On the case that was re raised in November there are 5 payments also to Company A which they reject as liable.The attached letter is all I got in relation to the outcome of the two cases - that is it. The only other comment was on the exec complaints letter saying “fraud concluded you're liable for the transactions due to evidence available to them from yourself, the merchants and transaction data. We cannot unfortunately reverse this decision as correct processes have been followed”

I was reading up claiming chargebacks under visa, is this an option to report the outstanding ones or not.Thanks again 0

0 -

were the transactions made on a credit card? if not I don't see what Visa has to do with anything.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅

STRUGGLING DURING THE HOLIDAYS??

click here for ideas on how to cope....Some websites and helplines if you're struggling this Christmas — MoneySavingExpert Forum0 -

Did they provide evidence that the payments were yours?

Can you name who the payments were to?Life in the slow lane1 -

Hi no they were debit. Just reading an article on MSE about chargebacks and it quoted purchases on both credit and debit cards can be chargeback’d?Brie said:were the transactions made on a credit card? if not I don't see what Visa has to do with anything.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards