We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Changing how I Budget

Comments

-

Can someone explore the number of posts you need to do certain things?There are things I would like to post. I feel frustrated.0

-

What are you wanting to post?Peterxxxxxx said:Can someone explore the number of posts you need to do certain things?There are things I would like to post. I feel frustrated.1 -

Excel tables and spreadsheets. I’ve been doing calculations on the increase in costs of electricity from my energy supplier. I would like to post the calculations and get feedback. There appears to be interesting rounding errors in the company’s calculations.RG2015 said:

What are you wanting to post?Peterxxxxxx said:Can someone explore the number of posts you need to do certain things?There are things I would like to post. I feel frustrated.Do a project of the increase in costs.0 -

I may be wrong, but I do not believe that anyone can post Excel tables and spreadsheets.Peterxxxxxx said:

Excel tables and spreadsheets. I’ve been doing calculations on the increase in costs of electricity from my energy supplier. I would like to post the calculations and get feedback. There appears to be interesting rounding errors in the company’s calculations.RG2015 said:

What are you wanting to post?Peterxxxxxx said:Can someone explore the number of posts you need to do certain things?There are things I would like to post. I feel frustrated.Do a project of the increase in costs.

You have already posted screenshots of these, so I believe that you already have all the posting privileges possible.1 -

You can budget to have an emergency fund though - and that would take care of things that go wrong unexpectedly. personally, if I had a boiler that I knew was getting on in years, I would be researching now what the likely replacement cost would be for that, and would be starting to pay extra into my EF ready to cover that when the time comes. We are currently doing this with car costs - we have both changed our cars in the last few years and they are now costing less to run than either older one did - instead of cutting back the amount we budget monthly for car related expenses, we've left this the same and are allowing the money to build up a little in that account. This will begin to build the fund for the next time a replacement vehicle is needed.phillw said:I don't understand budgets, for me the idea is to spend as little money as necessary. If I set a budget, then I would find myself spending more money to use up the budget. What happens when you have blown your food budget, do you stop eating?

You can't budget for emergencies either, will I need a new boiler this year or next? How much should I put by for that?

Just because you budget a certain amount, you don't have to spend it - a budgeted amount might be the maximum you expect a certain category to cost you, and if it actually costs less one month, some people transfer that surplus either towards clearing debt, or to savings. Others leave it to "roll over" to bolster another month where for whatever reason costs are unexpectedly higher.🎉 MORTGAGE FREE (First time!) 30/09/2016 🎉 And now we go again…New mortgage taken 01/09/23 🏡

Balance as at 01/09/23 = £115,000.00 Balance as at 31/12/23 = £112,000.00

Balance as at 31/08/24 = £105,400.00 Balance as at 31/12/24 = £102,500.00

£100k barrier broken 1/4/25

Balance as at 31/08/25 = £ 95,450.00. Balance as at 31/12/25 = £ 91,100.00

SOA CALCULATOR (for DFW newbies): SOA Calculatorshe/her0 -

This has been my biggest change recently. Really altered my mindset, and has made everything more comfortable even though on paper I have less money for spur of the moment fun.EssexHebridean said:

You can budget to have an emergency fund though - and that would take care of things that go wrong unexpectedly. personally, if I had a boiler that I knew was getting on in years, I would be researching now what the likely replacement cost would be for that, and would be starting to pay extra into my EF ready to cover that when the time comes. We are currently doing this with car costs - we have both changed our cars in the last few years and they are now costing less to run than either older one did - instead of cutting back the amount we budget monthly for car related expenses, we've left this the same and are allowing the money to build up a little in that account. This will begin to build the fund for the next time a replacement vehicle is needed.phillw said:I don't understand budgets, for me the idea is to spend as little money as necessary. If I set a budget, then I would find myself spending more money to use up the budget. What happens when you have blown your food budget, do you stop eating?

You can't budget for emergencies either, will I need a new boiler this year or next? How much should I put by for that?

Just because you budget a certain amount, you don't have to spend it - a budgeted amount might be the maximum you expect a certain category to cost you, and if it actually costs less one month, some people transfer that surplus either towards clearing debt, or to savings. Others leave it to "roll over" to bolster another month where for whatever reason costs are unexpectedly higher.

Monthly bills are easy to budget for as they are always the same every time I get paid. I don't have to think about them other then getting the best deal. The money isn't available to spend on anything else anyway.

Monthly variable expenses like food, entertainment etc I've set a maximum spend with the amount based on reviewing the last 6 months of actual costs. When it runs out that is it. Groceries has a more generous amount than required for that exact reason I will still have to eat. Left over gets added to next months income to go be allocated out again. What budgeting means is that until the next payday the money is locked into groceries only. I may have £10 unspent but it is not available for clothes shopping, or a lottery ticket etc.

Then there are variable expenses that may not happen monthly. I don't need clothes every month, but I set aside something for it each month so it is there when needed. Another example, there is a savings account just for birthday presents. These pots increase every month and go down occasionally. Again this is locking money into a task to make it unavailable for anything else and only using that pot for that task.

Amounts set aside for big annual expenses are worked out by dividing what the cost will be by how many months are left until when it is needed. So Christmas, Car MOT, holidays etc. That way they don't cost you any more in the month they happen. These are almost debt payments you owe yourself, otherwise they go on credit cards and you owe someone else!

There are plenty of different ways to track all this. I have an excel and use lots of small savings accounts with my bank.

You can budget for emergencies. It is the same thing as having a misc. category for monthly spending. For money I know I will spend just not sure on what at the start of the month. I don't have a replacement fund for every appliance, white good, part of the house/car, act of god. I have a single pot to cover them all. It's currently big enough to deal with most things, if they don't happen simultaneously. The washing machine packed in two weeks before Xmas. The part and labour was the same price as a new one. So new machine ordered and paid for by emergency fund no stress. How is it replenished? Again no additional thought. I save a set amount each month regardless of the withdrawals from it. This rule for myself means I'm not tempted to think there is enough in there and not save. (This rule may change if I ever get to 6-12 months of all expenses set aside) You have to come up with your own rules for what counts as an emergency, but any regular or expected expense doesn't for me.

My Debt free diary

https://forums.moneysavingexpert.com/discussion/6492297/10-000-steps-1-step-at-a-time3 -

PDF files can be converted to JPEG’s

PDF files can be converted to JPEG’s

This for me means that I can post a lot more useful information. I any one else is interested I can post the details.

What I’ve posted is a test.0 -

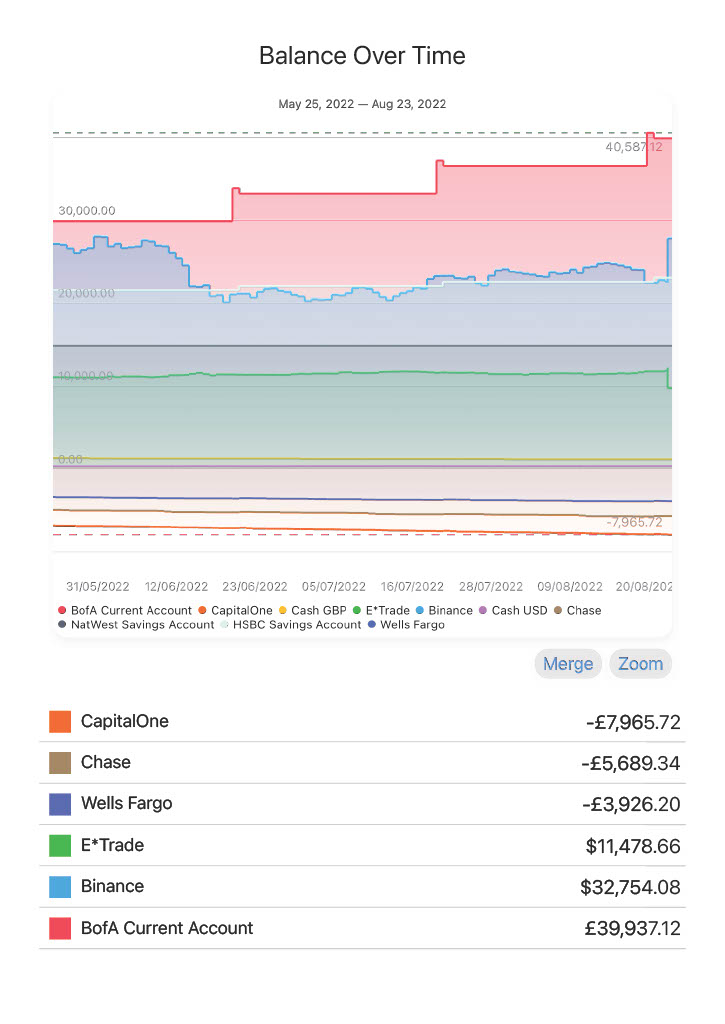

It’s coming to the end of the month. Finishing my accounts for this month. Have a revised balance for February.Any comments?0

-

Not sure what comments you're expecting but here goes.Peterxxxxxx said:It’s coming to the end of the month. Finishing my accounts for this month. Have a revised balance for February.Any comments?

I already know my balances at the end of January and at the end of February. It's all fixed including my monthly credit card payments which relate to expenditure from mid December to mid January

Any variable expenditure from now to the end of February is on my credit cards which will not be paid until March.

I like to be in control.

As and when I spend any money on my credit cards, either regular such as groceries or variable such as Amazon or Pizza Express will be added to my credit card forecast payment for March.1 -

Also, I am now planning my cash ISA balances at the end of the financial year (5th April).

I managed to take out too many fixed savers maturing next year and will pay tax on my interest for the first time ever. The cash ISA planning is to minimise the excess interest above £1,000.

The calculation also takes into account the ISA rate which needs to deliver more than a non ISA rate less 20% for tax.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards