We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Rubbish savings rates

Comments

-

Don't understand. What's the difference between what you call a paper original and a true original ?0

-

Sending me booklets, brochures and paper copies of original digital documents is a waste of time, effort and resources. I have to shred everything with my name and address on it. Waste, waste, waste.

I still sort of prefer paper, just out of habit/history/familiarity etc.

However due to the waste as highlighted above, environmental impact etc I have gone largely paperless, where possible.

1 -

Paper isn't a complete waste.

* You can often use the other side of the document if you don't need it.

* It can be burnt to provide heat.

* Has numerous secondary applications.

* Helps keeps the refuse collection industry gainfully employed.

Etc, etc.

0 -

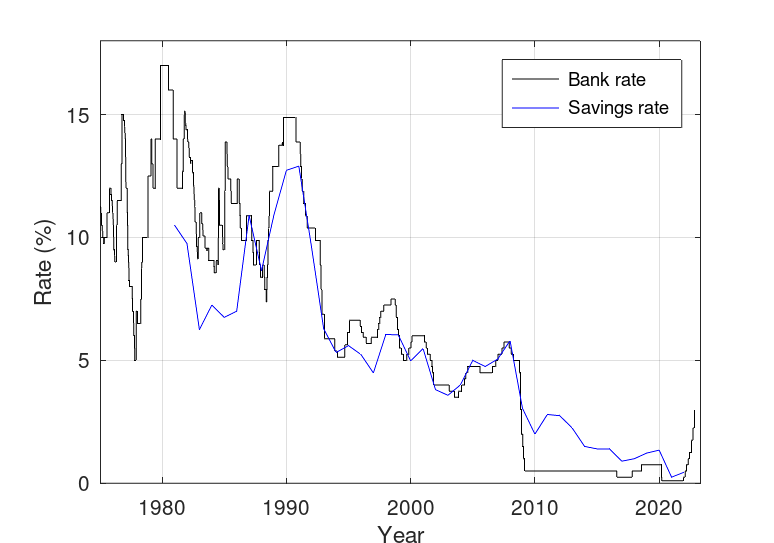

Here is a plot of the savings interest rate (from swanlow park - I'd already downloaded this before their website certificate expired back in August - hence the problem that firefox detected) and bank rate (from Bank of England) as a function of time. Note that the savings rate data is annual, while the bank rate data is down to the nearest day. I note that the savings rate data is from December each year, so I could have, but didn't, add another point right at the end around 2.5%dosh37 said:I don't remember a time when savings interest rates were actually below the BoE interest rate.Why is this happening?

You have to go quite a way back to find periods prior to today where the savings account rate was below the bank rate, e.g., periods around early 2000s, early and mid-1990s and mid-1980s. The cause of this is not immediately apparent - the different periods do not appear to share a common feature except rapid upward changes in the bank rate that do not then get tracked in the savings rate (although this doesn't always happen).

4 -

"Bank rate" is easy to define - BoE base rate.

But what is "savings rate"? The best instant access rate? The best average instant access rate? The average of a number of rates? ISA rates included (in which case, which ones)?0 -

Don't want paper? Take a screenshot. Next!Now a gainfully employed bassist again - WooHoo!0

-

I think it is inferred from the OP's posts as the unrestricted instant access savings account rates.Band7 said:"Bank rate" is easy to define - BoE base rate.

But what is "savings rate"? The best instant access rate? The best average instant access rate? The average of a number of rates? ISA rates included (in which case, which ones)?

I can see why regular savers are excluded as these are by their very nature restricted. Similarly with fixed rate, fixed term savers as these tend to follow bonds rates rather than the BoE rate.

ISAs should match non ISAs but they tend to be bit lower. I think this is more down to demand and competition although there is the issue of the additional admin cost for the banks.

Very few instant access accounts match the BoE rate but in these unusual times there have always been a few that are there or thereabouts. Right now though there are none, which is the point the OP is making.

The best current rate for new customers is Atom at 2.55% albeit with a limit of £100k

Including lower limits there is Barclays at 5% for up to £5k and the Virgin Money ISA at 3% within the ISA limits of £20k per annum.

2 -

Thanks for that. It would appear to contradict the OP's assertion that savings rates were above the base rate. Apart from the time since the global crisis and minimal rates which admittedly is the last 14 years most of the time before that the base rate was generally above savings for many of the previous years.OldScientist said:

Here is a plot of the savings interest rate (from swanlow park - I'd already downloaded this before their website certificate expired back in August - hence the problem that firefox detected) and bank rate (from Bank of England) as a function of time.dosh37 said:I don't remember a time when savings interest rates were actually below the BoE interest rate.Why is this happening?Remember the saying: if it looks too good to be true it almost certainly is.1 -

My recollection (which could be wrong) is that the swanlowpark values are an average of a selection of instant access rates - I do not have a note of the exact ones they used (but once the site is secure again, they do list them in detail). Over the last 15 years or so (since 2004), the swanlowpark values have, on average, been about 35 basis points below the best easy access rate as indicated in Martin's newsletters (the worst discrepancy, 2010, is about 1 percentage point), so I think they are probably representative enough.Band7 said:"Bank rate" is easy to define - BoE base rate.

But what is "savings rate"? The best instant access rate? The best average instant access rate? The average of a number of rates? ISA rates included (in which case, which ones)?

There are other sources of historical savings interest rates, e.g. the Building Societies Association at https://www.bsa.org.uk/statistics/savings. However, since these are for bank and building society accounts, they tend to be a lot lower than the swanlowpark or recent MSE best rates.

2 -

It is not just the paper though.subjecttocontract said:Paper isn't a complete waste.

* You can often use the other side of the document if you don't need it.

* It can be burnt to provide heat.

* Has numerous secondary applications.

* Helps keeps the refuse collection industry gainfully employed.

Etc, etc.

The printing ink, energy needed to put the document in an envelope, package it up with others, drive it to Post centre, transport it to relevant part of the country, sort it, deliver it, recycle it maybe etc etc.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards