We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

S&P 500

Comments

-

NoviceInvestor1 said:

From say 2000 - 2010 anyone buying US Large Cap Growth will have done horrendously badly, whilst those buying Emerging Markets Small Cap Value would have done very well. Fast forward a decade and the opposite applies.

History leads me to believe that the chance of the same factors (growth/quality), countries (US), individual stocks (FAANGs) continuing to drive market returns for multiple decade cycles is extremely low.

Your assertion above cites selective market sector performances to support your argument.

It's also not a fair comparison for this debate as the S&P500 is a blended index of growth and value not exclusively growth and emerging market small caps are not the global index. So, to have picked the best performing sectors and regions decade by decade would require some serious predictive abilities.

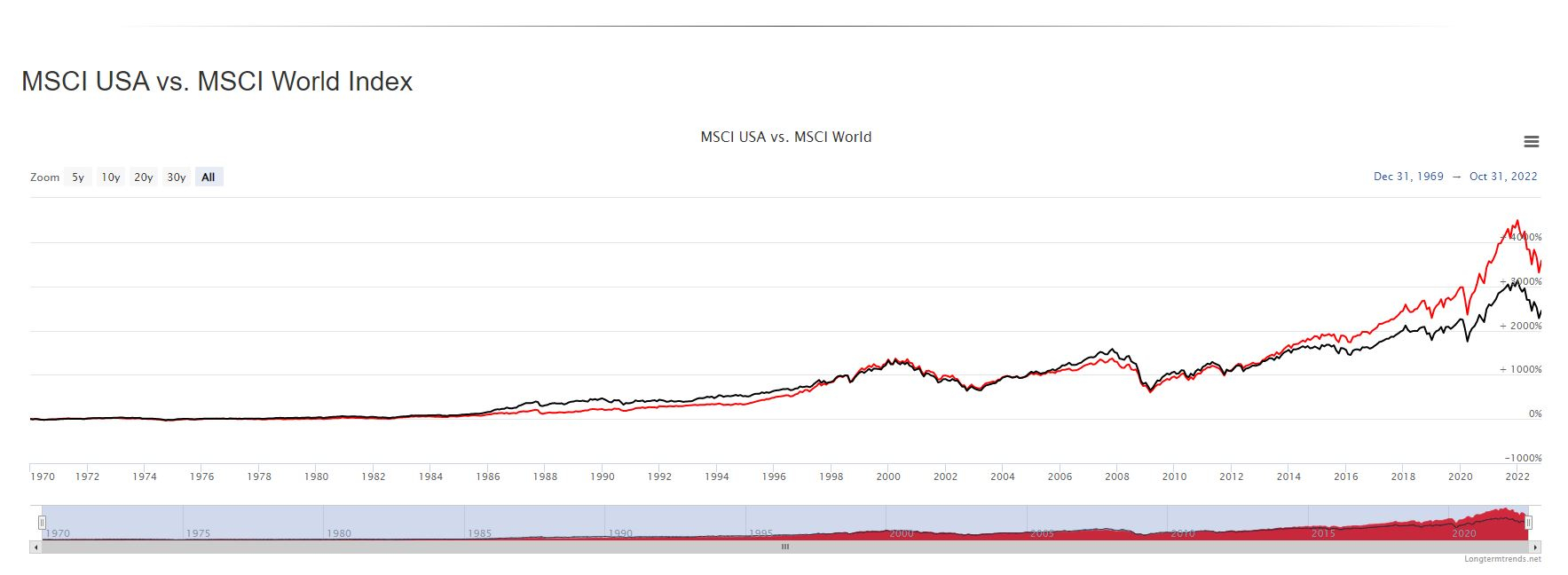

If the often-regaled wisdom is to hold a global market cap weighted index rather than the S&P500, then surely a fairer comparison is to look at how an index such as MSCI Global Index fared against the S&P500 during the "lost decade" of 2000-2010.

How does that comparison make investing in the S&P500 for the long-term look now?

US Stocks vs. The World - 52 Year Chart | Longtermtrends

Rightly, or wrongly, I take a much broader view and rationale for investing in US stock indexes.

The US is a huge swathe of land filled with natural resources and fertile soils, it is not landlocked by a nation that is likely to wage a land war with it. The US also has regulation and governance that promotes capitalism and investing and has made startling progress since being founded in 1776, despite its many inequalities and flaws.

From the signing of the declaration of independence in 1776 it took just 193 years to put a man on the moon. Impressive. I am betting on the US continuing to be enormously successful for at least another 100 years.

5 -

It's the majority of retail investors, if studies about fund flows etc are to be believedadindas said:It is only a person who does not have a common sense at the slightest will ever do that. This sort of person should stay on saving and should never be getting involved in investing in the first instance until they understand the risk involve as investing will always get involved some degree of risk.0 -

FWIW I dont even remotely have a view on if the US is overvalued or not.

I just wouldn't want to bet on a single countries market continuing it's multi year outperformance when previous cycles have shown that trend is likely to reverse for a period of time.

If other people do want to do that then that's fine

3 -

NoviceInvestor1 said:FWIW I dont even remotely have a view on if the US is overvalued or not.

I just wouldn't want to bet on a single countries market continuing it's multi year outperformance when previous cycles have shown that trend is likely to reverse for a period of time.

If other people do want to do that then that's fine I think it is good to see what the research is showing regarding US stock market and other country single stock market. Credit to JohnWinder who posted this link and summarising it.It is also available on you tube

I think it is good to see what the research is showing regarding US stock market and other country single stock market. Credit to JohnWinder who posted this link and summarising it.It is also available on you tube https://www.youtube.com/watch?v=411fKAh05pk "And an analysis of investing in single country stocks (developed market only, not the dodgy emerging markets) shows that for any random 30 year investing period the average chance of losing money compared to inflation was 13%; so a one in eight chance of going backwards by holding only one country’s stocks for a long period. The detail shows that if it was US stocks the chance would have been only 1%, but if it was Viennese stocks before the Russians pushed the Nazis out of eastern Europe, 100%. 13% is why we diversify by country, and why it doesn’t always ‘make very little difference"That is why it is important do not just read the headline, a single country stock market always bad. Let alone you are talking about S&P500 index where many of revenues are coming from all over the world and we are in the fourth industrial revolution, where country boundary will become less relevant.Also Just be aware of the S&P500 is different with the US stock market, not a single country stock market if you refer to the nature of the companies and how they operate in the this index. So it is important to differentiate S&P500 with a single country stock market. Also not to generalise the US stock market with other single country stock market.Just to reiterate I never say whether a single country portfolio is a good or bad idea, less riskier than the global tracker. People will need to make their own judgement adapted with their risk attitude and their needs not just following the crowd of random people on the internet. It is about becoming a more open minded, learning new things, want to do your desk work, keep your eye on those country in question.0

https://www.youtube.com/watch?v=411fKAh05pk "And an analysis of investing in single country stocks (developed market only, not the dodgy emerging markets) shows that for any random 30 year investing period the average chance of losing money compared to inflation was 13%; so a one in eight chance of going backwards by holding only one country’s stocks for a long period. The detail shows that if it was US stocks the chance would have been only 1%, but if it was Viennese stocks before the Russians pushed the Nazis out of eastern Europe, 100%. 13% is why we diversify by country, and why it doesn’t always ‘make very little difference"That is why it is important do not just read the headline, a single country stock market always bad. Let alone you are talking about S&P500 index where many of revenues are coming from all over the world and we are in the fourth industrial revolution, where country boundary will become less relevant.Also Just be aware of the S&P500 is different with the US stock market, not a single country stock market if you refer to the nature of the companies and how they operate in the this index. So it is important to differentiate S&P500 with a single country stock market. Also not to generalise the US stock market with other single country stock market.Just to reiterate I never say whether a single country portfolio is a good or bad idea, less riskier than the global tracker. People will need to make their own judgement adapted with their risk attitude and their needs not just following the crowd of random people on the internet. It is about becoming a more open minded, learning new things, want to do your desk work, keep your eye on those country in question.0 -

GazzaBloom said:The US is a huge swathe of land filled with natural resources and fertile soils, it is not landlocked by a nation that is likely to wage a land war with it. The US also has regulation and governance that promotes capitalism and investing and has made startling progress since being founded in 1776, despite its many inequalities and flaws.

From the signing of the declaration of independence in 1776 it took just 193 years to put a man on the moon. Impressive. I am betting on the US continuing to be enormously successful for at least another 100 years.I think you hit the nail on the head here. There is something different about the US, and how it cultivates innovation. It's effectively a goose that lays golden eggs.I invested a sizable amount in the S&P500 on 12 March 2019 for this reason, and it has held up very well.That said, nothing is risk free. The thing which most concerns me about the US is the possibility of civil war. Because of this I wouldn't want to have all my eggs in that basket.1 -

Very useful insight into what has happened in the past.adindas said:NoviceInvestor1 said:FWIW I dont even remotely have a view on if the US is overvalued or not.

I just wouldn't want to bet on a single countries market continuing it's multi year outperformance when previous cycles have shown that trend is likely to reverse for a period of time.

If other people do want to do that then that's fine I think it is good to see what the research is showing regarding US stock market and other country single stock market. Credit to JohnWinder who posted this link and summarising it.It is also available on you tube

I think it is good to see what the research is showing regarding US stock market and other country single stock market. Credit to JohnWinder who posted this link and summarising it.It is also available on you tube https://www.youtube.com/watch?v=411fKAh05pk "And an analysis of investing in single country stocks (developed market only, not the dodgy emerging markets) shows that for any random 30 year investing period the average chance of losing money compared to inflation was 13%; so a one in eight chance of going backwards by holding only one country’s stocks for a long period. The detail shows that if it was US stocks the chance would have been only 1%, but if it was Viennese stocks before the Russians pushed the Nazis out of eastern Europe, 100%. 13% is why we diversify by country, and why it doesn’t always ‘make very little difference"That is why it is important do not just read the headline, a single country stock market always bad. Let alone you are talking about S&P500 index where many of revenues are coming from all over the world and we are in the fourth industrial revolution, where country boundary will become less relevant.Also Just be aware of the S&P500 is different with the US stock market, not a single country stock market if you refer to the nature of the companies and how they operate in the this index. So it is important to differentiate S&P500 with a single country stock market. Also not to generalise the US stock market with other single country stock market.Just to reiterate I never say whether a single country portfolio is a good or bad idea, less riskier than the global tracker. People will need to make their own judgement adapted with their risk attitude and their needs not just following the crowd of random people on the internet. It is about becoming a more open minded, learning new things, want to do your desk work, keep your eye on those country in question.Unfortunately my investment outlook is about what happens in the future, and despite being mid 30s my timeline is shorter than 30 years.Again, if people wish to invest 100% of their equity exposure into a single countries stock market (be that the US or any other) I wish them all the best with that. It’s not a strategy that is for me regardless of what some random people on the internet say.I maintain the view that people on this forum 10 years ago would definitively not be recommending going all in on the US. When I first joined Neil Woodford was all the rage.PS also wary of USD based data which doesn’t take GBP or currency into account. Is the data cited based on a UK investor in GBP like the data below?

https://www.youtube.com/watch?v=411fKAh05pk "And an analysis of investing in single country stocks (developed market only, not the dodgy emerging markets) shows that for any random 30 year investing period the average chance of losing money compared to inflation was 13%; so a one in eight chance of going backwards by holding only one country’s stocks for a long period. The detail shows that if it was US stocks the chance would have been only 1%, but if it was Viennese stocks before the Russians pushed the Nazis out of eastern Europe, 100%. 13% is why we diversify by country, and why it doesn’t always ‘make very little difference"That is why it is important do not just read the headline, a single country stock market always bad. Let alone you are talking about S&P500 index where many of revenues are coming from all over the world and we are in the fourth industrial revolution, where country boundary will become less relevant.Also Just be aware of the S&P500 is different with the US stock market, not a single country stock market if you refer to the nature of the companies and how they operate in the this index. So it is important to differentiate S&P500 with a single country stock market. Also not to generalise the US stock market with other single country stock market.Just to reiterate I never say whether a single country portfolio is a good or bad idea, less riskier than the global tracker. People will need to make their own judgement adapted with their risk attitude and their needs not just following the crowd of random people on the internet. It is about becoming a more open minded, learning new things, want to do your desk work, keep your eye on those country in question.Unfortunately my investment outlook is about what happens in the future, and despite being mid 30s my timeline is shorter than 30 years.Again, if people wish to invest 100% of their equity exposure into a single countries stock market (be that the US or any other) I wish them all the best with that. It’s not a strategy that is for me regardless of what some random people on the internet say.I maintain the view that people on this forum 10 years ago would definitively not be recommending going all in on the US. When I first joined Neil Woodford was all the rage.PS also wary of USD based data which doesn’t take GBP or currency into account. Is the data cited based on a UK investor in GBP like the data below? 1

1 -

This a great reminder on the "lost decade" for US stocks and funds. While it would not have necessarily been troublesome for the younger working age adult paying into a pension each year hoovering up cheaper units, it would be very a tricky period to navigate for the retiree if depending on drawdown from the sale of US equity funds during that period. Even with drawdown rules such as Guytons or Vanguards you would have been reducing your drawdown each year for a decade which may have lead to a long lean period or even been untenable for some.NoviceInvestor1 said:Unfortunately my investment outlook is about what happens in the future, and despite being mid 30s my timeline is shorter than 30 years.Again, if people wish to invest 100% of their equity exposure into a single countries stock market (be that the US or any other) I wish them all the best with that. It’s not a strategy that is for me regardless of what some random people on the internet say.I maintain the view that people on this forum 10 years ago would definitively not be recommending going all in on the US. When I first joined Neil Woodford was all the rage.PS also wary of USD based data which doesn’t take GBP or currency into account. Is the data cited based on a UK investor in GBP like the data below?

I am personally heavy in US currently but also accumulating aggressively as working and still maintain that widening the window to 20-30 years will give good performance with a US allocation but that lost decade needs serious consideration.1 -

TSMC to up Arizona investment to $40 billion with second semiconductor chip plant (cnbc.com)

An example of moves to make US supply chains more resilient, this is why I like investing in the US, it's a formidable powerhouse. Now, if only they could develop their own machines that make the semi-conductors rather than relying on Dutch company ASML !0 -

That is why I invest in Europe as well. ASML is in my Growth portfolio's top 10 holdings.GazzaBloom said:TSMC to up Arizona investment to $40 billion with second semiconductor chip plant (cnbc.com)

An example of moves to make US supply chains more resilient, this is why I like investing in the US, it's a formidable powerhouse. Now, if only they could develop their own machines that make the semi-conductors rather than relying on Dutch company ASML !0 -

ASML are in top 10 of my S&S ISA fund but US are definitely working to be more protectionist and on-shoring, is the age of globalisation in retreat?Linton said:

That is why I invest in Europe as well. ASML is in my Growth portfolio's top 10 holdings.GazzaBloom said:TSMC to up Arizona investment to $40 billion with second semiconductor chip plant (cnbc.com)

An example of moves to make US supply chains more resilient, this is why I like investing in the US, it's a formidable powerhouse. Now, if only they could develop their own machines that make the semi-conductors rather than relying on Dutch company ASML !

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards