We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

My comparison of banking apps (Monzo, Starling, Lloyds, Natwest and others)

Comments

-

Like some regular MSEs. I have a few dozen accounts comprise of current accounts and saving accounts, credicards. And I personally do not need any app to manage all of that. In fact I hate apps to be installed on my phone. The only reason I install apps if there is not other visible option available to take advantage of the bank offer.Rob5342 said:Thanks this is useful to see as the app functionality is now the most important thing to consider when choosing a bank.Andy clever cash has done a good comparison on YouTube too. Starling and Monzo were the best as you:d probably expect and Nationwide was absolutely awful.1 -

Band7 said:

I agree. Apps for current accounts and credit cards are now the norm, nothing more than a commodity. All of them do the basics. There are many other factors - monthly fees, cashback, rewards, switch bonuses, interest on current and other accounts, premium accounts with insurances, loans/mortgages if I need them, FSCS cover, quality and accessibility of CS, and general reliability would be some or all of the other factors I would consider. I might even consider their investment offerings although it is usually better to chose a specialist investment platform.eskbanker said:

Massive generalisation alert!Rob5342 said:this is useful to see as the app functionality is now the most important thing to consider when choosing a bank.Rob5342 said:They might all have an app of some sort but there is a vast difference in the functionality. Starling and Monzo have lots of budgeting features that I'd now class as essential, but Nationwide don't even let you set up a new payee (they seem to have done the minimum possible to say they have an app with taking any sort of interest in making it useful)Most accounts don't charge fees or pay interest, so I still say the app is the most important as it's something you'll be using multiple times a day.

For the avoidance of doubt, I wasn't claiming that app functionality is irrelevant, just that it's clearly a huge generalisation to make a blanket assertion that it's the most important aspect of choosing a bank, even though it may be for some.SouthLondonUser said:Also, every app does the basics but some people aren't happy with just the basics. Very simple tasks like checking how much you spent on groceries this month vs the previous one, and checking if a transaction was classified in the correct category, are very straightforward with Monzo and Starling, clunky with other apps (unless you use a budgeting app like MoneyDashboard or MoneyHub) and outright impossible with other apps.

For me these things are important, but I totally get it that for many people they aren't - otherwise Monzo and Starling would have more users than HSBC etc, or the traditional banks would have caught up, instead none of that has happened.

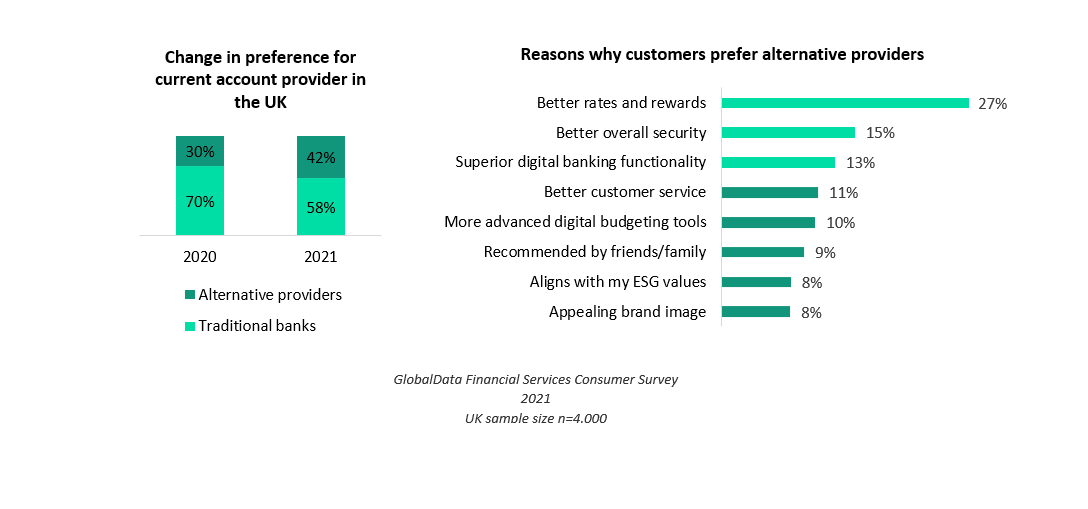

A recent GlobalData study placed it at number three in the list of factors identified by their sample of customers preferring 'alternative providers' (as opposed to 'traditional banks'), with budgeting capabilities at number five:

and on the point about relative scales, the upsurge in interest in fintech challengers still needs to be seen in perspective:/cloudfront-us-east-2.images.arcpublishing.com/reuters/RYIQNN3YKVOYVLSTXDEJ6OHXDY.png)

https://www.fca.org.uk/publication/multi-firm-reviews/strategic-review-retail-banking-business-models-final-report-2022.pdf4 -

Yes it does, set up a new payee last week (albeit needed card reader).Rob5342 said:

....but Nationwide don't even let you set up a new payee (they seem to have done the minimum possible to say they have an app with taking any sort of interest in making it useful)2 -

@eskbanker yes, some people care about apps, but many don't - I had made the same point at the beginning. Let's please try to stay on topic. This thread is not a discussion of whether you think apps are important, it's a summary of which apps do what how (since there is so much confusion on it), so, if apps are not important for you, please ignore this thread. this way it will be much easier, for those interested, to find the information they need.

0 -

Again, super generalisation… many other people will look at many more useful things then just the app, even for using it everyday, all one may want to do with it is making fast payment, check incoming payment and generally checking some transactions and all banking apps allow to do that.. for people like me that make most spending via Amex, I may look at categorisation of spending there, and then checking my Santander 1-2-3 for DD on household bills giving me cashback etc..Rob5342 said:They might all have an app of some sort but there is a vast difference in the functionality. Starling and Monzo have lots of budgeting features that I'd now class as essential, but Nationwide don't even let you set up a new payee (they seem to have done the minimum possible to say they have an app with taking any sort of interest in making it useful)Most accounts don't charge fees or pay interest, so I still say the app is the most important as it's something you'll be using multiple times a day.Monzo is my main account but I have three others too.

I would not go back to Starling nor Monzo as the so called fantastic apps did not do anything for me, and actually had terrible customer service from Starling and fantastic from Chase, so if I have to stick to a challenger bank I will with Chase, even if the app is not yet perfect .

also, once you factor in other financial products, they may be more reasons to stick with some of the major banks that still have very workable apps, for example one may have a Scottish Widows pension pot and like to have visibility of that from his/her Lloyds app, and or may have mortgages or investment accounts which wants to monitor from his/her Barclays, HSBC, Santander apps,

Saying that the app is the most important thing in choosing which bank to choose is indeed a massive generalisation3 -

This is a forum and on this thread some less knowledgable reader will land and read certain inaccurate statements (like “app is the most important thing”) which do indeed merit an alternative perspective. None of us, when starting a thread, should monopolise the discussion on the single topic we had immagine, for that one should look at creating a personal blog.SouthLondonUser said:@eskbanker yes, some people care about apps, but many don't - I had made the same point at the beginning. Let's please try to stay on topic. This thread is not a discussion of whether you think apps are important, it's a summary of which apps do what how (since there is so much confusion on it), so, if apps are not important for you, please ignore this thread. this way it will be much easier, for those interested, to find the information they need.Asking to staying on topic is off course a perfectly reasonable approach, which will include discussion on the merits of giving more or less relevance to the app functionality when choosing a bank, especially as some of your original analysis is not complete (e.g. included Chase without any direct knowledge)5 -

Direct debit notifications are something you could add to your table. Monzo shows upcoming ones a few days in advance so you can check you have enough money to cover them.You could also change the Lloyds heading to Lloyds/Halifax as the apps are pretty much the same apart from branding.1

-

@rob5342 Good point. The Natwest app sends me a notification about direct debits and also tells me how long I have to cancel it (this second part I hadn't seen anywhere else). I suppose I can get a few more comments and then update the table

0 -

Yes, Monzo and Starling are definitely the best. Chase and Revolut are very good too. Showing upcoming payments (DD, SO, salary) in advance is very nice. If nothing else, you know for sure that your direct debit has been set up properly.

Some banks are still so bad that they don't show you new DD until it's actually paid for the first time. Some banks don't show pending payments either.

We had similar discussion just a few days ago. I don't know how old are most of those forumites but it turned out, they're not too much into innovations and prefer collecting paper receipts, etc. They literally don't care about having more info available to them. For me, banking apps showing exact time of each transaction, logo, address, etc. are a huge factor when choosing which bank to use. I love the fact that I can attach a note to Monzo and Revolut card purchases, which then appears below that payment so I can see the note while scrolling through transactions.

EPICA - the best symphonic metal band in the world !0 -

I would add that Monzo and Starling pay out standing orders on any day. For example, if I decide to set up a new SO today with the first payment going out this Saturday, it will go out on Saturday! Most dinosaur banks will only send it out next Monday. And some won't even let you set up the SO if the first payment falls on weekend. You must use a different date.

EPICA - the best symphonic metal band in the world !2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards