We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Are savings rates on their way down?

Comments

-

Here's the latest from a member of the Bank Of England.

Very much hedging his bets, but it isn't inconceivable that rates flatten or drop due to inflation reducing and avoiding choking any limited growth - also there is expectation the US Federal Reserve will rein back interest rate increases.

In other words, medium to long term savings rates will likely be lower.

I had hoped a month ago that we would get to 5% then I'd jump, but seeing where the wind was blowing I went for a 4.35% 1 year , 2 year at 4.85% and another at 4.75

(have several large pots to spread around)BoE's Ramsden: I could consider case for cutting interest rates

A senior Bank of England policymaker has suggested that he could consider voting to cut UK interest rates, if growth and inflation are weaker than expected.

Sir Dave Ramsden, BoE deputy governor, says that while he expects that interest rates will need to rise higher, there are “considerable uncertainties" about the economic outlook.

Giving a speech at the Bank of England Watchers’ Conference in London, Ramsden pledges to take a ‘watchful and responsive’ approach to setting borrowing costs.

Given the uncertainties we face it is important also to be humble about what we don’t know or still have to learn. I favour a watchful and responsive approach to setting policy.

Although my bias is towards further tightening, if the economy develops differently to my expectation and persistence in inflation stops being a concern, then I would consider the case for reducing Bank Rate, as appropriate.3 -

I think that must be the longest post I have ever seenwestv said:I started to wonder if I'd ever scroll on my phone to the end of the last two posts. 2

2 -

How amzing would it be if this type of data would be going into an online database so we can much easier detect trends. Same for easy access, reg saver, etc. Missing such info on all the comparison sites. We have graphs for everything usually but not for this. Would allow to show correlation with BoE rates as well.3

-

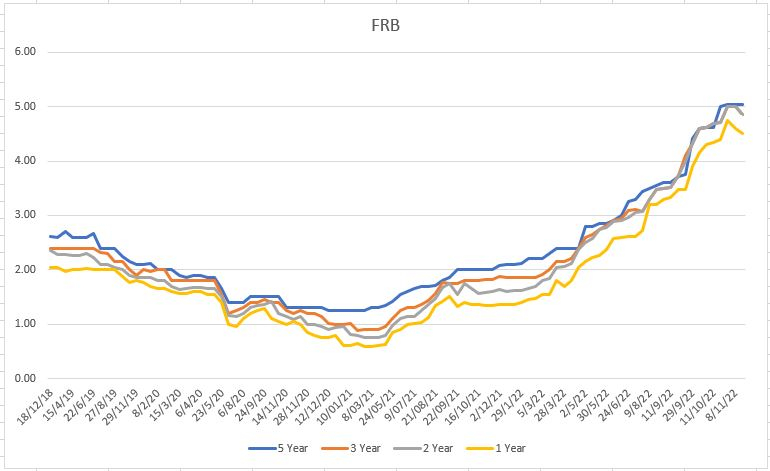

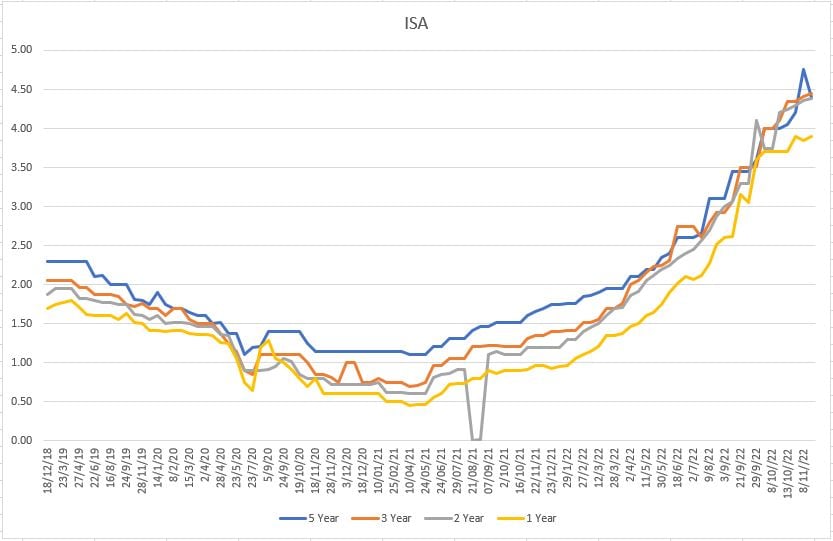

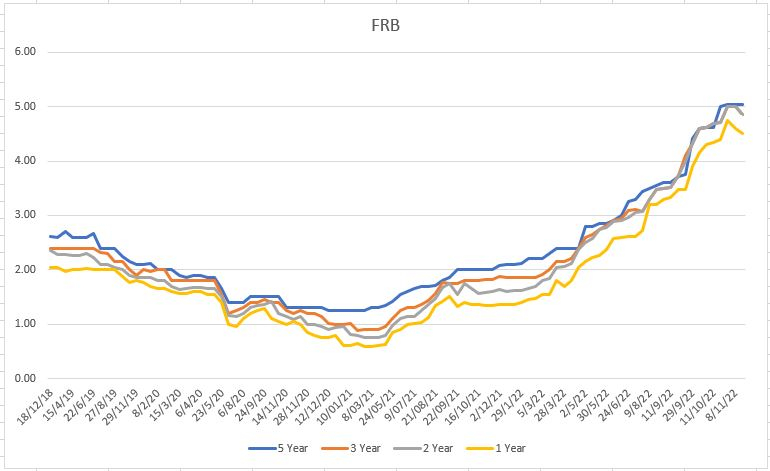

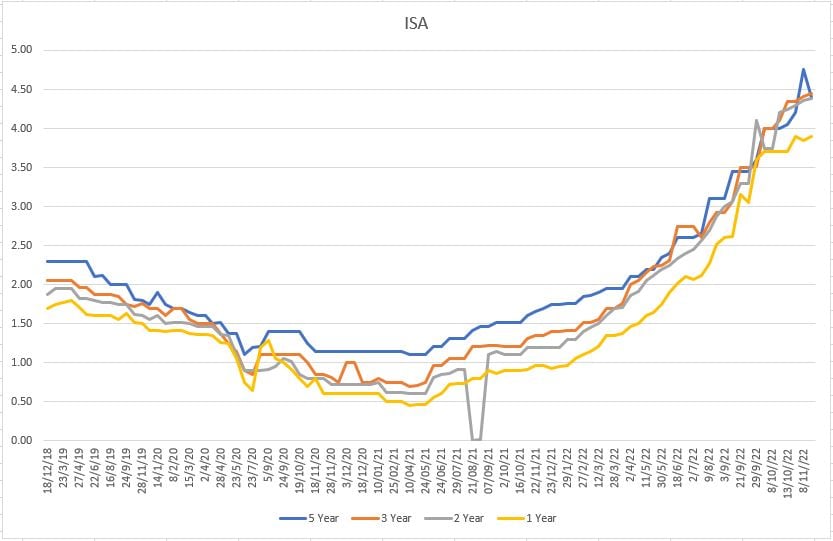

Data set was pretty horrible but here are the graphs. One dodgy data element in the ISA 2Yr graph to ignore.20 -

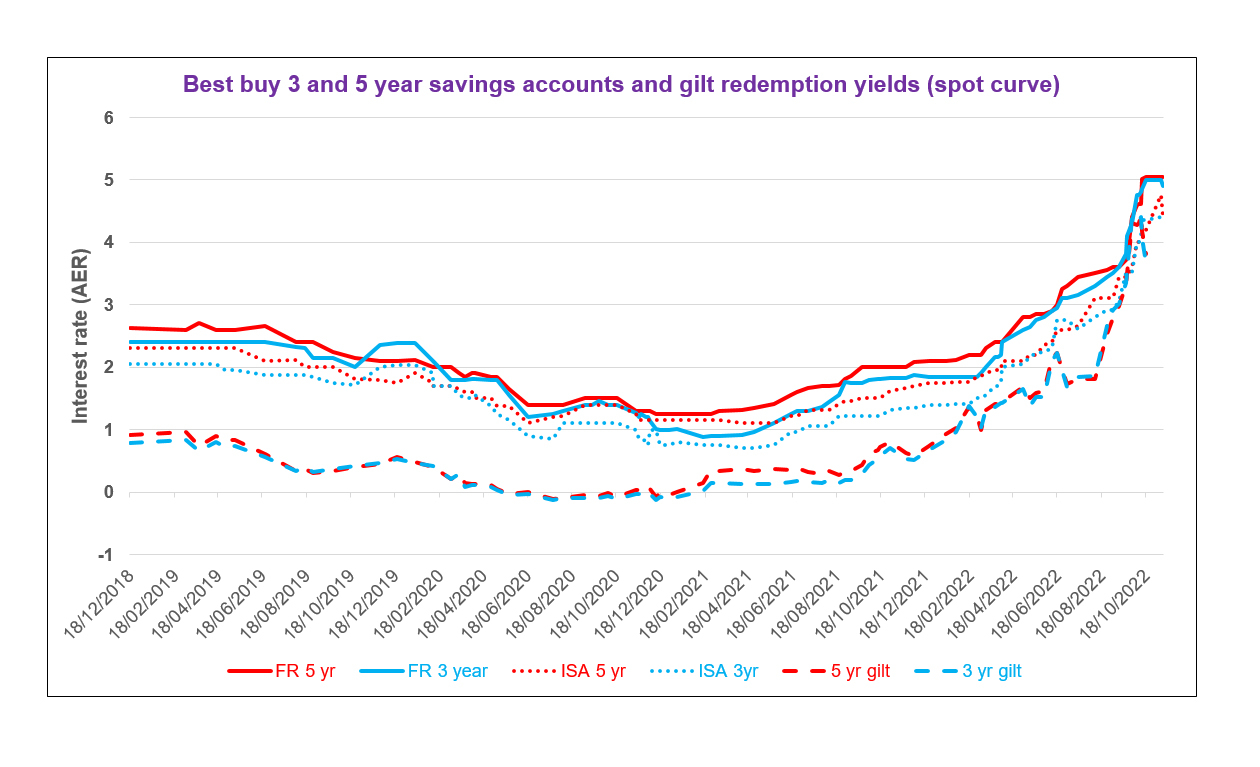

This was my earlier attempt to chart some of Ocelot's dataAdded in the 3 and 5 year gilt historical redemption yields from the Bank of England website (spot rates actually) also to see how the savings rates of 3 and 5 year fixed rates compared with gilt yields of the equivalent term at the same time points. It's why I prefer savings accounts to gilts generally in running alongside investments.

I came, I saw, I melted13 -

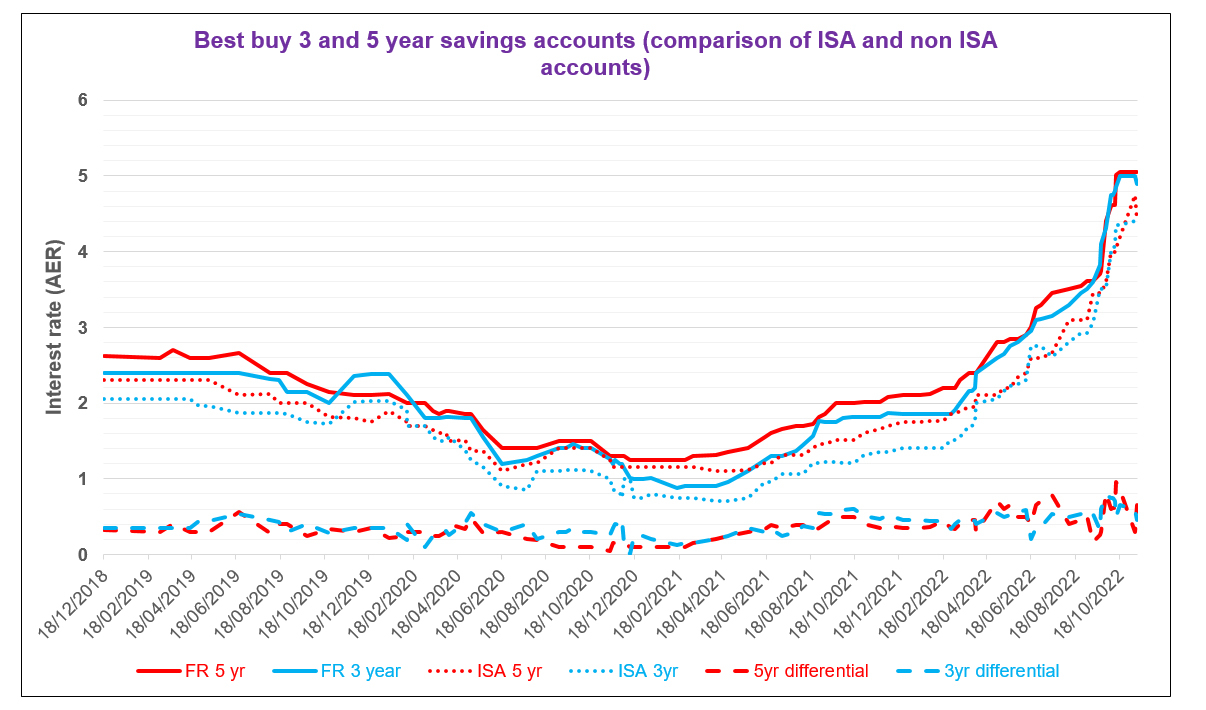

And it's interesting to quantify the differential between the rates on best buy non ISA and equivalent term best buy ISA accounts over time.

I came, I saw, I melted4

I came, I saw, I melted4 -

Source was MSE best buy tables. It's just a paste from my spreadsheet.

Apologies for anyone using their phone - I used a mouse!2 -

Bobajobbob said:

Data set was pretty horrible but here are the graphs. One dodgy data element in the ISA 2Yr graph to ignore.

I just cut and pasted the text from my spreadsheet into Notepad, so format was, indeed, horrible. Well done for this.1 -

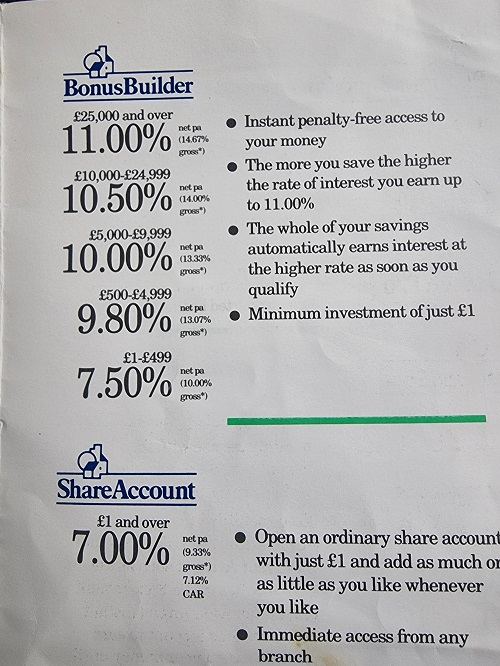

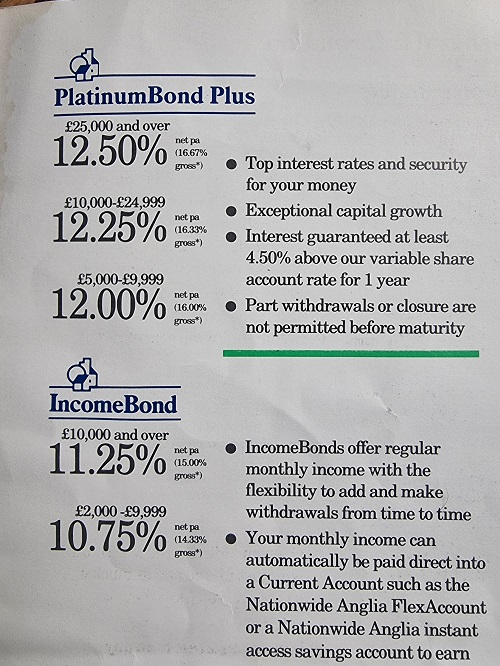

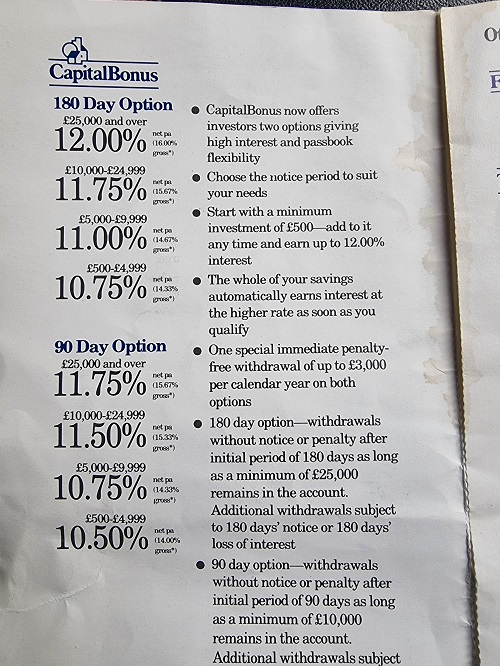

Here are some excerpts from a 1990 Nationwide interest rate flyer: 14.67% gross instant access on £1. Inflation was about 10% then.

13 -

Lovely as those savings rates are, the corresponding mortgage rates were rather more of an issue as I recall!🎉 MORTGAGE FREE (First time!) 30/09/2016 🎉 And now we go again…New mortgage taken 01/09/23 🏡

Balance as at 01/09/23 = £115,000.00 Balance as at 31/12/23 = £112,000.00

Balance as at 31/08/24 = £105,400.00 Balance as at 31/12/24 = £102,500.00

£100k barrier broken 1/4/25

Balance as at 31/08/25 = £ 95,450.00. Balance as at 31/12/25 = £ 91,100.00

SOA CALCULATOR (for DFW newbies): SOA Calculatorshe/her2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards