We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Investing for future returns

Comments

-

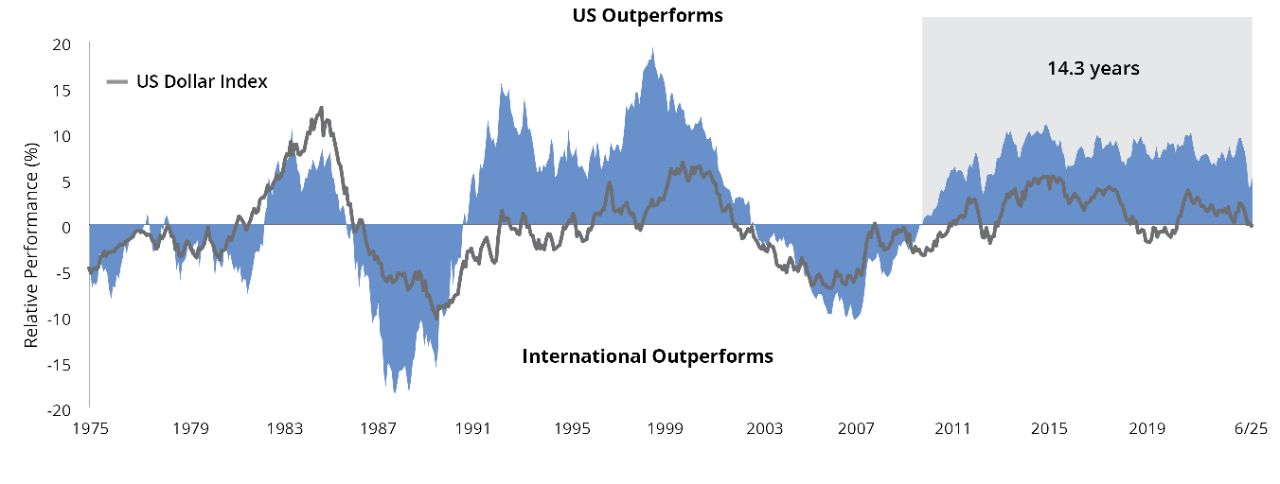

A year, or even recent years, is too short a timescale to see how there can be long periods when US shares both outperform and underperform the rest of the world. For example the US underperformed the rest of the world during most of the 2000s as it started the decade so highly valued. Before that there were long periods in the 1970s and 1980s when it underperformed. We have just had a long period of US outperformance similar to the 1990s.

Looking back over the past 50 years the US has outperformed more than not but the long periods in which it underperformed would not have been much fun for those invested exclusively in that market.

1 -

dunstonh said:A bit curious, I have my ISA in Vanguard FTSE Global All Cap Index Fund GBP which is up +21.13% 1 year change, but Vanguard S&P 500 UCITS ETF USD Accumulation is up +29.41% 1 year change.

I am thinking of transfering my money to S&P500.What about periods when global out performs the S&P500?

US equity and global equity ex US tend to alternate in cycles. This cycle has seen S&P500 be the key growth area. The previous cycle had US equity being the worst. That alternating cycle goes back generations.

The Global tracker already has US equity in it to a high ratio. So, it's a diverse and sensible option. Whereas S&P500 would be gambling on US always being best which is highly unlikely.

Cycles play out over a decade or two. So, don't make rash decisions on short term data. You will just end up chasing the gains after they have happened and not before.

If you look at the US vs global in the first decade of this millennium (red: Global inc US vs blue: US), would you have considered going 100% US when it is was 20% down after 10 years?

Some of the gains in US in this cycle are because it did so poorly in the previous (in particular tech). Those gains have already happened and you are never going to get them by invested a decade too late.

Great perspective the global fund has US exposure 58.42%. 100% US will be too risky just like how I avid the FTSE 100.

1 year is not enough to base it on.

Will just leave it getting decent returns currently with the global fund.

0 -

Out of curiosity, I looked for a more up to date version of that chart and found this one, confirming that the current US outperformance has continued for about 14 years:

There are detailed differences between the charts where the timescales overlap (e.g. in the mid-1990s) but the principle is clear - the references for this one are:https://www.hartfordfunds.com/practice-management/client-conversations/investing-for-growth/us-and-international-markets-have-moved-in-cycles.htmlThe chart shows the values of the S&P 500 Index’s returns minus the MSCI World ex USA Index’s returns. When the line is above 0, domestic stocks outperformed international stocks. When the line is below 0, international stocks outperformed domestic stocks.

Data Sources: Morningstar, Bloomberg, and Hartford Funds, 10/24.

4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards