We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

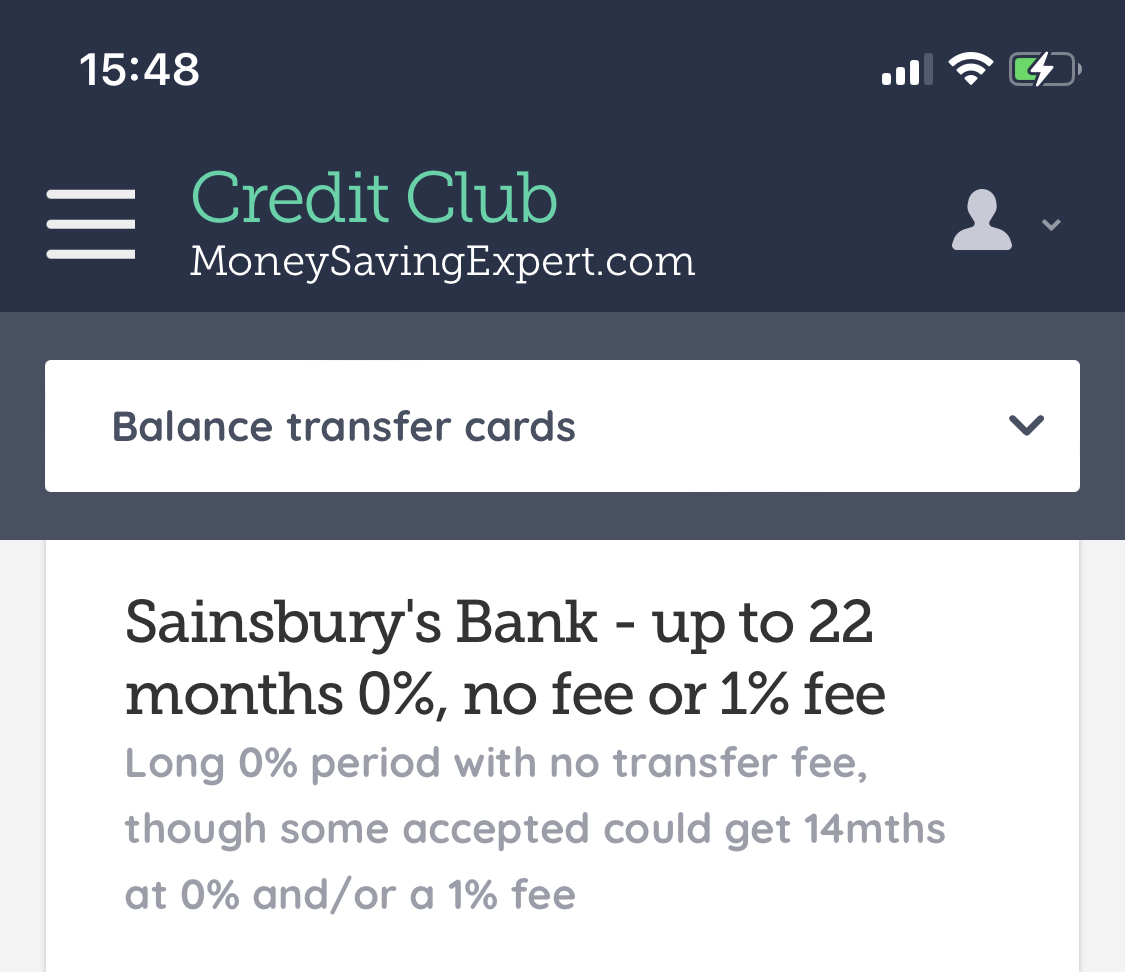

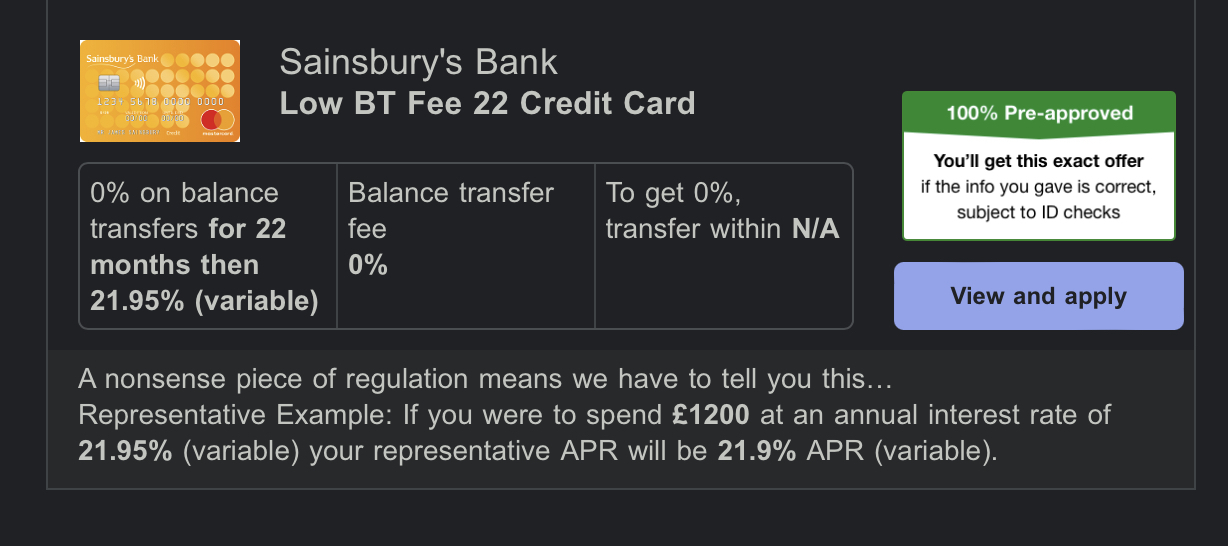

Sainsbury's doesn't match the Credit Club offer -- what can I do?

Comments

-

3rd party checkers (such as Credit Club) are not accurate. How could they be, as they are provided by organisations that aren't the lender and therefore don't know the lender's requirements? They are just a guide.Checkers provided by a lender are likely to be better, but even then there is no guarantee that you will get the actual offer (length and fee) even if it says 100%. It's a common misconception, but all it means is that, "on what we know about you at the moment" there is no reason why you won't get an offer of some some kind if you apply. When you apply and they do their credit check, they will know more about you, and this can easily affect what you are offered. So these are just a somewhat better guide.There is never any way of knowing for certain if you will get an offer, or exactly what it will be, (or what credit limit you will be offered), without applying. Treat what checkers say as you would (I hope!) treat claims on a TV advert.Finally, please read the sticky "What your credit score really means" at the top of the "Credit file and ratings" forum. Then maybe you will stop worrying about how "this whole debacle has just negatively impacted my credit score".0

-

I disagree. When it says "100% pre-approved" that's what it means.1

-

Take it up with credit club? But remember they are not the lender & in fact were correct that you would get the card. But they do not have access to your credit history & debt to income ratio, like the lender. Which could be why you did not get the top offer. Which many do not.Yawn said:I disagree. When it says "100% pre-approved" that's what it means.How can I make a complaint about Credit Club?

We're sorry you want to complain about MSE's Credit Club. If you wish to raise a complaint, please contact our team via email: creditclub@moneysavingexpert.com

Once we receive your complaint, the team will investigate it and send a final response to you by email.

Remember Credit Club gets a kickback for your application.

https://help.creditclub.com/hc/en-us/articles/115015690488-How-do-you-make-money-from-Credit-Club-

Life in the slow lane1 -

Thanks! I'll try that. If they can't help, maybe they might have a lead I can follow0

-

Did you read the information on the credit club site and in particular the last paragraph?I'm 'pre-approved'. What does that mean?

Some lenders – usually (but not always) ones you already have a banking relationship with – may be happy to pre-approve you for certain credit cards. This pre-approval is based on the information you supply on the eligibility calculator form, your credit report data obtained through the soft search, and (in the cases where you have a banking relationship) information they already hold on you.

When you click through to the lender to apply, you'll see a normal credit card application page, which'll say you're pre-approved, and then you will have to go on and fill in the form like any normal application.

If you then go on to apply for the card, your lender will still make a hard search footprint on your credit report, even if you're pre-approved. This is to report to the credit reference agencies that you have made a credit application. They're just not using that hard search to credit check you in this case, as you're already approved.

It's worth noting that pre-approval is not a cast-iron guarantee that you'll get the card. In exceptional circumstances you could be declined for other reasons – the bank still has to carry out some checks for identity and fraud purposes, and there's a very small chance some will fail on these.

There is no absolute guarantee and they say that. Not sure you have a complaint with their disclaimer in place.

1 -

Yawn said:I disagree. When it says "100% pre-approved" that's what it means.OK, maybe I didn't explain clearly enough. There's a big difference between "100% pre-approved" and "100% finally approved". Many people make the mistake of thinking of both as a 100% solid guarantee, but that really isn't the case."pre-approved" does not mean fully and irreversibly approved, even before you apply. It means approved as far as possible at the pre-application stage". Think about it. If there was no possibility of it being turned down (or changed), what would be the point of the lender doing a credit check?If you are saying that you find the terminology misleading and bordering on dishonest, then I agree with you. But like (for example) the advert for a skin care product that guarantees it will make you look 10 years younger, it's "mere advertising puff" (to quote a court judgement from many years ago). It's probably designed to encourage people to apply, as you did. But it's what we have to live with and there's no comeback afterwards.0

-

When I applied for a Sainsburys card some time ago I was offered 14 months 0% with 1% fee which like you I declined.Yawn said:I checked my score on Credit Club before applying and was told I was 100% guaranteed for a 22 month 0% balance transfer offer. I applied but the application process froze midway. Waited for several minutes. Moved closer to the router, tried again and was only offered 14 months and a 1% balance transfer fee, an offer which I declined... Is there anything I can do? I worry this whole debacle has just negatively impacted my credit score for no reason. 😔

No hard search appeared on my credit reports.

I applied again a couple of weeks back and was offered the same 14 months with 1% fee this time I accepted after all it is still a good deal.

Did it really say you were pre approved for the card with 22 month offer?

Or did it say you were preapproved for the card which is upto 22 months with 0 or 1% fee?1 -

I’ve just had a look in my own credit club card list and have found the card you mentioned (I’m also pre-approved) but the small print is there on the screen for all to see

2 -

Yes they do (how exactly could they assess your credit without access to your credit report!?)... And if they're offering pre-approval then they clearly have a direct relationship with relevant provider - obviously they don't have the power to personally pre-approve anyone. They would have forwarded information to Sainsbury's and Sainsbury's would respond with the pre-approval.born_again said:

Take it up with credit club? But remember they are not the lender & in fact were correct that you would get the card. But they do not have access to your credit history & debt to income ratio, like the lender. Which could be why you did not get the top offer. Which many do not.Yawn said:I disagree. When it says "100% pre-approved" that's what it means.How can I make a complaint about Credit Club?

We're sorry you want to complain about MSE's Credit Club. If you wish to raise a complaint, please contact our team via email: creditclub@moneysavingexpert.com

Once we receive your complaint, the team will investigate it and send a final response to you by email.

Remember Credit Club gets a kickback for your application.

https://help.creditclub.com/hc/en-us/articles/115015690488-How-do-you-make-money-from-Credit-Club-

As everyone says, that's still not a cast iron guarantee, but these services are far more sophisticated than they were when they first debuted.1 -

This is from the email I received so the precise offer (22 months, no transfer fee) couldn't be clearer. I've followed the suggestions to email the Credit Club. Will keep people posted!

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.3K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards