We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

SEISS and compliance review even though I met the criteria

tifo

Posts: 2,160 Forumite

I've had a letter today about my 3 SEISS payments in 2020 (2) and 2021 (1) and a compliance review.

I met the criteria for the first 3 grants (this was shown online) and got those, I didn't get the 4th grant.

I submitted tax returns for all previous years to 2019. Then I submitted 2020-2021, next one is 2021-2022. I didn't submit the 2019-2020 return because my income was below £1,000 (I was very ill in that year) and it showed a message that I don't need to submit it for that year at the end of the online process. I then called them and they said 'that's fine, we'll do an exemption'. I received the confirmation letter a few weeks later in Feb 2021 which said I don't need to complete a 2019-2020 tax return but should do the next year unless i'm exempt.

The letter now is asking why I didn't submit a 2019-2020 tax return and should do it now. I called them and the lady I spoke to was very unhelpful. She basically asked have I paid the grants back, why did I not submit the 2019-2020 tax return. I replied that I met the criteria and don't need to pay them back. I explained about the below £1,000 income for that year and that's why I was given an exemption. She didn't listen to any of it. She just kept going on about the fact that I didn't submit the return and haven't paid them back. Saying "Give me Yes or No answers". I didn't of course. She just assumed I'm guilty. I asked for a manager who said I should complete the 2019-2020 tax return now just to meet what compliance are asking. Kind of saying don't mess with them. But that's not what the rules say.

Both the first adviser and the manager said "well, you'd have had to include the SEISS grants in the tax return" and I replied "they weren't paid before april 2020 so are in my following year's tax return". They should know covid was from march 2020. The grants were paid in June 2020 and October 2020.

The letter even said "if your income was below £1,000 for the year let us know and we'll update our records". But they know that I didn't need to and got the exemption letter. It's on their systems. The SEISS criteria for the first 3 grants doesn't need the 2019-2020 tax return though. The 4th one did and I didn't get that because I hadn't submitted the 2019-2020 tax return.

Advice would be appreciated.

I met the criteria for the first 3 grants (this was shown online) and got those, I didn't get the 4th grant.

I submitted tax returns for all previous years to 2019. Then I submitted 2020-2021, next one is 2021-2022. I didn't submit the 2019-2020 return because my income was below £1,000 (I was very ill in that year) and it showed a message that I don't need to submit it for that year at the end of the online process. I then called them and they said 'that's fine, we'll do an exemption'. I received the confirmation letter a few weeks later in Feb 2021 which said I don't need to complete a 2019-2020 tax return but should do the next year unless i'm exempt.

The letter now is asking why I didn't submit a 2019-2020 tax return and should do it now. I called them and the lady I spoke to was very unhelpful. She basically asked have I paid the grants back, why did I not submit the 2019-2020 tax return. I replied that I met the criteria and don't need to pay them back. I explained about the below £1,000 income for that year and that's why I was given an exemption. She didn't listen to any of it. She just kept going on about the fact that I didn't submit the return and haven't paid them back. Saying "Give me Yes or No answers". I didn't of course. She just assumed I'm guilty. I asked for a manager who said I should complete the 2019-2020 tax return now just to meet what compliance are asking. Kind of saying don't mess with them. But that's not what the rules say.

Both the first adviser and the manager said "well, you'd have had to include the SEISS grants in the tax return" and I replied "they weren't paid before april 2020 so are in my following year's tax return". They should know covid was from march 2020. The grants were paid in June 2020 and October 2020.

The letter even said "if your income was below £1,000 for the year let us know and we'll update our records". But they know that I didn't need to and got the exemption letter. It's on their systems. The SEISS criteria for the first 3 grants doesn't need the 2019-2020 tax return though. The 4th one did and I didn't get that because I hadn't submitted the 2019-2020 tax return.

Advice would be appreciated.

0

Comments

-

The original criteria were:

You can apply if you’re a self-employed individual or a member of a partnership and you:

- have submitted your Income Tax Self Assessment tax return for the tax year 2018-19

- traded in the tax year 2019-20

- are trading when you apply, or would be except for COVID-19

- intend to continue to trade in the tax year 2020-21

- have lost trading/partnership trading profits due to COVID-19

0 -

I know a tax return was not needed for 2019-2020 just trading. As i've said, the figure for 2019-2020 were under £1,000 so i could not submit online. I then called them and they sent me an exemption letter from the call. Now they're saying they have no record of that call and the exemption letter was sent automatically when I could not submit online. I've tried to explain to the person that there was no need for me to submit a 2020 tax return but she kept asking "did you submit a 2020 tax return, Yes or No" and "did you pay the money back, Yes or No". I said to her you're not understanding what i'm saying and she replied "I do understand, but (same 2 questions again)". She even said "you would have had to include the grants in the return" and I replied "no, the grants were in the next return which I did". Totally unhelpful.Jeremy535897 said:The original criteria were:

You can apply if you’re a self-employed individual or a member of a partnership and you:

- have submitted your Income Tax Self Assessment tax return for the tax year 2018-19

- traded in the tax year 2019-20

- are trading when you apply, or would be except for COVID-19

- intend to continue to trade in the tax year 2020-21

- have lost trading/partnership trading profits due to COVID-19

I asked for a manager call and she said just complete it now. I asked will I get fined for a late tax return when it wasn't due in the first place?

However, if the trade is below £1,000 do they assume you were not trading? This can't be right ....

They even asked me during the call in 2021 "do you want an exemption for the next year and I said no". I submitted a 2020-2021 tax return.

They know i was sent an exemption letter and the lady I spoke to said "this recent letter trumps that".

"but not submitting one has been assumed by HMRC to indicate that you were not trading in 2019/20, thus failing the second criterion above. I recall this matter being raised a couple of years back, and the recommendation was to file a return even if the £1,000 figure was not achieved". For me it's just come up now.

Their letter even says "if your income was below £1,000 let us know so we can update our records" and the operator wouldn't do this (see questions above) but in any case they know this anyway.

Bottom line, i met the criteria and followed the grant and tax rules.0 -

I can't speak to the compliance team, the manager tried and she couldn't get them to call me back, the number on the letter is the general 0300. Should I write to them?0

-

Email your MP. I received compensation yesterday by going to the top,. different organisation.tifo said:I can't speak to the compliance team, the manager tried and she couldn't get them to call me back, the number on the letter is the general 0300. Should I write to them?

Fones are answered by screen readers, trying to be helpful, but needing to close the case and get to the next call.0 -

The figure being under £1,000 would not have prevented you filing online, but that is water under the bridge. In the first instance, write to HMRC self assessment at:

Self Assessment

HM Revenue and Customs

BX9 1AS

United Kingdom

In that letter, explain the circumstances, and enclose copies of the previous correspondence. Explain that you will have to raise a complaint if the matter is not dealt with in a month. See:

https://www.gov.uk/government/organisations/hm-revenue-customs/contact/complain-about-hmrc

0 -

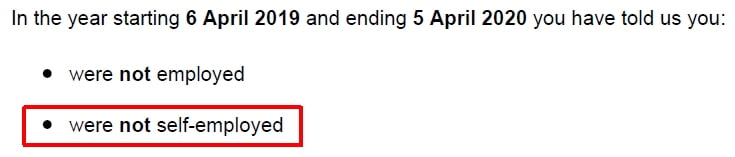

The problem appears to be here .... Ticking NO to income over £1,000 generates a NOT in self employment in the return.

See below:

But then online my account said the tax return was received on that day I called. The letter i've received now says I didn't submit a return.

0 -

The rules didn't say that income should be over £1,000, just that you must have traded. Because some people can trade and make a loss.0

-

At the time of claiming the grant:

0 -

See the image above, it appears to have been filed on the same day anyway. I can't remember if it was me online or done during my call to them, the call for which they have no record but asked me do i want exemption for next year too.The figure being under £1,000 would not have prevented you filing onlinect/complain-about-hmrc

Thanks0 -

Should I not write to:Jeremy535897 said:

write to HMRC self assessment at:

Self Assessment

HM Revenue and Customs

BX9 1AS

United Kingdom

Customer Compliance Complaints

HM Revenue and Customs

BX9 2AB

United Kingdom

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards