We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Notice Accounts

Comments

-

I have a Vanquis 90 Day Issue 2. It dropped from 5.5%AER to 5%AER about a month ago.At the moment, I have most in DFCapital 90 Day and I'm looking forward to the end of April to see where to make the most then. It seems like it is just jumping mostly NLA notice accounts at the moment. I was hoping that MHBS may keep a good rate on their 195 day notice account, but they dropped it recently. Fortunately, they give you immediate access and it is possible to keep the account going with a nominal £1.If anyone knows of loyalty notice account, it would be good to share here. DFCapital tend to do these and some of the smaller Building Societies have had some really good ones, but, generally, there is very little happening at the moment across pretty much all types of accounts. I wish I could put more into instant Cash ISAs as their rates are some of the best at 5.11%AER currently.0

-

It's true that there is very little happening at the moment. I think lots of providers are waiting until next week's BOE meeting. If the base rate drops we can expect plenty to happen after that.0

-

Charter have launched a 60 day and 120 day account at 4.81 and 4.86% respectively. Both of these are higher than their current 90 day at 4.8. Not sure an extra 0.05 is worth an additional 60 days notice though. T&Cs state at least 14 days notice of reduction in rate and if that isn't at least 14+notice period, you have 30 days to close the account without penalty.2

-

INVESTEC 90-Day Notice Saver.

If you hold Issue 1 or Issue 2:

On 26/02/2025 your rate will decrease from 4.94% gross (variable) / 5.05% AER* to 4.74% gross (variable) / 4.84% AER*The above was announced back in November and is a reminder so only the below is a new notification.

If you hold Issue 1, 2 or 3:

From 27/05/2025 your rate will decrease from 4.74% gross (variable) / 4.84% AER* to 4.54% gross (variable) / 4.64% AER*4 -

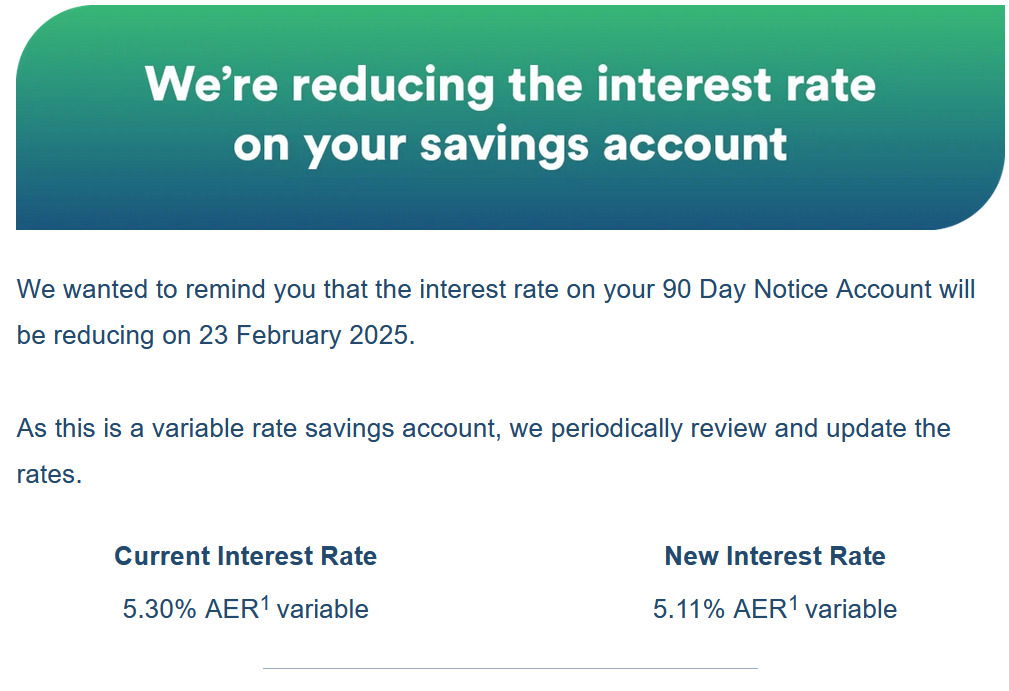

Received this email reminder a few days ago on my DF capital 90 day notice account (issue 1). Not a new notification just a reminder of what was notified to me by email on 11th November 2024. As notified to me by email on 8th January the rate also drops further to 4.9% AER on 29th April 2025 but that's not covered in this email. No notification of any further change from the latest base rate cut yet

I came, I saw, I melted0

I came, I saw, I melted0 -

Vanquis 90 day Notice account Iss 6 ...

Email from Vanquis today announcing a further reduction in the 90 Day Interest rate .... this is on top of the scheduled rate reduction announced a while ago that comes into effect on March 3rd. So that makes ....

03/03/2025 down to 4.89% Gross/5.00% AER from 4.98%/5.10%

then

04/06/2025 down to 4.55% Gross/4.65% AER from 4.89%/5.00%

The later drop being 0.34%/0.35% which seems somewhat severe!Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum3 -

Bobblehat said:Vanquis 90 day Notice account Iss 6 ...

Email from Vanquis today announcing a further reduction in the 90 Day Interest rate .... this is on top of the scheduled rate reduction announced a while ago that comes into effect on March 3rd. So that makes ....

03/03/2025 down to 4.89% Gross/5.00% AER from 4.98%/5.10%

then

04/06/2025 down to 4.55% Gross/4.65% AER from 4.89%/5.00%

The later drop being 0.34%/0.35% which seems somewhat severe!Yeah, just had this Vanquis email too. Wondering what to do, by 4 June who knows what rates will be on offer!If i give 90 day notice for withdrawal, can i cancel it later if required?

0 -

I'm wondering too! I have a close notice that expires in early April, possibly ready to fund a new ISA. I'm tempted to cancel that in the next day or so and set up a new one for 4th June (on 6th March I reckon). I can fund the new ISA from elsewhere and will choose an account that is the lowest rate on the day! I'll then see what all the rates look like a week before 4th June and decide whether to keep the 90 Day open or not.Aidanmc said:Bobblehat said:Vanquis 90 day Notice account Iss 6 ...

Email from Vanquis today announcing a further reduction in the 90 Day Interest rate .... this is on top of the scheduled rate reduction announced a while ago that comes into effect on March 3rd. So that makes ....

03/03/2025 down to 4.89% Gross/5.00% AER from 4.98%/5.10%

then

04/06/2025 down to 4.55% Gross/4.65% AER from 4.89%/5.00%

The later drop being 0.34%/0.35% which seems somewhat severe!Yeah, just had this Vanquis email too. Wondering what to do, by 4 June who knows what rates will be on offer!If i give 90 day notice for withdrawal, can i cancel it later if required?

You can cancel a withdrawal/closure notice up to the day before.... although I try not to leave it to the last minute and cancel a day or so earlier.

Problem is, this is my only remaining account with Vanquis and I generally try to open something like an EA beforehand to keep my foot in the door. Vanquis wants a minimum of £1000 in their EA which is a bit of a bind for the rate they offer. So it could be a case of close the Notice account if needed, and start from scratch as a new customer if they offer anything decent in the future. No big deal.Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum3 -

I've had the Vanquis & DF Capital 90 Day Notice accounts for a couple of months. The first time I've had any notice account. Talking about cancelling withdrawals made me question something.

Sorry if this is a silly question, but if one requested a withdrawal for 90 days time, which happened, is it not possible to just put some of the money back in if desired? (e.g. depending on other rates in 90 days time)1 -

The short answer is .... Yes, usually!moi said:I've had the Vanquis & DF Capital 90 Day Notice accounts for a couple of months. The first time I've had any notice account. Talking about cancelling withdrawals made me question something.

Sorry if this is a silly question, but if one requested a withdrawal for 90 days time, which happened, is it not possible to just put some of the money back in if desired? (e.g. depending on other rates in 90 days time)

Unless you've given notice to withdraw all funds, which would then end in closure of the account. Otherwise, you could change your mind and redeposit some of the withdrawn money. Some Notice Accounts let you withdraw up to the amount you've indicated, or just part of it, eliminating the need to redeposit. See the T&C's of the particular account for what you are allowed to do.Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards