We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

0% chance of getting Barclaycard Rewards Visa ??

Malkytheheed

Posts: 664 Forumite

HI,

Long story short I need a new travel credit card. Im currently traveling with my Aqua card but it's just dire, the limit is only a couple of grand and I'm constantly throwing money at it to bring the balance down so I can use it again. It's just a faff. Despite having maintained it perfectly for about 3 years now they wont increase the limit any further. it's not a good fit for me.

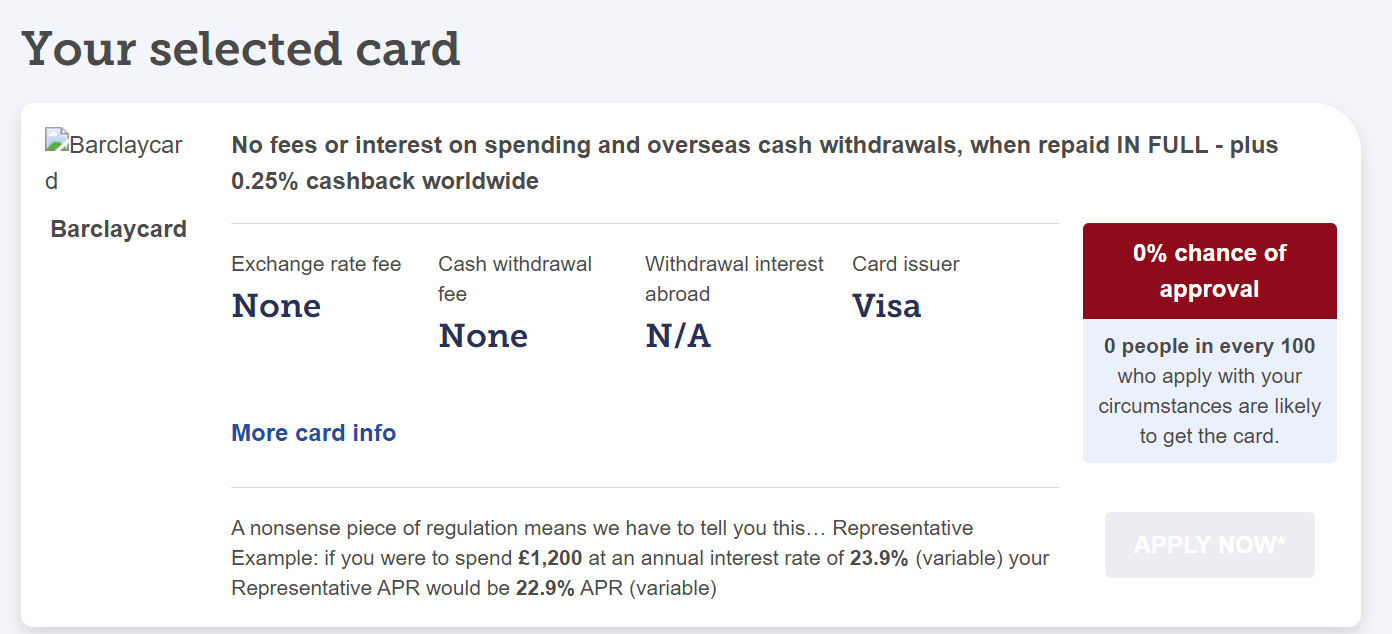

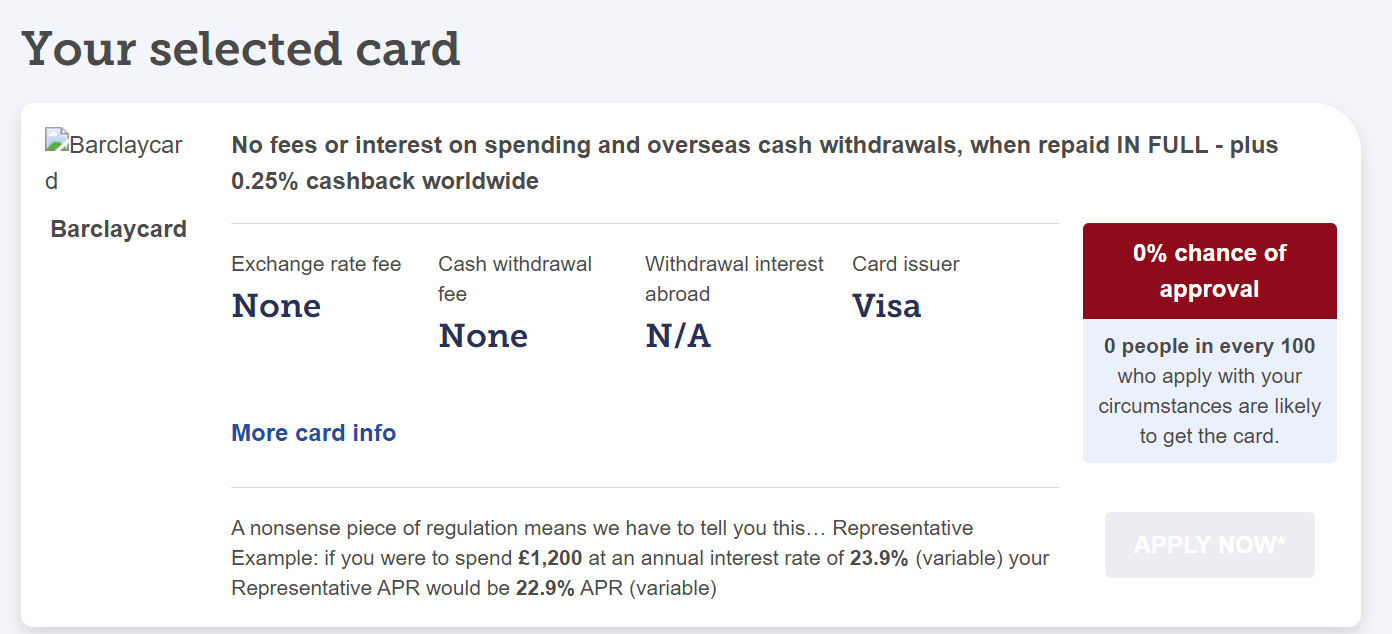

So I had a quick search and other good "travel" credit cards and results came back with Barclaycard Rewards Visa scoring well. So I did an eligiblilty calculator (meh, why not) and to my considerable suprise got this...

I really can't imagine why I got this, my income is good, my wifes income is good, I've maintained my credit history impeccably for decades now, there is nothing untoward on any of my credit reports and I've never had an issue getting a card before. My credit worthiness by all accounts is very good.

Would you just go ahead and apply anyway? I'm tempted to but 0%....is just weird. Maybe I'm not the right demograpgic? I've never seen that before, In the past when I've done eligibility checkers I've always returned 95-100% I think?

Long story short I need a new travel credit card. Im currently traveling with my Aqua card but it's just dire, the limit is only a couple of grand and I'm constantly throwing money at it to bring the balance down so I can use it again. It's just a faff. Despite having maintained it perfectly for about 3 years now they wont increase the limit any further. it's not a good fit for me.

So I had a quick search and other good "travel" credit cards and results came back with Barclaycard Rewards Visa scoring well. So I did an eligiblilty calculator (meh, why not) and to my considerable suprise got this...

I really can't imagine why I got this, my income is good, my wifes income is good, I've maintained my credit history impeccably for decades now, there is nothing untoward on any of my credit reports and I've never had an issue getting a card before. My credit worthiness by all accounts is very good.

Would you just go ahead and apply anyway? I'm tempted to but 0%....is just weird. Maybe I'm not the right demograpgic? I've never seen that before, In the past when I've done eligibility checkers I've always returned 95-100% I think?

0

Comments

-

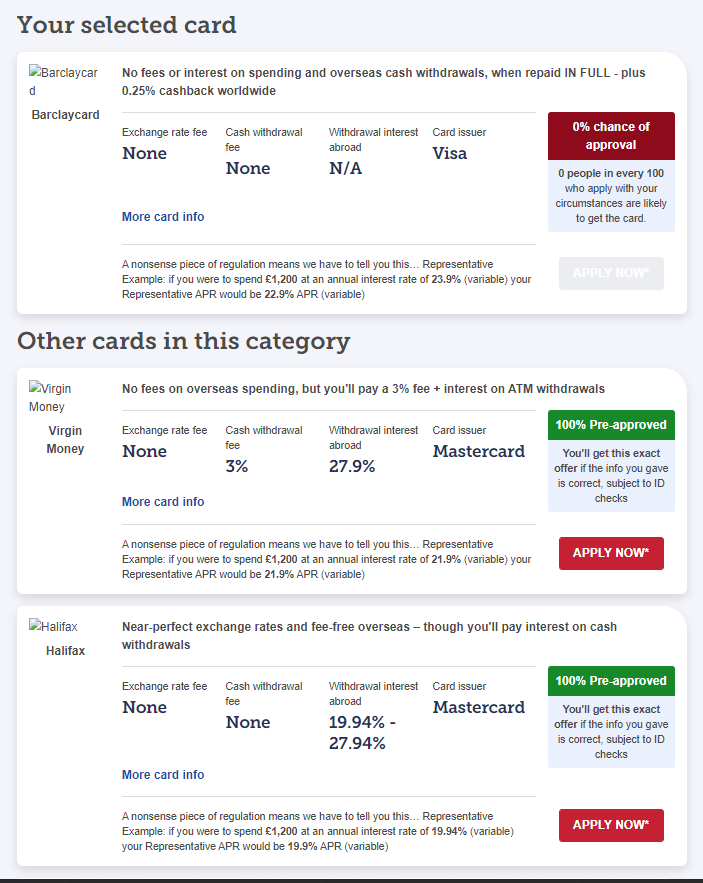

Just as an add to this. The other similar cards it suggests, I am "pre-approved" for. Which I know doesn't actually mean that but is quite a juxtaposition compared to the first one

Just werid?

Just werid?

0 -

The most likely explanation is that it's simply how Barclaycard operate.

They've been schizophrenic in their strategy for the past few years, flipping between giving £50 bribes to stop customers closing their accounts, to slashing limits to unusable levels.

Their current appetite for growth still seems muted at present.

0 -

have you ever complained about Barclays? If not why??

Mr Generous - Landlord for more than 10 years. Generous? - Possibly but sarcastic more likely.0

Mr Generous - Landlord for more than 10 years. Generous? - Possibly but sarcastic more likely.0 -

@Malkytheheed - It looks like you are using a Third Party eligibility checker.

If so, may I suggest you try the one provided by Barclaycard and see if you get a different result.

https://www.barclaycard.co.uk/personal/credit-cards/eligibility-checker

1 -

Do you already have a Barclaycard? / Had one recently?

Last year they said I couldn't apply for the rewards card unless I closed my current one and waited months, then applied for the rewards card.

Then this year I saw it as an offer on the Barclays app and it switched me over no problem.0 -

Not had a barclayc ard in the last 10 years anyway. Sounds like I might have dodged a bullet here anyway! What are peoples recommendations for a (typically) high limit travel card?0

-

I know people say your credit record isn't looked at by banks but have you looked in case there is something lurking that you don't know about? A CCJ from a couple of years back or something?

I do agree that Barclaycard have been really cutting their credit - my card went from having an available credit of nearly £20k to under £2k. A useless amount to me but I've not got round to closing it for some reason. Mostly sentimental I guess as I've had it longer than any other card.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅

STRUGGLING DURING THE HOLIDAYS??

click here for ideas on how to cope....Some websites and helplines if you're struggling this Christmas — MoneySavingExpert Forum0 -

No idea if you will get a high limit, but probably the most used card for foreign travel is the Halifax clarity card. Although you do pay interest on cash withdrawals ( + like with other cards there will be local ATM charges as well)Malkytheheed said:Not had a barclayc ard in the last 10 years anyway. Sounds like I might have dodged a bullet here anyway! What are peoples recommendations for a (typically) high limit travel card?

So not as good in that respect as the Barclaycard rewards card.

Using Halifax Clarity card for cash abroad — MoneySavingExpert Forum

0 -

Brie said:I know people say your credit record isn't looked at by banks but have you looked in case there is something lurking that you don't know about? A CCJ from a couple of years back or something?Banks certainly do look at your credit record/history - that's what they're most interested in, especially stuff like missed payments, CCJ's as you say, things like that. It's the score generated by the reference agency that is of no value.(OK, to caveat that a little bit. Most financial institutions take the data contained within your credit file, churn it through their systems, and generate their own internal score - which no-one is privy to. A few lenders, often smaller ones, will send their criteria to the agency and ask the agency to generate a score for them. But even then, it's tailored to the lender's particular requirements, and bears no resemblance to the generic score you see when you look at your file).0

-

OP, are you a Barclays Bank customer? There has been suggestion on the Head for Points forum that they are using Barclaycard products to recruit new customers reports of putting a Different bank On the application to get approved.I have two discontinued Barclaycard product myself, and on the oldest one I also have seen my credit limit slashed from over £20k to £8.5k without apparent reason during the first lock down, and although recent reports have not been great, Barclaycard should have the infrastructure and background to quickly bounce back

also you mention that income is good but do you have any other borrowing and how are those in relations to your income? PHP, loans, balance on other credit cards?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards