We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Loosing more than I have earned in interest when transferring an isa

Comments

-

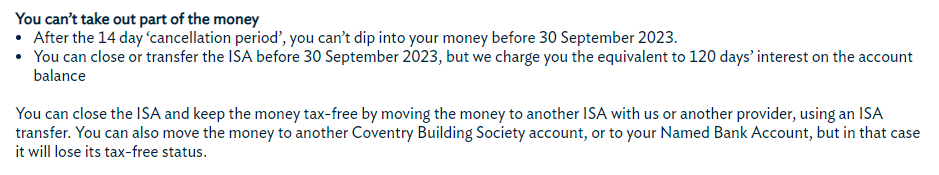

I have complained as I feel this was not explained sufficientlyI just took a look a the published terms and it is quite clear.

https://www.coventrybuildingsociety.co.uk/member/product/savings/cash_isa/fixed-rate-isa-170-30-09-2023.html

If you sought advice and were not made aware of restrictions on exit then you may have a case. However, if you didn't seek advice and chose not to read the terms of the product you bought then it is your responsibility for your error.I am about to go to the financial ombudsman, but would be interested to hear from anyone who has had the same experience.What exactly is the wrongdoing are you alleging?

Have you made a complaint to Coventry yet as the FOS will not jump in unless you have?

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.4 -

They told me they would reinvest it in one of their products on maturity.

What was the product and what were the terms and conditions?

Sometimes with some providers, maturing products are reinvested in the same product, if no other instructions are received from the customer. So for example if you had a one year fixed rate isa, then it would be reinvested in the current one year fix product, unless they are instructed otherwise.

1 -

normally don't ISAs go back to the variable saver rate which is lower in interest? unless as OP said they would re-invest.

so basically yes, you can lose more than you put in....why dont you hand on for 4 months then transfer? surely the rates are going to go up, therefore the virgin account you have moved to, could be beaten in 4 months time anyway?1 -

normally don't ISAs go back to the variable saver rate which is lower in interest? unless as OP said they would re-invest.

Some do and some do not.

Recently I had a Skipton fixed term ISA mature . The main options given were all new fixed rate ISA's, and the default was the same fixed rate term that was maturing. As I wanted to actually transfer it, I did find an option to mature into a standard easy access account, but it took some looking for as an option.

2 -

I had the same problem with a Coventry maturing ISA.Albermarle said:normally don't ISAs go back to the variable saver rate which is lower in interest? unless as OP said they would re-invest.Some do and some do not.

Recently I had a Skipton fixed term ISA mature . The main options given were all new fixed rate ISA's, and the default was the same fixed rate term that was maturing. As I wanted to actually transfer it, I did find an option to mature into a standard easy access account, but it took some looking for as an option.

On the documents sent through the post to warn me that my ISA was maturing there was absolutely no option to tick a box for anything other than a 2,3, or 5 yr fixed rate

It was really long winded to find an instant access ISA and it took several phone calls to make sure that the maturing ISA would not be transferred into a 2 year fix.

I can see how ops problem could easily have happened to me too.

sx1 -

What was the reason for the delay exactly?

After reading the terms and conditions of the new account Coventry was going to move you into, why did the "120 days loss of interest" come as a surprise to you?

I have found building society loss of interest clearly stated. In what way was yours not explained sufficiently?

3 -

Firstly many thanks for everyones who took the time to research and respond. Really appreciated. The new ISA is now set up and money transferred so there is no going back. In terms of my alleged wrongdoing by Coventry, I have always assumed that you could only loose the accrued interest, not part of the principle. I don't think this was made clear to me by Coventry. Other investments make it very clear that the principle sum is at risk and can be lost. Coventrys ISA did not. Also, the penalty charge (close to £400) bears no relation to their costs or losses, so is disproportionate and therefore unfair.0

-

Oh and yes Dunstonh, I have complained and they are sending me a letter to confirm their final decision. So I will go to the Financial Ombudsmen with this letter.0

-

Curdy said:Firstly many thanks for everyones who took the time to research and respond. Really appreciated. The new ISA is now set up and money transferred so there is no going back. In terms of my alleged wrongdoing by CoventryExactly what has Coventry alleged you have done wrong? You have an absolute right to transfer your ISA at any time, and you did this. Coventry has an absolute right to charge the penalty equivalent to 120 days interest in response, and they have done so. All of this is right and proper within the terms and conditions of the account, so there has been no wrongdoing.

Then you've made a wrong assumption. No different than if you'd made the wrong assumption that you could spread your £20k ISA allowance between multiple cash ISAs from different providers. When assuming things are incorrect, like that you could only lose the accrued interest, not part of the principal, when these faulty assumptions catch up with you, unfortunately you have to face the consequences.Curdy said:I have always assumed that you could only loose the accrued interest, not part of the principle.

The terms of the account are clear, and it is common practice for fixed term ISAs across many providers. I would venture that it is common knowledge.Curdy said:I don't think this was made clear to me by Coventry.The Summary Box says: "Can I withdraw money? You can close or transfer the ISA before ..., but we charge you the equivalent to 120 days’ interest on the account balance.""The equivalent to" makes it absolutely clear that it is not limited by the amount of interest actually accrued.

Your principal is not at risk. The charge works like any other charge levied by a bank. Banks make charges to various types of account that need not be branded 'capital at risk' accounts, such as current accounts.Curdy said:Other investments make it very clear that the principle sum is at risk and can be lost. Coventrys ISA did not.

Where is your evidence of that? The purpose of a fixed term ISA is to give the provider the freedom to lend the capital sum to a borrower over a longer term. If you pull out early, the lender must find other capital to take the place of your capital. An opportunity cost arises through not having that capital available to make other loans for the period of time remaining on your fix. The loan will be made at a higher rate than your ISA. Therefore, it is entirely possible the penalty is lower than this opportunity cost.Curdy said:Also, the penalty charge (close to £400) bears no relation to their costs or losses, so is disproportionate and therefore unfair.In short, I do not think you have a valid complaint against Coventry. You are blaming them for you not having carefully read the terms of the product, or for your incorrect assumptions.However, you mentioned earlier "For one reason and another, the transfer took place after the new isa with Coventry started, and after the cool off period of 14 days." Whomever is responsible for the "one reason and another", may have caused the transfer to have been unnecessarily delayed, and may therefore have some responsibility for your consequential losses through the penalty. You should consider whether you may have a valid complaint against Virgin Money for not actioning your transfer within a reasonable time frame.2 -

I requested Yorkshire building society to transfer my Coventry BS isa to them when it matured.

I rang the Coventry to say there was no option to transfer to an easy access isa on maturity and they said it wouldn't be a problem as it would be within the 14 days. It got transferred ok within that time.

I do think there should have been an easy access option though.Not Rachmaninov

But Nyman

The heart asks for pleasure first

SPC 8 £1567.31 SPC 9 £1014.64 SPC 10 # £1164.13 SPC 11 £1598.15 SPC 12 # £994.67 SPC 13 £962.54 SPC 14 £1154.79 SPC15 £715.38 SPC16 £1071.81⭐⭐⭐⭐⭐⭐⭐⭐⭐Declutter thread - ⭐⭐🏅0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards