We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Personal Finance tracking application

Comments

-

Back to the original question, Open Banking might not even be a useful option. Not all banks participate in it. For example, Co-operative Bank (with which I have one of my two current accounts) doesn't, and nor do the two savings banks with which I have accounts. I'm not sure, but I don't think that things like mortgage or loan accounts are included. At least credit cards appear to be included now (as long as the issuer participates). IIRC, that wasn't the case last time I looked at it.

0 -

Well this may or may not matter - my main purpose here is that I am thinking of taking early retirement in about 3-4 years from now, but I don't feel comfortable that my budgeting spreadsheets are representative of what is really happening.blue.peter said:Back to the original question, Open Banking might not even be a useful option. Not all banks participate in it. For example, Co-operative Bank (with which I have one of my two current accounts) doesn't, and nor do the two savings banks with which I have accounts. I'm not sure, but I don't think that things like mortgage or loan accounts are included. At least credit cards appear to be included now (as long as the issuer participates). IIRC, that wasn't the case last time I looked at it.

According to my budgets, I should have money left over each month, and even more because I often each year receive a discretionary bonus which also isn't included in any of my budgeting. Therefore my bank balances should be going up, but generally they seem to be remaining fairly flat over the years, so I am spending most or all of what I earn, even though my budgets says I shouldn't be.

An example is that I am totally sure I am spending more money on holidays and meals out than budgeted, but I don't know exactly the mix and what I would have to change if I had less income. There are also one off costs related to the house that need to be isolated.

Therefore I would like to track more closely how my money is being spent for a couple of years in order to solidify my retirement options. Hence my need is more to track historical spending with a lot of categories and sub categories over a couple of years.0 -

This certainly resonates with me and probably many others.Pat38493 said:

Well this may or may not matter - my main purpose here is that I am thinking of taking early retirement in about 3-4 years from now, but I don't feel comfortable that my budgeting spreadsheets are representative of what is really happening.blue.peter said:Back to the original question, Open Banking might not even be a useful option. Not all banks participate in it. For example, Co-operative Bank (with which I have one of my two current accounts) doesn't, and nor do the two savings banks with which I have accounts. I'm not sure, but I don't think that things like mortgage or loan accounts are included. At least credit cards appear to be included now (as long as the issuer participates). IIRC, that wasn't the case last time I looked at it.

According to my budgets, I should have money left over each month, and even more because I often each year receive a discretionary bonus which also isn't included in any of my budgeting. Therefore my bank balances should be going up, but generally they seem to be remaining fairly flat over the years, so I am spending most or all of what I earn, even though my budgets says I shouldn't be.

An example is that I am totally sure I am spending more money on holidays and meals out than budgeted, but I don't know exactly the mix and what I would have to change if I had less income. There are also one off costs related to the house that need to be isolated.

Therefore I would like to track more closely how my money is being spent for a couple of years in order to solidify my retirement options. Hence my need is more to track historical spending with a lot of categories and sub categories over a couple of years.

I took early retirement 10 years ago and whilst my income has gone down, I am saving much more.

The answer is recording expenditure to know where the big money goes. Budgeting software will help some but there is no substitute for discipline. For some pen and paper works fine.

I put as much as I can on my credit card (and pay it off each month) and download my monthly transactions to a spreadsheet. I now have 10 years worth of expenditure, from weekly groceries to holidays and house insurance.

For me, if my monthly expenditure is projected at £1,000 and I actually spend £1,400, it it quite easy to see where the bulk of the £400 "overspend" has come from.1 -

I will second that.RG2015 said:

This certainly resonates with me and probably many others.Pat38493 said:

Well this may or may not matter - my main purpose here is that I am thinking of taking early retirement in about 3-4 years from now, but I don't feel comfortable that my budgeting spreadsheets are representative of what is really happening.blue.peter said:Back to the original question, Open Banking might not even be a useful option. Not all banks participate in it. For example, Co-operative Bank (with which I have one of my two current accounts) doesn't, and nor do the two savings banks with which I have accounts. I'm not sure, but I don't think that things like mortgage or loan accounts are included. At least credit cards appear to be included now (as long as the issuer participates). IIRC, that wasn't the case last time I looked at it.

According to my budgets, I should have money left over each month, and even more because I often each year receive a discretionary bonus which also isn't included in any of my budgeting. Therefore my bank balances should be going up, but generally they seem to be remaining fairly flat over the years, so I am spending most or all of what I earn, even though my budgets says I shouldn't be.

An example is that I am totally sure I am spending more money on holidays and meals out than budgeted, but I don't know exactly the mix and what I would have to change if I had less income. There are also one off costs related to the house that need to be isolated.

Therefore I would like to track more closely how my money is being spent for a couple of years in order to solidify my retirement options. Hence my need is more to track historical spending with a lot of categories and sub categories over a couple of years.

I took early retirement 10 years ago and whilst my income has gone down, I am saving much more.

The answer is recording expenditure to know where the big money goes. Budgeting software will help some but there is no substitute for discipline. For some pen and paper works fine.

I put as much as I can on my credit card (and pay it off each month) and download my monthly transactions to a spreadsheet. I now have 10 years worth of expenditure, from weekly groceries to holidays and house insurance.

For me, if my monthly expenditure is projected at £1,000 and I actually spend £1,400, it it quite easy to see where the bulk of the £400 "overspend" has come from.

Good financial control is very difficult without a good budget (although I am sure there are some savants out there).

A guestimated one (which we all do first), is a good starting point, but we all miss/forget/underestimate things, especially irregular payments.

I found that budgeting didn't work for me until I started to consolidate and categorise all expenditure.

Currently I am doing this with an Open banking app for individual transactions/current accounts and credit cards.

I find this much easier and quicker than a manual transaction consolidation spreadsheet, as I can do this ongoing, rather than let it build up each month, and then put off.

I also use a high level 'end of month' balances spreadsheet to cross check against the transactions (does change in balances = transactions)

It also very satisfying to see the numbers do indeed add up each month/quarter/year!1 -

Pat38493 said:Well this may or may not matter - my main purpose here is that I am thinking of taking early retirement in about 3-4 years from now, but I don't feel comfortable that my budgeting spreadsheets are representative of what is really happening....

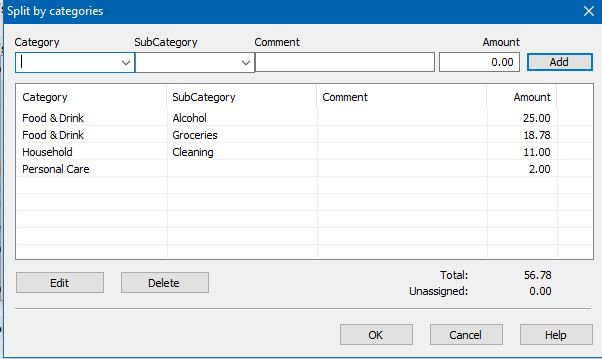

Therefore I would like to track more closely how my money is being spent for a couple of years in order to solidify my retirement options. Hence my need is more to track historical spending with a lot of categories and sub categories over a couple of years.That's a very sensible approach. But I would say that, since it's pretty much what I did before I took early retirement in 2015.AceMoney is ideal for that sort of tracking.It comes with a bunch of pre-defined categories and sub-categories, but it's easy to edit them, delete unwanted ones and add new ones. Transactions can be split between multiple categories - here, for example, is the split for my supermarket trip a couple of days ago: It'll generate reports either as tables or as pie charts. It's got standard reporting periods built in, but you can easily use custom dates instead. Tabulated reports can be printed or exported (as CSV, text or in HTML).Like @RG2015, I find it helpful to put as much of my spending as I can on my credit cards. I then record and categorise each transaction when I get home. Categorisation is helped by the fact that AceMoney assumes that if your last spend with a particular payee was in one category, your next one will be, too.If you're thinking of early retirement, you might find it worth your while to browse this thread (warning: it's very long!).1

It'll generate reports either as tables or as pie charts. It's got standard reporting periods built in, but you can easily use custom dates instead. Tabulated reports can be printed or exported (as CSV, text or in HTML).Like @RG2015, I find it helpful to put as much of my spending as I can on my credit cards. I then record and categorise each transaction when I get home. Categorisation is helped by the fact that AceMoney assumes that if your last spend with a particular payee was in one category, your next one will be, too.If you're thinking of early retirement, you might find it worth your while to browse this thread (warning: it's very long!).1 -

By the way I guess one other option here is to use a small business accounting software for personal finances - for example there are quite a few articles online about using software like Quickbooks for personal finance and it looks like it's hardly more expensive than options like Emma Pro.0

-

I MoneyDashboard and it works well for me. There were some hiccups a year or so ago when they did an upgrade but since then it's been really easy to use and you can customise categories/tagging, etc.

1 -

Yes I did actually sign up to money dashboard yesterday evening as even if I use a different package finally, I can use something like Money Dashboard to download all the transactions and hopefully import them, as suggested elsewhere on this thread.Medi123 said:I MoneyDashboard and it works well for me. There were some hiccups a year or so ago when they did an upgrade but since then it's been really easy to use and you can customise categories/tagging, etc.

My first attempt to do this into Ace Money lite, which I downloaded for a play around, failed as the data ended up in the wrong fields - I have to see if I can fix it by re-arranging the columns in Excel before the import.

Unfortunately none of the open banking packages that I found so far allow you to save files in a standard format like QIF or whatever.

However maybe Money Dashboard would be enough with the categorisation it allows, and I could then download the transactions and use Excel to do a deeper analysis.0 -

I don't know if you've already found the answer to this. In case you haven't, there's a discussion of the column ordering required here.Pat38493 said:My first attempt to do this into Ace Money lite, which I downloaded for a play around, failed as the data ended up in the wrong fields - I have to see if I can fix it by re-arranging the columns in Excel before the import.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards