We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Craft Gin Club Bond 2

anna_amanda

Posts: 1 Newbie

I've been send an investment email for this- I've searched the net but cannot find any reviews about whether it's worth investing in. Any ideas from forumites?

-2

Comments

-

If this is an unsolicited approach, don’t touch it with a barge pole.1

-

Absolutely not. Genuine investment opportunities don't mysteriously turn up in your email inbox. "Bond" in the title is also a red flag, as it often means it is an unsecured loan note to a company which could later go bust without repaying any of your money.

1 -

The name of the investment suggests one of those "novelty minibonds" that pay interest in a couple of gin bottles a year (or flowers, chocolate, etc) before going bust and losing most of your money.Even when genuine, these are ultra high investment products masquerading as loyalty schemes, which are unsuitable for virtually everyone who would invest in one.The fact that the approach was unsolicited suggests it's just a scam.2

-

It's a "mini-bond" which have fallen out of favour after many failed and many turned out to be scams. From a quick look I have no reason to think this is the latter but your investment is at risk - there is no FSCS protection. At the very least I would wait until they publish their next accounts (due by 31st July).2

-

Delete and block sender....1

-

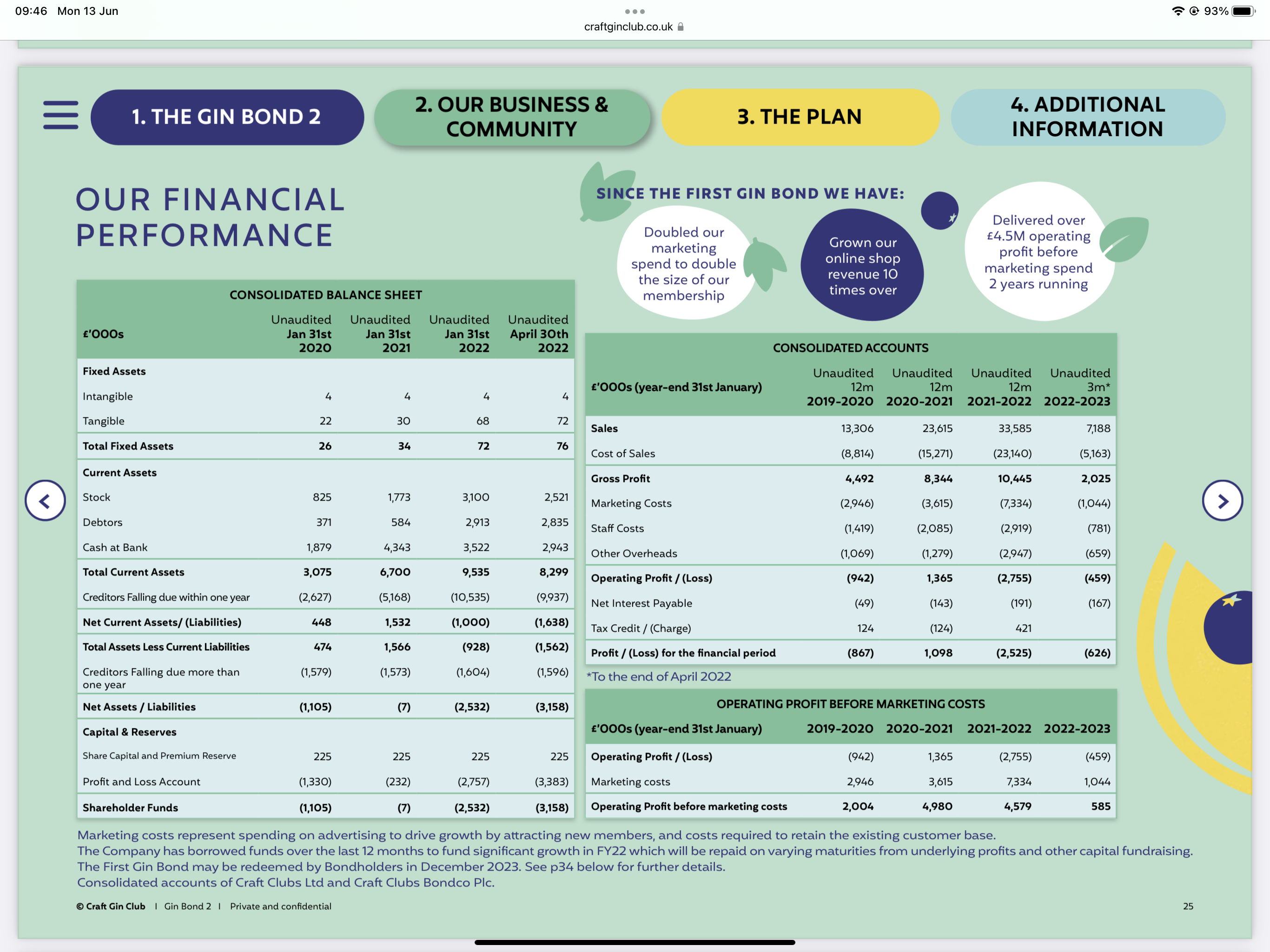

A loss making micro company offering 8% in the form of a non-negotiable bond? No, thanks. Better to stick to mainstream investments.anna_amanda said:I've been send an investment email for this- I've searched the net but cannot find any reviews about whether it's worth investing in. Any ideas from forumites?

https://www.craftginclub.co.uk/assets/gin-bond/Craft-Gin-Club-Gin-Bond.pdf

3 -

Mini bonds are banned from being marketed to retail consumers. So, receiving an unsolicited email marketing it to you is a concern. https://www.fca.org.uk/publication/policy/ps20-15.pdf

The website https://www.craftginclub.co.uk/ginbond includes warnings. However, 8% interest for a loan is extremely high.

Borrowing from the bank would cost around base plus 2%. So, 3% currently. Why borrow at 8% if you can get 3% (or thereabouts) from the banks? When businesses go to the market to borrow money, they pay an interest rate that reflects the chances of failure. Market rates for secure businesses are down at the sort of level you would get from banks. 8% is at the high-risk end of the scale.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.3 -

If you have to ask such a question I suggest you never invest in anything. Stick to savings accounts.anna_amanda said:I've been send an investment email for this- I've searched the net but cannot find any reviews about whether it's worth investing in. Any ideas from forumites?3 -

I’m not a qualified accountant, but the accounts above show not only losses so far, but a deficit position of over £3mn, so they would need to start making big profits before they could turn that around and have any funds to pay dividends or repay investors at the end of the term. Happy to be corrected though …0

-

You don't need accumulated net profits to pay interest on bonds. Repayment of bonds is often via refinancing with another bond issue, bank loan or equity raise so that isn't *necessarily* an issue, either. I still wouldn't touch it, though.Sarnian1 said:I’m not a qualified accountant, but the accounts above show not only losses so far, but a deficit position of over £3mn, so they would need to start making big profits before they could turn that around and have any funds to pay dividends or repay investors at the end of the term. Happy to be corrected though …

4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards