We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Wedding dress from the USA import charges?

angelfire

Posts: 870 Forumite

Hi I’m just wanting to check that the import charges that UPS have just invoices me for are correct.

I’ve bought my wedding dress from a shop in the US. They charged me tax and delivery, which I’ve paid and they’ve sent the dress.

I’ve bought my wedding dress from a shop in the US. They charged me tax and delivery, which I’ve paid and they’ve sent the dress.

I’ve just received an email and invoice from UPS, the courier and it amounts to £173.89 in total which is broken down as £11.50 for their admin charges and the rest is ‘government taxes’.

I just need to know if this is correct? I expected to be charged but wasn’t expecting this amount. The dress was £500..

Many thanks in advance!

I just need to know if this is correct? I expected to be charged but wasn’t expecting this amount. The dress was £500..

Many thanks in advance!

0

Comments

-

About right, duty on clothing is normally around 12%, (so £60), then VAT at 20% (£112) plus the admin charge plus/minus a little bit for the exchange rate differences…1

-

Thankyou for clarifying, I just wanted to make sure it was correctJonboy_1984 said:About right, duty on clothing is normally around 12%, (so £60), then VAT at 20% (£112) plus the admin charge plus/minus a little bit for the exchange rate differences…0 -

Should your American supplier have charged you "tax" if they were exporting it to the UK?1

-

No, and it would be surprising if they charged sales tax given it is only charged if the customer is in the same state as the business who is charging it, so charging internationally is strange.Manxman_in_exile said:Should your American supplier have charged you "tax" if they were exporting it to the UK?1 -

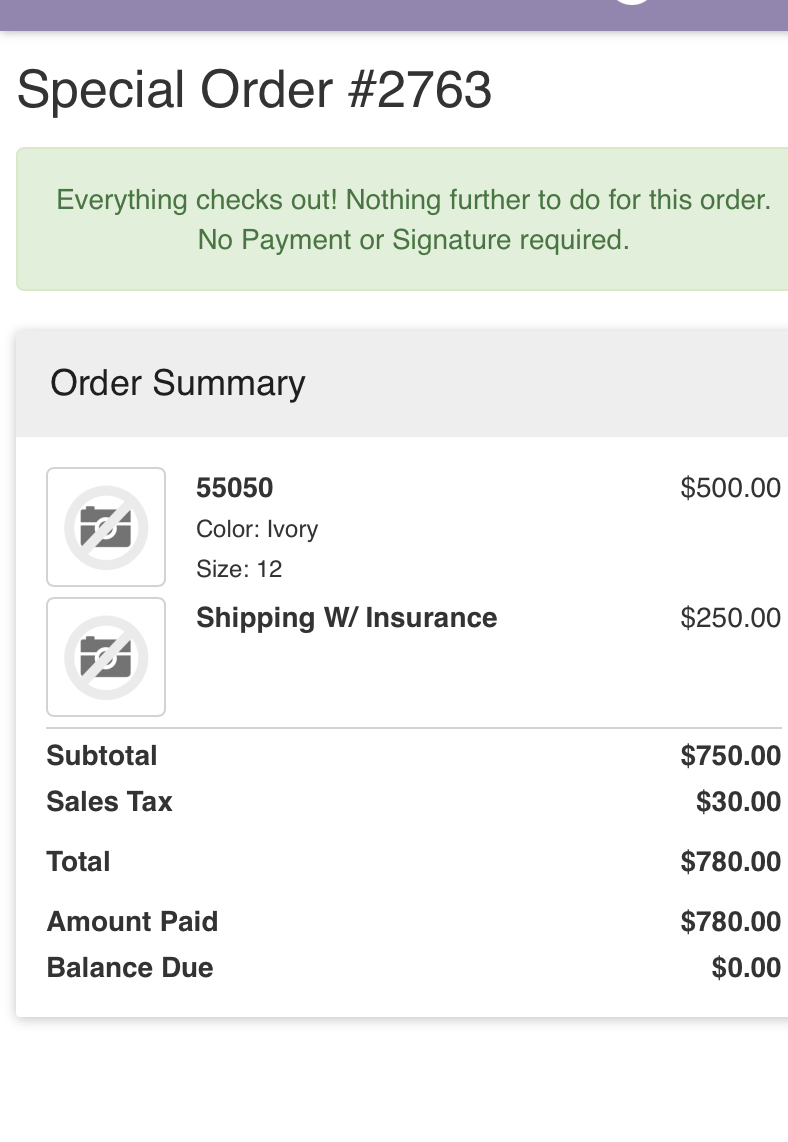

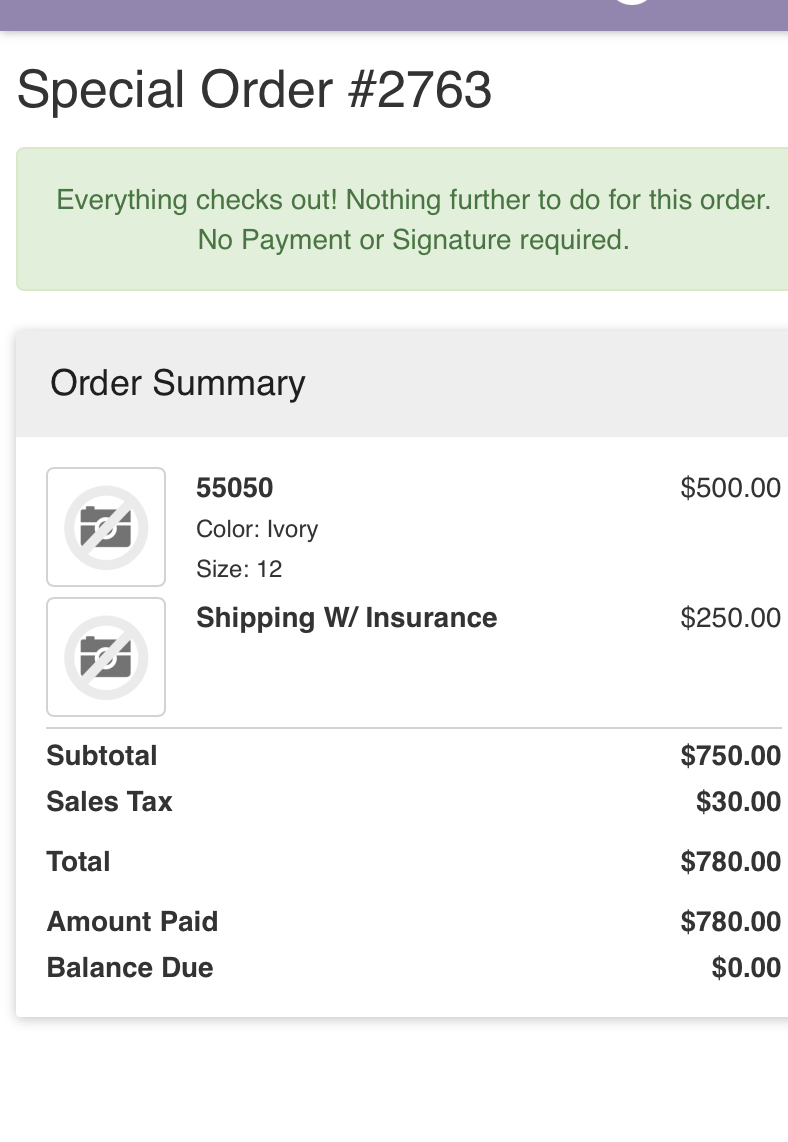

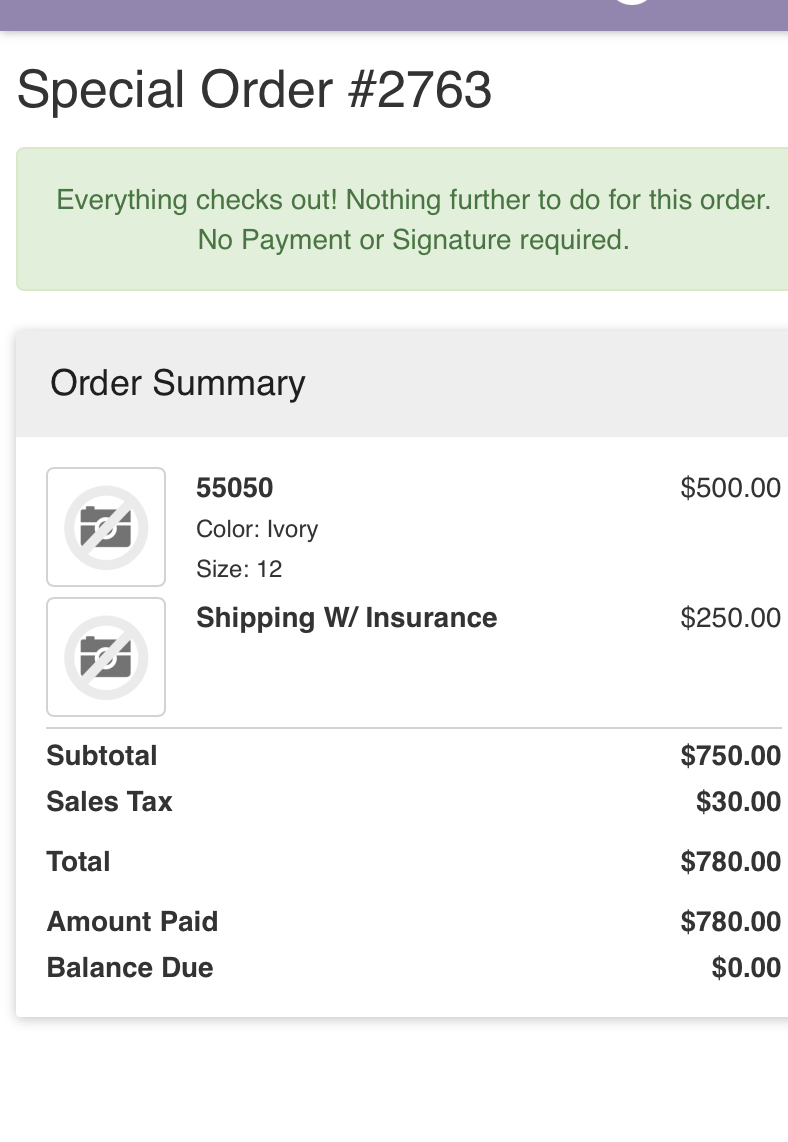

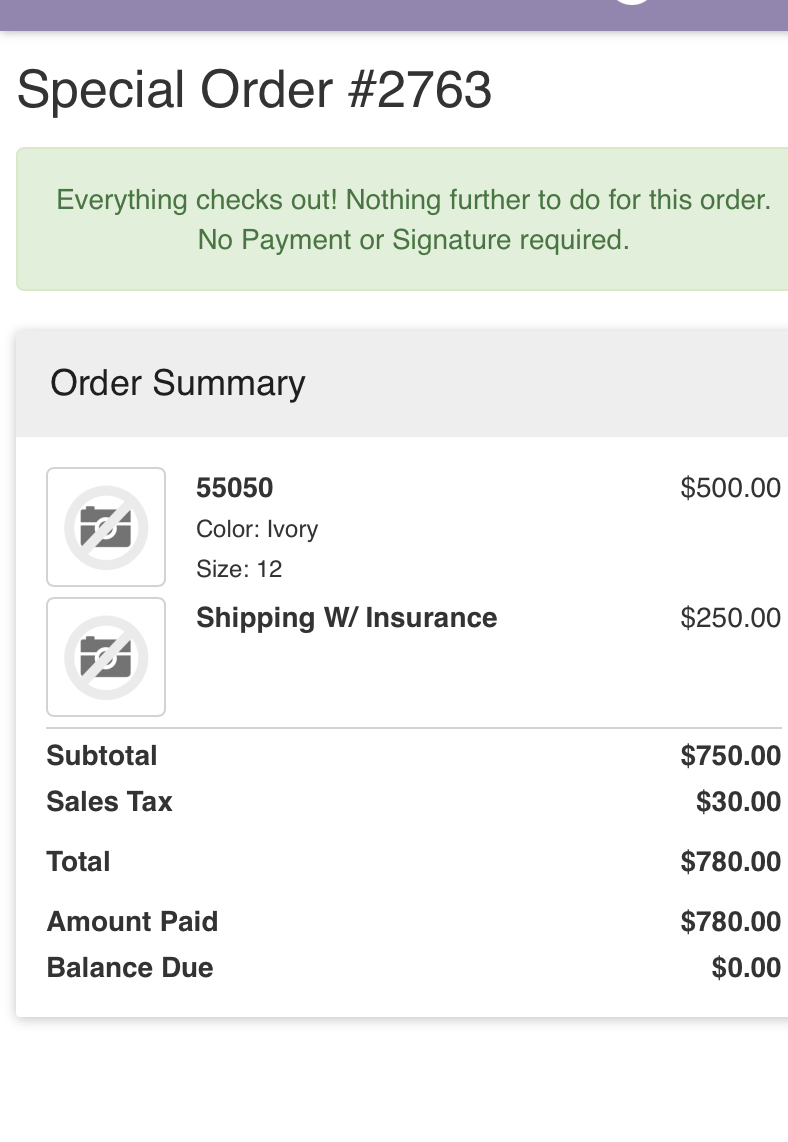

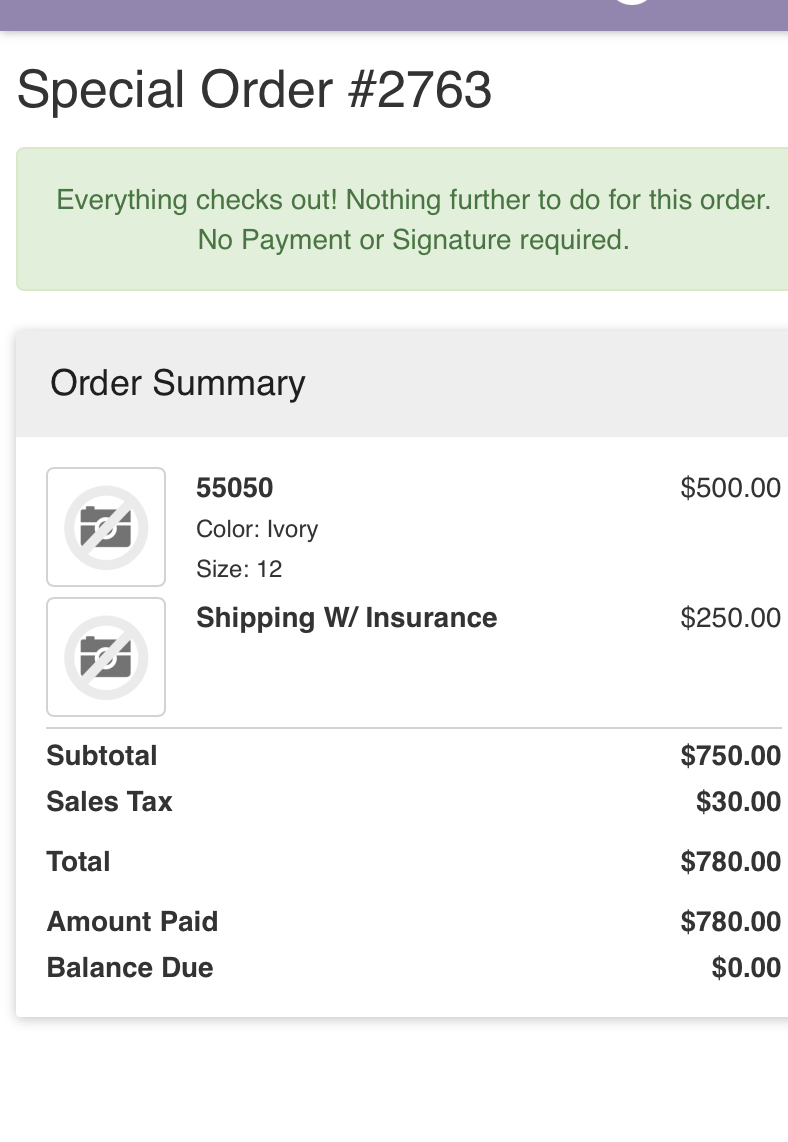

This is my invoice from the seller/store. Should I not have paid sales tax then? 0

This is my invoice from the seller/store. Should I not have paid sales tax then? 0 -

Not if it was being exported outside USA.

Your supplier may not have done this before so may not know the correct procedure. Speak to them and ask for an explanation.

(Wait to see if anybody else comments before you do so).2 -

No. It's an export item so probably not subject to sales tax. You need to see the state laws of the seller to see how they deal with exports. Sales tax is not a federal system so states can decide who they charge tax to and can charge tax to exports if they wish., but I don't think most do.!!!!!! said: This is my invoice from the seller/store. Should I not have paid sales tax then?

This is my invoice from the seller/store. Should I not have paid sales tax then?

It IS possible for non-UK sellers to sign up with HMRC and charge VAT/Import Duty and pay it to HMRC, but that would be 20% (and I'm guessing 12% duty on women's dresses) so they'd be charging you $174.72 in sales tax, not $30.

The amounts seem roughly correct. Slightly on the high side but you really need to show us the breakdown to prove they're incorrect, and we're probably talking £20 here at most.

1 -

See this is my only breakdown unfortunately . I fully accept the customs charges etc, although higher than I’d anticipated , I fully understand I need to pay this. I’m just unsure now what to do re the sales tax charged by the supplier…FeaturelessVoid said:

No. It's an export item so probably not subject to sales tax. You need to see the state laws of the seller to see how they deal with exports. Sales tax is not a federal system so states can decide who they charge tax to and can charge tax to exports if they wish., but I don't think most do.!!!!!! said: This is my invoice from the seller/store. Should I not have paid sales tax then?

This is my invoice from the seller/store. Should I not have paid sales tax then?

It IS possible for non-UK sellers to sign up with HMRC and charge VAT/Import Duty and pay it to HMRC, but that would be 20% (and I'm guessing 12% duty on women's dresses) so they'd be charging you $174.72 in sales tax, not $30.

The amounts seem roughly correct. Slightly on the high side but you really need to show us the breakdown to prove they're incorrect, and we're probably talking £20 here at most.

0 -

Ask them to refund it back to you.!!!!!! said:

See this is my only breakdown unfortunately . I fully accept the customs charges etc, although higher than I’d anticipated , I fully understand I need to pay this. I’m just unsure now what to do re the sales tax charged by the supplier…FeaturelessVoid said:

No. It's an export item so probably not subject to sales tax. You need to see the state laws of the seller to see how they deal with exports. Sales tax is not a federal system so states can decide who they charge tax to and can charge tax to exports if they wish., but I don't think most do.!!!!!! said: This is my invoice from the seller/store. Should I not have paid sales tax then?

This is my invoice from the seller/store. Should I not have paid sales tax then?

It IS possible for non-UK sellers to sign up with HMRC and charge VAT/Import Duty and pay it to HMRC, but that would be 20% (and I'm guessing 12% duty on women's dresses) so they'd be charging you $174.72 in sales tax, not $30.

The amounts seem roughly correct. Slightly on the high side but you really need to show us the breakdown to prove they're incorrect, and we're probably talking £20 here at most.0 -

The breakdown would be the bill from UPS. They will tell you how they got to their final billing amount, although as I said, it's roughly correct so I wouldn't bother them to be honest.!!!!!! said:

See this is my only breakdown unfortunately . I fully accept the customs charges etc, although higher than I’d anticipated , I fully understand I need to pay this. I’m just unsure now what to do re the sales tax charged by the supplier…FeaturelessVoid said:

No. It's an export item so probably not subject to sales tax. You need to see the state laws of the seller to see how they deal with exports. Sales tax is not a federal system so states can decide who they charge tax to and can charge tax to exports if they wish., but I don't think most do.!!!!!! said: This is my invoice from the seller/store. Should I not have paid sales tax then?

This is my invoice from the seller/store. Should I not have paid sales tax then?

It IS possible for non-UK sellers to sign up with HMRC and charge VAT/Import Duty and pay it to HMRC, but that would be 20% (and I'm guessing 12% duty on women's dresses) so they'd be charging you $174.72 in sales tax, not $30.

The amounts seem roughly correct. Slightly on the high side but you really need to show us the breakdown to prove they're incorrect, and we're probably talking £20 here at most.

As said above, if you want the sales tax back ask the seller. It would be unusual for a state to collect sales tax on an export order but without knowing which state they operate out of nobody can say definitively that they've made a mistake.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards