We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Stocks & Shares ISAs - Seriously Worried about Losses

Comments

-

While I try to avoid market timing, apart from some lucky buying of Tesla in 2018-2019 and loading up on equity in April 2020, it is common sense that such a long period of above average returns, leading to valuations that can literally only be compared with the .com bubble (in particular CAPE and PB), and more being paid out dividends and buybacks than is generated as post-tax earnings fuelled by lower corporate bond yields, to expect a period of below average returns to follow.Albermarle said:

If we could have this info in advance, then none of us would be sat here on an internet forum . We would be on the sundeck of our Billion Pound yacht(s) in the Bahamas.DoneWorking said:eskbanker said:

That was probably a rhetorical question, but where would you recommend private investors access such data, in reasonably quantified form?dunstonh said:Can we assume that you looked at the loss potential of your chosen funds before you invested?

Also is information always available to ensure investors know whether they are buying at the top or the bottom of the marketOr is this only available in retrospect

About three or four years ago all the talk was that the market had grown unsustainably , especially in the US. Many people withdrew funds thinking the US market was at a peak ( including me ...) Since then the S&P 500 grew over 70% , although it has dropped back about 12% this year.The problem is that valuations are next to useless at timing when that "change" will happen. The US has been "high" for years.0 -

Indeed, there were some very lively discussions here in c. 2011 concerning selling out of the US completely and going overweight on cheap Russian equities.tebbins said:The problem is that valuations are next to useless at timing when that "change" will happen. The US has been "high" for years.

5 -

masonic said:

Indeed, there were some very lively discussions here in c. 2011 concerning selling out of the US completely and going overweight on cheap Russian equities.tebbins said:The problem is that valuations are next to useless at timing when that "change" will happen. The US has been "high" for years.And that, kids, is why you shouldn't blindly follow valuation. I'm currently 2/3-3/4 UK equity, but if/when the US is "normal" again, or the valuation gap normalises, or the UK "catches up" (vice versa the rest of the world "catches down") I may look at rebalancing to something more like 50:50 or potentially lower.0 -

I invested in an S& SISA for the first time in November 2000, by March 2003 that fund had dropped by around 40%, but remember that it hasn't made a loss unless you actually sell out of the investment.

Also, don't check it every day. I check mine once a month now, and that's enough.0 -

I check ours every few days or weekly just for the 'interest factor' (and its a few clicks away) so what may be contributing to a fall or rise although I appreciate many of the reasons probably go above my head (like yesterdays small rise on my VLS60). I've no intention of touching it however for another decade or so and still continue to invest monthly.droopsnoot said:I invested in an S& SISA for the first time in November 2000, by March 2003 that fund had dropped by around 40%, but remember that it hasn't made a loss unless you actually sell out of the investment.

Also, don't check it every day. I check mine once a month now, and that's enough.0 -

You might be missing the last few wordings "historically Stocks & Shares have always out performed savings accounts" IN THE LONG RUNmorriJ said:

When I invested, the stock market was doing fairly well and everything I read said that historically Stocks & Shares have always out performed savings accounts.morriJ said:

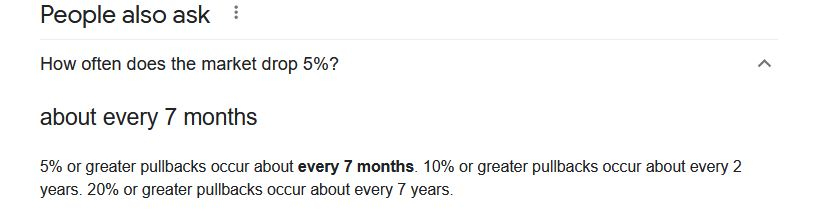

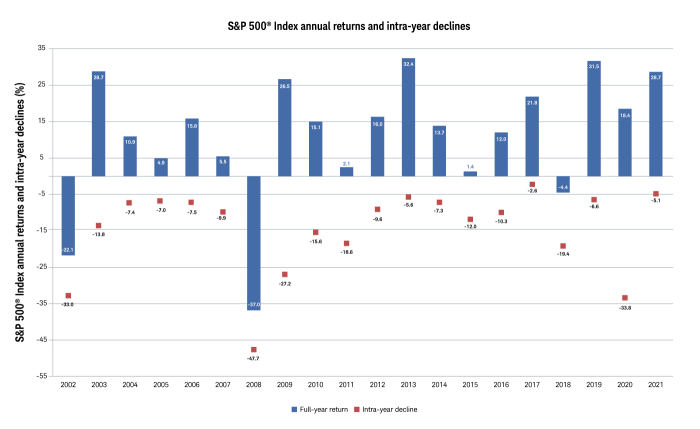

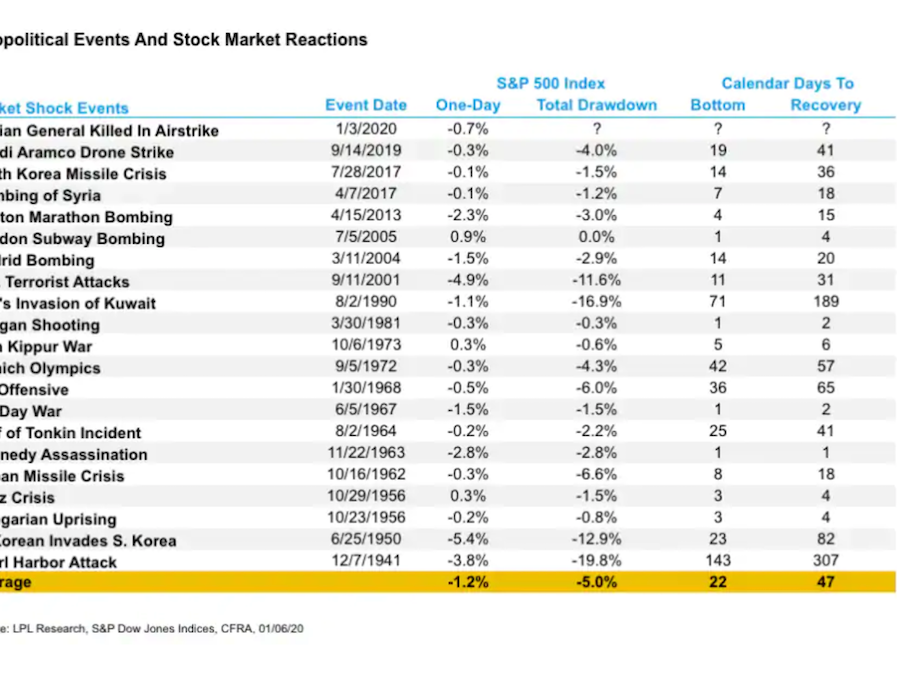

On reading the comments here, I realise that in the grand scheme of things 8% is not much, however the reason for the panic is quite simply world events that have happened since I invested, the cost of living crises and mega inflation now coming our way.Given that your investment is tracking or quite similar the performance of the market, not a high risk/high reward investment. 8% drop is nothing let alone you start investing just a few months ago.This statistics below is probably put you you at ease.

Timing the market is not something unusual, but mainly more suitable for people who understand the market behaviour, regularly read the stock market news, have good understanding of Fundamental and Technical Skills. Most of the hedge fund manager, billionaires investors, acute trader are in fact timing the market all the time. They can not perfectly timing the market (100% right) but they just need to get 50%+ right to be better off than another alternative (by not timing the market)morriJ said:

Whereas they are forecasting slow economic growth for the next few years, hence this is why I wanted some advice as to whether I should be putting the money back into savings. I would add that I was aware that investments can lose money, it is simply the Ukraine thing that is making me so unsure.You are using a managed fund is a good to start with and I am assuming you understand about the risk/reward when selecting the investment. The followings statistics will probably put you at ease and have a comfortable sleep at night.

1

1 -

...and may I ask what growth you've had in that investment overall since 2000? I would think that the rise from March 2003 until now blitzed the 40% drop on your investment in that initial 2.5 years?droopsnoot said:I invested in an S& SISA for the first time in November 2000, by March 2003 that fund had dropped by around 40%, but remember that it hasn't made a loss unless you actually sell out of the investment.

Also, don't check it every day. I check mine once a month now, and that's enough.1 -

"There are two kinds of forecasters: those who don't know, and those who don't know they don't know.“ - John Kenneth Galbraith.

Those lucky enough to know they don't know have a significant advantage.

1 -

There are those who carry on regardless irrespective of the prevailing weather conditions.......Rollinghome said:"There are two kinds of forecasters: those who don't know, and those who don't know they don't know.“ - John Kenneth Galbraith.

Those lucky enough to know they don't know have a significant advantage.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards