We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Opinions on a possible perfect storm

Comments

-

: poop :TonyTeacake said:This crash will be much worse than 2008. It will be carnage.

1 -

Whether it's the mother of all bubbles or the everything-bubble, we'll be in for a real treat in my opinion.

My base case is as follows: US equities will remain under pressure in H2 when corporate earnings will disappoint. Rallies throughout are likely to be short-lived and mistaken for an end in sight. Not so fast. I'd pitch the S&P 500 at around 3000, give or take. How long it will take to get there, not sure.

Bonds are in a peculiar state. QT will reduce price support from central banks, TIPS may still be popular, but here we have to watch what's going on with inflation. Commodities have come down for a short while now. I am almost tempted to say we're past peak inflation (with grains and oil and gas being the Russian wild card here) but volatility of commodity prices will stay with us. As for nominal bonds, maybe the long dated ones could be a tactical recession play for a while. Corporate credit I'd stay away from when I read that German banks have been asked by the ECB to stress-test their loan books. Floating rate was until now an easy call to ride the wave of hikes, but money market is inverted next year on recession concerns, so that may no longer work.

Elevated levels of inflation will stay with us for quite some time. By elevated I do not mean 7 or 8% but above target levels, so more like 3-4% (ex energy). Households are experiencing a negative wealth effect from decline in asset prices and of course the cost of living crisis. How this can sustain property prices, I do not know. Some countries may even implement rent controls, so yields will be compressed.

UK large cap was a safe haven for a while, a play of relative value (cheap GBP) and commodity/materials/minerals heavy FTSE100 names. I don't think that'll continue much longer.

Finding a hiding place is difficult. Even gold's coming off in USD terms. It worked in GBP terms but that was more of an FX play with Sterling having depreciated 10% YTD. While I am no expert on gold, lower inflation expectation on recession fears could be responsible for its sliding price. As for inflation, I suspect that it will remain more persistent here in UK than US given it's structurally less flexible labour market. As for Eurozone, well, all a function of Putin's gas supply.

0 -

Swipe said:

: poop :TonyTeacake said:This crash will be much worse than 2008. It will be carnage.

You do come out with the most succinct and persuasive counter arguments.Tony is brave coming here at all, so he gets respect from me. Our economy is in the toilet, as is that of our supposed ally the US, while the governments of EU countries have done incredibly stupid things in pursuit of a war against the climate and Russia. I wouldn't pretend to understand much of what's discussed here, but I know a pile of that stuff Swipe refers to when I see it.My take on this would be to buy farm land. If Bill Gates thinks it's a smart move....

0 -

Bill Gates also thought getting involved with Epstein and his girls was a smart move. I wonder how much that cost him.Woolsery said:Swipe said:

: poop :TonyTeacake said:This crash will be much worse than 2008. It will be carnage.

If Bill Gates thinks it's a smart move.... 1

1 -

As I say, I'm no expert, but I'd imagine buying some acres of good farm land would be somewhat less risky than involvement with Epstein. It hasn't affected my marriage yet, anyhow!Alistair31 said:

Bill Gates also thought getting involved with Epstein and his girls was a smart move. I wonder how much that cost him.Woolsery said:Swipe said:

: poop :TonyTeacake said:This crash will be much worse than 2008. It will be carnage.

If Bill Gates thinks it's a smart move....

0 -

This seems like a set of scenarios that are entirely plausible and things may well play out this way. Consider this, if you have come to these conclusions, do you think that many of the professional analysts and fund managers, handing billions of dollars of investors money may have reached their own conclusions on the global economic forward outlook, some of which may align with your views? Collectively, these thousands of professionals and the millions of retail investors will have formed a view already and positioned their portfolio's accordingly, hence forming the hive market "view" already and so their expectations will be already priced into the "market". It's the data that does not match their already baked in expectations that will move the markets up or down from here.bd10 said:Whether it's the mother of all bubbles or the everything-bubble, we'll be in for a real treat in my opinion.

My base case is as follows: US equities will remain under pressure in H2 when corporate earnings will disappoint. Rallies throughout are likely to be short-lived and mistaken for an end in sight. Not so fast. I'd pitch the S&P 500 at around 3000, give or take. How long it will take to get there, not sure.

Bonds are in a peculiar state. QT will reduce price support from central banks, TIPS may still be popular, but here we have to watch what's going on with inflation. Commodities have come down for a short while now. I am almost tempted to say we're past peak inflation (with grains and oil and gas being the Russian wild card here) but volatility of commodity prices will stay with us. As for nominal bonds, maybe the long dated ones could be a tactical recession play for a while. Corporate credit I'd stay away from when I read that German banks have been asked by the ECB to stress-test their loan books. Floating rate was until now an easy call to ride the wave of hikes, but money market is inverted next year on recession concerns, so that may no longer work.

Elevated levels of inflation will stay with us for quite some time. By elevated I do not mean 7 or 8% but above target levels, so more like 3-4% (ex energy). Households are experiencing a negative wealth effect from decline in asset prices and of course the cost of living crisis. How this can sustain property prices, I do not know. Some countries may even implement rent controls, so yields will be compressed.

UK large cap was a safe haven for a while, a play of relative value (cheap GBP) and commodity/materials/minerals heavy FTSE100 names. I don't think that'll continue much longer.

Finding a hiding place is difficult. Even gold's coming off in USD terms. It worked in GBP terms but that was more of an FX play with Sterling having depreciated 10% YTD. While I am no expert on gold, lower inflation expectation on recession fears could be responsible for its sliding price. As for inflation, I suspect that it will remain more persistent here in UK than US given it's structurally less flexible labour market. As for Eurozone, well, all a function of Putin's gas supply.0 -

A lot of potentially negative outcomes, but there are a couple of signs that are counter to the usual ones you see when there is a recession apparently looming.Woolsery said:Swipe said:

: poop :TonyTeacake said:This crash will be much worse than 2008. It will be carnage.

You do come out with the most succinct and persuasive counter arguments.Tony is brave coming here at all, so he gets respect from me. Our economy is in the toilet, as is that of our supposed ally the US, while the governments of EU countries have done incredibly stupid things in pursuit of a war against the climate and Russia. I wouldn't pretend to understand much of what's discussed here, but I know a pile of that stuff Swipe refers to when I see it.My take on this would be to buy farm land. If Bill Gates thinks it's a smart move....House prices hit a fresh record in June, according to Halifax, despite expectations the rising cost of living in the UK would dampen demand.

The mortgage lender said the average house price reached £294,845 in June after rising by 1.8% - the steepest monthly increase since 2007.

Halifax said a lack of available homes for sale was lifting prices as well as a shift towards people buying larger, detached homes. House prices rose by 13% in the year to June, which Halifax said was the highest rate since late 2004.

The number of job vacancies in March to May 2022 rose to a new record of 1,300,000.

The unemployment rate of the United Kingdom was 3.8 percent in April 2022, compared with 3.7 percent in the previous month, which was the lowest unemployment rate since 1974.

At least it shows demand in the economy generally is holding up well, despite all the doom and gloom. As can also be seen by the unexpected high level of demand for foreign holidays, which largely do not come cheap.

1 -

2 Million using food banks in the UK and most of these are working so for these people not so good.Albermarle said:

A lot of potentially negative outcomes, but there are a couple of signs that are counter to the usual ones you see when there is a recession apparently looming.Woolsery said:Swipe said:

: poop :TonyTeacake said:This crash will be much worse than 2008. It will be carnage.

You do come out with the most succinct and persuasive counter arguments.Tony is brave coming here at all, so he gets respect from me. Our economy is in the toilet, as is that of our supposed ally the US, while the governments of EU countries have done incredibly stupid things in pursuit of a war against the climate and Russia. I wouldn't pretend to understand much of what's discussed here, but I know a pile of that stuff Swipe refers to when I see it.My take on this would be to buy farm land. If Bill Gates thinks it's a smart move....House prices hit a fresh record in June, according to Halifax, despite expectations the rising cost of living in the UK would dampen demand.

The mortgage lender said the average house price reached £294,845 in June after rising by 1.8% - the steepest monthly increase since 2007.

Halifax said a lack of available homes for sale was lifting prices as well as a shift towards people buying larger, detached homes. House prices rose by 13% in the year to June, which Halifax said was the highest rate since late 2004.

The number of job vacancies in March to May 2022 rose to a new record of 1,300,000.

The unemployment rate of the United Kingdom was 3.8 percent in April 2022, compared with 3.7 percent in the previous month, which was the lowest unemployment rate since 1974.

At least it shows demand in the economy generally is holding up well, despite all the doom and gloom. As can also be seen by the unexpected high level of demand for foreign holidays, which largely do not come cheap.

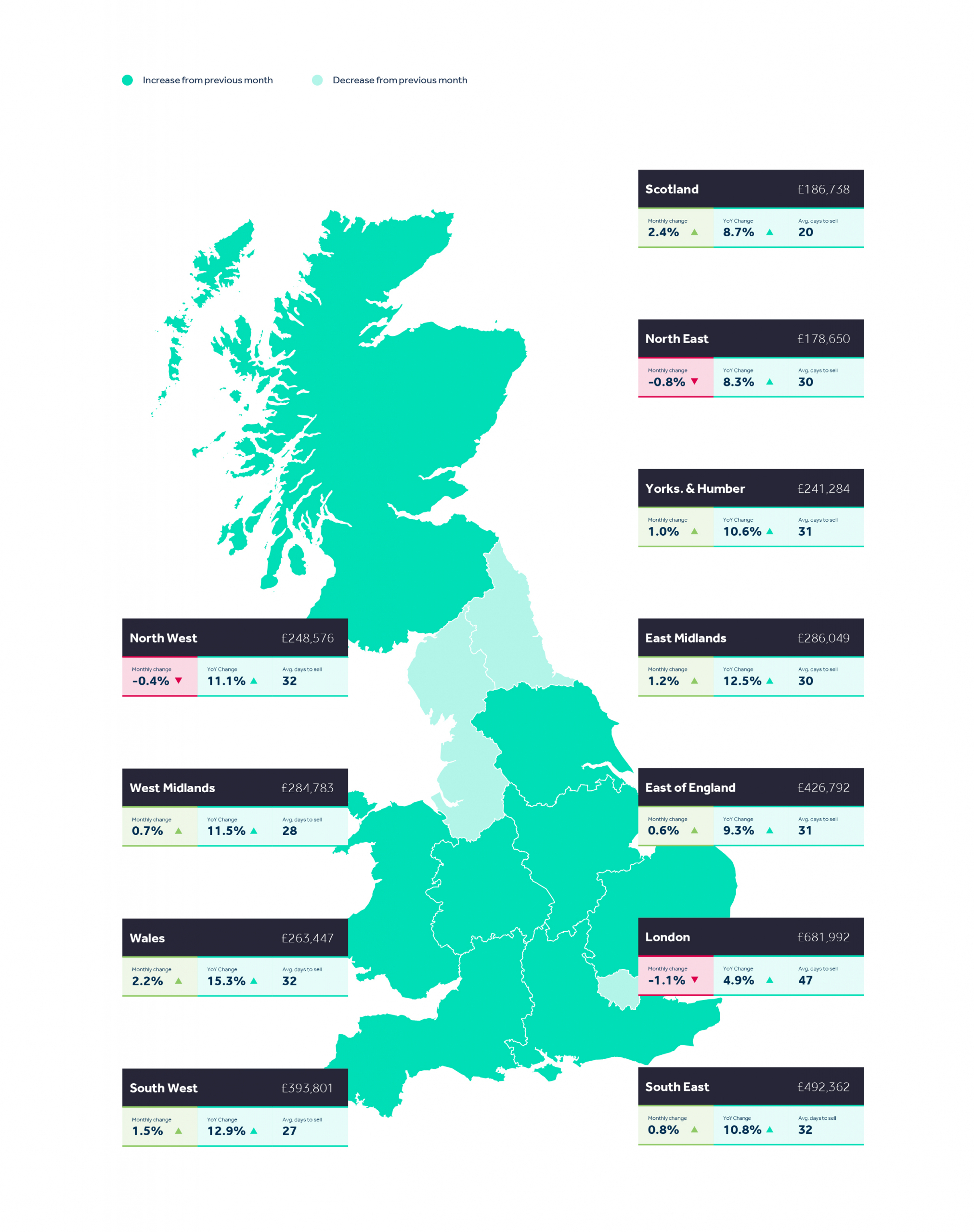

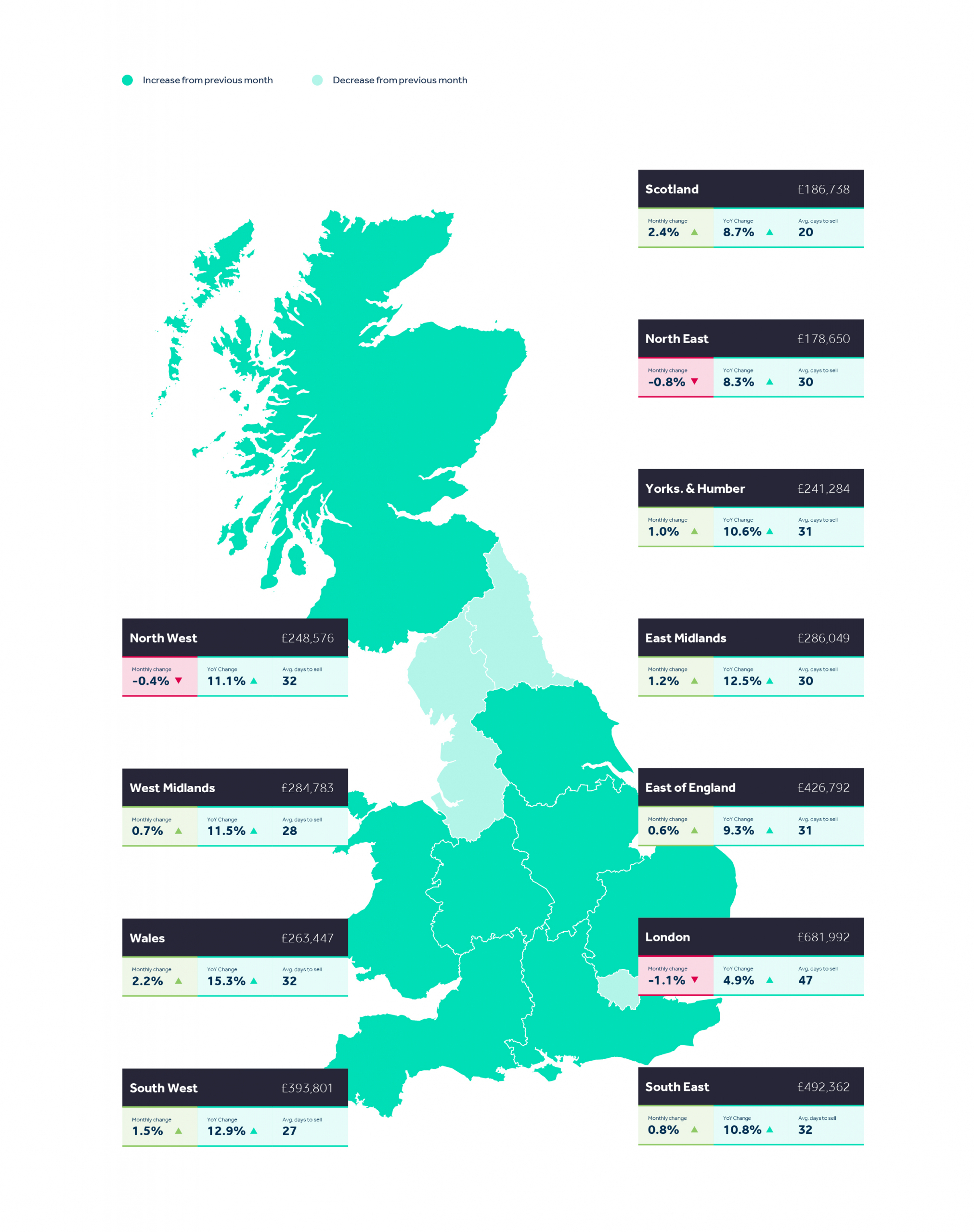

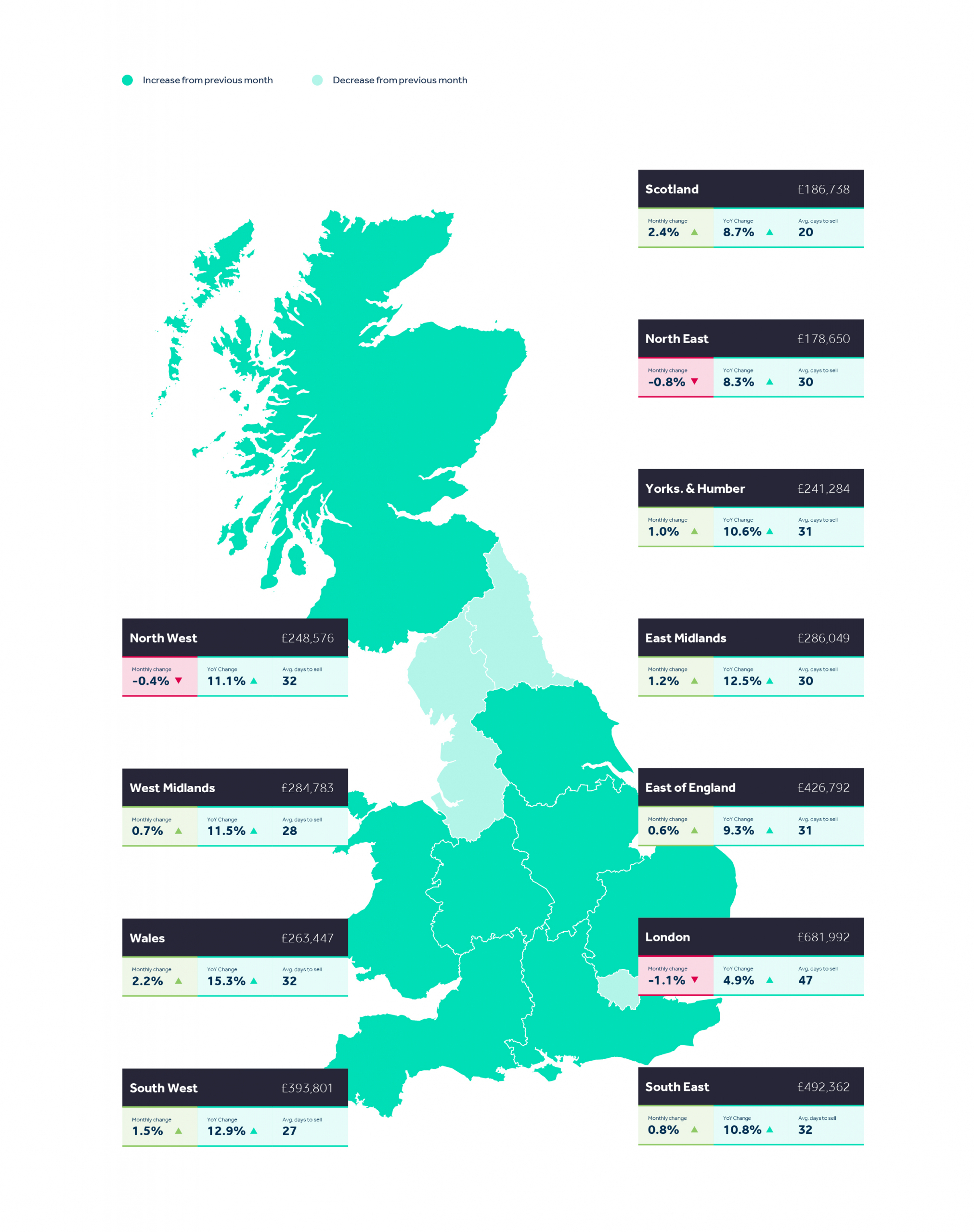

Here are the regional trends which as shown for the first time price drops in the North.

Once we go into the winter I expect to see most of these regions in red. The tide is already starting to turn and over time will only get much worse. When we see the bottom of this market over the next few years, expect to see some houses to have dropped by 50%.

I don't think most people are yet grasping what is about to hit us.

-1 -

When people do grasp it what do you think they should do? What is your investment strategy? Or are you saying the situation is the end of the world as we know it and investments are irrelevent?TonyTeacake said:

2 Million using food banks in the UK and most of these are working so for these people not so good.Albermarle said:

A lot of potentially negative outcomes, but there are a couple of signs that are counter to the usual ones you see when there is a recession apparently looming.Woolsery said:Swipe said:

: poop :TonyTeacake said:This crash will be much worse than 2008. It will be carnage.

You do come out with the most succinct and persuasive counter arguments.Tony is brave coming here at all, so he gets respect from me. Our economy is in the toilet, as is that of our supposed ally the US, while the governments of EU countries have done incredibly stupid things in pursuit of a war against the climate and Russia. I wouldn't pretend to understand much of what's discussed here, but I know a pile of that stuff Swipe refers to when I see it.My take on this would be to buy farm land. If Bill Gates thinks it's a smart move....House prices hit a fresh record in June, according to Halifax, despite expectations the rising cost of living in the UK would dampen demand.

The mortgage lender said the average house price reached £294,845 in June after rising by 1.8% - the steepest monthly increase since 2007.

Halifax said a lack of available homes for sale was lifting prices as well as a shift towards people buying larger, detached homes. House prices rose by 13% in the year to June, which Halifax said was the highest rate since late 2004.

The number of job vacancies in March to May 2022 rose to a new record of 1,300,000.

The unemployment rate of the United Kingdom was 3.8 percent in April 2022, compared with 3.7 percent in the previous month, which was the lowest unemployment rate since 1974.

At least it shows demand in the economy generally is holding up well, despite all the doom and gloom. As can also be seen by the unexpected high level of demand for foreign holidays, which largely do not come cheap.

Here are the regional trends which as shown for the first time price drops in the North.

Once we go into the winter I expect to see most of these regions in red. The tide is already starting to turn and over time will only get much worse. When we see the bottom of this market over the next few years, expect to see some houses to have dropped by 50%.

I don't think most people are yet grasping what is about to hit us.0 -

Sorry I don't give financial advice. I am not saying this is the end of the world, what I am saying we are heading for economic disaster. The only thing I would say is to make sure you have some hard cash under the floorboards because I predict this super bubble we are in is going to be the biggest crash we will ever see in our lifetimes.Linton said:

When people do grasp it what do you think they should do? What is your investment strategy? Or are you saying the situation is the end of the world as we know it and investments are irrelevent?TonyTeacake said:

2 Million using food banks in the UK and most of these are working so for these people not so good.Albermarle said:

A lot of potentially negative outcomes, but there are a couple of signs that are counter to the usual ones you see when there is a recession apparently looming.Woolsery said:Swipe said:

: poop :TonyTeacake said:This crash will be much worse than 2008. It will be carnage.

You do come out with the most succinct and persuasive counter arguments.Tony is brave coming here at all, so he gets respect from me. Our economy is in the toilet, as is that of our supposed ally the US, while the governments of EU countries have done incredibly stupid things in pursuit of a war against the climate and Russia. I wouldn't pretend to understand much of what's discussed here, but I know a pile of that stuff Swipe refers to when I see it.My take on this would be to buy farm land. If Bill Gates thinks it's a smart move....House prices hit a fresh record in June, according to Halifax, despite expectations the rising cost of living in the UK would dampen demand.

The mortgage lender said the average house price reached £294,845 in June after rising by 1.8% - the steepest monthly increase since 2007.

Halifax said a lack of available homes for sale was lifting prices as well as a shift towards people buying larger, detached homes. House prices rose by 13% in the year to June, which Halifax said was the highest rate since late 2004.

The number of job vacancies in March to May 2022 rose to a new record of 1,300,000.

The unemployment rate of the United Kingdom was 3.8 percent in April 2022, compared with 3.7 percent in the previous month, which was the lowest unemployment rate since 1974.

At least it shows demand in the economy generally is holding up well, despite all the doom and gloom. As can also be seen by the unexpected high level of demand for foreign holidays, which largely do not come cheap.

Here are the regional trends which as shown for the first time price drops in the North.

Once we go into the winter I expect to see most of these regions in red. The tide is already starting to turn and over time will only get much worse. When we see the bottom of this market over the next few years, expect to see some houses to have dropped by 50%.

I don't think most people are yet grasping what is about to hit us.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards