We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Shall we sell the stock?

Comments

-

RoseLondon said:

It's a bit overly generalised, no? Probably need to take into account if the event is one-off or a small puzzle of the larger picture. Like the war in Ukraine, nobody knows how big it can grow or how long it could last. The scale of drawdown could be limited or globally massive.adindas said:Geopolitical Event, Calender days to reach the Bottom and Days to Recovery.In average, it takes about 22 Days after the event to reach the bottom and take another 47 days to recover.

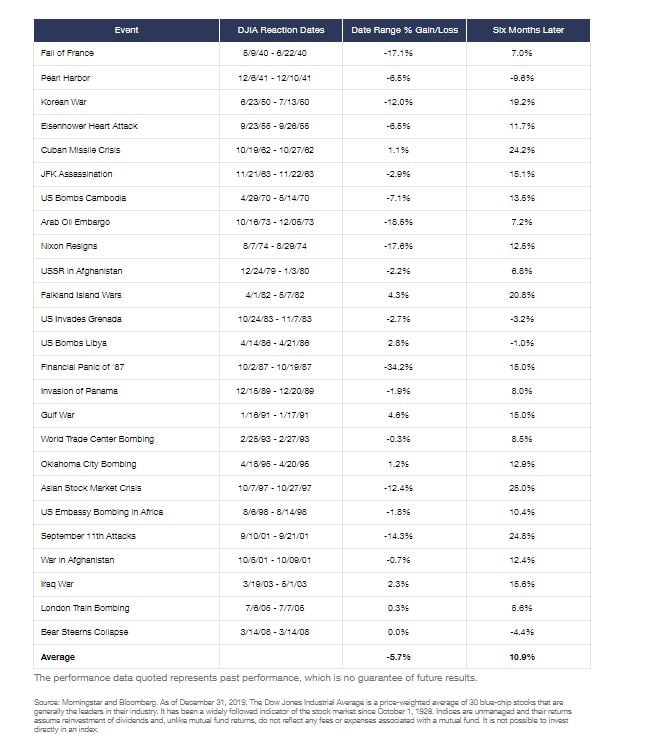

The drawdown for Pearl Harbour Attack would have lasted much longer than a year if the world didn't finish with an atomic bomb...You have the point I just found the Dow Jones DJIA performance during the major crisis. The Dow Jones DJIA performance during the major crisis. During these events, the Dow Jones Industrial Average (DJIA) dropped by an average of about 6%. In all but four cases, the market returned to positive territory within six months of the end of each decline.https://www.amundi.com/usinvestors/Resources/Classic-Concepts/Crisis-Events-and-the-US-Stock-Market

1 -

Apology, my bad. Just that event engraved too deep in my known knowledge about the war. But yes, you are right!steampowered said:

Off topic, but couldn't let this one past. That simply is not true. The war was over by the time the bomb was dropped.RoseLondon said:

The drawdown for Pearl Harbour Attack would have lasted much longer than a year if the world didn't finish with an atomic bomb...0 -

how much of your stocks are in equities?

most people are experiencing big falls at the moment, but like most have said above, investing must be considered longer term (ideally 5 years minimum).

and you just can't know for sure when it has bottomed out?

1 -

You'd need to convert into sterling as well to make meaningfull comparisons. Not simply rely on returns quoted in US$. The outcome will vary considerably depending on the actual date of purchase/sale of the underlying funds.adindas said:Thrugelmir said:

As far as VLS is concerned it's only ever been accessible to retail investors in the UK during a bull market.adindas said:

She is investing in fund "Vanguard for a total of £40k", not individual stock. Presumably a relatively good diversifies fund, such as VLS not individual stocks. Historical data show that this fund has only gone up in the long term.Notepad_Phil said:

I dare say it depends on your risk profile and costs. If regular small amount investment was a definite winner over lump sum investment then surely once you've built up a decent sum shouldn't you then sell it so that you can reinvest it back into the market in regular small amounts again?Roselondon_2 said:

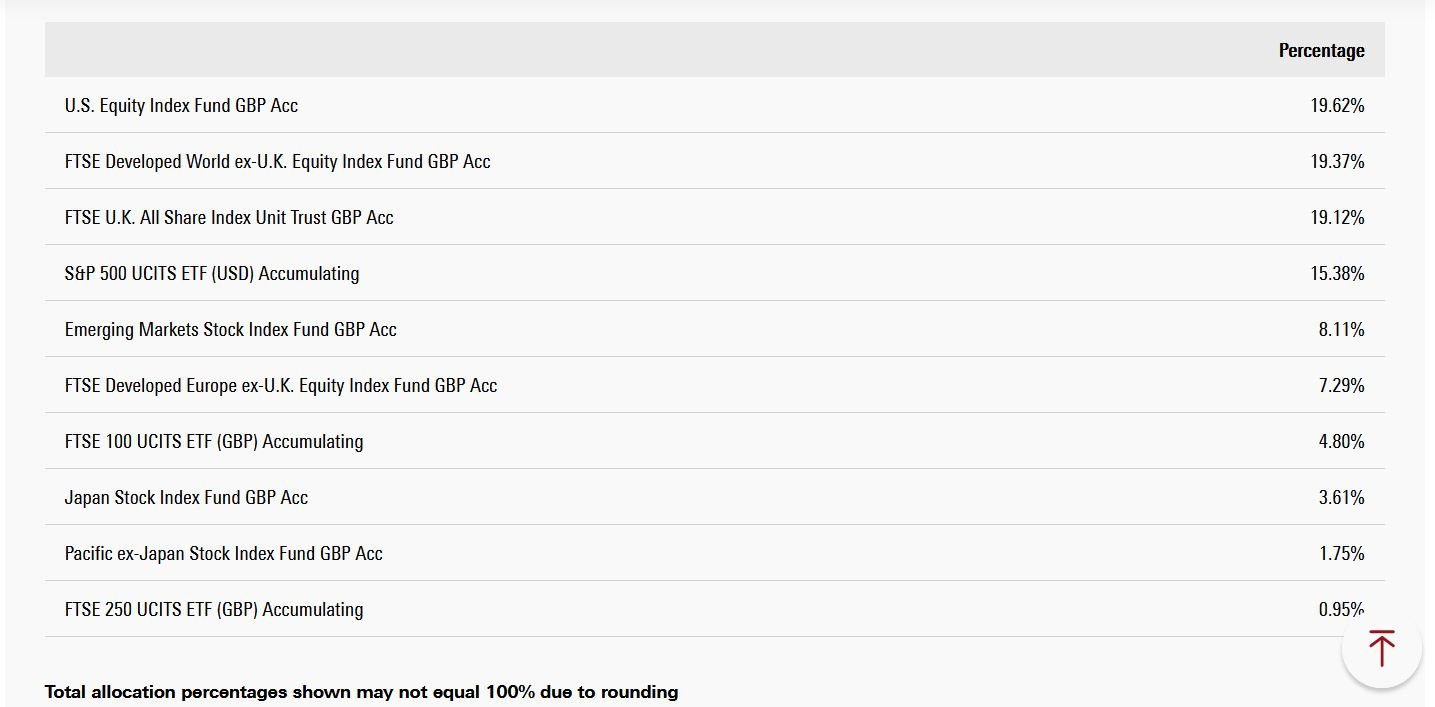

"If you have money it is probably better to drip-feed it, buy in a smaller chunk in the red day to improve your cost average." I really like this particular piece of advice... I've seen a comparison of different investment scenarios. The outcome was regular small amount investment wins in the long term. But your advice gives it a more precise timing. Makes sense.True but majority of VLS holding are weighted heavily on US & UK indexes. So you just need to see the performance of FTSE & US Indexes such as S&P500, DJIA, NASDAQ composite to see performance for a longer period 1

1 -

What is your timeframe for holding the investment?Roselondon_2 said:We are later comers in terms of investment and therefore are still learning (slowly). We missed out the boat for 20 market rise and only put in Vanguard for a total of £40k between last May and November last year. At one point time, the indexes were shooting up unsustainably strong. But we knew all was too high to last, but still put money in because it's silly to let cash idling in a bank without knowing when the market would adjust itself/crashes. (We didn't put all cash in and this £40k is about half of what we have in saving).

I'm aware there's nobody can guarantee the outcome, but would like to hear some thoughts from others - What would you do in the same position?. Would you pull the £40k out accepting the loss (about £2k together across 4 types of funds up to today) and wait for the situation stabilises/dips to the bottom at an unknown time?

Everyone is talking about recession. I fear the value would be cut down to lower than half if we leave it in the market. And the market is at the highest point in history. Certainly it would be years for it to recover if there's really a stagflation?

I found some of the articles from JL Collins stock investing series quite informative for the situation we find ourselves in and for investing in equities in general.

1.

Stocks — Part XXXII: Why you should not be in the stock market1 -

1

-

0

-

I’m in a similar boat and don’t like it but I can leave the money there and I’m sure it will be ok in the long term.

I will leave my remaining allowance as cash in the S&S ISA1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards