We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Shall we sell the stock?

I'm aware there's nobody can guarantee the outcome, but would like to hear some thoughts from others - What would you do in the same position?. Would you pull the £40k out accepting the loss (about £2k together across 4 types of funds up to today) and wait for the situation stabilises/dips to the bottom at an unknown time?

Everyone is talking about recession. I fear the value would be cut down to lower than half if we leave it in the market. And the market is at the highest point in history. Certainly it would be years for it to recover if there's really a stagflation?

Comments

-

You could take the money out and leave it in the bank as a melting ice cube, and be sure of a net loss of at least 7% per year via inflation, which may get worse.

Or you could stay invested, let capitalism do its thing. In the long, number go up.

5 -

What's your longer term objectives? Stock markets aren't places to take punts simply because savings rates are currently low. Are you maximising your annual pension contributions?1

-

As thruelmir said, it depends on your long term objective.2

-

A loss of £2K on £40K , is 5% , which is relatively minor in terms of movement of investment value.

At a guess probably your fund value is still higher than what you put in last year, or about the same ?

and wait for the situation stabilises/dips to the bottom at an unknown time?

If by the situation , you mean Ukraine , it might go on for years . By which time there will have no doubt many more 'situations'

Also how will you know when it has dipped to the bottom ? Maybe it already has . Markets went up quite strongly yesterday.4 -

Thrugelmir said:What's your longer term objectives? Stock markets aren't places to take punts simply because savings rates are currently low. Are you maximising your annual pension contributions?

Thank you. We aim at long term, but do fear of a sharp downturn. We just thought to take money out and go back in when reach the bottom which seems a year or two away. But yes, the inflation would eat at least 7% of it...

My husband is looking into maximising his pension contribution but we didn't realise he could put in up to £40k a year... And just after having read your suggestion, I realised I could still contribute even when I'm not working (with a young child)... So thanks for the reminder.0 -

We just thought to take money out and go back in when reach the bottom which seems a year or two away.

Your crystal ball is a lot better than mine !

My husband is looking into maximising his pension contribution but we didn't realise he could put in up to £40k a year.

So you are thinking about pulling out your £40K investment in a S&S ISA, but at the same time thinking about investing £40K in a pension.......

Of course a pension has some tax advantages, but for sure investments in a pension will also go down in this crash you seem certain will happen . ( but may not )

4 -

Unfortunately by the time you decide that we've reached the bottom and that it's safe to go back into the market the market will likely have already decided that many months before and the markets will have already zoomed back up again.Roselondon_2 said:

We aim at long term, but do fear of a sharp downturn. We just thought to take money out and go back in when reach the bottom which seems a year or two away. But yes, the inflation would eat at least 7% of it...

Just think of what happened in the early days of covid. The markets tumbled for a little then shot up and shot up again, so anyone who had sold out during the 'panic' because everything was doomed was suddenly faced with having to pay significantly more to get back into the funds they had sold out of.

Personally, I'm retired and I'm still investing monthly into funds - but I'm aware that markets fall and markets rise and this monthly money is not going to be needed in the foreseeable future.2 -

If you are investing in index fund, not individual stock and you have done your DDs before buying them. Selling when you are already down is not a good strategy. Unless you know with very high degree of certainty that it will be going down again significantly from here, or you need the money. It could happen when you sell it the stock market today is going up again tomorrow and you will regret it. If you have money it is probably better to drip-feed it, buy in a smaller chunk in the red day to improve your cost average. But you make your own decision as noone know for sure what will happen in the future. It could happen that the bear market this time is a prolonged bear market. You will never know.Roselondon_2 said:We are later comers in terms of investment and therefore are still learning (slowly). We missed out the boat for 20 market rise and only put in Vanguard for a total of £40k between last May and November last year. At one point time, the indexes were shooting up unsustainably strong. But we knew all was too high to last, but still put money in because it's silly to let cash idling in a bank without knowing when the market would adjust itself/crashes. (We didn't put all cash in and this £40k is about half of what we have in saving).

I'm aware there's nobody can guarantee the outcome, but would like to hear some thoughts from others - What would you do in the same position?. Would you pull the £40k out accepting the loss (about £2k together across 4 types of funds up to today) and wait for the situation stabilises/dips to the bottom at an unknown time?

Everyone is talking about recession. I fear the value would be cut down to lower than half if we leave it in the market. And the market is at the highest point in history. Certainly it would be years for it to recover if there's really a stagflation?

Gauging when the situation is stabilized knowing the true dips to the bottom is not simple. The traders hedge funds are using sophisticated tools, yet they still get it wrong in many occasions. When the stock market recover they might recover in V shape, going up quickly without you realizing it. like we have seen in COVID-19.

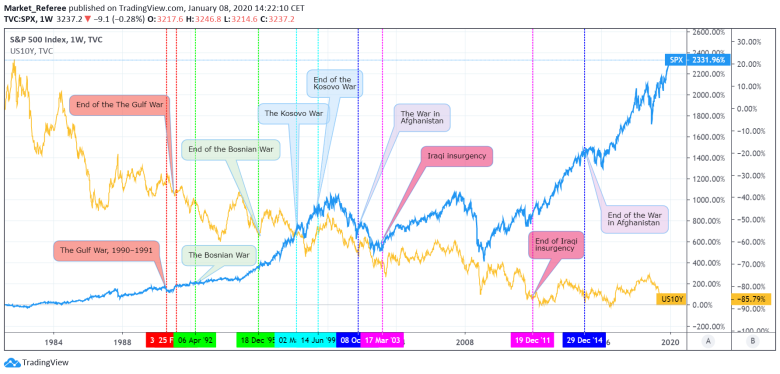

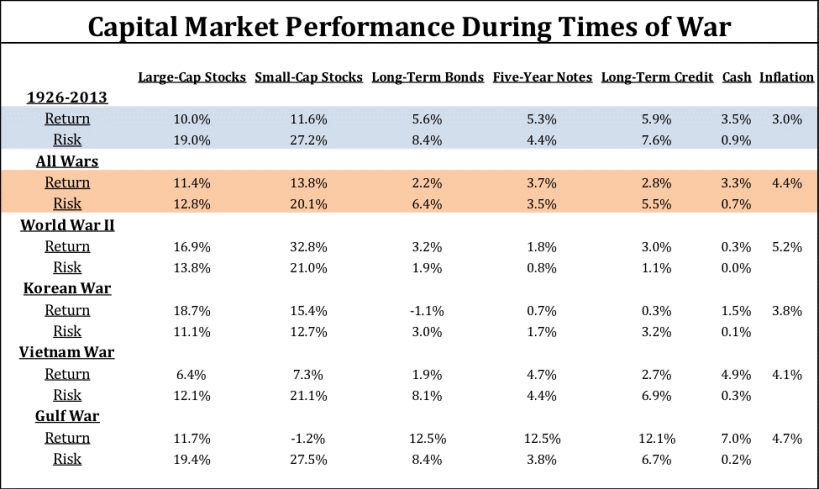

I posted the stock market performance during the war / conflict in other thread. As you could see it went down significantly but it is going up again thereafter. But It is up to you to interpret it and making judgement.

1 -

Yes, I was thinking to have him put in cash in S&S to stand by for now... Can't quite decide if shall dive in, or when to.Albermarle said:We just thought to take money out and go back in when reach the bottom which seems a year or two away.Your crystal ball is a lot better than mine !

My husband is looking into maximising his pension contribution but we didn't realise he could put in up to £40k a year.

So you are thinking about pulling out your £40K investment in a S&S ISA, but at the same time thinking about investing £40K in a pension.......

Of course a pension has some tax advantages, but for sure investments in a pension will also go down in this crash you seem certain will happen . ( but may not )

0 -

adindas said:

If you are investing in index fund, not individual stock and you have done your DDs before buying them. Selling when you are already down is not a good strategy. Unless you know with very high degree of certainty that it will be going down again significantly from here, or you need the money. It could happen when you sell it the stock market today is going up again tomorrow and you will regret it. If you have money it is probably better to drip-feed it, buy in a smaller chunk in the red day to improve your cost average. But you make your own decision as noone know for sure what will happen in the future. It could happen that the bear market this time is a prolonged bear market. You will never know.

Gauging when the situation is stabilized knowing the true dips to the bottom is not simple. The traders hedge funds are using sophisticated tools, yet they still get it wrong in many occasions. When the stock market recover they might recover in V shape, going up quickly without you realizing it. like we have seen in COVID-19.

I posted the stock market performance during the war / conflict in other thread. As you could see it went down significantly but it is going up again thereafter. But It is up to you to interpret it and making judgement.

Really appreciate the charts as a reminder of a much bigger/higher perspective about the performance during/after wartime. We don't need the money now and there's still some time before retirement. So I guess we will just have to sit through this storm. (On the other hand, it's truly hard to believe the current level shoved up by Covid is something sustainable. That's why I feel it would certainly dip down to match pre-covid level in some way. But I really know too little to say!)

"If you have money it is probably better to drip-feed it, buy in a smaller chunk in the red day to improve your cost average." I really like this particular piece of advice... I've seen a comparison of different investment scenarios. The outcome was regular small amount investment wins in the long term. But your advice gives it a more precise timing. Makes sense.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards