We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Fixed Interest Savings Discussion Area

Comments

-

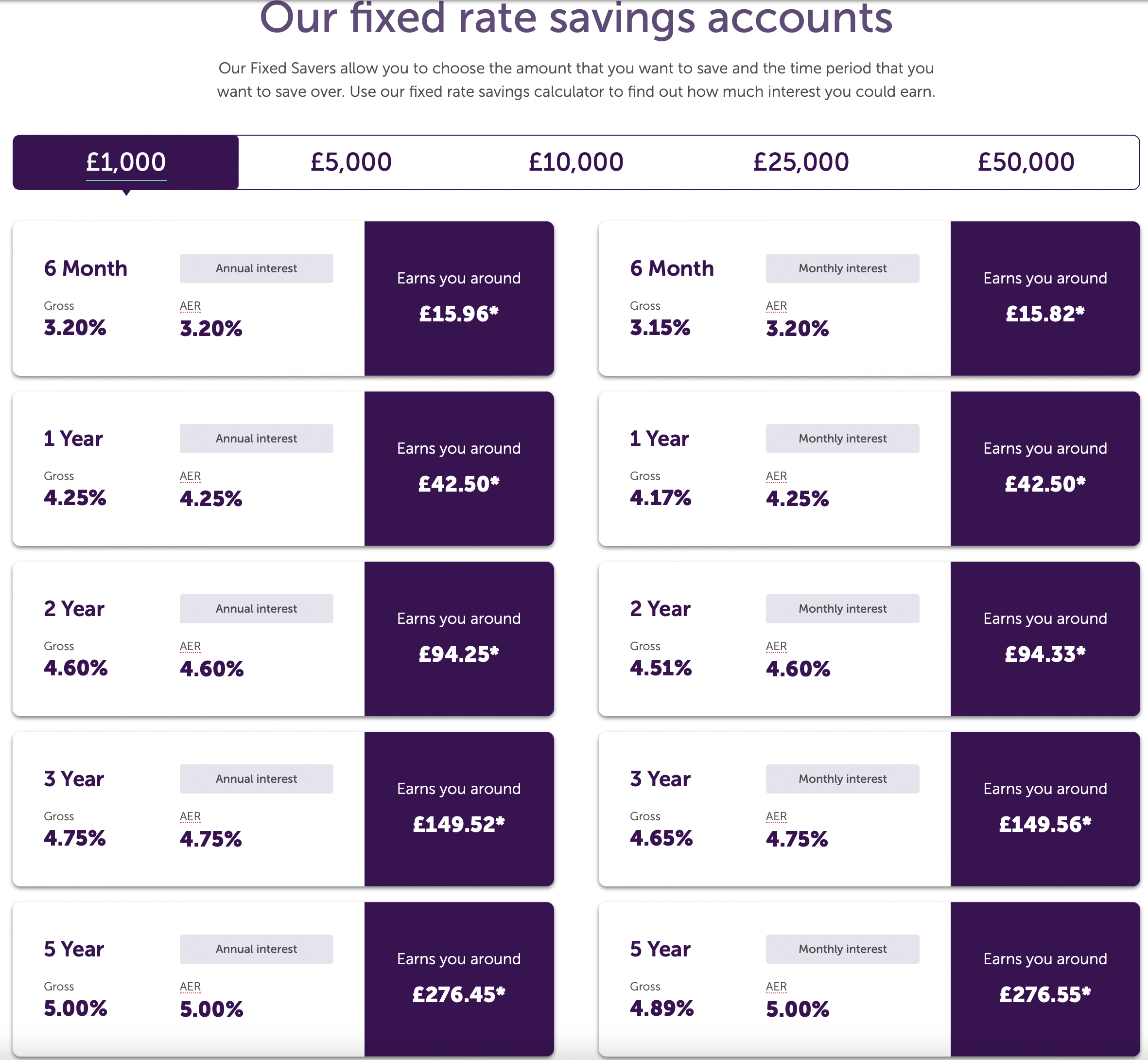

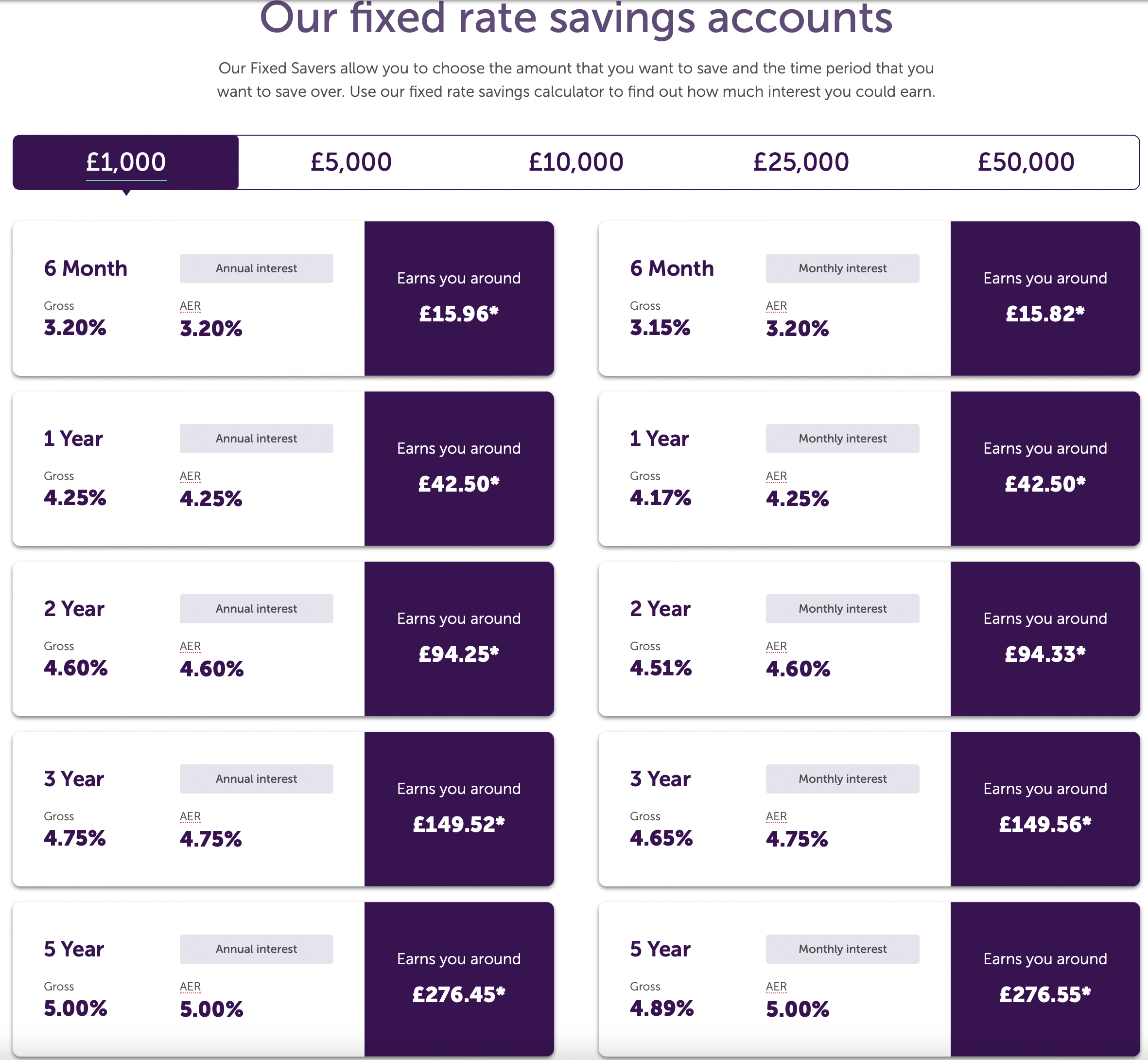

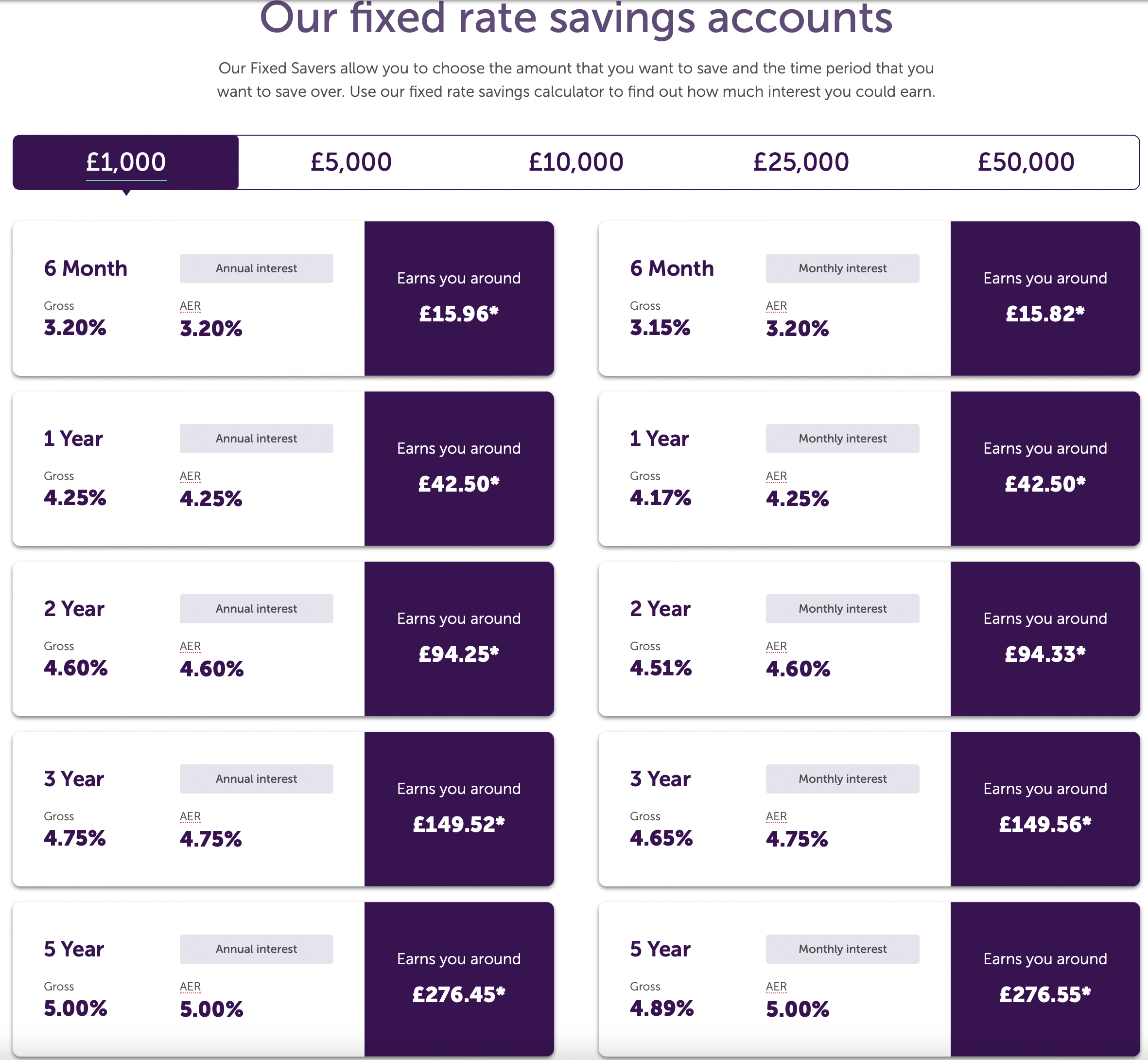

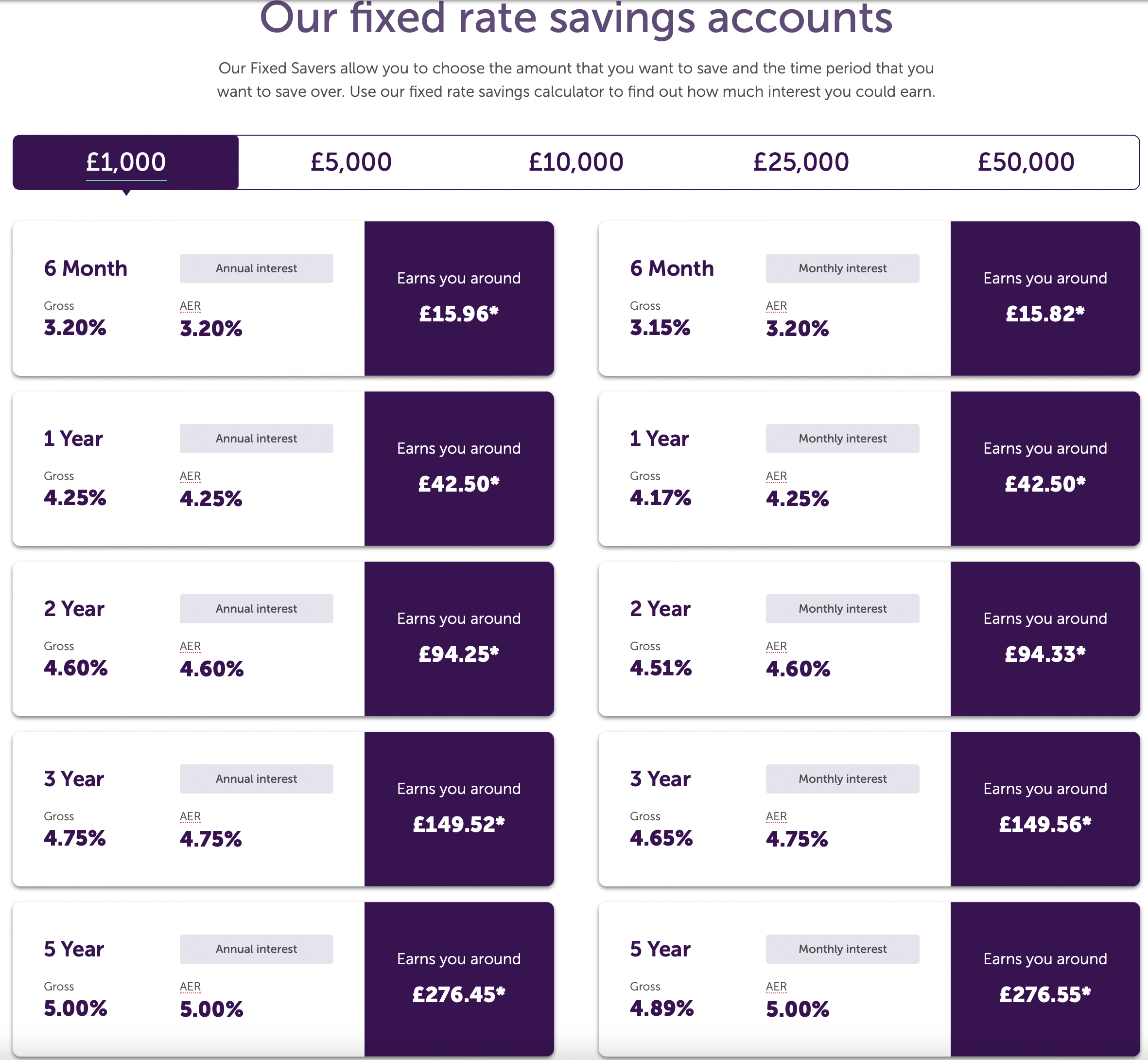

Atom new fixed saver rates

6 months 3.2%

1yr 4.25%

2yr 4.6%2 -

Atom Bank have also released a 3 year at 4.75%, and now a 5 year at 5%!

According to the MoneyFacts article, this is the 'first provider in over 10 years to list a fixed bond at 5% AER'. atom-bank-five-year-fixed-rate If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.9 -

Plus 3 yr at 4.75% AND 5 yr at 5 %! That most elusive animal, the 5% fixed rate savings account, has finally emerged from the undergrowth!TomDolan said:Atom new fixed saver rates

6 months 3.2%

1yr 4.25%

2yr 4.6%2 -

I'm also seeing on MoneyFacts that Coventry Building Society is releasing some new fixed rate bonds:

Approx 1 year Fixed Rate Bond (284) 31.12.2023 @ 4.40% AER

Approx 2 year Fixed Rate Bond (286) 31.12.2024 @ 4.70% AER

Approx 3 year Fixed Rate Bond (288) 31.12.2025 @ 4.85% AER

These rates appear to be table toppers (for now at least)!If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.3 -

Very interesting (pun intended) that monthly interest (if allowed to compound) pays a little more than annual interest for the 2 year, 3 year and 5 year fixed rate accounts!ForumUser7 said:Atom Bank have also released a 3 year at 4.75%, and now a 5 year at 5%!

According to the MoneyFacts article, this is the 'first provider in over 10 years to list a fixed bond at 5% AER'. atom-bank-five-year-fixed-rate 1

1 -

The mighty Atom has stolen at least some of Santander’s thunder with the 5% rate for 5 yrs and Coventry’s latest set of fixed savings rates has stolen some more!2

-

Didn't notice that! Any clue why? Perhaps because the rates are so high and the terms are quite long? I currently hold most of my savings in approx 3% easy access (an account I opened when I was under 18) and I had been hoping this rate would increase, but by waiting I'm probably missing out on quite a bit of interest. I think I'm going to start this Fixed Rate Bond Ladder plan I've heard so much about and invest little and often. That said, with FRB rates increasing all the time, I feel like I may be using lots of 14 day cancellation periods...cricidmuslibale said:

Very interesting (pun intended) that monthly interest (if allowed to compound) pays a little more than annual interest for the 2 year, 3 year and 5 year fixed rate accounts!ForumUser7 said:Atom Bank have also released a 3 year at 4.75%, and now a 5 year at 5%!

According to the MoneyFacts article, this is the 'first provider in over 10 years to list a fixed bond at 5% AER'. atom-bank-five-year-fixed-rate If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

Yes they are good rates, particularly the 3 year and 2.5 months fixed rate, but beware of Coventry’s usual trick of adding a couple of months or more on to the usual fixed rate period in order to appear to be offering a very generous fixed rate!ForumUser7 said:I'm also seeing on MoneyFacts that Coventry Building Society is releasing some new fixed rate bonds:

Approx 1 year Fixed Rate Bond (284) 31.12.2023 @ 4.40% AER

Approx 2 year Fixed Rate Bond (286) 31.12.2024 @ 4.70% AER

Approx 3 year Fixed Rate Bond (288) 31.12.2025 @ 4.85% AER

These rates appear to be table toppers (for now at least)!4 -

With the monthly interest rate, the percentage offered is the closest possible rate (to 2 decimal places) that would enable the same lump sum e.g. £1000 to earn the same amount of interest (if the monthly interest is left in the account to compound) as it would with annual interest compounding each year. Thus if the monthly interest for the 5 year fixed account was only 4.88%, for example, the final amount in the account would be not just lower than the final amount for annual interest but also further away from the annual amount than the quoted figure slightly higher than this annual amount that 4.89% monthly interest generates!ForumUser7 said:

Didn't notice that! Any clue why? Perhaps because the rates are so high and the terms are quite long? I currently hold most of my savings in approx 3% easy access (an account I opened when I was under 18) and I had been hoping this rate would increase, but by waiting I'm probably missing out on quite a bit of interest. I think I'm going to start this Fixed Rate Bond Ladder plan I've heard so much about and invest little and often. That said, with FRB rates increasing all the time, I feel like I may be using lots of 14 day cancellation periods...cricidmuslibale said:

Very interesting (pun intended) that monthly interest (if allowed to compound) pays a little more than annual interest for the 2 year, 3 year and 5 year fixed rate accounts!ForumUser7 said:Atom Bank have also released a 3 year at 4.75%, and now a 5 year at 5%!

According to the MoneyFacts article, this is the 'first provider in over 10 years to list a fixed bond at 5% AER'. atom-bank-five-year-fixed-rate

I think using a Fixed Rate Bond Ladder plan is a very good idea at the moment, until interest rates start to plateau at the top of the interest rate hill that’s presently being ascended.1 -

TomDolan said:Atom new fixed saver rates

6 months 3.2%

1yr 4.25%

2yr 4.6%

I only opened a 1yr yesterday @ 4.11% but they won't change to the new rate. Also they say they do not operate the 14 day cooling off period so I can't cancel. Caveat emptor.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards