We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Fixed Interest Savings Discussion Area

Comments

-

roose0 said:GB Bank offers 4.58% for a one year fixed bond.

https://www.gbbank.co.uk/savings/fixed-rate-bonds/1-year-fixed-rate-bond

Sigh dropped down to 4.3% now. Looking for a new home for my RBS fixed saver, which had pretty good rates when I opened it, but not anymore. Any experience with this Bank?0 -

GB Bank use the Newcastle Building Society outsourcing service in Wallsend, which is also used by the likes of Gatehouse. The apps look the same, the website looks the same, the letters look the same (they even have the same mistake in my address!), so if you've ever experienced a financial institution that uses NBS before, it's pretty much the same. It's not fancy, but it works.2

-

NS&I reducing 1 year GGBs and GIBs from today

- 1-year British Savings Bonds (Guaranteed Growth) 4.04% gross/AER

- 1-year British Savings Bonds (Guaranteed Income) 3.97% gross/4.04% AER

1 -

I struggle to see the point of these when the current 1-year fix rate is a fair few bps above their rate, and it's not like its exempt from income tax like PBs.ColdIron said:NS&I reducing 1 year GGBs and GIBs from today- 1-year British Savings Bonds (Guaranteed Growth) 4.04% gross/AER

- 1-year British Savings Bonds (Guaranteed Income) 3.97% gross/4.04% AER

5 -

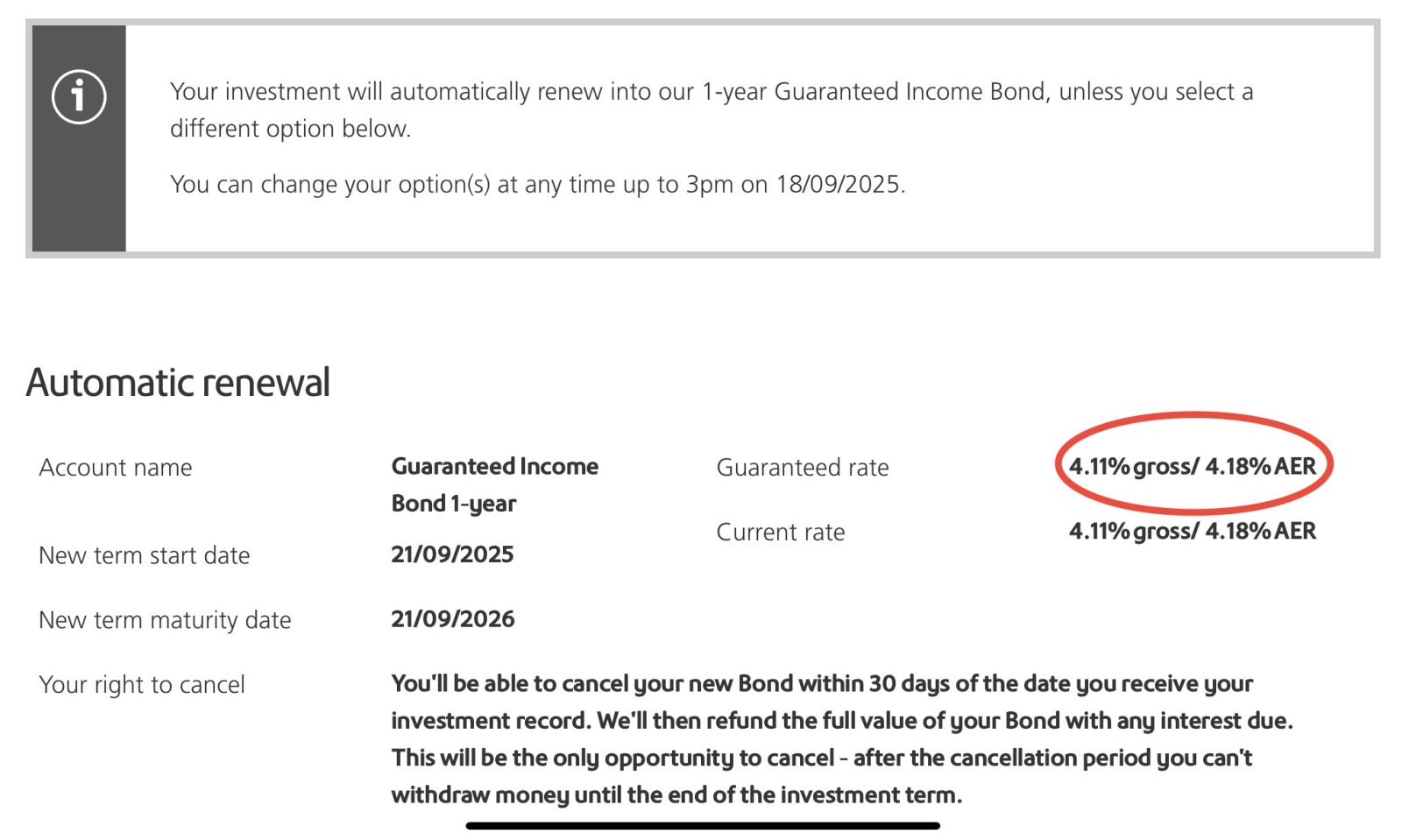

Agreed. My renewal offer is at 4.11% but think I’ll shop around before letting it roll overdcs34 said:

I struggle to see the point of these when the current 1-year fix rate is a fair few bps above their rate, and it's not like its exempt from income tax like PBs.ColdIron said:NS&I reducing 1 year GGBs and GIBs from today- 1-year British Savings Bonds (Guaranteed Growth) 4.04% gross/AER

- 1-year British Savings Bonds (Guaranteed Income) 3.97% gross/4.04% AER

3 -

I agree - I'm withdrawing my GGB that's about to mature and saving elsewhere this time but, for more cautious savers, the recently-offered 4.18% 1 year renewal rate is still better than anything you can get with the 'big names' on the high-street and even the current 4.04% offer puts it in the same ball-park as places like the Coop and some other (but localised) high-street building societies.dcs34 said:

I struggle to see the point of these when the current 1-year fix rate is a fair few bps above their rate, and it's not like its exempt from income tax like PBs.ColdIron said:NS&I reducing 1 year GGBs and GIBs from today- 1-year British Savings Bonds (Guaranteed Growth) 4.04% gross/AER

- 1-year British Savings Bonds (Guaranteed Income) 3.97% gross/4.04% AER

The reason I've had to look into this is that I've got an elderly relative who has an online account for Premium Bonds (out of necessity) but does no other online banking. When they were asking my advice about locking some money away a couple of years ago, I pointed them towards the 6.20% 1 year bond that NS&I were offering at the time (and the subsequent 5.15% bond that's just about to mature) and for them (approaching renewal time again), even though their 4.18% renewal offer isn't great compared to the very best available, it's a fair bit higher than they'd get with any of the banks and building societies found in their local town (I checked just to be sure).

8 -

Has anyone had experience with Afin Bank? I see they have a 1-year fixed rate at 4.52%.

https://afinbank.com/savings/fixed-saver/1-year/

https://www.moneysavingexpert.com/savings/savings-accounts-best-interest/#fixedsavings2 -

Just to update/remind of the latest oxbury range including 'existing customer' (which is easily obtained but otherwise not visible on comparison sites):(duration:%AER)3month: 4.196m: 4.411year: 4.292yr: 4.343yr: 4.444yr: 4.325yr: 4.313

-

Aww, they started their name with the wrong vowel.SeriousHoax said:Has anyone had experience with Afin Bank? I see they have a 1-year fixed rate at 4.52%.

https://afinbank.com/savings/fixed-saver/1-year/

https://www.moneysavingexpert.com/savings/savings-accounts-best-interest/#fixedsavings8 -

I have the same dilemma re. the GGBs (decision to be made tomorrow).refluxer said:

I agree - I'm withdrawing my GGB that's about to mature and saving elsewhere this time but, for more cautious savers, the recently-offered 4.18% 1 year renewal rate is still better than anything you can get with the 'big names' on the high-street and even the current 4.04% offer puts it in the same ball-park as places like the Coop and some other (but localised) high-street building societies.dcs34 said:

I struggle to see the point of these when the current 1-year fix rate is a fair few bps above their rate, and it's not like its exempt from income tax like PBs.ColdIron said:NS&I reducing 1 year GGBs and GIBs from today- 1-year British Savings Bonds (Guaranteed Growth) 4.04% gross/AER

- 1-year British Savings Bonds (Guaranteed Income) 3.97% gross/4.04% AER

As you say, the guaranteed 4.18% renewal rate is better than some around, but I can see for example the 4.5% 1 year and 4.4% 2 year fixes from Chetwood bank, which are obviously both higher.

Chetwood has FSCS protection; it's just a question of the crystal ball as to what interest rates are likely to be in a year's time! (Also, interest is added on each anniversary for the 2 year, so I assume it would be credited for tthe purposes of income tax calculations in that tax year even if not accessible ... )1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards