We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Why are so many landlords now selling up do they anticipate a housing market crash coming?

Comments

-

I have sufficient allowance left to feed around £16 per year into my pension. That gives me a 25% uplift from the day it goes in. Then there is my share ISA. £20K a year over the next few years into my ISA keeps it away from the tax man. So I will probably plan to keep enough in cash to max out my pension and ISA for the next three years. The remainder will go into equities via a GIA.solidpro said:0 -

I have been following the same thought process. I worked out the money in a £300k property over 20 years, despite being 'inflation proof' was significantly less at the end than an index tracker.

However, I since learned that basing such a calculation on 'past performance' is entirely subjective. On one, hand, what else can I do but look at the last 20 years? Well I could look at the 1960s-1980s and see that an index tracker would have made exactly nothing in 20 years.

So who knows. My only real, definitive, conclusion is that if you're lucky enough to not have to morgage a BTL, the income from the rent on a BTL, mitigated as much as possible through a Ltd company and having little other forms of income, is immediate, whereas the income from the index tracker SIPP/ISA has to wait 20 years and is by no means guaranteed.0 -

There is no question that the tax treatment and regulations are currently very much driving out landlords with 1-2 properties in their own name - even worse if they are a high rate tax payer. In some ways this is not all bad as its resulting in more LTD companies with 5+ properties and a more professional approach. I can see why the govt would want to have the PRS run by business's rather than individuals along similar lines to student accomodation over recent years.

Given this environment the high earning folks with 1-2 properties on the side are seeing that stock investments in ISA/SIPP are getting tax incentives while BTL are getting tax dis-incentives.

I have bought 2 more properties in the last 2 years in my LTD company and I am aware of other landlords who are switching to LTD as well. I think there was a stat the LTD BTL mortgages have shot multiple fold in the last couple of years.

So the short answer is that landlords are either going big/professional or selling up.. I think if the govt go after BTL LTD companies then that will more likely have a bigger impact

I do agree with a previous poster that the increasing regulations are making things difficult for landlords so don't blame those who want to cash in and get out.,0 -

There are many musings on the subject of the upward direction of travel of stocks over time, such as the following…

https://occaminvesting.co.uk/why-do-stocks-go-up/

…which is of course not to say that returns are guaranteed, far from it. However I am comforted to know that with a 20+ year time horizon, I’d have to be exceedingly unlucky to be dramatically outperformed by BTL.

In all honesty, even if somebody told me in advance the BTL would outperform investment in equities by 10%, I genuinely think I might still ditch the BTL because of the hassle. I value taking the path of least resistance as often as possible in life quite highly.1 -

AIUI, if the property has not gained in value, the liability for CGT will be NIL.MEM62 said:My motivation for selling is that the value is not increasing yet my liability for CGT is. (In fact, it is currently worth around £40K less than it was at the time we bought the house almost six years ago.)0 -

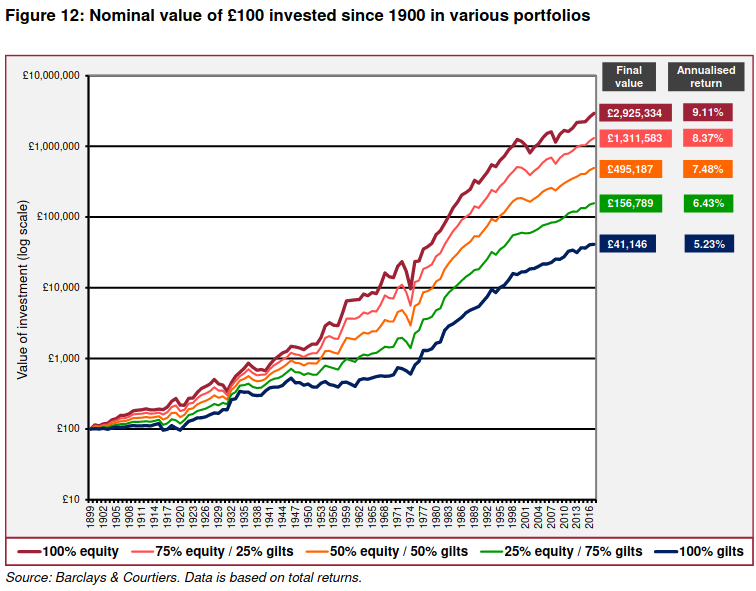

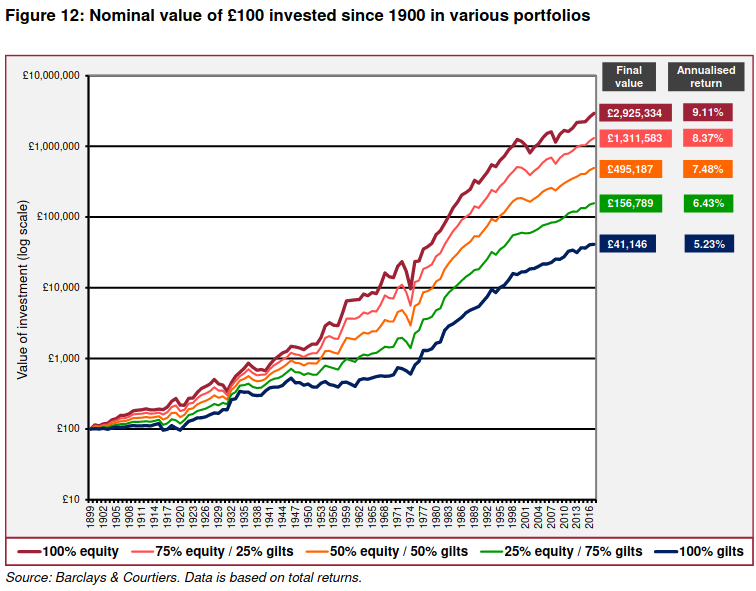

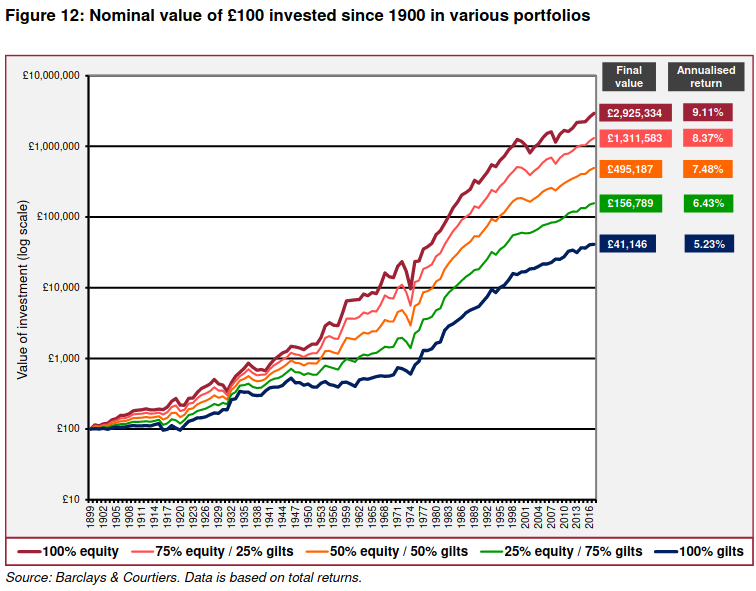

solidpro said:However, I since learned that basing such a calculation on 'past performance' is entirely subjective. On one, hand, what else can I do but look at the last 20 years? Well I could look at the 1960s-1980s and see that an index tracker would have made exactly nothing in 20 years.Where did you get the data for 1960-1980 please? Was it just the value of the index, or did it include dividends? It seems to be at odds with data I've seen, for example:

0

0 -

I guess it depends on location then. Mine has gone from £600 to £850 as the market rent in the last decade.MEM62 said:

The market rate for my property has not changed in nearly six years. Yet, my tax liability, expenses and running costs have all increased over that period.jimjames said:

Rent is one item that should be kept in line with other rises so should be able to track inflation, at least over medium term.coypondboy said:Landlords selling up as rising interest rates and inflation kill the market any thoughts if you are a landlord at the moment?

EDIT - looking at local rents I'm rather underpricing, nothing available under £950, most around £1000.Remember the saying: if it looks too good to be true it almost certainly is.0 -

It'll be this with the total returns showing flat periods around 1960-80.masonic said:solidpro said:However, I since learned that basing such a calculation on 'past performance' is entirely subjective. On one, hand, what else can I do but look at the last 20 years? Well I could look at the 1960s-1980s and see that an index tracker would have made exactly nothing in 20 years.Where did you get the data for 1960-1980 please? Was it just the value of the index, or did it include dividends? It seems to be at odds with data I've seen, for example:

FGg7rdIXMAsRMQq (900×510) (twimg.com)

Adjust the chart to 1960-80. Yearly data also linked.

S&P 500 Index - 90 Year Historical Chart | MacroTrends

MSCI World goes to 1969.

MSCI World - Wikipedia

1 -

coastline said:

It'll be this with the total returns showing flat periods around 1960-80.masonic said:solidpro said:However, I since learned that basing such a calculation on 'past performance' is entirely subjective. On one, hand, what else can I do but look at the last 20 years? Well I could look at the 1960s-1980s and see that an index tracker would have made exactly nothing in 20 years.Where did you get the data for 1960-1980 please? Was it just the value of the index, or did it include dividends? It seems to be at odds with data I've seen, for example:

FGg7rdIXMAsRMQq (900×510) (twimg.com)

Adjust the chart to 1960-80. Yearly data also linked.

S&P 500 Index - 90 Year Historical Chart | MacroTrends

MSCI World goes to 1969.

MSCI World - WikipediaThanks, yes that's the trouble with single country investing, it seems the rest of the world didn't fare as badly on average over that period. The Austrian market has a much worse record as noted often in the Barclays Equity and Gilt study. With S&P500 valuations at such a high, there's every reason to think there will be an absence of real returns there during the next decade or so.Data for global markets from 1900 exists, as it has been used in Tim Hale's book amongst others. Based on that data, the odds of a 20 year period not giving rise to a positive real return is <1 in 10 (but says the same of losses over 30 and 40 year periods, which to the best of my knowledge are unprecedented). Would be nice to see the underlying data, but it doesn't seem to be freely available.1 -

The property has gained significantly in value since I purchased in in 1987 so I will absolutely have a CGT liability.Grumpy_chap said:

AIUI, if the property has not gained in value, the liability for CGT will be NIL.MEM62 said:My motivation for selling is that the value is not increasing yet my liability for CGT is. (In fact, it is currently worth around £40K less than it was at the time we bought the house almost six years ago.)0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards