We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Self Assessment: HMRC refunded tax and then want me to refund it back again??

fuzexi

Posts: 40 Forumite

in Cutting tax

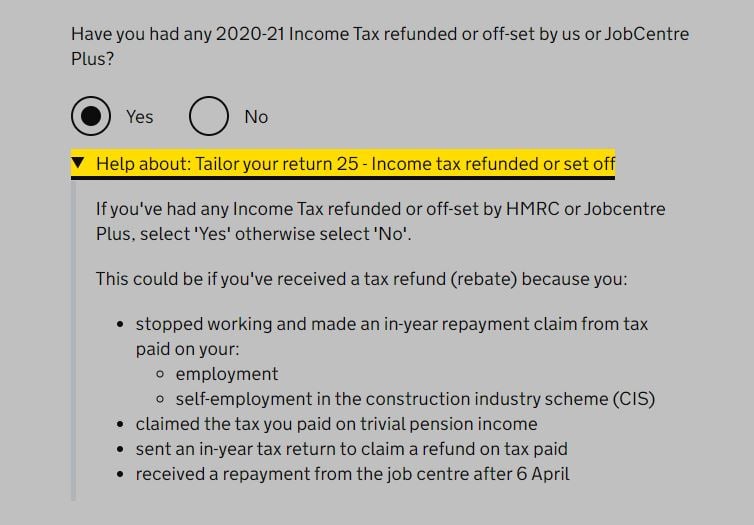

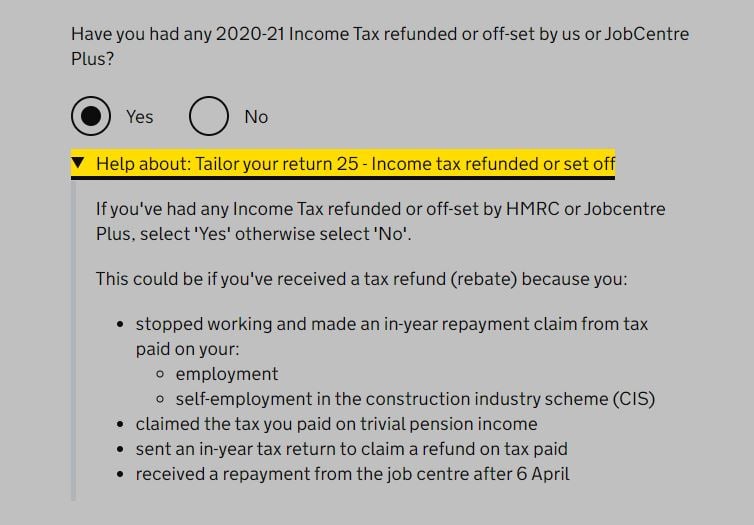

Filling in my tax return, and got presented with the following question, which I thought I understood:

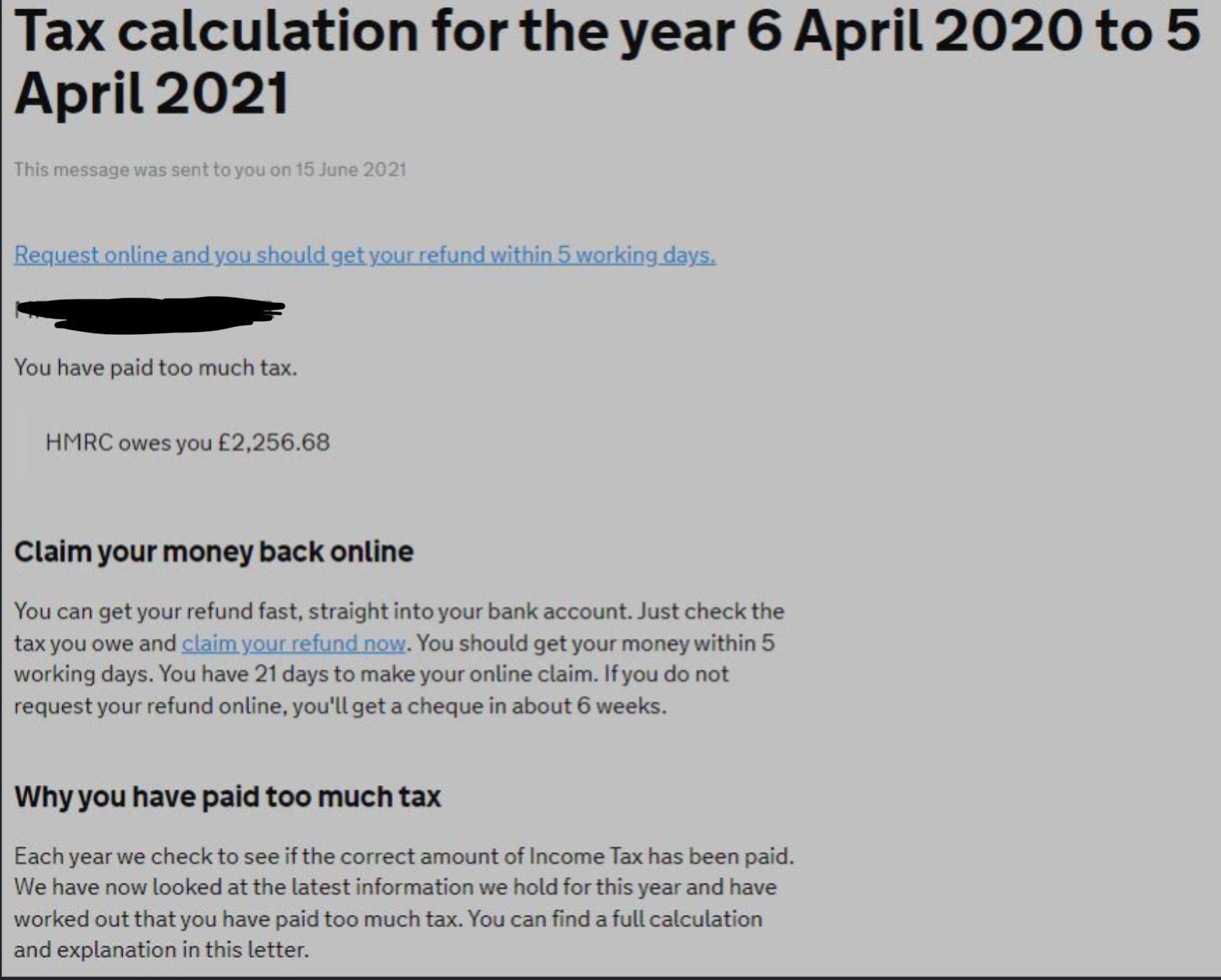

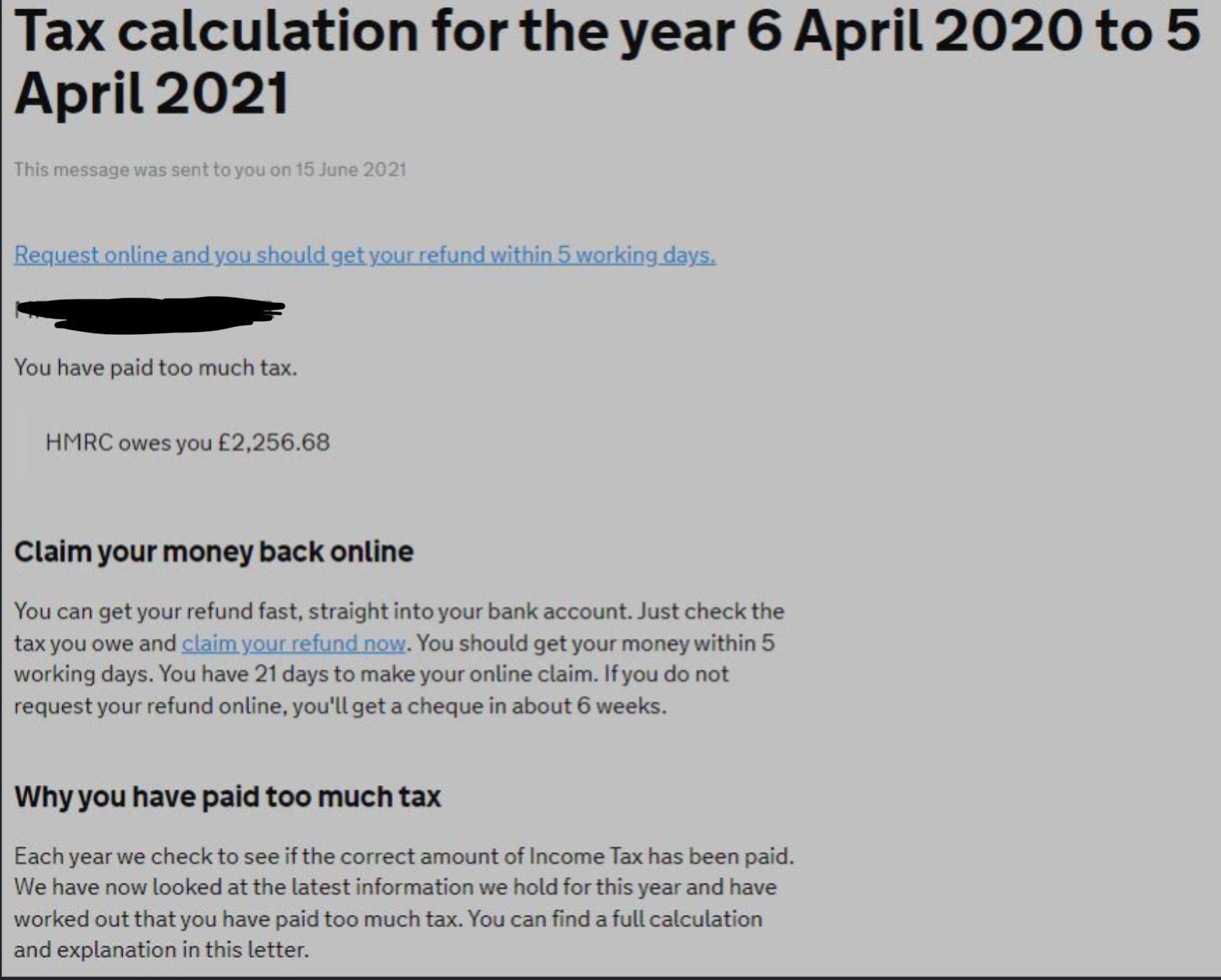

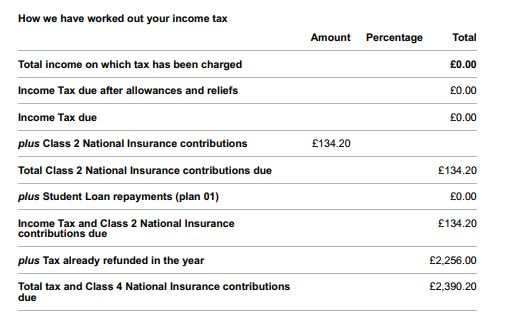

I thought it did until I saw my tax calculation...

I then declared this to Universal Credit, who then gave me nothing for that month because I had "too much earnings" (I lost about £1.8k)

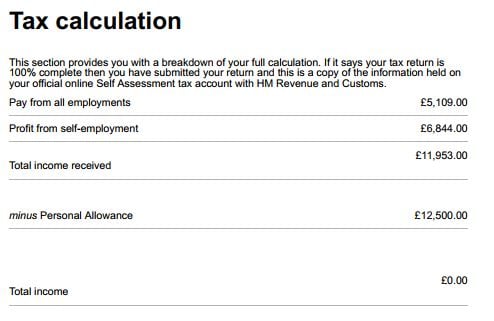

Now, it looks like HMRC are wanting to take the money back, by taxing me £2,390 when I only earned just under £12k.

It's like, they give me £2,390, then UC take it away, then HMRC ask for it back again. So I paid twice. Why refund me taxes when you are going to ask for it back again???

Don't understand....

Does this:

......refer to this?

I thought it did until I saw my tax calculation...

If it does, then it's really weird and I think unfair:

I got this surprise letter from HMRC this year, and they put money in my account. I didn't claim it, they just paid it.I then declared this to Universal Credit, who then gave me nothing for that month because I had "too much earnings" (I lost about £1.8k)

Now, it looks like HMRC are wanting to take the money back, by taxing me £2,390 when I only earned just under £12k.

It's like, they give me £2,390, then UC take it away, then HMRC ask for it back again. So I paid twice. Why refund me taxes when you are going to ask for it back again???

Don't understand....

0

Comments

-

HMRC don't transfer money to bank accounts like that.

You either claim it i.e. you put your your bank details in for them to pay to or they send you a cheque.

You wil be claiming credit for the tax (PAYE?) on your return, that question is simply to ensure you declare that it has been repaid to you by HMRC.

Have you a really got to the end of your Self Assessment calculation?0 -

Yes - what happens at the end of the calculation? Is it not simply to prevent you getting this refund twice over?0

-

Just realised that you had another thread earlier - could it be that the original refund should not have been made given that you have self-employment to declare?

https://forums.moneysavingexpert.com/discussion/6330078/completing-online-tax-return-for-both-employed-and-self-employed#latest

0 -

Yes, you're right. They sent me a cheque, now I remember. So I put it in the bank,

I don't understand what "claiming credit for the tax" means, but I did get to the end of of the calculation, and it said they I would have to pay £2,390.

I must have done something wrong when doing the self-assessment, surely?

0 -

If you have completed the return correctly then you owe £2390.20.

But I suspect you haven't.

How many employment pages have you completed?

How much taxed interest have you declared?0 -

Did you include the tax paid at your employment in the relevant section as I advised earlier or did you just include the income?

It looks like you haven’t.0 -

I made two employment pages: 1 for my casual worker employment, and one for my self-employment as an online teacher.

I haven't hid any earnings, and the self-employment started in April 2020.

I think I must have made a mistake but I don't know where. I really tried my best.

0

0 -

If you check the other thread Dazed you will see that the op was attempting to put the PAYE income in the self-employed section. I suspect that this income has now been correctly entered on the employment pages, but not the tax that was deducted (which created the earlier refund).Dazed_and_C0nfused said:If you have completed the return correctly then you owe £2390.20.

But I suspect you haven't.

How many employment pages have you completed?

How much taxed interest have you declared?0 -

Ok, you could be right there![Deleted User] said:

If you check the other thread Dazed you will see that the op was attempting to put the PAYE income in the self-employed section. I suspect that this income has now been correctly entered on the employment pages, but not the tax that was deducted (which created the earlier refund).Dazed_and_C0nfused said:If you have completed the return correctly then you owe £2390.20.

But I suspect you haven't.

How many employment pages have you completed?

How much taxed interest have you declared?

0 -

Perhaps - although that was a sizeable amount of tax deducted - more than 40%!Dazed_and_C0nfused said:

Ok, you could be right there![Deleted User] said:

If you check the other thread Dazed you will see that the op was attempting to put the PAYE income in the self-employed section. I suspect that this income has now been correctly entered on the employment pages, but not the tax that was deducted (which created the earlier refund).Dazed_and_C0nfused said:If you have completed the return correctly then you owe £2390.20.

But I suspect you haven't.

How many employment pages have you completed?

How much taxed interest have you declared?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards