We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Best place to invest cash

Comments

-

What's going to happen in 6 years? You'll spend all the money you have?

If you can really only invest for 6 years then I would suggest looking at savings: Premium Bonds and fixed rate accounts. You can also put some of it in high interest current accounts though you only make interest on small amount of holdings there (for example you can have up to 3 Virgin Money current accounts, which pay 2.02% on up to £1,000 in each.

If you want to invest you should look at keeping your money invested for 10 years or more.0 -

In a Brenda from Bristol voice: Not another one!

2 -

You should invest a few pounds in a financial magazine at your local newsagents.

There are more investment choices than you can shake a stick at. If you want to get started next week you can consider investing £100 in premium bonds, £100 in a FTSE stock through a low cost broker and £100 in a large, mainstream fund. You should not invest large amounts unless/until you have done some research. It's quite possible to lose £20k in a few months if you make bad choices.0 -

Generally on this forum, many would suggest to only invest if you can tie it up for "10 years" or more. However, the experts who do this for a living i.e. fund managers say 5 years is enough.

I can only assume that those who say 10-20 years are probably investing into index trackers and value shares, hence the extrodinary timeframe.1 -

There's no binary switch that says that investing for less than n years is a problem but more than n years is fine - it's all about risk management, probability and a spectrum of outcomes. Many people will have come out ahead after investing for days or weeks, but obviously more will win on average if investing for years and more still after decades.SharpShooter said:Generally on this forum, many would suggest to only invest if you can tie it up for "10 years" or more. However, the experts who do this for a living i.e. fund managers say 5 years is enough.

I can only assume that those who say 10-20 years are probably investing into index trackers and value shares, hence the extrodinary timeframe.

This Nutmeg study is often cited in support of this point:

In OP's case, the timeframe of 5/6 years might not be too much of an issue for the lump sum they have, but there's also a reference to ongoing drip-feeding, and so if there's a desire to access the whole pot in 5/6 years time, some of that won't have been invested for any time at all. The key thing is the degree of flexibility, i.e. if there's a specific event in 5/6 years time, for which all the money must be available, then that's more of a risk than if they may be able to delay accessing it for a few years if weak market conditions had depressed values....0 -

Don't ever recall a fund manager suggesting that. Fund managers often invest in companies with a 5 year time horizon in mind. That's a totally different perspective. Ignores the broader macro economic environment. That no one can forecast. Too many variables and uncertainties.SharpShooter said:However, the experts who do this for a living i.e. fund managers say 5 years is enough.0 -

The other side of the coin is that the longer you invest the more likely you are to suffer a catastrophic loss, e.g. due to losing a war, catastrophic climate change, massive volcanic eruption, asteroid strike, or simply a plague as infectious as Covid and fatal in most cases. The past hundred years in the US and UK is not typical of human history. The world economy cannot grow forever.0

-

SharpShooter said:Generally on this forum, many would suggest to only invest if you can tie it up for "10 years" or more. However, the experts who do this for a living i.e. fund managers say 5 years is enough.

I can only assume that those who say 10-20 years are probably investing into index trackers and value shares, hence the extrodinary timeframe.

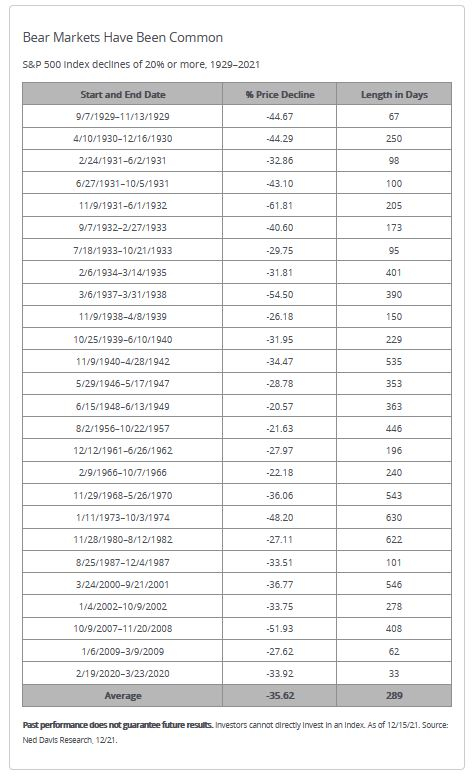

For Five years: it could be yes could be no. In the history of stock market between 1929-2021, a bear market could last up to two years with an avarage of 289 days.

Today, it has not been confirmed as a bear market. But Many have predicted it will be coming soon. What happen after 1-2 years of you start investing and the long bear market hit, your investment down 20%+ and still need to recover another 1-2 year to get to its original value ?

I know someone who invested his house deposit money for five years and losing money when selling his investment as he already needed that deposit to buy a house. But while losing money in his investment he gained from getting the house price cheaper as at the time house price is around the bottom.

There is always be a risk in investment. But what is the other alternatives?? Put it in premium bond ?? It is a guaranteed money losing strategy considering the growing of inflation in the coming years which is higher than bond yields.

0 -

You will get better info if you actually supply some info about yourself . Age , pension situation , mortgage etc etcVfrjohn said:Have just come into some spare cash ie 20k plus 1000 a month to invest for max 5to 6 years any suggestions and I don’t mind high risk thanks.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.8K Banking & Borrowing

- 253.4K Reduce Debt & Boost Income

- 454K Spending & Discounts

- 244.7K Work, Benefits & Business

- 600.2K Mortgages, Homes & Bills

- 177.3K Life & Family

- 258.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards