We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Funds vs Individual shares

Comments

-

coastline said:

I'm in and out all the time with ETF's, IT's and stocks but much of it is based on timing using charts and a bit of TA. Again a subject which get's the thumbs down by most. Not to worry my returns are much better than using the FA's I had years ago.Could you share what platform/broker are you using, to avoid any fees including forex fees?? I know with eToro, you could avoid any fee including forex fees using US$ as a base currency. The problem here is the availability of the stocks on eToro are rather limited such as Chinese stocks, small cap high growth companies in Russell 2000, OTC penny stock even for penny stock exempt category.

Probably not, but just asking is it possible to do it within the ISA/SIPP wrapper and avoid any fees when trading a US stock including forex fees?? I am aware that ISA/SIPP have got to be in GBP. But some broker will waive those fees.

0 -

If only it was possible to buy the investments though.GeoffTF said:

No, a global tracker has long been and will always be the benchmark for investment. The theoretical framework dates back to CAPM in the early 1960s:Thrugelmir said:

Ten years ago no one was discussing global trackers. Exxon was never a high growth stock. Despite being the largest capitalised company in the world at the time.Audaxer said:

Interested to know what reward you get from taking more risk by investing in individual shares? For example how has your portfolio performed, net of all costs, over the past 5 and 10 years, compared to that of a global tracker?lozzy1965 said:Based on what I have read previously on this forum, here's a topic to get the emotions flowing!

I invest in individual shares. I am nearing retirement and wonder if I should lower my risk by moving to funds. The lowest fees I can find are 0.15% per annum. If I have a pot of £500K when I retire I will be quite well diversified in individual shares (not the 1000's of different shares worldwide that get mentioned as a 'benefit' of holding a fund - but a diversification I am happy with).

To switch it all into a fund at 0.15% would cost me £750 per year. If a platform charged that for me to belong to it, that would be considered extremely expensive, Why should I switch to funds?

Discuss...

Five years ago. Vanguard 60/40 was still the in fad.

In 5 years time I suspect we'll be back here discussing another as yet undetermined trade.

https://en.wikipedia.org/wiki/Capital_asset_pricing_model0 -

Sounds like a lot of work. I haven't done anything with my funds for the past 10 years and not that much before that either. I let my money work for me rather than me working for it.lozzy1965 said:Hmmm, I guess in the same way one 'trusts' a fund to invest sensibly or as stated, I trust to writers of the articles I read to have done the research for me. There's a certain amount of experience or maybe gut feeling as well. I probably spend an hour a day - every day - looking at trends, past performance, reading articles. That is not for everyone, but it interests me. I may have more time to do it when I am not working, or may have more interesting things to do when work isn't getting in the way!

It doesn't always work but you just have to be right 51% of the time.“So we beat on, boats against the current, borne back ceaselessly into the past.”2 -

It was work like that that lead to the creation of the first index funds. Vanguard Developed World ex UK has been on sale in the UK since 02/09/2014:Thrugelmir said:

If only it was possible to buy the investments though.GeoffTF said:

No, a global tracker has long been and will always be the benchmark for investment. The theoretical framework dates back to CAPM in the early 1960s:Thrugelmir said:

Ten years ago no one was discussing global trackers. Exxon was never a high growth stock. Despite being the largest capitalised company in the world at the time.Audaxer said:

Interested to know what reward you get from taking more risk by investing in individual shares? For example how has your portfolio performed, net of all costs, over the past 5 and 10 years, compared to that of a global tracker?lozzy1965 said:Based on what I have read previously on this forum, here's a topic to get the emotions flowing!

I invest in individual shares. I am nearing retirement and wonder if I should lower my risk by moving to funds. The lowest fees I can find are 0.15% per annum. If I have a pot of £500K when I retire I will be quite well diversified in individual shares (not the 1000's of different shares worldwide that get mentioned as a 'benefit' of holding a fund - but a diversification I am happy with).

To switch it all into a fund at 0.15% would cost me £750 per year. If a platform charged that for me to belong to it, that would be considered extremely expensive, Why should I switch to funds?

Discuss...

Five years ago. Vanguard 60/40 was still the in fad.

In 5 years time I suspect we'll be back here discussing another as yet undetermined trade.

https://en.wikipedia.org/wiki/Capital_asset_pricing_model

https://www.morningstar.co.uk/uk/funds/snapshot/snapshot.aspx?id=F00000UDZC&tab=13

I have held it since near the beginning. It would appear to be the case that rather than diversifying across the world, you decided that the UK market would be the best performer and put your money there. The UK turned out to be the worst performer. You would have beaten the global market if you had put your money in the US or India, but there was no way of knowing that in advance. The safest course of action is the spread your risk.0 -

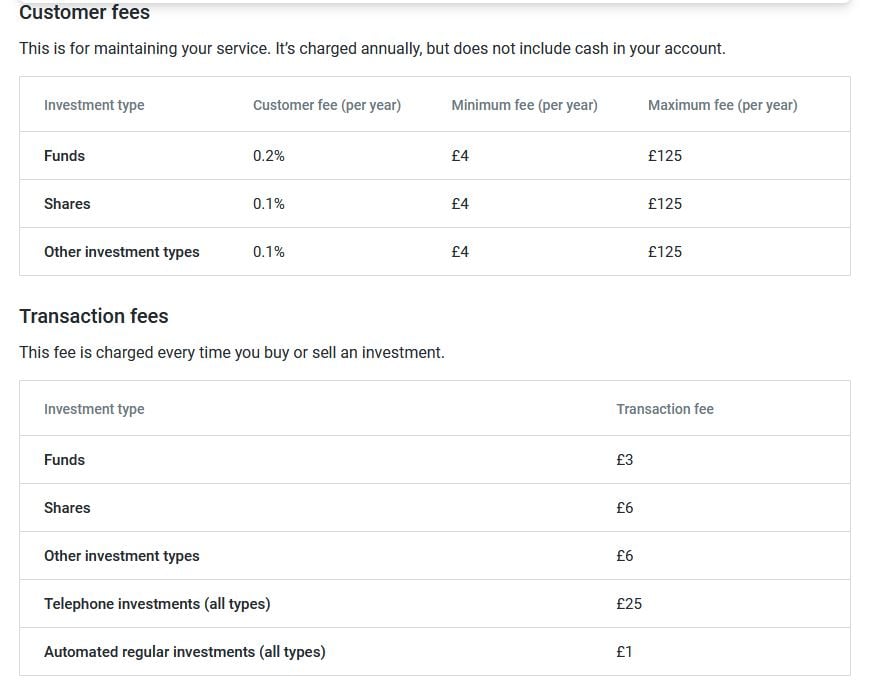

Not the cheapest but been with Barclays for years. All in ISA's and have a SIPP building up elsewhere. ISA dealing is £6 and annual fee 0.1%. If you are active you're saving on dealing as some are £10-12 ish. Never had problems quoting on busy days like reported on here by posters and they are using the price improver to gain a competitive price. You are better off if your broker uses as many market makers as possible. Overall it'll do for me. International trading is about to commence after a brokers Q and A recently.adindas said:coastline said:

I'm in and out all the time with ETF's, IT's and stocks but much of it is based on timing using charts and a bit of TA. Again a subject which get's the thumbs down by most. Not to worry my returns are much better than using the FA's I had years ago.Could you share what platform/broker are you using, to avoid any fees including forex fees?? I know with eToro, you could avoid any fee including forex fees using US$ as a base currency. The problem here is the availability of the stocks on eToro are rather limited such as Chinese stocks, small cap high growth companies in Russell 2000, OTC penny stock even for penny stock exempt category.

Probably not, but just asking is it possible to do it within the ISA/SIPP wrapper and avoid any fees when trading a US stock including forex fees?? I am aware that ISA/SIPP have got to be in GBP. But some broker will waive those fees.

Don't read company accounts just reports and updates. Research normally from various platforms and websites which issue future profit forecasts EG below.

TESCO PLC : Financial Data Forecasts Estimates and Expectations | TSCO | GB00BLGZ9862 | MarketScreener

The rest is down to charts which as I said on here will be laughed off as tea leaves etc. I watch the main indices daily again with charts and lower indicators. Basically clear the chart below and set with 10 day moving average just as a guide. Lower indicators set with RSI but mainly use Slow Stochastic and Williams %R. Buy at the extremes and sell when you're happy with what you've got . Nothing wrong with a quick 5% after all the MSCI world index is averaging around 10% since launch decades ago and the best fund performance since inception is around 13.5% ? Hard to pick funds which will keep up with the markets although the likes of Fundsmith and SMT seem to be doing something right. I trade the main tracker ETF's , ISF.L ,VWRL.L etc along with a few IT's and shares.

$INDU | SharpChart | StockCharts.com

A bit here what I do and going in the right direction. Posters probably don't believe it anyway but I was asked so it's here as live as can be.

This isn't day trading it's buying and selling over a period of weeks/months. Basically you'll need a decent sum to absorb your ETF dealing fee of £6 a go. No platform ticks all the boxes.

Economy crash =/= stock market crash? - Page 40 — MoneySavingExpert Forum

2 -

coastline said:Not the cheapest but been with Barclays for years. All in ISA's and have a SIPP building up elsewhere. ISA dealing is £6 and annual fee 0.1%. If you are active you're saving on dealing as some are £10-12 ish. Never had problems quoting on busy days like reported on here by posters and they are using the price improver to gain a competitive price. You are better off if your broker uses as many market makers as possible. Overall it'll do for me. International trading is about to commence after a brokers Q and A recently.

Each to their own looking into this table of fees structure, If you are and active investor/trader you will avoid Barclay for this purpose. To make it simple, you are trading 100x shares (open/close position) in a month (this could be a small transanction valued of US$100-200 for each transaction) it will cost you $6*100+=$600+/month. This is just for share dealing fees alone you have not included the platform fees, forex fees, etc. It might be a capping (I have not investigated it) but even with capping that fees are still high like fee structures of other major platforms.

For active retail investor/trader, the fees are the real killers. Your profit will be eaten day by day by the fees, literally you make money for them using your own money, not making money for yourself. If you are a buy and hold type LT investor that share dealing/transaction fees are not really a big deal.

0 -

Not that old FTSE100 mantra again. Markets are broad and diverse. More than one way to skin a cat. Though do I agree that the average investor is best suited to a diverse multi asset fund. A little knowledge is a dangerous thing. Results in assumptions and misunderstanding. Leading to seeking confirmation bias for ones own investment choices. Personally I'm comfortable with my own style. Though it has taken decades to evolve. You'll never stop learning is my motto.GeoffTF said:

It was work like that that lead to the creation of the first index funds. Vanguard Developed World ex UK has been on sale in the UK since 02/09/2014:Thrugelmir said:

If only it was possible to buy the investments though.GeoffTF said:

No, a global tracker has long been and will always be the benchmark for investment. The theoretical framework dates back to CAPM in the early 1960s:Thrugelmir said:

Ten years ago no one was discussing global trackers. Exxon was never a high growth stock. Despite being the largest capitalised company in the world at the time.Audaxer said:

Interested to know what reward you get from taking more risk by investing in individual shares? For example how has your portfolio performed, net of all costs, over the past 5 and 10 years, compared to that of a global tracker?lozzy1965 said:Based on what I have read previously on this forum, here's a topic to get the emotions flowing!

I invest in individual shares. I am nearing retirement and wonder if I should lower my risk by moving to funds. The lowest fees I can find are 0.15% per annum. If I have a pot of £500K when I retire I will be quite well diversified in individual shares (not the 1000's of different shares worldwide that get mentioned as a 'benefit' of holding a fund - but a diversification I am happy with).

To switch it all into a fund at 0.15% would cost me £750 per year. If a platform charged that for me to belong to it, that would be considered extremely expensive, Why should I switch to funds?

Discuss...

Five years ago. Vanguard 60/40 was still the in fad.

In 5 years time I suspect we'll be back here discussing another as yet undetermined trade.

https://en.wikipedia.org/wiki/Capital_asset_pricing_model

https://www.morningstar.co.uk/uk/funds/snapshot/snapshot.aspx?id=F00000UDZC&tab=13

I have held it since near the beginning. It would appear to be the case that rather than diversifying across the world, you decided that the UK market would be the best performer and put your money there. The UK turned out to be the worst performer. You would have beaten the global market if you had put your money in the US or India, but there was no way of knowing that in advance. The safest course of action is the spread your risk.1 -

FTSE 250 performance is comparable to VLS100% Equity (if not better). IMO, It has a better potential to grow faster than VLS100 if your base line is COVID-19 pandemic 2020 in the near future. FTSE 250 is already higher than pre-COVID19 but it has not been running as high as VLS100, so more room to grow faster than VLS100% Equity. After it reaches it potential and running out of steam switch it to a more diversified funds to reduce risk.Thrugelmir said:

Not that old FTSE100 mantra again. Markets are broad and diverse. More than one way to skin a cat. Though do I agree that the average investor is best suited to a diverse multi asset fund. A little knowledge is a dangerous thing. Results in assumptions and misunderstanding. Leading to seeking confirmation bias for ones own investment choices. Personally I'm comfortable with my own style. Though it has taken decades to evolve. You'll never stop learning is my motto.GeoffTF said:

It was work like that that lead to the creation of the first index funds. Vanguard Developed World ex UK has been on sale in the UK since 02/09/2014:Thrugelmir said:

If only it was possible to buy the investments though.GeoffTF said:

No, a global tracker has long been and will always be the benchmark for investment. The theoretical framework dates back to CAPM in the early 1960s:Thrugelmir said:

Ten years ago no one was discussing global trackers. Exxon was never a high growth stock. Despite being the largest capitalised company in the world at the time.Audaxer said:

Interested to know what reward you get from taking more risk by investing in individual shares? For example how has your portfolio performed, net of all costs, over the past 5 and 10 years, compared to that of a global tracker?lozzy1965 said:Based on what I have read previously on this forum, here's a topic to get the emotions flowing!

I invest in individual shares. I am nearing retirement and wonder if I should lower my risk by moving to funds. The lowest fees I can find are 0.15% per annum. If I have a pot of £500K when I retire I will be quite well diversified in individual shares (not the 1000's of different shares worldwide that get mentioned as a 'benefit' of holding a fund - but a diversification I am happy with).

To switch it all into a fund at 0.15% would cost me £750 per year. If a platform charged that for me to belong to it, that would be considered extremely expensive, Why should I switch to funds?

Discuss...

Five years ago. Vanguard 60/40 was still the in fad.

In 5 years time I suspect we'll be back here discussing another as yet undetermined trade.

https://en.wikipedia.org/wiki/Capital_asset_pricing_model

https://www.morningstar.co.uk/uk/funds/snapshot/snapshot.aspx?id=F00000UDZC&tab=13

I have held it since near the beginning. It would appear to be the case that rather than diversifying across the world, you decided that the UK market would be the best performer and put your money there. The UK turned out to be the worst performer. You would have beaten the global market if you had put your money in the US or India, but there was no way of knowing that in advance. The safest course of action is the spread your risk.

1 -

Just retired

Don't feel any different. Sticking 100% with individual shares. Have held many for more than ten years. All else being equal, they should outperform the funds they are in.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards