We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

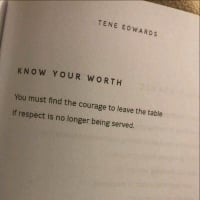

The last obstacale: it's the path.

Comments

-

I've never really thought about which % of my salary goes where... after a rough calc I think I'm a bit out of whack as I have 40% needs, 15% wants and 45% debts/saving. But I'm fairly happy that I'm shifting my debt at this rate and once it's clear then I might look at doing the 50/30/20 method, thanks for suggesting it.

Good luck giving up smoking, I've never smoked but my parents found it tough.

LMDxLife gets in the way...PADding is addictive...Saving's better than spending...My savings diary - Now for a healthier, wealthier me2025 1p challenge #41 | Cash envelope challenge #01 | SPC #017EF £1000/£1000 | Sabbatical £4055/£60002 -

@LittleMissDetermined I saw the 50/30/20 method here on the forum somewhere and then googled it a lot! One of my downfalls after clearing debt previously, I never had a plan after it had gone. I am hoping this method will provide a framework for that, and not overspend!

Only 40% on needs is impressive.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)1 -

I will do a bit of research and look into it more, thank you

I am fortunate to have a good salary, something that I will never take for granted again. During Covid I got used to living quite frugally and I hope this will continue once my debt is cleared. I have made a bit of a wish list for some (expensive) things I would like to buy once the debt is gone but I will save for these.

After the debt is gone I will start overpaying on the mortgage and my pension. That seems a sensible way to invest for my future.

LMD xLife gets in the way...PADding is addictive...Saving's better than spending...My savings diary - Now for a healthier, wealthier me2025 1p challenge #41 | Cash envelope challenge #01 | SPC #017EF £1000/£1000 | Sabbatical £4055/£60002 -

Good luck on giving up smoking. I have never smoked but I know people do generally find it tough. I would struggle to get on board with spending £150 on cigarettes which just go up in smoke though so all the best wishes in the world for giving up.

I used to break our income into percentages when working but interesting enough after retiring early our breakdown is more like 40% needs, 20% savings and 40% wants so the wants is higher than when we were working. I think when you retire early and your needs are met somehow saving for the future takes a back seat for wants for the present as time seems to be running out.I’m a Forum Ambassador and I support the Forum Team on the Debt free Wannabe, Budgeting and Banking and Savings and Investment boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

The 365 Day 1p Challenge 2025 #1 £667.95/£667.95

Save £12k in 2025 #1 £12000/£150005 -

So I am entering into day 5 of not smoking, it's going well. Definitely, the medication I am taking is helping.

Generally though, finances in a bit of a mess, well and truly overspent.

Redone budget for next month, loads of it was wrong...oops.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)2 -

Well done on stopping. If you have made it this far you are a good way down the path of being forever smoke free. When I left my ex I knew I couldn't afford to rent and smoke and that was some serious motivation to kick a 20 year habit. 10 years later I wish I'd done both sooner.

Good luck with the rest of your debt free journey you're doing a fab job !!2 -

Dear diary,

I have been absent for some time, but all is far from lost. I have given myself some nice things, looked after myself and stood up for myself. It's been a funny old time of learning about myself, not all of it comfortable. Here are the wins.

1. I am a non smoker - 3 months now.

2. Caught up with my sisters post COVID and professional thing

3. I have had a bit of time away, Bristol and Cornwall. I have made new memories.

4. I have learned more about my spending, the spending that got me into debt, over and over. I haven't used my CC's since April 2020, and having time away and using actual money I have has really let me see how I just spent, spent and spent. I have myself a daily budget, I wasn't extravagant - really, but boy of boy the money just falls out of my purse. I can really see how I got into debt, and overspent when I wasn't in debt, taking me back into debt.

5. I have put a boundary in at work. Last October I was asked to 'step up' and this will be followed by remuneration. This has not arrived. I have increased my workload and taken on more responsibility and my workload is unmanageable. Roles and responsibilities are unclear. This has caused me a lot of turmoil. I have though, informed my bosses boss that I will need to return to my usual role if the promotion is not forthcoming in a timely way, there is some other stuff too, about terms ad conditions, (London weighting). The boundary is the end of August.

I earn a lot of money, I have good earning potential. I want to buy a cottage in the Midlands. I am in debt and I need to save a deposit. If the promotion doesn't arrive I am going to do a day as a sole trader to get my deposit. Apparently, this was interpreted as me being motivated by money. I am motivated by securing my future, now that I see clearly how to do that. I can't do 2 people's work and a day self-employed to build some savings.

I am on annual leave for another week and today is my last 'big splurge' - to see Duran Duran at Hyde Park. Then back to more frugal ways.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)0 -

I signed a letter today for London Clinic Allowance - its 6.5K a year, it really should pay most of my commute, even after tax. So delighted...incoming in August payday.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)2 -

I paid £815 off the credit card yesterday. Still 25% ish of the original figure to pay - determined to get rid of this by the end of the year. So refocusing. Hardline frugality again.

The main points of action are:

- No bought coffee or lunches at work

- No lottery tickets

- When there is £5 in my change pot in M0nz0 > goes on the CC - I used to do this, it really helped with the psychology of focussing on the debt.

Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)0 -

@DrCarrie just wondering how you are? Have subscribed and am really looking forward to following your journey. I'm shocked that your extra responsibilities weren't followed by the extra pay promised and then that emotional pressure was piled onto you! Good for you for asserting yourself as this deffo helps in dealing with stress. Love Humdinger x1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards