We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The last obstacale: it's the path.

Comments

-

So, I have re-worked my budget a bit more, gave myself some more wriggle room.

Balance transfer made. Need to pay the Tax Bill.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)1 -

Ok...so Tax bill paid. Won £25 on the Premium bonds.

Also, put a deposit on a Holiday in Italy - October. A yoga week.

Been at work 2 days and yoga the same 2 days -IRL on the 5.06. train and on the yoga mat at 6.30, at my desk 8.50. Intense. Been at work 2 days this year already, was at work for 2 days of the previous 22 months. - a lit o '2's there.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)2 -

Fantastic work on your debt busting so far. I think we're in the same neck of the woods and I love the beach for a good walk too!1

-

@elbree - Many thanks for your words. I am in Brighton.

Had a bit of a blow yesterday - a rent increase of £70pcm which is 8.5%. I haven't had an increase since I moved here 4.5 years ago, so I guess it's not so bad. But will need to re-jig the budget.

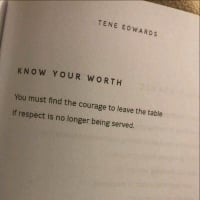

Been noticing a real change in spending habits, now that restrictions are lifting, there are things that I would normally book immediately and put on the CC - yoga weekends as an example. This would come out of my holiday budget now, and I am focused on what I really do have a budget for, and what my priorities are. It is quite a shift from my previous behaviour, really am understanding why I got in so much debt and as a result, changed my relationship with money.

Feel a bit proud of myself, and also deflated that even though I earn a fair amount of money, I can't do everything I want to do. It's a big lesson. Adjusting expectations on my lifestyle is really a very big lesson.

Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)6 -

This was a tough lesson I had to learn too - most of my debt was built up just from assuming I could afford stuff because I was earning decent money. Life on the other side of that realisation is much less stressful though!DrCarrie said:It is quite a shift from my previous behaviour, really am understanding why I got in so much debt and as a result, changed my relationship with money.

Feel a bit proud of myself, and also deflated that even though I earn a fair amount of money, I can't do everything I want to do. It's a big lesson. Adjusting expectations on my lifestyle is really a very big lesson.Debt at LBM (Dec 2018): £23,167

Debt free Feb 20213 -

Thank you @astrocytic_kitten, its such a hard lesson! Hopefully, it will ease, with practice.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)2 -

I find the important thing to think is you can have what you want - as long as you REALLY want it! i.e. are prepared to go without something else. No-one gets everything they want after all.

Someone's signature on here says 'stop giving up what you really want, for what you want right now' and that is SO me and my Am@zon habit.5 -

Living expenses up another £60 a month with Gas and Electric increased DD, that's £150 increase pcm with the aforementioned rent increase, from last month.

Will need to rejig the 'wants' budget' certainly will not be 30% of my income as per the model - I meat it hasn't been that since I started that way of budgeting (50/30/20).

I was out on a walk last week after fiddling with the budget, the biggest expense in the wants category is £150 for smoking! I had wanted to put that in the essentials but really had to recognise that this is not essential at all, quite the reverse. Spending £150 on killing myself a month is not essential.

So I have decided to give up, on the 4th of July. Need to change my doctor to get some medication to help and I will be on 2 weeks leave so the worst of the irritability will have passed. I plan on doing a lot of walking!Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)1 -

Goodness, it's been a while.

Updates: been in a bit of a pit since I had a big, planned spend up earlier this month, found it difficult to get the spending back in line. I mean I haven't used a CC, but I definitely noticed a change in attitude to spending after I had a splurge.

- I bought some clothes but not many

- I went for a treat makeover and spent a fair bit on make-up

- I had my eyes tested (for the first time in 5 years) got sunglasses and glasses and a trial of varifocal contact lenses

I was so looking forward to the splurge, and then I just felt so weird! A bit out of control.

In other news, the final step of the professional thing that I have had going on for 19 months appears to be done. I am exhausted with the relief of that. But now need to process it, so off to therapy I go next week (that's quite expensive), but bow budgeted for.

Instead of buying tobacco when my wages came in, I ordered a private prescription for Zyban, I just didn't want to spend another £150 on smoking, so my give-up day is now Good Friday.

Had a big re-jig of my budget. Needs now 52.1% (cut the food budget), wants now 23% and debts saving 24.9%, of my take-home salary. I want this to be 50/20/30.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)2 -

Really like the idea of splitting %’s of your needs/wants/savings. Sounds like you’re doing really wellApril 2020 - £102,222 Loans/CC’s.

Jan 2022 - £0

Cleared - £102,222

Jan 2022 - Now time to build suitable investments and a business!1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards