We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Losses on investments in shares

Comments

-

With individual companies it often really depends on the news. If it's been holed below the waterline because the well turned out to be dry or its promising new technology turns out to be a dud or uncommercial it's probably time to move on. If the price has fallen along with the rest of the market due to some generalised worry, panic or whatever but nothing has apparently fundamentally changed with the company's prospects then sure, keep holding. To repeat myself, it really depends.Retireby40 said:

Yes and he sells now, someone picks up his shares 30% cheaper and with more patience makes profit.Thrugelmir said:

The red will reflect the broader market view of the stock. Somebody has to be last to the party and end up on the wrong side of the trade. As to buy a stock somebody else has to sell. For every winner there's a loser. Trading isn't a one sided activity.Retireby40 said:

People were using individual shares as an example. The same can be used for anything. S&P 500 as well. Imagine he had knvested at 49....seen drop to 38 and thought let's sell.Thrugelmir said:

The OP has bought a number of individual shares though. We're not discussing the SP500.Retireby40 said:

S&P 500 Vanguard was at 49 before Covid. Dropped to like 38. Imagine thinking I've backed the wrong horse and selling only for a year or two later it sitting at 67.bostonerimus said:

The differences are volatility and risk.Retireby40 said:

Why are they any different. Imagine someone who had bought Amazon shares. Or Apple shares. Or Tesla shares years ago. You'd have been telling them at the first loss sell up quick and take the hit.Thrugelmir said:

Holding collective investments for the long term yes. Individual shares I'd say generally not. Company fortunes wax and wane rapidly. The markets will have the news well before retail investors ever do. Providing no opportunity to react. Actively trading shares requires one to be both watchful and nimble. Also not greedy.Retireby40 said:

Yes. If you sell. My point was 1 year you can be up, one year you can be down.Thrugelmir said:

If you are holding a stock that falls 20% then recovers 20%. You'll still be 4% down. To recover past losses the stock needs to rise 25%. That's basic mathematics.Retireby40 said:

Thanks. That's exactly my point. There's going to be years where you are down 20%. Other years up 20%. It seems to me that the OP has probably started investing and feels like he should cut his losses.DiamondLil said:The op's first sentence reads "Over the past 12 months I've started investing in stocks using trading 212."Not sure why posters arguing the point with @Retireby40 who states nothing more than that stated everywhere on this forum - investing is for the long term and not recommended for periods any shorter than five years, preferably ten years.He/she is suggesting exactly the mantra repeated on here every day that 12 months is not long enough to make a judgement.

When in reality he should probably hold and see what happens down the line.

Hence why everyone says hold onto stock for the long term. 5+ years to ride any bumps along the road.

Today they would have been coming here looking your blood.

The OP is in the classic conundrum of when to sell and when to stick or buy. If the OP has confidence in the stocks they bought the drop in price could be a buying opportunity and if they don't have confidence then why buy the share in the first place. If nothing has changed except the price then buy more.

The fact is that most retail investors cannot, and should not, research individual stocks in the depth required to make any really sensible decision. So they buy on what they last read in the newspaper, hear on TV or down the pub, or on a tip from a friend or purely on a whim. So individual stocks should be avoided and the regular investor should build a simple diversified portfolio using multi-asset funds and/or some sector investment funds. They should also have a simple rebalancing strategy that takes all the emotion out of buying and selling. Do that for 30 years are you will be ok.

That's not 1 individual share. You buy stock you hold for more than 1 year unless you're broke and need the money.

That's what 99% of the advice on this board is. Buy and leave. The OP has bought. Now he should leave and not be reacting to seeing red for 1 year.

If the shares he brought were sitting at even or in slight profit would he think the same? No. He is being reactionary because of the red

Listen you would never encourage someone to invest for only a 12 month period of time. We are going round in circles.

Investing is for the long term. 12 months is not enough.2 -

Given your user name. Seems I was working in the investment sector before you were even born. The technology may have changed over the decades, but the principles of investing haven't and never will. I'll leave you to your musing and move on.Retireby40 said:

Yes and he sells now, someone picks up his shares 30% cheaper and with more patience makes profit.Thrugelmir said:

The red will reflect the broader market view of the stock. Somebody has to be last to the party and end up on the wrong side of the trade. As to buy a stock somebody else has to sell. For every winner there's a loser. Trading isn't a one sided activity.Retireby40 said:

People were using individual shares as an example. The same can be used for anything. S&P 500 as well. Imagine he had knvested at 49....seen drop to 38 and thought let's sell.Thrugelmir said:

The OP has bought a number of individual shares though. We're not discussing the SP500.Retireby40 said:

S&P 500 Vanguard was at 49 before Covid. Dropped to like 38. Imagine thinking I've backed the wrong horse and selling only for a year or two later it sitting at 67.bostonerimus said:

The differences are volatility and risk.Retireby40 said:

Why are they any different. Imagine someone who had bought Amazon shares. Or Apple shares. Or Tesla shares years ago. You'd have been telling them at the first loss sell up quick and take the hit.Thrugelmir said:

Holding collective investments for the long term yes. Individual shares I'd say generally not. Company fortunes wax and wane rapidly. The markets will have the news well before retail investors ever do. Providing no opportunity to react. Actively trading shares requires one to be both watchful and nimble. Also not greedy.Retireby40 said:

Yes. If you sell. My point was 1 year you can be up, one year you can be down.Thrugelmir said:

If you are holding a stock that falls 20% then recovers 20%. You'll still be 4% down. To recover past losses the stock needs to rise 25%. That's basic mathematics.Retireby40 said:

Thanks. That's exactly my point. There's going to be years where you are down 20%. Other years up 20%. It seems to me that the OP has probably started investing and feels like he should cut his losses.DiamondLil said:The op's first sentence reads "Over the past 12 months I've started investing in stocks using trading 212."Not sure why posters arguing the point with @Retireby40 who states nothing more than that stated everywhere on this forum - investing is for the long term and not recommended for periods any shorter than five years, preferably ten years.He/she is suggesting exactly the mantra repeated on here every day that 12 months is not long enough to make a judgement.

When in reality he should probably hold and see what happens down the line.

Hence why everyone says hold onto stock for the long term. 5+ years to ride any bumps along the road.

Today they would have been coming here looking your blood.

The OP is in the classic conundrum of when to sell and when to stick or buy. If the OP has confidence in the stocks they bought the drop in price could be a buying opportunity and if they don't have confidence then why buy the share in the first place. If nothing has changed except the price then buy more.

The fact is that most retail investors cannot, and should not, research individual stocks in the depth required to make any really sensible decision. So they buy on what they last read in the newspaper, hear on TV or down the pub, or on a tip from a friend or purely on a whim. So individual stocks should be avoided and the regular investor should build a simple diversified portfolio using multi-asset funds and/or some sector investment funds. They should also have a simple rebalancing strategy that takes all the emotion out of buying and selling. Do that for 30 years are you will be ok.

That's not 1 individual share. You buy stock you hold for more than 1 year unless you're broke and need the money.

That's what 99% of the advice on this board is. Buy and leave. The OP has bought. Now he should leave and not be reacting to seeing red for 1 year.

If the shares he brought were sitting at even or in slight profit would he think the same? No. He is being reactionary because of the red

Listen you would never encourage someone to invest for only a 12 month period of time. We are going round in circles.

Investing is for the long term. 12 months is not enough.3 -

The implication of your posts is that investing in individual shares is just a waiting game. Whereas there are many examples of individual shares that drop and never recover.Retireby40 said:

Yes and he sells now, someone picks up his shares 30% cheaper and with more patience makes profit.Thrugelmir said:

The red will reflect the broader market view of the stock. Somebody has to be last to the party and end up on the wrong side of the trade. As to buy a stock somebody else has to sell. For every winner there's a loser. Trading isn't a one sided activity.Retireby40 said:

People were using individual shares as an example. The same can be used for anything. S&P 500 as well. Imagine he had knvested at 49....seen drop to 38 and thought let's sell.Thrugelmir said:

The OP has bought a number of individual shares though. We're not discussing the SP500.Retireby40 said:

S&P 500 Vanguard was at 49 before Covid. Dropped to like 38. Imagine thinking I've backed the wrong horse and selling only for a year or two later it sitting at 67.bostonerimus said:

The differences are volatility and risk.Retireby40 said:

Why are they any different. Imagine someone who had bought Amazon shares. Or Apple shares. Or Tesla shares years ago. You'd have been telling them at the first loss sell up quick and take the hit.Thrugelmir said:

Holding collective investments for the long term yes. Individual shares I'd say generally not. Company fortunes wax and wane rapidly. The markets will have the news well before retail investors ever do. Providing no opportunity to react. Actively trading shares requires one to be both watchful and nimble. Also not greedy.Retireby40 said:

Yes. If you sell. My point was 1 year you can be up, one year you can be down.Thrugelmir said:

If you are holding a stock that falls 20% then recovers 20%. You'll still be 4% down. To recover past losses the stock needs to rise 25%. That's basic mathematics.Retireby40 said:

Thanks. That's exactly my point. There's going to be years where you are down 20%. Other years up 20%. It seems to me that the OP has probably started investing and feels like he should cut his losses.DiamondLil said:The op's first sentence reads "Over the past 12 months I've started investing in stocks using trading 212."Not sure why posters arguing the point with @Retireby40 who states nothing more than that stated everywhere on this forum - investing is for the long term and not recommended for periods any shorter than five years, preferably ten years.He/she is suggesting exactly the mantra repeated on here every day that 12 months is not long enough to make a judgement.

When in reality he should probably hold and see what happens down the line.

Hence why everyone says hold onto stock for the long term. 5+ years to ride any bumps along the road.

Today they would have been coming here looking your blood.

The OP is in the classic conundrum of when to sell and when to stick or buy. If the OP has confidence in the stocks they bought the drop in price could be a buying opportunity and if they don't have confidence then why buy the share in the first place. If nothing has changed except the price then buy more.

The fact is that most retail investors cannot, and should not, research individual stocks in the depth required to make any really sensible decision. So they buy on what they last read in the newspaper, hear on TV or down the pub, or on a tip from a friend or purely on a whim. So individual stocks should be avoided and the regular investor should build a simple diversified portfolio using multi-asset funds and/or some sector investment funds. They should also have a simple rebalancing strategy that takes all the emotion out of buying and selling. Do that for 30 years are you will be ok.

That's not 1 individual share. You buy stock you hold for more than 1 year unless you're broke and need the money.

That's what 99% of the advice on this board is. Buy and leave. The OP has bought. Now he should leave and not be reacting to seeing red for 1 year.

If the shares he brought were sitting at even or in slight profit would he think the same? No. He is being reactionary because of the red

That is of course not to say you should sell as soon as they drop*, that depends on the particular shares in question (as you said earlier in the thread). But equally holding shares that have dropped because they must go back up (which is what you are saying in the post above - not sure if this is what you meant to say) is flawed logic.

Compared to todays share price there is no guarantee of

a) profit at all (i.e. this is highest share price ever will be

b) (much more plausible) profit versus another investment (e.g. global index tracker, collective fund)Listen you would never encourage someone to invest for only a 12 month period of time. We are going round in circles.

Investing is for the long term. 12 months is not enough.

I don't see anyone actually encouraging anyone to stop investing. But to consider if their current investments are suitable.

For example:

If you invest £1000 in A and after 12 months it has dropped by 1/4. You now have £750.

At this point you could keep your £750 invested in A or switch to B.

If over the next X years B outperforms A then switch = better and If A outperforms B switch = worse.

Does the price you bought A at impact on how A or B will perform?

In this scenario A is individual share(s) and B is some form of tracker.

4 -

Maybe someone who had used this advice when their shares in Marconi had dropped 30% would like to update you as to how long they had to wait for them to make a profit?Retireby40 said:

Yes and he sells now, someone picks up his shares 30% cheaper and with more patience makes profit.Thrugelmir said:

The red will reflect the broader market view of the stock. Somebody has to be last to the party and end up on the wrong side of the trade. As to buy a stock somebody else has to sell. For every winner there's a loser. Trading isn't a one sided activity.Retireby40 said:

People were using individual shares as an example. The same can be used for anything. S&P 500 as well. Imagine he had knvested at 49....seen drop to 38 and thought let's sell.Thrugelmir said:

The OP has bought a number of individual shares though. We're not discussing the SP500.Retireby40 said:

S&P 500 Vanguard was at 49 before Covid. Dropped to like 38. Imagine thinking I've backed the wrong horse and selling only for a year or two later it sitting at 67.bostonerimus said:

The differences are volatility and risk.Retireby40 said:

Why are they any different. Imagine someone who had bought Amazon shares. Or Apple shares. Or Tesla shares years ago. You'd have been telling them at the first loss sell up quick and take the hit.Thrugelmir said:

Holding collective investments for the long term yes. Individual shares I'd say generally not. Company fortunes wax and wane rapidly. The markets will have the news well before retail investors ever do. Providing no opportunity to react. Actively trading shares requires one to be both watchful and nimble. Also not greedy.Retireby40 said:

Yes. If you sell. My point was 1 year you can be up, one year you can be down.Thrugelmir said:

If you are holding a stock that falls 20% then recovers 20%. You'll still be 4% down. To recover past losses the stock needs to rise 25%. That's basic mathematics.Retireby40 said:

Thanks. That's exactly my point. There's going to be years where you are down 20%. Other years up 20%. It seems to me that the OP has probably started investing and feels like he should cut his losses.DiamondLil said:The op's first sentence reads "Over the past 12 months I've started investing in stocks using trading 212."Not sure why posters arguing the point with @Retireby40 who states nothing more than that stated everywhere on this forum - investing is for the long term and not recommended for periods any shorter than five years, preferably ten years.He/she is suggesting exactly the mantra repeated on here every day that 12 months is not long enough to make a judgement.

When in reality he should probably hold and see what happens down the line.

Hence why everyone says hold onto stock for the long term. 5+ years to ride any bumps along the road.

Today they would have been coming here looking your blood.

The OP is in the classic conundrum of when to sell and when to stick or buy. If the OP has confidence in the stocks they bought the drop in price could be a buying opportunity and if they don't have confidence then why buy the share in the first place. If nothing has changed except the price then buy more.

The fact is that most retail investors cannot, and should not, research individual stocks in the depth required to make any really sensible decision. So they buy on what they last read in the newspaper, hear on TV or down the pub, or on a tip from a friend or purely on a whim. So individual stocks should be avoided and the regular investor should build a simple diversified portfolio using multi-asset funds and/or some sector investment funds. They should also have a simple rebalancing strategy that takes all the emotion out of buying and selling. Do that for 30 years are you will be ok.

That's not 1 individual share. You buy stock you hold for more than 1 year unless you're broke and need the money.

That's what 99% of the advice on this board is. Buy and leave. The OP has bought. Now he should leave and not be reacting to seeing red for 1 year.

If the shares he brought were sitting at even or in slight profit would he think the same? No. He is being reactionary because of the redRemember the saying: if it looks too good to be true it almost certainly is.4 -

add CINE to the list of shares which will unlikely recover. Glad I got out of that one 1 year ago"It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

G_M/ Bowlhead99 RIP2 -

I am going to have to say it

"It's not about timing the market its about time in the market"

There I said it. I know banal.

I have timed the market twice and got it right on both occasions using the PUL method.

I believe the FAANG's and you can throw in Microsoft and in particular Tesla plus Chinese big tech companies are grossly over priced and will eventually have there share prices rebased by as much as 50% (on average). When it happens they will bring down the rest of the market which will recover.

Hence my investments in the stock market was small. I was right about the crash....but not for the right reason!

An example of the PUL method is, I am up 126% on Smithson Investment Trust and 76% with a 10.7% dividend on legal and general. Bought during the crash (obviously).

The PUL method by the way is

Pure Unadulterated Luck!!

I would advise the poster to not try the PUL method! I would advise to go down the Investment trust Road but read up first. Use the AIC site. I also use quoteddata an excellent site.

PS for those with Investment knowledge you may want to look at primary bid a way for retail investors to take part in IPOs

0 -

You know that Tencent and Alibaba have already had their fall down around 40% and 60%. Both trade at a PE for less that 20. You think they are going to drop by half again?GB12 said:

I believe the FAANG's and you can throw in Microsoft and in particular Tesla plus Chinese big tech companies are grossly over priced and will eventually have there share prices rebased by as much as 50% (on average). When it happens they will bring down the rest of the market which will recover.

Of the FAANGs, Microsoft is the only one I have some confidence in with its domination of the cloud.0 -

Prism said:

You know that Tencent and Alibaba have already had their fall down around 40% and 60%. Both trade at a PE for less that 20. You think they are going to drop by half again?GB12 said:

I believe the FAANG's and you can throw in Microsoft and in particular Tesla plus Chinese big tech companies are grossly over priced and will eventually have there share prices rebased by as much as 50% (on average). When it happens they will bring down the rest of the market which will recover.

Of the FAANGs, Microsoft is the only one I have some confidence in with its domination of the cloud.

Tencent and other Chinese Blue Chip stocks are not just about Fundamental in financial performance. Who could foresee what the c.c.p did to their own companies for the sake of ideology? A lot of people are losing their jobs, becoming poorer, slowing the growth of the Chinese economy. But we have seen recenlty the statement from chinese authority that they will still allow the VIE structure. Hopefully this will grow the investors confidence in blue chip chinese stocks hoping they will not be delisted for at least a foreseeable future.

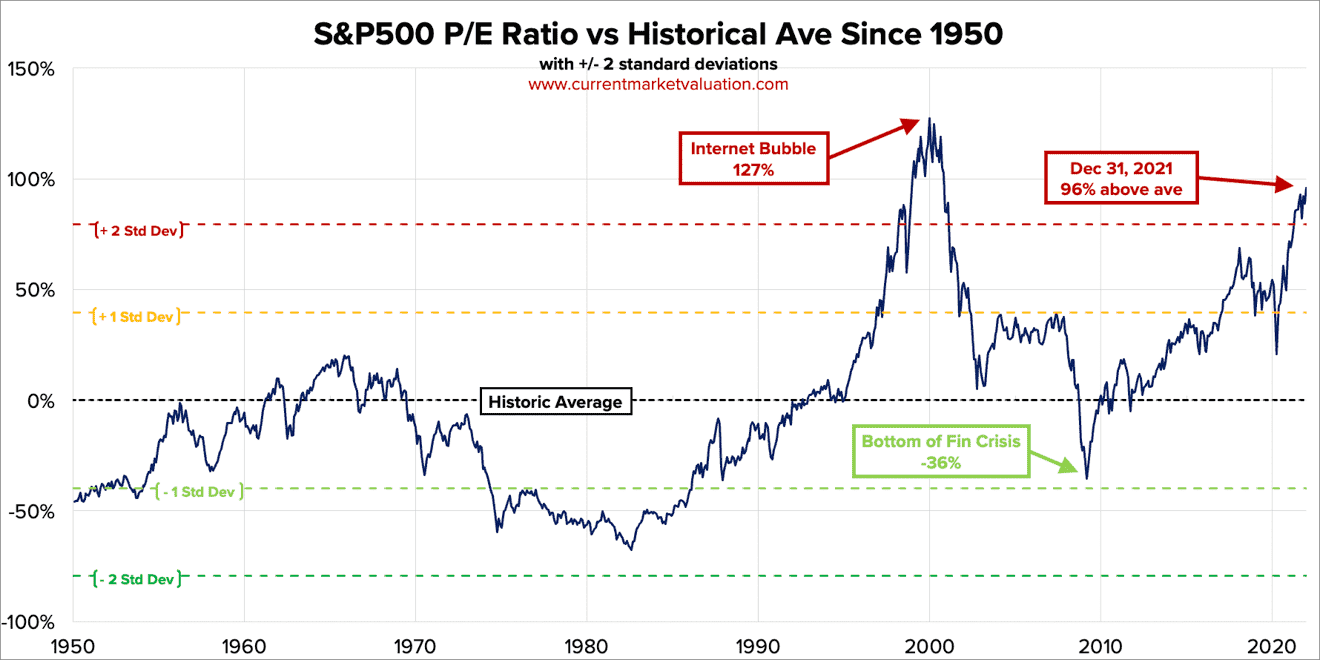

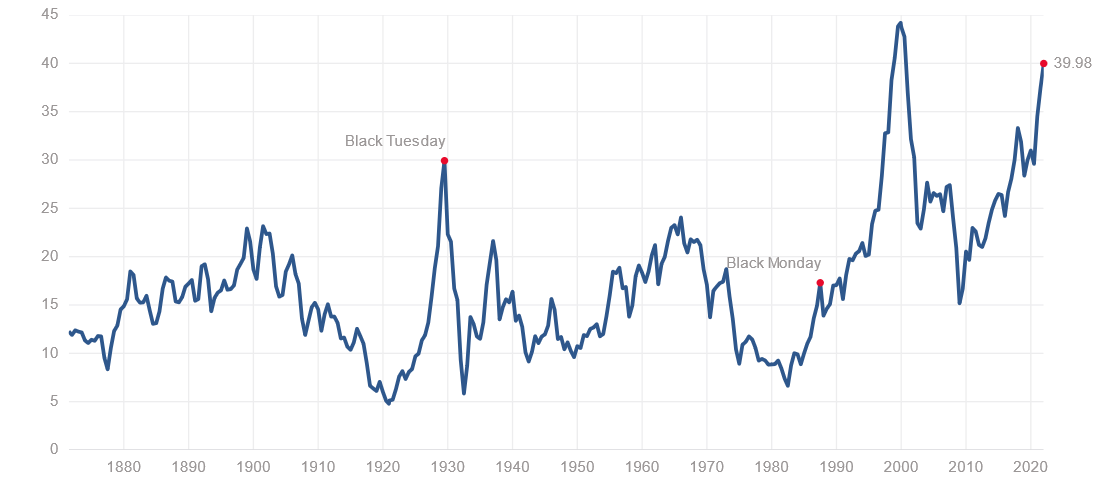

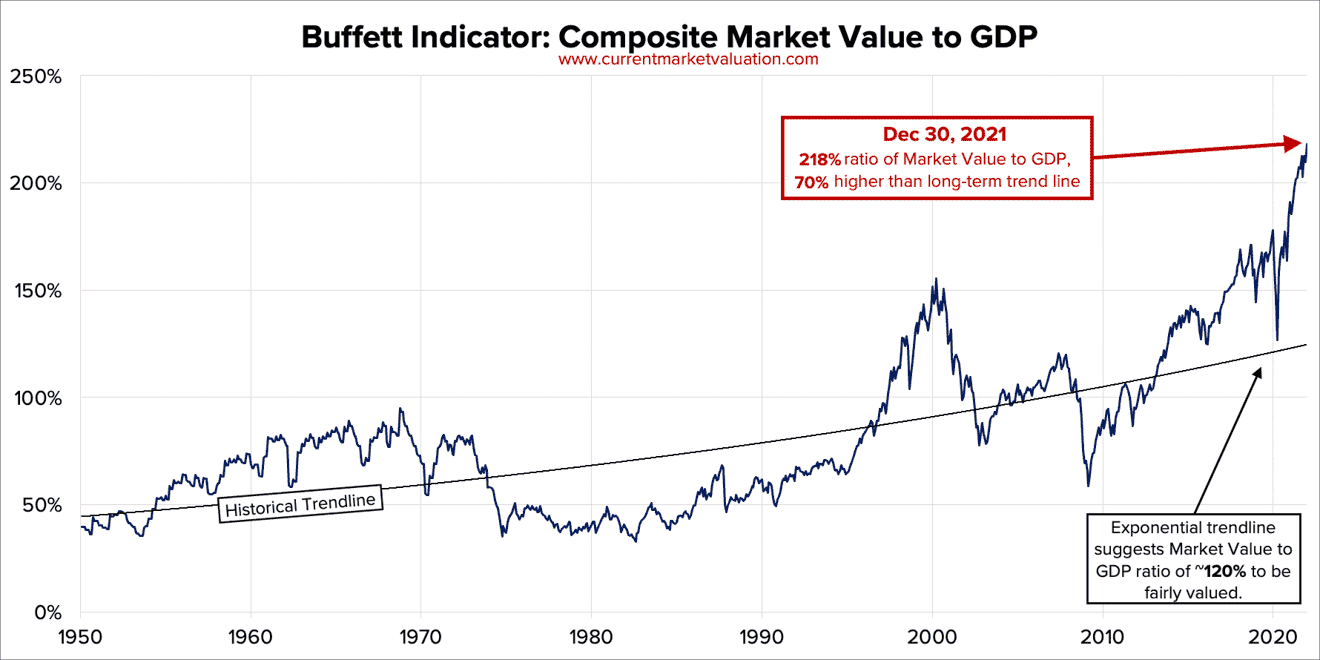

S&P P/E ratio is already very high close to the value when there was a dot.com bubble. This is also in line with Shiller P/E Ratio. But if you look the valuation based on the Warren Buffet indicator the market is already at ATH.

S&P 500 performance is driven by the performance of Mega Caps stocks such as by FAANG which is already overheated.

0 -

Yes I was aware of Tencent and Alibaba taking a kicking from the Chinease government. It was meant as an example. Also I don't believe the pe ratios. I don't believe much that comes out of China.Prism said:

You know that Tencent and Alibaba have already had their fall down around 40% and 60%. Both trade at a PE for less that 20. You think they are going to drop by half again?GB12 said:

I believe the FAANG's and you can throw in Microsoft and in particular Tesla plus Chinese big tech companies are grossly over priced and will eventually have there share prices rebased by as much as 50% (on average). When it happens they will bring down the rest of the market which will recover.

Of the FAANGs, Microsoft is the only one I have some confidence in with its domination of the cloud.

Nor do I believe that Microsoft dominates the cloud. Amazon is big on data centres. BUT with artificial intelligence there is a long long way to go. I will give you that. Via crowd cube I have a small Investment in the small robot company. There robots go into the field and note down where every single plant is, including the weeds. Imagine the amount of data that amounts to in a wheat field alone?

Data centres are (in my opinion) barely started.

As an aside does anyone know why at least 3 of my posts have been removed? They contained no swearing. Who is the moderator for this.

0 -

Hence the rest of the companies are not overpriced and the crash in the mega caps will bring down the market including those that are not overpriced. They will recover.adindas said:Prism said:

You know that Tencent and Alibaba have already had their fall down around 40% and 60%. Both trade at a PE for less that 20. You think they are going to drop by half again?GB12 said:

I believe the FAANG's and you can throw in Microsoft and in particular Tesla plus Chinese big tech companies are grossly over priced and will eventually have there share prices rebased by as much as 50% (on average). When it happens they will bring down the rest of the market which will recover.

Of the FAANGs, Microsoft is the only one I have some confidence in withS&P 500 performance are drivend by the performance of Mega Caps stocks such as by FAANG is already overheated.

I have NAIT in my Portfolio. An income investment trust which has been raising its dividends by 9% a year and adding to its dividend reserves. The cover has averaged about 1.13. This year it has increased its dividend by 5% and covered it 1.18. I would say the value sector is far from overpriced.

I have written a post on this but it's been removed?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards