We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Trying to understand the impact of currency costs for a fund denominated in USD vs GBP?

isayhello

Posts: 455 Forumite

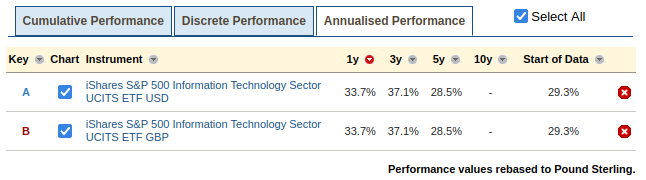

While browsing some funds on iWeb I've come across the following - iShares S&P 500 Information Technology Sector UCITS ETF GBP. I've also found a version of this denominated in USD.

The annualised 5yr difference in performance is 30.78% for the USD and 29.50% for GBP.

Is it still worth getting the GBP version to avoid certain fees even if there is a small gain in performance like in this example?

The annualised 5yr difference in performance is 30.78% for the USD and 29.50% for GBP.

Is it still worth getting the GBP version to avoid certain fees even if there is a small gain in performance like in this example?

0

Comments

-

Why do you think such a small difference will be consistent?

0 -

I don't think that, I just wondered what the pro's and con's of both are, I'm new to this but I've heard some platforms charge a currency fee but if the platform doesn't then is the USD a better option?

Actually shouldn't the performance be identical, why does it vary if they invest in the same things?0 -

Buy the UK version if that's what you are after. The small difference I would suspect is a currency conversion error. You are talking what 1.28% over 5 years so 0.24% a year. That or have you looked at the OCF on both?1

-

The performances of a USD denominated fund and a GBP denominated version of the same fund will be different unless the two currencies track one another perfectly, which they certainly do not. If you want to compare the performance of a fund denominated in USD with that of a fund denominated in GBP, you can do that by converting the USD price at both the beginning and end of the time period to GBP. You probably cannot buy the USD version in the UK anyway.isayhello said:While browsing some funds on iWeb I've come across the following - iShares S&P 500 Information Technology Sector UCITS ETF GBP. I've also found a version of this denominated in USD.

The annualised 5yr difference in performance is 30.78% for the USD and 29.50% for GBP.

Is it still worth getting the GBP version to avoid certain fees even if there is a small gain in performance like in this example?1 -

If you are in UK, then your life is based around GBP. You can invest in a USD fund and you might do well, you might not, but you are taking a risk by investing in something that's not in GBP.

Having said that, almost every FTSE company has significant USD exposure.0 -

isayhello said:Actually shouldn't the performance be identical, why does it vary if they invest in the same things?It is, to the nearest 0.1%, but there will be slight differences due to the difference in how uninvested cash is received and held within the funds:

The data provided by iWeb is probably not comparable on a like for like basis.1

The data provided by iWeb is probably not comparable on a like for like basis.1 -

This article explains (with algebra!) why fund denomination currency doesn't matter:isayhello said:While browsing some funds on iWeb I've come across the following - iShares S&P 500 Information Technology Sector UCITS ETF GBP. I've also found a version of this denominated in USD.

Currency risk and ETFs, trackers, and other funds - Monevator.com

0 -

But that does not appear to be the issue here. Suppose that the value of ETF in $ terms is the same at the end of the time period as it was at the beginning. Suppose also that $1 is worth £1 at the beginning of the time period, and $1 is worth £2 at the end of the time period. The growth of the fund over the period in $ terms is 0%. The growth of the same fund over the period in £ terms is 100%.EdSwippet said:

This article explains (with algebra!) why fund denomination currency doesn't matter:isayhello said:While browsing some funds on iWeb I've come across the following - iShares S&P 500 Information Technology Sector UCITS ETF GBP. I've also found a version of this denominated in USD.

Currency risk and ETFs, trackers, and other funds - Monevator.com

Currently, UK based retail investors are not all allowed to buy US based ETFs anyway, unless they have KIIDs, which none of them do.1 -

The effect of currency movements on fund prices depends on what currency the underlying investments use rather than the currency of the fund. If, for example, your $ denominated ETF invests in UK Government bonds then the ETF's price in $s when converted to £s should always match the £ price of the bonds ignoring currency conversion costs. You should not be able to make (or lose) significant money by switching between the same funds denominated in different currencies.GeoffTF said:

But that does not appear to be the issue here. Suppose that the value of ETF in $ terms is the same at the end of the time period as it was at the beginning. Suppose also that $1 is worth £1 at the beginning of the time period, and $1 is worth £2 at the end of the time period. The growth of the fund over the period in $ terms is 0%. The growth of the same fund over the period in £ terms is 100%.EdSwippet said:

This article explains (with algebra!) why fund denomination currency doesn't matter:isayhello said:While browsing some funds on iWeb I've come across the following - iShares S&P 500 Information Technology Sector UCITS ETF GBP. I've also found a version of this denominated in USD.

Currency risk and ETFs, trackers, and other funds - Monevator.com

Currently, UK based retail investors are not all allowed to buy US based ETFs anyway, unless they have KIIDs, which none of them do.

With equity it can be more complicated than that since currency movements can affect shares in their native currency. For example a UK company could do most of its business exporting in $s. If the £ falls against the $ the UK company could increase in value in £ terms since its $ income would be worth more.1 -

That is true but irrelevant. There are plenty of dollar-denominated ETFs traded in London (for example I hold the iShares Healthcare Innovation in US dollars).GeoffTF said:Currently, UK based retail investors are not all allowed to buy US based ETFs anyway, unless they have KIIDs, which none of them do.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards