We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Hyperfund

Ryno28

Posts: 1 Newbie

Hi does anyone have any experience and or knowledge to share about Hyperfunds? I have a few close friends that have bought in and seem to be doing well but the whole principle of the investment seems off to me. Grateful for any views. Thanks

0

Comments

-

FCA Warning: HyperFund | FCAI am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.8

-

If your close friends have done well, I would tell them to at least take out the amount they originally invested - leaving any profit to carry on growing. That will a) prove whether it is possible to withdraw their money - a red flag it they can't, and b) mean that they will not have lost anything if the scheme goes 'tots' up!

I for one would be interested to hear if they manage to withdraw into hard cash at least the amount they invested.1 -

I find it interesting how scammers have the resources to make professional looking websites but their English is still, well, see for yourself.

"Application scenarios will gradually increase and there will be not only a multiplication of wealth, but also a symbol of success in the future."3 -

Apparently spelling mistakes in spam emails help filter out the more clued up people from taking action so they can focus their resources on those who are more likely to go ahead with whatever is suggested next.tebbins said:I find it interesting how scammers have the resources to make professional looking websites but their English is still, well, see for yourself.3 -

i have been reading about this.-Keep your eyes to the sunshine and you would not see the shadows-:beer:

-Remember your forgetfulness is not my emergency 0

0 -

That's quite a word salad theretebbins said:

"Application scenarios will gradually increase and there will be not only a multiplication of wealth, but also a symbol of success in the future."Remember the saying: if it looks too good to be true it almost certainly is.3 -

There are plenty of "funds", many of which are genuine. Tagging "hyper" onto a word just means "big" or "highly excited". There are plenty of big funds around which offer investment opportunities. As far as I know, it's only scammers that have joined the words "hyper" and "fund" together. If you are looking for a genuine investment opportunity, you should not be looking for the first people to join a couple of words together.1

-

Remember the days of the good old simple Megafunds? Ah those were the days, now they just stick hyperbole in the marketing. First it was Ultrafunds, now Hyperfunds, what next, Masterfunds, Fundasaurus Rex, Gigafund, HMS Fund, Funderbirds, Confunded.com, Fundtastic, Returns R Us? Where will it end, because we all know Infinity Fund doesn't make sense.

1 -

I've been tacking Hyperfund, using Google Trends, Google Search, and web analytics, for a few months now after a friend said they were investing in it. In short there are a lot of red flags, including warnings and concerns issued by authorities in 6 countries at the time of writing this. The rewards scheme, if genuine, would qualify for regulation under UK and US rules. Google the US's Howey Test. They're claiming to avoid this with their use of terminology i.e. rewards scheme but the definitions don't allow you to dodge the rules in this way so easily.

Setting these observations aside let me give you some numbers:

I've 10mths of visit data to their app download site covering Jan to Oct 2021. I got this from a couple of web analytics sites that allow a free trial. The app download site saw nearly 4 million visits in that time, 45% of which were single page views. As you'd only expect to download the app once, I'd speculate that there were 2.2m to 4m new members in this time. Taking the lower number, ignoring the affiliate rewards, and further assuming an average investment of $500 and 85% adoption of the rebuy strategy gives a lower bound on the value that would need to be return to community in 600 hundreds days from the end of October of $4bn. That's already a tall order for a company that doesn't have customers. Their words. And that's a lower bound. So, what happens if we up the numbers? Assuming 3m new members with an average investment of $3000 gets us to $34bn, and assuming 4m new members with an average investment of $7000 gets us to $80bn that needs to be returned in 600 days.

That's a really big issue, especially as there is no real evidence of where this money will come from. As a Ponzi however the rebuy payments would never be made and payments to the minority of people not following a rebuy strategy could easily be paid from new investments; at least until the recruitment starts to dry up and the whole thing collapses.

Hope that gives people something solid to think about.

2 -

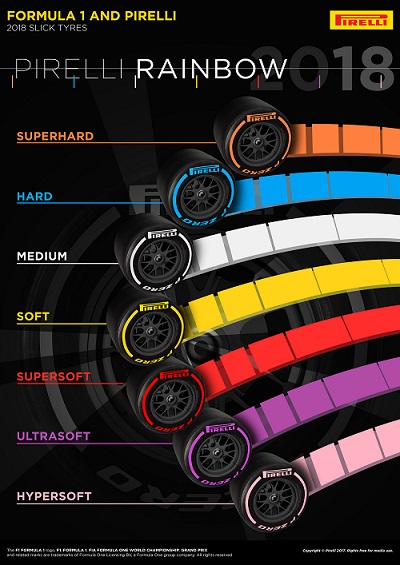

Perhaps inspired by the increasingly hyperbolic Formula 1 tyre naming convention in 2018?tebbins said:Remember the days of the good old simple Megafunds? Ah those were the days, now they just stick hyperbole in the marketing. First it was Ultrafunds, now Hyperfunds, what next, Masterfunds, Fundasaurus Rex, Gigafund, HMS Fund, Funderbirds, Confunded.com, Fundtastic, Returns R Us? Where will it end, because we all know Infinity Fund doesn't make sense.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards