We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Lloyd’s Bank Preferential Shares

typistretired

Posts: 2,099 Forumite

Received letter today from Equiniti offering to buy my Lloyd’s Bank Preferential shares at 112.050% wondering if this considered a good offer by the more saffy shareholders on here?

"Look after your pennies and your pounds will look after themselves"

0

Comments

-

The offer is around market price. An easy cost free means of exiting the holding if you so wished.1

-

If you sold would you be able to get equivalent the annual income elsewhere? Mine are returning about 7% per year ignoring any capital growth.1

-

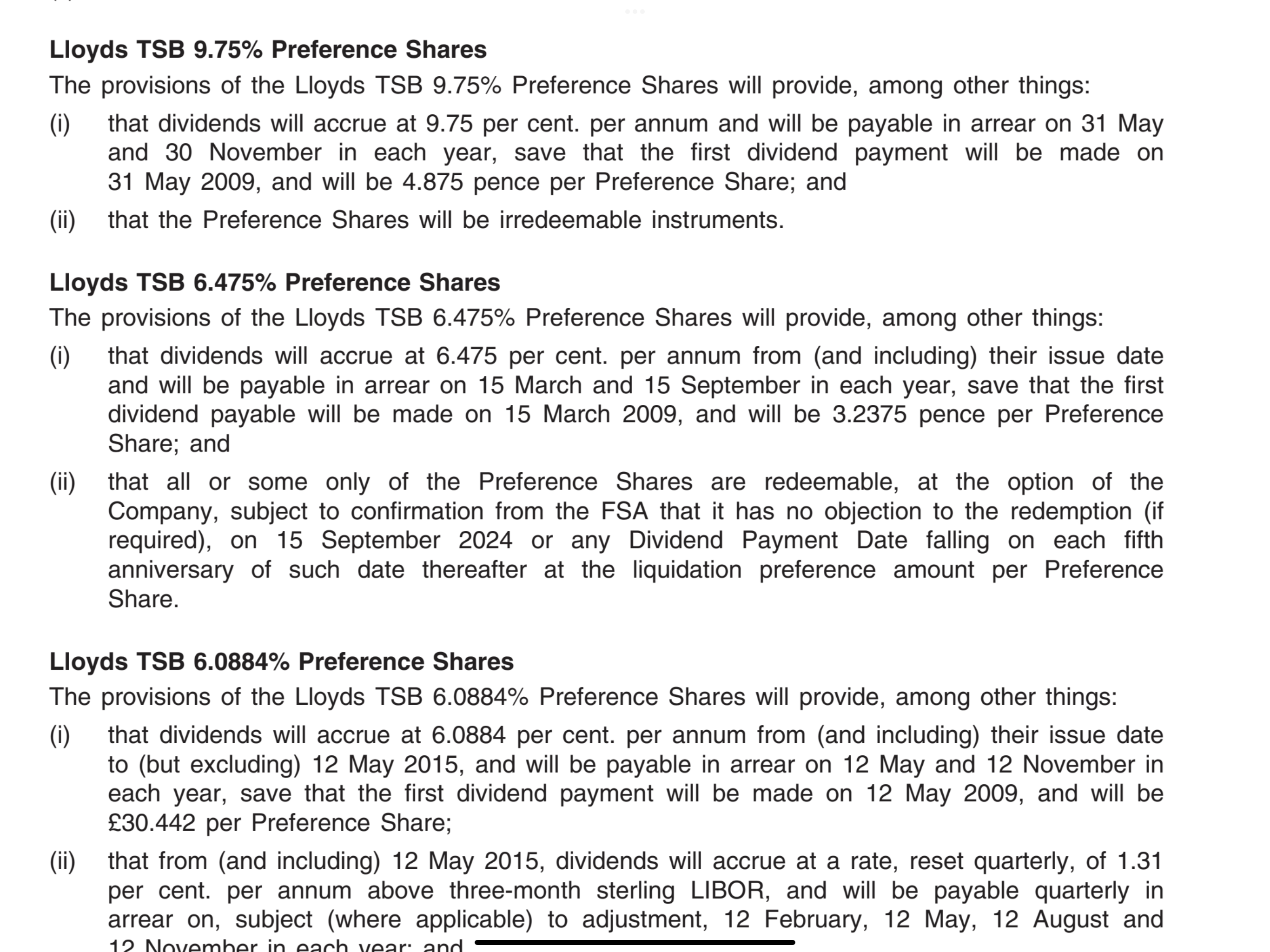

*preference. If you've been offered 112.05p then they must be the 6.475% Non-Cumulative Preference Shares*, LSE:LLPE. The thing to bear in mind with these is that they are redeemable at par, 100p, if Lloyds chooses on 15/09/24 so they might only have a few years left in them anyway. It's whether you effectively take the next year's dividend now and reinvest in something else or just continue holding.*IIRC these were originally issued by Halifax in 1999 when it bought Birmingham Midshires and these were given to BM's members as compensation, 400 per member.

2

2 -

On redemption you'll only receive nominal value. Any market premium will dissipate.uknick said:If you sold would you be able to get equivalent the annual income elsewhere? Mine are returning about 7% per year ignoring any capital growth.2 -

True, if Lloyds cancel them, despite them saying they won't. Maybe, it is time to take the offer. Of course with my luck and poor judgement, whatever way I go everybody else should do the oppositeThrugelmir said:

On redemption you'll only receive nominal value. Any market premium will dissipate.uknick said:If you sold would you be able to get equivalent the annual income elsewhere? Mine are returning about 7% per year ignoring any capital growth. 0

0 -

Seems that the 6.475% preference shares will be redeened in 2024 in any event. LLoyds are merely accelerating the process. Most likely as they've spare capital to utilise at the current time. Also the share registrars charge for their services. Removing a large number of small individual stock holders will pay for itself in terms of a reduced administrative charge for LLoyds.uknick said:

True, if Lloyds cancel them, despite them saying they won't. Maybe, it is time to take the offer. Of course with my luck and poor judgement, whatever way I go everybody else should do the oppositeThrugelmir said:

On redemption you'll only receive nominal value. Any market premium will dissipate.uknick said:If you sold would you be able to get equivalent the annual income elsewhere? Mine are returning about 7% per year ignoring any capital growth. 2

2 -

These probably no longer count as

capital these days so LBG wants rid of them now.

1 -

I have 400 of the 6.475% shares.

They have been paying a dividend of £12.95 twice a year, so a total of £25.80 per year.

If they are offering £1.12 per share that equals £448

if I continue to hold until 2024, then that will mean that I get £1 for them plus at least another £51.60 (2 years dividends) totalling £451.60. Unless I get 3 years dividends which would mean £477.40

I am no expert, and have probably got this wrong?0 -

Which ones do you own? Some are redeemable whilst some are irredeemable. LLPE, the one we've been talking about, is redeemable. LLPC 9.25% and LLPD 9.75%, the two others commonly held by retail investors, are, short of shenanigans of the type Aviva tried with its preferences shares a few years ago, irredeemable.uknick said:

True, if Lloyds cancel them, despite them saying they won't. Maybe, it is time to take the offer. Of course with my luck and poor judgement, whatever way I go everybody else should do the oppositeThrugelmir said:

On redemption you'll only receive nominal value. Any market premium will dissipate.uknick said:If you sold would you be able to get equivalent the annual income elsewhere? Mine are returning about 7% per year ignoring any capital growth. 0

0 -

Its ex-dividend dates look to be in February and August so your £477 calculation appears to be about correct, with dividends for 2022, 23 and 24. If you're lucky inflation and concomitantly borrowing costs will have rocketed by then and 6.475% will begin to look cheap to Lloyds.RAFFLES said:I have 400 of the 6.475% shares.

They have been paying a dividend of £12.95 twice a year, so a total of £25.80 per year.

If they are offering £1.12 per share that equals £448

if I continue to hold until 2024, then that will mean that I get £1 for them plus at least another £51.60 (2 years dividends) totalling £451.60. Unless I get 3 years dividends which would mean £477.40

I am no expert, and have probably got this wrong? 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards