We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Nationwide Switch Bonus Rejection

Jubudz

Posts: 39 Forumite

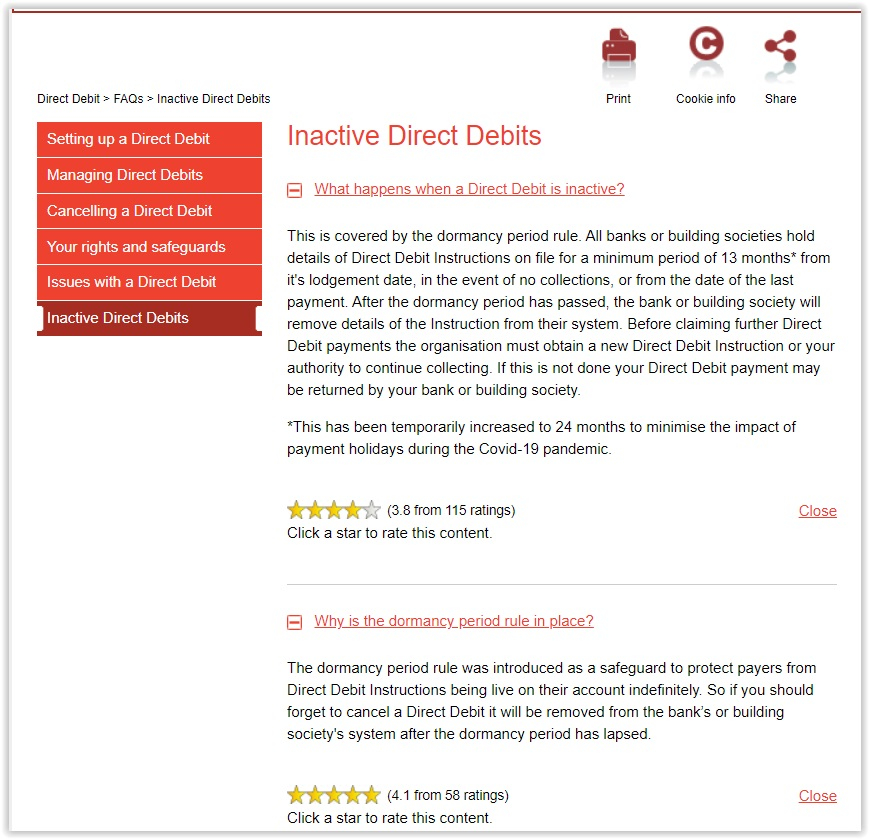

Hi. I switched a Barclays current account to Nationwide a few weeks ago making sure I followed Martin's suggestion to get the maximum £125 bonus. This has not been paid. I have discussed the matter on the phone with them twice & the latest conclusion from their side is that my bonus award has been rejected. The criteria to get the bonus has been fulfilled-three active direct debits (two actually required in their T&Cs) were moved across. Interestingly, the hard copy paper confirmation of the switch completing only showed one direct debit but logging online the same day showed all three direct debits present & correct. In one of the telephone conversations with Nationwide the agent randomly added that the DD's had to be active in the previous thirteen months which they were all be it in another Barclays current account-I moved two DD's from this account to the second Barclays current account that I wanted to switch/close. It appears they maybe using this as a get out clause...so far. The bonus T&C's state a minimum of two active direct debits must be included with no reference at all to how long they were in the old account or the like. The black & white of it is that the switch has completed with three active DD's & that qualifies for the £125. If the three DD's had not been the the old Barclays account they would not be in the new Nationwide one. I am currently awaiting another phone call from them to elaborate exactly why the rejection has been implemented.

0

Comments

-

They need to have been part of the switch (i.e. active on the old account at the point the old bank inform the new bank of the list of payments). A direct debit subsequently set up using the old account details is still automatically set up on the account it was switched into, just like a payment sent to the old account is forwarded on. I've a feeling this may be why your letter only mentions 1 direct debit being switched which is why that switch fails to qualify.Jubudz said:Hi. I switched a Barclays current account to Nationwide a few weeks ago making sure I followed Martin's suggestion to get the maximum £125 bonus. This has not been paid. I have discussed the matter on the phone with them twice & the latest conclusion from their side is that my bonus award has been rejected. The criteria to get the bonus has been fulfilled-three active direct debits (two actually required in their T&Cs) were moved across. Interestingly, the hard copy paper confirmation of the switch completing only showed one direct debit but logging online the same day showed all three direct debits present & correct. In one of the telephone conversations with Nationwide the agent randomly added that the DD's had to be active in the previous thirteen months which they were all be it in another Barclays current account-I moved two DD's from this account to the second Barclays current account that I wanted to switch/close. It appears they maybe using this as a get out clause...so far. The bonus T&C's state a minimum of two active direct debits must be included with no reference at all to how long they were in the old account or the like. The black & white of it is that the switch has completed with three active DD's & that qualifies for the £125. If the three DD's had not been the the old Barclays account they would not be in the new Nationwide one. I am currently awaiting another phone call from them to elaborate exactly why the rejection has been implemented.0 -

-

So you moved two direct debits from a Barclays account that was not switched to the one that was just before applying for the switch? I think Ed-1 is correct that you didn't leave it long enough for these direct debits to be set up on the second Barclays account and consequently they were not moved as part of the switch, as your letter confirms.Jubudz said:I moved two DD's from this account to the second Barclays current account that I wanted to switch/close

1 -

Unfortunately, I agree with @masonic

It does not matter how many payments you made from the DD under the first Barclays account as they count for squat once you move the source account.

Effectively, they were two brand new DD instructions on the donor account and may well not have been active when the switch commenced/concluded, even if present.

I don't think you'll win, but you never know.0 -

Thanks for the replies. Interesting. Arguably, it seems to be a matter of timing. The two DD's were moved to the switching Barclays account from the other Barclays account seven days before Nationwide confirmed the switch had completed. The switch completion Royal Mail letter from Nationwide showing only one DD was dated October 1st. I logged into Nationwide online banking the same day & three DD's were present. The two DD's in question are monthly & annual with one already being paid out of the new Nationwide account. Both DD's were active for many years on the kept Barclays current account & I have offered to send a screen grab to Nationwide as proof. At the end of the day Nationwide have gained three active DD's over & above the bonus T&C's. I'm still waiting for a call back from them. Their actual words on the answer machine earlier were '"it has been rejected because of the direct debit" which is not really explaining anything precisely enough.0

-

It takes a few working days for a direct debit to be set up. It must be fully set up by day 1 of the 7 (working) day switch. If, as you say, the DDs were not moved until 7 days before completion of the switch, then they would not have been set up when the switch was started in line with the requirements of the offer. A switch completing on 1st October would start on 23rd September, so the new account details would need to be given to the DD originators no later than 20th September (but preferably earlier than that).Nationwide is not interested in gaining direct debits, it is interested in getting people to move their main account and do their day to day banking in their new Nationwide current account. They are designed to prevent someone just opening a completely new account and immediately switching it. Consequently, proof that the direct debits existed on a different account than the one switched is of no value at all.We can opt to manufacture a new account meeting the conditions, but in doing so must be careful that we actually meet the offer terms. While I have commented on the main Nationwide switching offer thread that waiting for the DDs to pay out on the donor account is overkill (I did not wait for this), it would have prevented your error in this case and perhaps is good advice for those who are inexperienced at switching for incentives.

2 -

The printed confirmation letter is basically their summary of what they are intending to transfer.

If it only had one D/D mandate listed as active then that is what info the donor bank supplied.

You tried to play the game, you were sloppy, move on or try again with another account (e.g. Starling or Monzo)2 -

If you moved the DDs only seven calendar days before the switch completion date, you were too late; you should wait until all DDs are showing in online banking before the switch even starts (or a full seven working days before completion).

It is irrelevant for how long the DDs were active on your other (kept) Barclays account, because that account is irrelevant to the switch (it’s not being switched), so I’m not sure what you’re hoping to achieve by showing Nationwide a screenshot of this.2 -

There is an update. Following on from the above conversations & a further call to Nationwide they have very kindly made an exception & awarded the £125 switch bonus. Thank goodness flexibility still exists in some large company customer support departments. It's also worth mentioning the good online chat service & UK based call centre. Ultimately, I will be keeping & using the account with them & not simply switching onwards. 5* to Nationwide.6

-

I'm glad your happy, although i smell a whiff of BS on the part of NW CS, if you plough through the main thread about this you'll find a post with a complaint very similar to yours - the upshot of which was that the CS bod they spoke to did a system refresh and all their transferred DDs then showed, if you can see them so can the NW CS team...Jubudz said:There is an update. Following on from the above conversations & a further call to Nationwide they have very kindly made an exception & awarded the £125 switch bonus. Thank goodness flexibility still exists in some large company customer support departments. It's also worth mentioning the good online chat service & UK based call centre. Ultimately, I will be keeping & using the account with them & not simply switching onwards. 5* to Nationwide.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards